By Christopher Sabo, CFA, Director of Risk Management at LMCG Investments.

Yogi Berra was right about the 30+ year rally in bonds: “It ain’t over ‘til it’s over”. The chart below shows the persistence of this rally starting in the 1980s. Over this period, bonds have been considered a productive asset not only because of this consistent performance, but also because of their diversification benefits. However, as rates have dropped from over 10% in the 1980s to below 1% in 2020, it begs the question: is it finally over?

Although difficult to answer, it is hard to argue that the characteristics of traditional fixed income assets still enjoy the same benefits as they once did. Market performance since the August low in rates has exemplified the risk of holding bonds in such a low yield environment. The losses across various fixed income indices due to a relatively small rise in interest rates were severe, especially for those with longer duration. Even after this move higher, current yields are still far below future inflation expectations of 2.6%[i], implying a negative real yield over the next ten years. Given this expected loss of purchasing power, many long-term investors are seeking alternative approaches to achieving their investment goals without being exposed to the risk of rising rates.

One alternative that investors should consider is the use of a type of mortgage-backed security known as Credit Risk Transfer bonds (CRTs). This may seem counter-intuitive given that most MBS bonds have a similar relationship to interest rates as US Treasuries. However, when doing a deeper dive, it is clear that not all MBS securities are alike. Understanding the unique characteristics of each bond is critical for identifying CRTs that benefit from rising interest rates.

Understanding the Types of Duration

There are two key types of durations relevant for analyzing bonds:

- The cash flow duration is the weighted average time for investors to get their money back on a bond investment.

- The effective duration is the price sensitivity of a bond to changes in interest rates.

In most bond markets comprised of non-callable fixed rate securities, the cash flow duration and the effective duration are the same, making the measurement of sensitivity to interest rates very straightforward. However, in the mortgage market, the cash flow duration and the effective duration can be very different, which makes the measurement of sensitivity to interest rates more complex.

One reason a difference between durations exists is due to prepayments. The incentive for borrowers to prepay a loan is dependent on the level in rates, which usually creates a no-win situation – known as negative convexity – for the bondholder. This is because the life of the investment – cash flow duration – is either extended (when rates rise) or shortened (when rates fall) at an inopportune time. However, depending on their characteristics, some mortgage bonds react atypically to this change in the bond’s cash flow duration.

Different Characteristics of Mortgage-Backed Securities

Credit Risk Profile - With $8.4 trillion outstanding, Agency MBS bonds make up more than 90% of the mortgage bond market[ii]. Similar to Treasuries, the implicit government guarantee of these bonds removes the risk of default, leaving interest rates as the primary driver of price changes. Yet, although the largest market, Agency MBS are not the only type of mortgage-backed security. Credit Risk Transfer bonds, a rapidly maturing market have grown from just $12 billion outstanding in 2014 to over $80 billion in 2020[iii]. Similar to Agency MBS, CRTs are issued by Fannie Mae and Freddie Mac. However, in an effort to limit their exposure to losses, the GSEs have created CRTs to transfer credit risk to private investors. Therefore, in addition to interest rate exposure, these bonds carry credit risk for which investors are compensated for in terms of yield. This additional factor shifts the price sensitivity dynamics and introduces the need for a more nuanced analysis to assess the durations of these bonds.

Coupon – When diving into the interest rate sensitivity of CRTs, the level of the bond coupon has an impact on interest rate sensitivity. When interest rates rise, bonds with a higher coupon are generally less exposed to the negative forces of life extension than those with a lower coupon. In fact, higher paying coupon bonds can actually benefit from a rise in interest rates if the bond trades above par. This dynamic exists because slower prepayment activity slows the amortization of these bonds, allowing the investor to collect the higher coupon for a longer period of time.

Another important characteristic that CRTs possess is the structure of their coupon. Most corporate bonds have a fixed coupon rate, which contributes to duration risk. If rates go up, the cash flow that the investors own, at a higher discount rate, is less valuable. However, CRT bonds have floating rate coupons. When rates rise, the yield offered by these bonds also rises, eliminating this source of interest rate sensitivity.

