By Eric Butter, an independent consultant and investor with experience in finance, statistics, and data engineering; and Ron McNamara Ph.D., Managing Director, First Principles Economics.

Richard Wiggins and Aaron Bloom compare the US electrical grid to the punchline from a Ron White joke about a guy who straps himself to a tree to be safe from the winds during a hurricane only to be hit by a “flying” Volvo; after all, it’s not the wind but rather what the wind is blowing that deserves your attention (link to Part One). Similarly, it is not so much the number of wind turbines or solar panels that are in operation - but rather the amount of transmission that can transport that energy - that deserves our attention.

Richard and Aaron make a compelling case that “the grid is the Volvo”, and now we will recommend several workout plans for income-hungry investors. We explain how "electrification" may be the most compelling driver of demand for electricity transmission and distribution, why the investment opportunity is so attractive over the next 20 years, and where to start looking for opportunities:

- Publicly traded Transmission-forward Utilities

- Publicly traded Transmission Service Providers

- Private Equity in Transmission Development

- Venture Funding of Emerging Technologies

- Transmission-linked Commodities

Electrification Leads the Investment Case

It turns out that the wind is blowing more than just Volvo's. Richard and Aaron explain that significant investment in the high voltage electricity transmission network (“the grid”) is (a) necessary to achieve our decarbonization goals, (b) justified already because our infrastructure is out-of-date relative to policy objectives, and (c) required to transport a high proportion of intermittent renewables to consumers. But a fourth driver is even more important to the investment case: electrification.

Many more devices are actively consuming and producing electricity than when our grid was built, and this too helps the grid decarbonize: smart thermostats, electric vehicles, rooftop solar, and smart meters, to name a few. Consumers are fundamentally changing how they consume energy. These changing consumption patterns impact how utilities transport energy in bulk at higher voltages (transmission) and at a local level (distribution). Engineers generally consider lines under 69 kV to be "distribution". Many of utilities' greatest challenges with electrification will be adapting transmission to intermittent utility-scale renewables, but also adapting to these new consumer patterns. Both renewables and electrification require a large investment in distribution.

Focusing on electrification of the transportation sector, from the perspective of electricity demand, every electric vehicle is roughly equivalent to a new house[i]. In 2020 in the United States, there were approximately 290 million automobiles, 1.8 million of which were electric vehicles. Assuming an average cost to a utility of $3,750 in necessary upgrades to accommodate each new electric vehicle, replacing one-half of the existing automobile fleet would require nearly $550 billion in new grid investment (including charging stations). The magnitude of this requirement is compelling under a wide range of assumptions about electric vehicle uptake rates. Consumer adoption rarely occurs linearly, so we expect transmission and distribution needs may catch many utilities off guard. Exacerbating the situation, there are large differences in costs to upgrade the grid in different locations: the investment needed in Wyoming will be very different than in Texas.

