By Hilary Till

Solich Scholar, J.P. Morgan Center for Commodities, University of Colorado Denver Business School and Committee Member, Chicago Chapter of CAIA.

With concerns on inflation flaring up, there has been renewed interest in potentially including commodities in diversified portfolios. This article will build off prior research in examining which commodities to include and in what size. We propose a novel and uncomplicated portfolio solution, which takes into consideration both historical results and plausible new paradigms. In addition, an investor would be able to implement this portfolio solution through deeply liquid futures markets.

Prior Research

Commodities for Inflation-Hedging

Neville et al. (2021) provides an updated look into inflation hedges with a long-term dataset of monthly commodity futures prices from 1946 through 2020. The authors find that “traded commodities have historically performed best during high and rising inflation.” In addition, their dataset’s commodity baskets had “a perfect track record of generating positive real returns” across inflationary regimes in the U.S., “averaging an annualized +14% real return.” This striking historical feature provides a good starting point for considering commodities in a diversified equity-and-bond portfolio.

The Special Role of Energy Futures Contracts

Energy-Focused Positions for Portfolio Diversification

Taken together, research work by Erb and Harvey (2006) and Bouchouev and Zuo (2020) indicate that an investor should consider avoiding non-energy commodities (a) so as not to add to equity risk exposures and (b) because there are not obvious structural sources of return in these markets. In addition, the Froot (1995) paper provides evidence that oil-weighted commodities had historically exhibited “strong hedging properties” for “broadly diversified portfolios.”

Crude Oil Futures Markets and a Timing Indicator

There are two deeply liquid oil futures markets: the WTI futures contract and the Brent futures contract. One difficulty in performing a historical study with the WTI market is that this contract has periodically detached from the global oil market, resulting in anomalous pricing of the front-month contract as compared to other markets’ crude oil prices. This has happened when there have been storage difficulties at the WTI contract’s hub, which impacts the market-clearing price of WTI, especially as the contract nears its maturity date, since it is a physically delivered contract. Similar issues have not been as severe for Brent futures contracts since, in contrast with WTI futures contracts, the Brent contracts can be cash-settled.

Investors would prefer that their commodity position-taking would not only provide portfolio diversification, but also be additive to returns. To achieve the latter ambitious goal, is there a relatively simple indicator for understanding when a commodity is scarce and therefore could be an indicator for taking on long positions? The short answer is yes. With monthly data, Gorton et al. (2013) examined 31 commodity futures over the period, 1971 to 2010 and were able to link relatively backwardated futures contracts with relatively low inventories (and correspondingly, relatively more scarcity.) Therefore, a relatively simple indicator for scarcity is if the futures contract’s front-month trades at a premium to the next delivery month’s contract.

Dynamic Portfolio Construction

Study Description

We will now examine whether it might be possible to systematically improve upon a classic balanced portfolio of 60% U.S. equities and 40% U.S. Treasuries. Unless there are solid reasons otherwise, such a portfolio will be our default allocation: it is our neutral benchmark. We will choose an alternative allocation of 30% U.S. equities, 30% commodities, and 40% Treasuries, which is near the historically optimal asset allocation in Levine et al. (2016) with several noteworthy differences. Our commodity allocation, as would be expected from our brief literature review, will solely be in Brent futures contracts, and we will only invest in the alternative allocation when the Brent contracts are trading in backwardation. In addition, this study will use liquid futures contracts for readily gaining exposure not only to the Brent market but also for taking positions in U.S. equities and U.S. Treasuries.

Our study’s specific trading rules are as follows: if the previous trading day’s Brent front-month-to-back-month spread is trading at a premium, take positions amounting to 30% in U.S. equities, 30% in Brent contracts, and 40% in 10-Year Treasuries. Otherwise, invest in the default portfolio of 60% U.S. equities and 40% 10-Year Treasuries. We will compare this trading rule’s results to the following two portfolios: (1) a balanced 60% equity / 40% 10-Year Treasury portfolio, and (2) an unconditional allocation to 30% in equities, 30% in commodities, and 40% in 10-Year Treasuries. We will gain exposure to each of the study’s asset classes through fully collateralized positions in their corresponding futures markets.