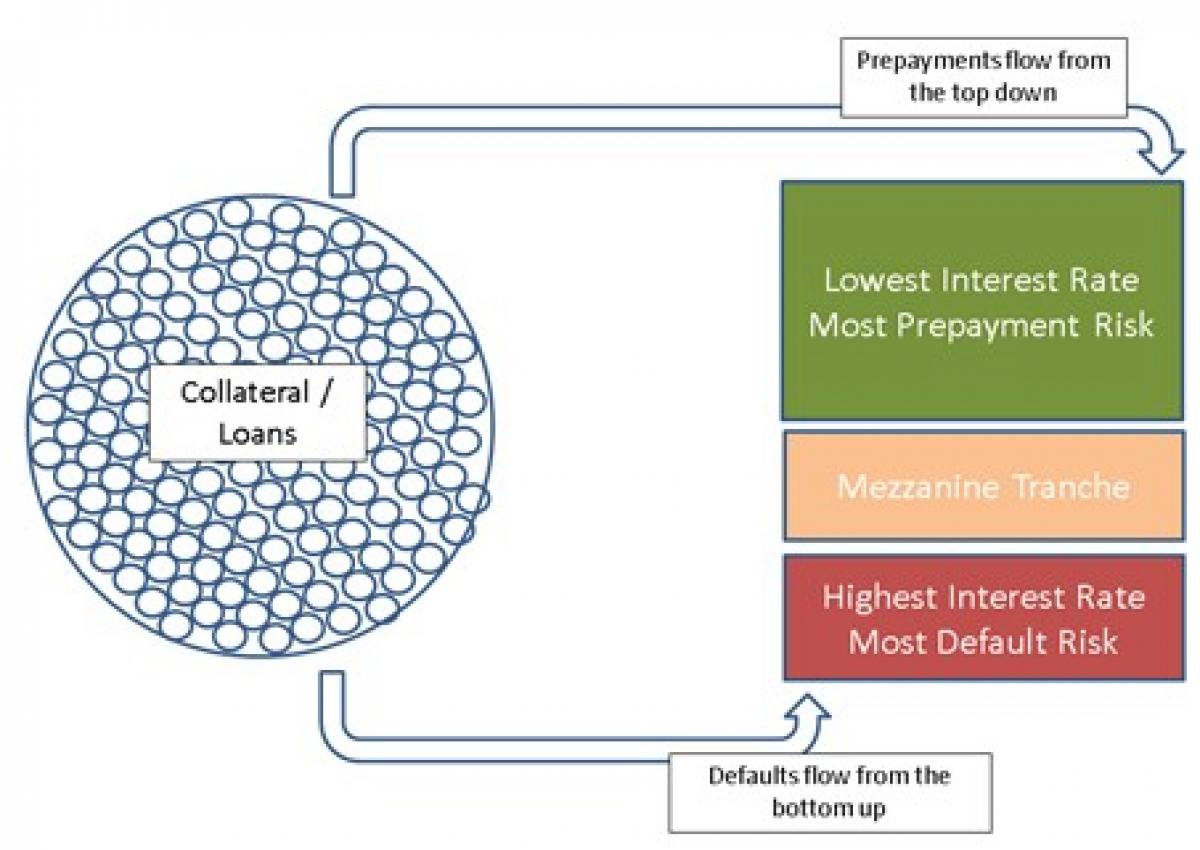

Bond Seniority – The tranching of mortgage-backed securities adds complexity to understanding the drivers of return. Bonds that sit higher in the capital structure – senior tranches – are the first to receive prepayments and the last to take losses from the underlying mortgage collateral. The reverse is true for bonds that sit lowest in the capital structure – junior tranches. The basic cash flow dynamics of such structured products are outlined in the diagram below.

A bond’s order of priority to prepayments or defaults determines its sensitivity to changes in the speeds of these factors. Because senior bonds are in a first pay position, they are primarily sensitive to changes in the prepayment rate. As interest rates rise and prepayment speeds slow, the bonds life will extend which impacts its price. Depending on whether the bond trades at a premium or discount will determine if this extended life is an advantage or disadvantage. The extended life is a positive for a bond that trades at a premium because the investor has more time to collect interest before the bond’s price depreciates toward par. The extended life is a negative for bonds that trade at a discount because the speed in which the bond’s price appreciates toward par slows.

Conversely, junior bonds are more sensitive to default rates as they are the first to receive losses. A small change to factors like delinquencies, recoveries or modifications will have a bigger impact on price. However, the prices of junior bonds still respond to changes in rates and prepayments, especially when they impact the bond’s loss protections. As rates fall and prepayment speeds increase, junior bonds can benefit from a deleveraging of the capital structure since the loans that have prepaid can no longer default. Therefore, it is difficult to understand how a CRT bond responds to changes in rates without understanding the impact of the position in the capital structure.

Putting Theory into Practice

Determining a CRT bond’s sensitivity to interest rates is nuanced, because the two factors mentioned above – coupon and seniority – are often at odds with each other. Slower prepayment speeds can be advantageous for senior bonds higher in the capital structure but can also be advantageous to junior bonds with higher coupons (i.e. compensation for more risk). The features of each bond are not mutually exclusive, so simply focusing on one type may not be sufficient.

