By Joachim Klement, Head of Strategy, Accounting, and Sustainability at Liberum Capital.

People who know me for a while know that I am a big fan of infrastructure investments. In particular, I like direct infrastructure investments, both green and traditional. Before I moved to the UK, I did not know about the large number of listed infrastructure funds in the UK that allow investors with every budget to invest in this asset class. Without endorsing any specific fund and reminding everyone to do their own due diligence before investing in any of these funds, you can get an overview of the listed closed-end funds in the infrastructure and renewable energy space at the homepage of The AIC.

But investors also need to be aware that infrastructure investments are not as straightforward as they might think. One of the most common reasons why investors want to get a hold of infrastructure assets is because they promise stable cash flows that often are linked to inflation. And in a yield-starved world getting a stable dividend of 5% or more is indeed very tempting.

But when you look at the actual performance of closed-end funds and direct infrastructure investments, then their cash flows look anything but stable and in fact resemble more the cash flows of traditional private equity and direct real estate funds.

Distributions of infrastructure funds, private equity and real estate over time

Source: Andonov et al. (2021)

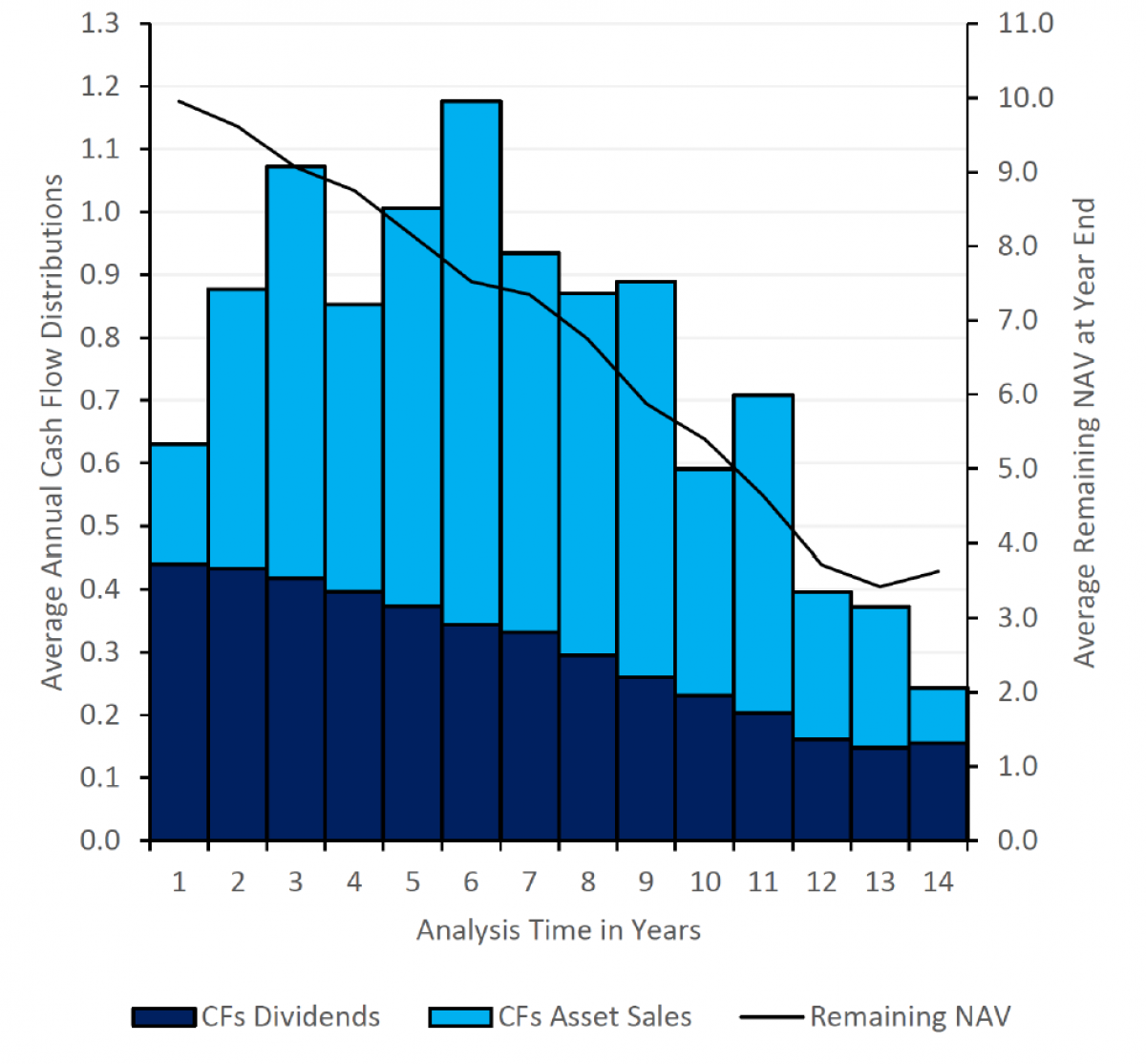

A new paper explains why. The underlying cash flows from the infrastructure assets are indeed very stable, but they only make a small part of the total cash flows of the investment. The bulk of the cash flows are generated by selling existing assets and distributing the proceeds to investors, just like a private equity or venture cap fund would do.

Simulated cash flows of infrastructure funds

Source: Andonov et al. (2021)

In fact, the main explanatory variable for the difference in performance between a top quartile and a bottom quartile infrastructure fund is how well the asset manager is able to exit an investment at a profit within the first five years of the fund’s life.

As they say in investing, a successful investment requires two good decisions, the decision to buy and the decision to sell. So far, the decision to sell generally was quite easy to make. As more and more investors increased their exposure to infrastructure investments, there were plenty of buyers for existing assets. Exits were easy and prices achieved were high. But as the asset class matures, less and less new money will flow into it and exits will become harder to do profitably – especially if you have paid too much for an asset when you bought it. This will mean that returns for infrastructure funds will likely decline over time, just like they did for private equity and venture capital. And it will become more and more important for investors to do their due diligence and invest in high-quality asset managers that don’t overpay for assets.

About the Author

Joachim Klement is an investment strategist based in London working at Liberum Capital. Throughout his professional career, Joachim focused on asset allocation, economics, equities and alternative investments. But no matter the focus, he always looked at markets with the lens of a trained physicist who became obsessed with the human side of financial markets.

Joachim studied mathematics and physics at the Swiss Federal Institute of Technology (ETH) in Zurich, Switzerland and graduated with a master’s degree in mathematics. During his time at ETH, Joachim experienced the technology bubble of the late 1990s first hand through his work at internet job exchange board Telejob.

Through this work, he became interested in finance and investments and studied business administration at the Universities of Zurich and Hagen, Germany, graduating with a master’s degree in economics and finance and switching into the financial services industry in time for the run-up to the financial crisis.

During his career in the financial services industry, Joachim worked as investment strategist in a Swiss private bank and as Chief Investment Officer for Wellershoff & Partners, an independent consulting company for family offices and institutional investors as well as Head of Investment Research for Fidante Partners.