Data

Our study will use daily data from December 31, 1999 through December 31, 2020. The trading days will follow the New York Stock Exchange’s holiday calendar. For the Brent oil futures contract’s front-to-back spread, we will use the Brent settlement prices that are available from Bloomberg. For our study’s asset class returns, we will use total return series that are calculated by S&P Dow Jones Indices and which are available from Bloomberg. For the calculation of the study’s Sharpe Ratios, we will use excess return series that are also calculated by S&P Dow Jones Indices and are available from Bloomberg.

Results

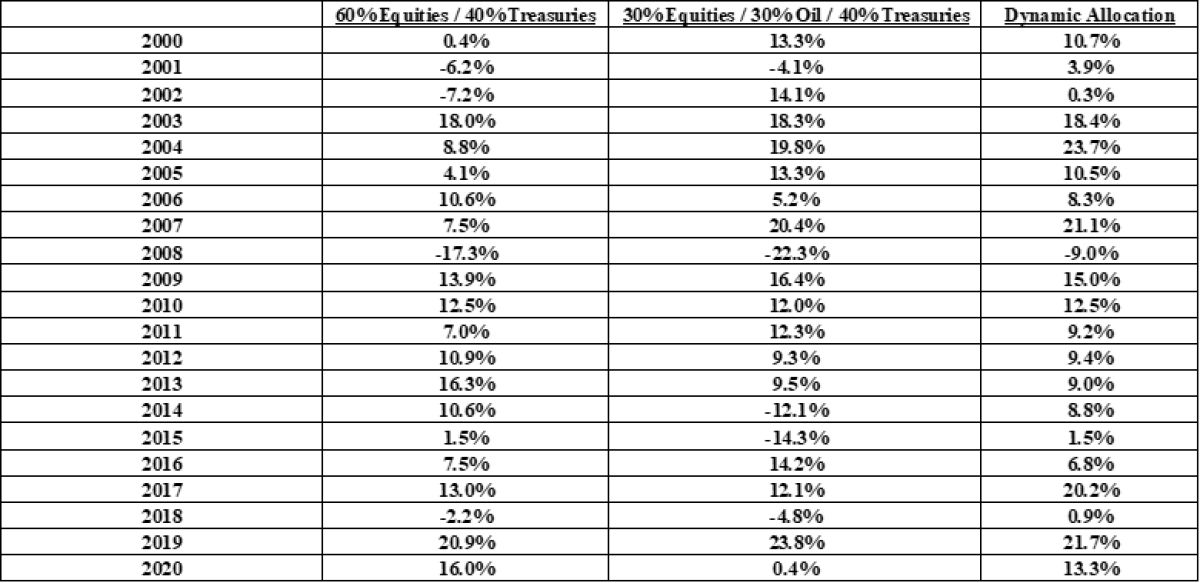

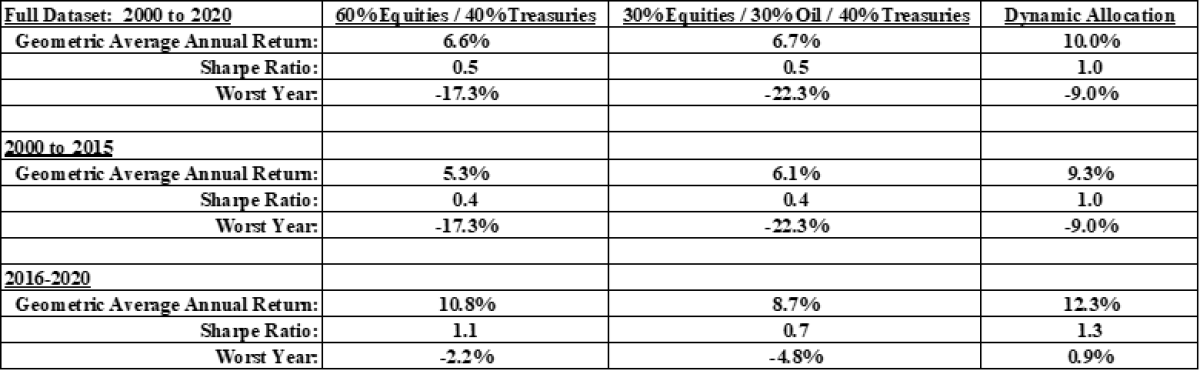

Table 1 provides the 2000-to-2020 yearly performance of (1) the neutral portfolio (60% equities and 40% Treasuries), (2) the static allocation across the three asset classes (30% equities, 30% oil, and 40% Treasuries), and (3) the conditionally determined strategy (the dynamic allocation portfolio). Table 2 provides the summary statistics for the three portfolios.