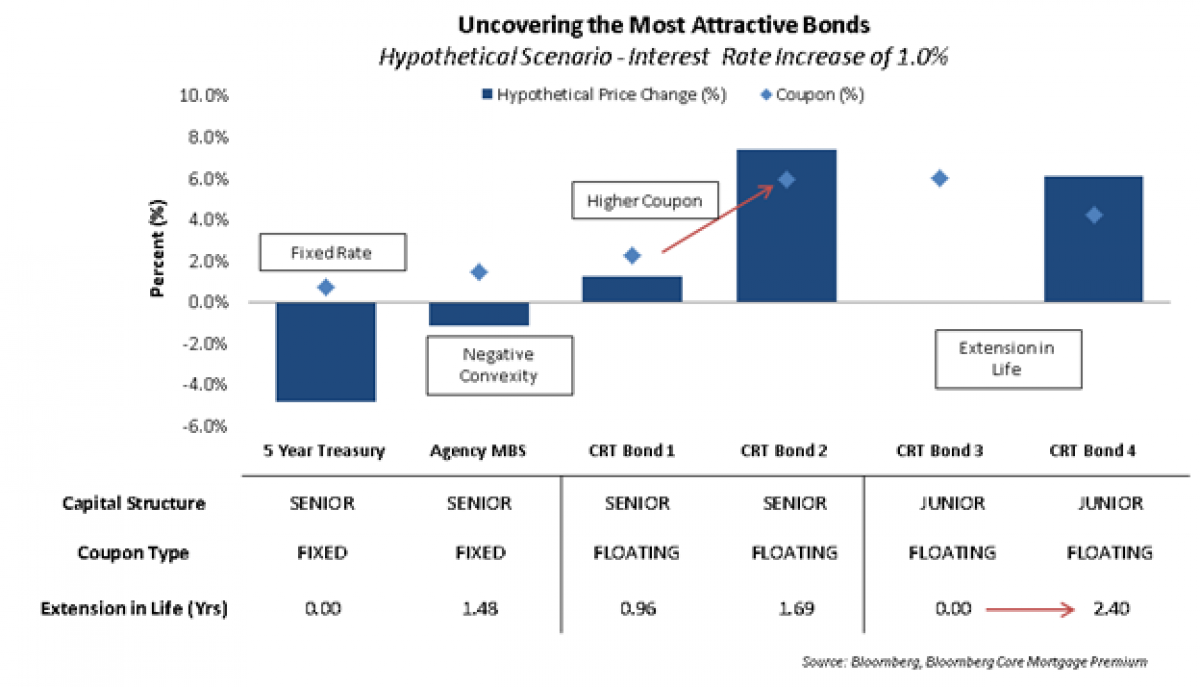

The scenario analysis below illustrates the price impact from a 1% rise in interest rates across various bonds. It is interesting to see how each bond is impacted differently. As discussed earlier, Agency MBS and Treasury bonds both experience losses due to their fixed rate or negative convexity. However, when looking at CRTs, the price reaction varies. CRT Bond 1 benefits modestly from a rise in rates due to its floating rate structure and seniority in the capital structure. However, it benefits less than CRT Bond 2 which has a higher coupon. CRT Bond 3 has the highest coupon, but does not benefit at all from a rise in rates. This seems odd. However, the higher coupon is only a benefit if the weighted average life of the bond is extended. Because of this bond’s extremely low position in the capital structure, it has no sensitivity to prepayments, forcing it to pay off at its legal maturity, making an extension of its life impossible. This is vastly different from CRT Bond 4. Although also a junior bond, it is not as low in the capital structure as CRT Bond 3 which is why the weighted average life of the bond extends and the price of the bond appreciates meaningfully.

Summary

As investors look to position their portfolios for rising interest rates, the use of CRT bonds is an unusual, but useful tool. The key is to target bonds that compensate for the credit risk, that have high floating rate coupons, trade at a premium and extend when interest rates rise due to slower prepayments. Regardless if Yogi Berra is right on the direction of the bond market, applying this approach appropriately could enable investors to regain the yield and diversification benefits of bonds without taking on the significant risk of rising interest rates.

About the Author

Christopher Sabo, CFA is the Director of Risk Management at LMCG Investments where he acts as a resource in portfolio construction, asset allocation and risk oversight for investment strategies that range from Global Equities, to Fixed Income to Relative Value Alternative Credit. Chris came to LMCG from Standish Mellon where he was a member of the investment team for Global and Opportunistic Fixed Income strategies. He started his career at JP Morgan working with high net-worth clients. He is currently a member of the investment committee at Babson College, responsible for management of the college endowment. He has over ten years of investment experience and is a frequent speaker at conferences on the topic of “The Behavioral Impact on Portfolio Management Decisions”. He is a CFA Charterholder and a member of the CFA Society Boston.

Disclosure

This publication is designed to provide general information about the use of mortgage credit bonds as an alternative approach to positioning for rising rates. The opinions herein are those of the author, are made as of the date of this material, and are subject to change without notice. There is no guarantee the views and opinions expressed in this communication will come to pass. It is for educational purposes only. The information in this paper was obtained from sources believed to be accurate, but we do not guarantee that it is accurate or complete. It is provided for informational purposes only and was not issued in connection with any proposed LMCG strategy of offering of securities.

[i] Future inflation expectations is measured by 10 year US Inflation Swaps as of June 30, 2021. The source of this data item is Bloomberg.

[ii] Source: SIFMA, “US Mortgage Backed Securities Statistics”, https://www.sifma.org/resources/research/us-mortgage-backed-securities-statistics/, December 2020.

[iii] Source: SIFMA, “US Mortgage Backed Securities Statistics”, https://www.sifma.org/resources/research/us-mortgage-backed-securities-statistics/, December 2020.