Over the full dataset, the “dynamic allocation” portfolio’s compound annual growth rate (CAGR) was 10.0%, which outperformed the two static allocation portfolios’ returns. The traditional portfolio earned 6.6% while the 30% equities/30% oil/40% Treasuries portfolio earned 6.7%. The dynamic allocation portfolio’s Sharpe Ratio came in at 1.0 while the other two portfolios had Sharpe Ratios of 0.5.

Over the 2016-to-2020 timeframe, the dynamic allocation portfolio still outperformed the classic balanced portfolio with the former portfolio having a CAGR of 12.3% and the latter portfolio earning 10.8%. The 30% equities/30% oil/40% Treasuries portfolio had the lowest returns of the three portfolios with a CAGR of 8.7%. The dynamic portfolio’s Sharpe Ratio was 1.3 while the classic balanced portfolio’s Sharpe Ratio was 1.1. The Sharpe Ratio of the 30% equities/30% oil/40% Treasuries portfolio was the lowest of the three portfolios at 0.7.

Table 1: Yearly Returns

Table 2: Summary Statistics

Note: The Sharpe Ratios are calculated from the yearly data in Table 1.

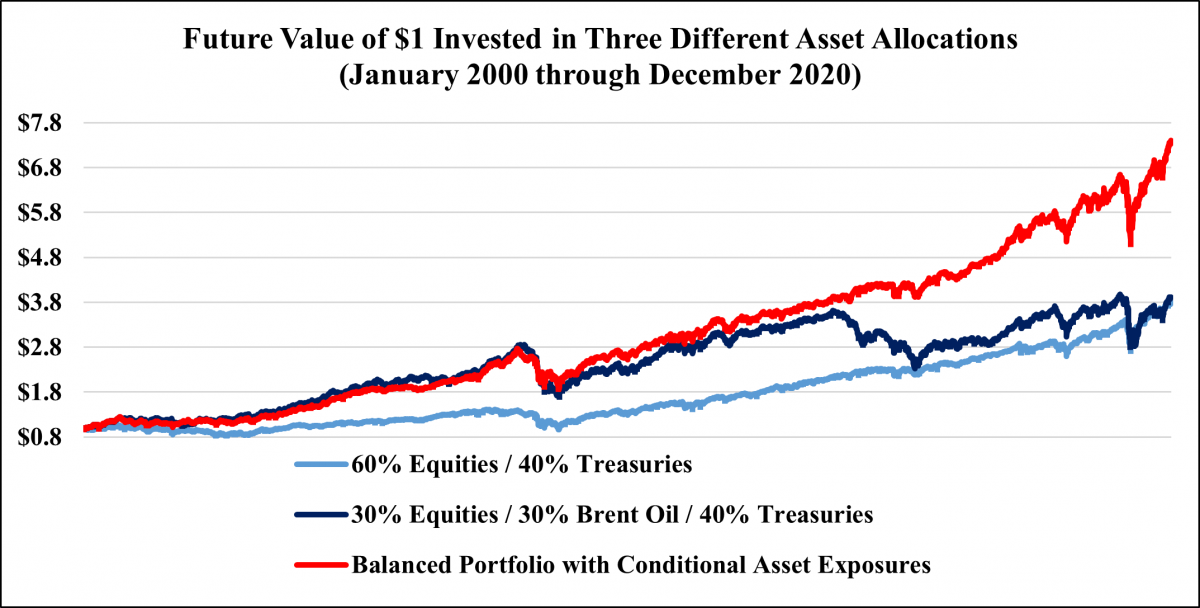

Figure 1 shows the growth of $1 in each of the three asset allocations from January 2000 through December 2020.

Figure 1

Source: Premia Research LLC.

Impact of a New Paradigm in the Energy Markets on Portfolio Construction

A potential concern with this paper’s results is its reliance on crude oil futures returns. What will happen to such a strategy if crude oil no longer remains a crucial fuel in the global economy, given how, in the words of Neville et al. (2021), “electric vehicle technology [is] developing fast”?

Dale and Fattouh (2018) provide a framework for the prospect of “peak oil demand.” Even if oil demand levels off, “[t]he world is likely to demand large quantities of oil for many decades to come.” The key paradigm shift under a “peak oil demand” scenario is that there would be a break from “a past dominated by concerns about adequacy of supply.” The world would be an entering an “age of [oil] abundance.”

The utility of our dynamic allocation’s strategy signal is that it is a proxy measure of oil inventory scarcity. And when there is a signal of surplus, the dynamic strategy does not include oil futures within its asset allocation. Under a new paradigm of oil abundance, the strategy would be expected to default to the classic balanced portfolio of equities and Treasuries. As a result, even with “peak oil demand,” an investor in the dynamic allocation strategy would plausibly be no worse off than solely investing in a classic balanced portfolio. And then however long the current paradigm holds, the investor in the dynamic allocation strategy could potentially earn superior returns relative to a neutral portfolio of equities and Treasuries.

Conclusion

Based on insights in prior research, this paper suggests a dynamic asset allocation into crude oil (and namely, into Brent futures contracts) when there is a (historically) reliable signal of scarcity. Such a portfolio, which consists entirely of collateralized futures contracts, would have had a Sharpe Ratio of 1.0 from 2000-to-2020 and a Sharpe Ratio of 1.3 from 2016-to-2020.

A key concern with such a strategy is if the demand for crude oil is supplanted by alternative fuels. Because the strategy is relying on the markets to provide a signal of oil scarcity or surplus, an investor can potentially be agnostic on when an energy transition could occur. When a surplus in oil is signaled, the rules-based investment strategy defaults to a classic balanced portfolio.

As always, one must sound a cautionary note on the paper’s historical results since past performance is no guarantee of future results. One hopes, though, that this article stimulates further interest in designing efficient hedges for the corrosive effect that inflationary surprises can have on traditional portfolios.

Endnote

This article is excerpted from the paper, “Commodities, Crude Oil, and Diversified Portfolios,” in the forthcoming Winter 2021 edition of the Global Commodities Applied Research Digest (GCARD). The comprehensive article is available here.

References

Bouchouev, I. and L. Zuo, 2020, “Oil Risk Premia under Changing Regimes,” Global Commodities Applied Research Digest, Editorial Advisory Board Analysis, Vol. 5, No. 2, Winter, pp. 49-59.

Dale, S. and B. Fattouh, 2018, “Peak Oil Demand and Long-Run Oil Prices,” Energy Insight: 25, Oxford Institute for Energy Studies, January.

Erb, C. and C. Harvey, 2006, “The Tactical and Strategic Value of Commodity Futures: Unabridged Version,” Trust Company of the West and Duke University Working Paper, January 12.

Froot, K., 1995, “Hedging Portfolios with Real Assets,” Journal of Portfolio Management, Vol. 21, No. 4, Summer, pp. 60-77.

Gorton, G., Hayashi, F. and G. Rouwenhorst, 2013, “The Fundamentals of Commodity Futures Returns,” Review of Finance, European Finance Association, Vol. 17, No. 1, January, pp. 35-105.

Levine, A., Ooi, Y. and M. Richardson, 2016, “Commodities for the Long Run,” National Bureau of Economic Research Working Paper No. 22793, November.

Neville, H., Draaisma, T., Funnell, B., Harvey, C. and O. van Hemert, Man Group Working Paper, 2021, “The Best Strategies for Inflationary Times,” May 25. Available at SSRN: https://ssrn.com/abstract=3813202 as of May 31, 2021.

Disclaimers

This article is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor's objectives and circumstances and in consultation with his or her advisors. The views and opinions expressed are for informational and educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions, legal and regulatory developments, additional risks and uncertainties and may not come to pass. This article may contain "forward-looking" information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of market returns, and proposed or expected portfolio composition. Any changes to assumptions that may have been made in preparing this article could have a material impact on the information presented herein by way of example. Past performance is no guarantee of future results. Investing involves risk; principal loss is possible. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

All investments carry a certain degree of risk and there is no assurance that an investment will provide positive performance over any period of time. Commodity Trading Involves Substantial Risk of Loss.