Competitive Transmission Unlocks Growth Opportunities

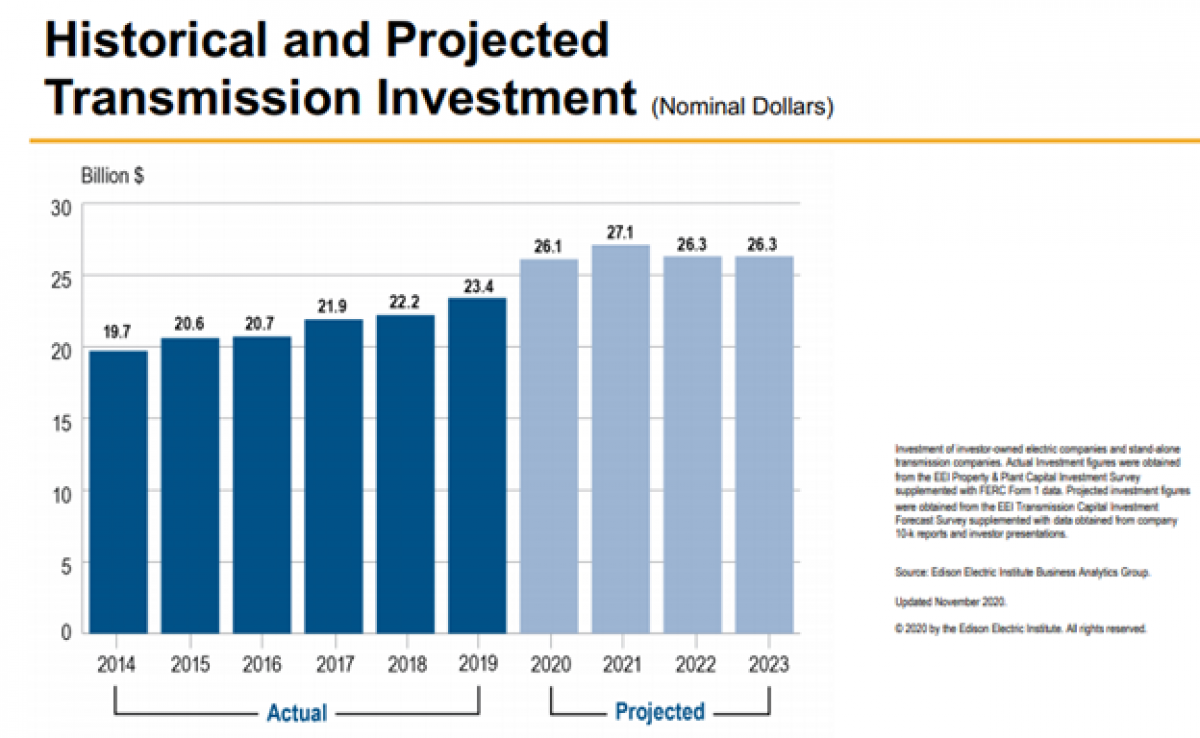

Until the passage of the Energy Policy Act (EPAct) of 2005, annual transmission investment was under $5b per year according to the Department of Energy (DOE) Annual Transmission Review and Edison Electric Institute Investor-Owned Utility surveys. EPAct added section 219 to the Federal Power Act, directing FERC to formalize rate-setting for transmission investments, justifications for new incentive-based rates to be approved by FERC, and rules around private-sector competition (FERC Orders 679, 890, and 1000). New rules limit risks when projects are abandoned, allow pre-commercial costs to be rate-based, and unlock adders on top of approved regulated rate of return. These rule changes are important enough that most investor-owned utilities have added Order 1000 to their list of material business risks in their annual SEC filings.

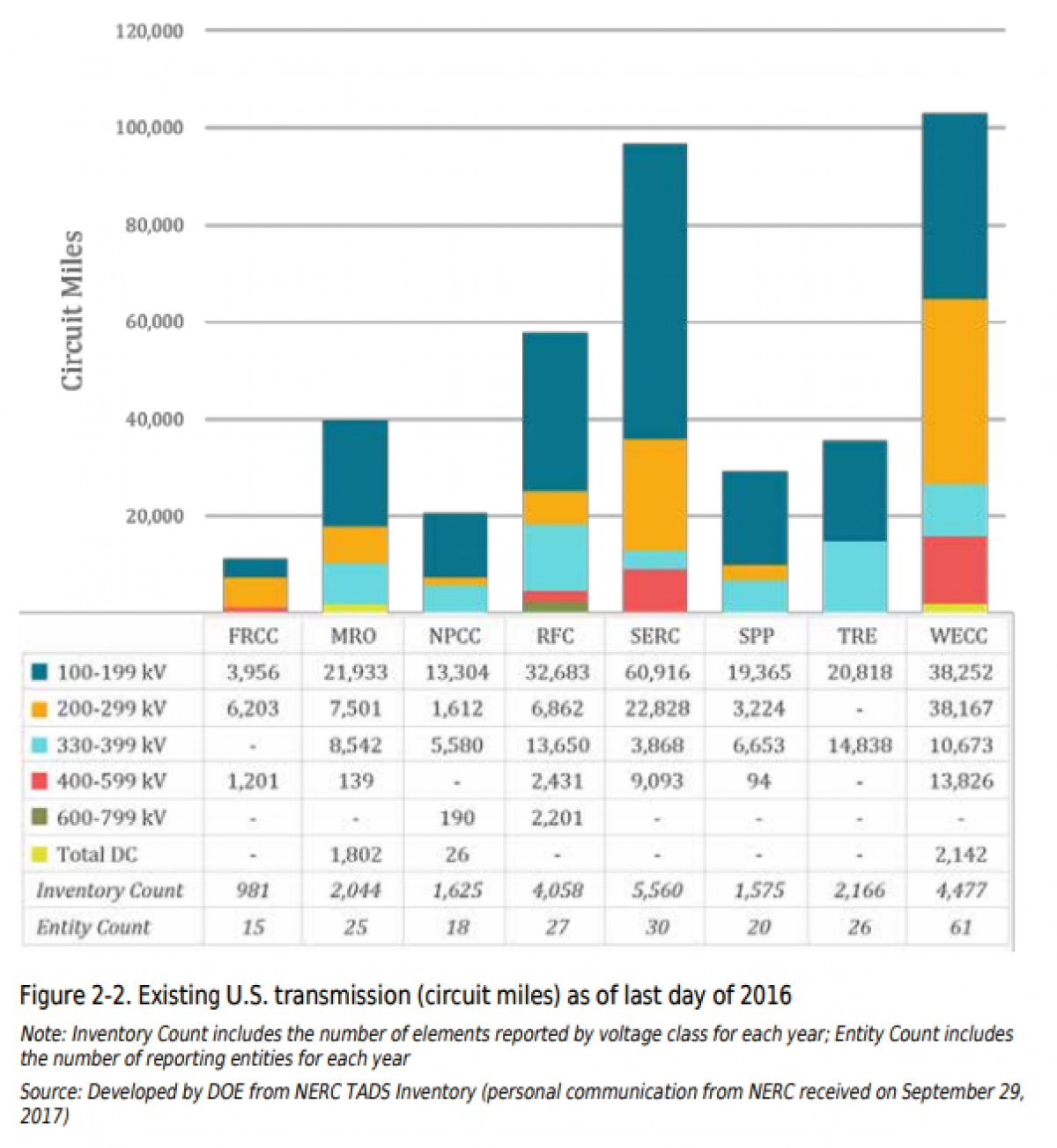

Since EPAct, investment in new transmission has grown to well over $20b per year, and continues to rise. Most of this investment is still simply improvement of existing infrastructure and networks. Each RTO has discretion on what transmission projects are open to private competition. Projects with shorter lead-times and lower voltage classes give incumbent regulated utilities a right of first refusal. Notably, well over half of US circuit-miles of transmission are under 199 kV, where regulated utilities all retain the right of first refusal. Distribution remains totally under the control of the regulated utilities, and requires equally large investments.

EEI survey results from Investor-Owned Utility (50% of total market) Transmission (>200 kV) investment expected through 2023 (EEI Public Investor-Owned Utility Transmission Forecasts 2021)

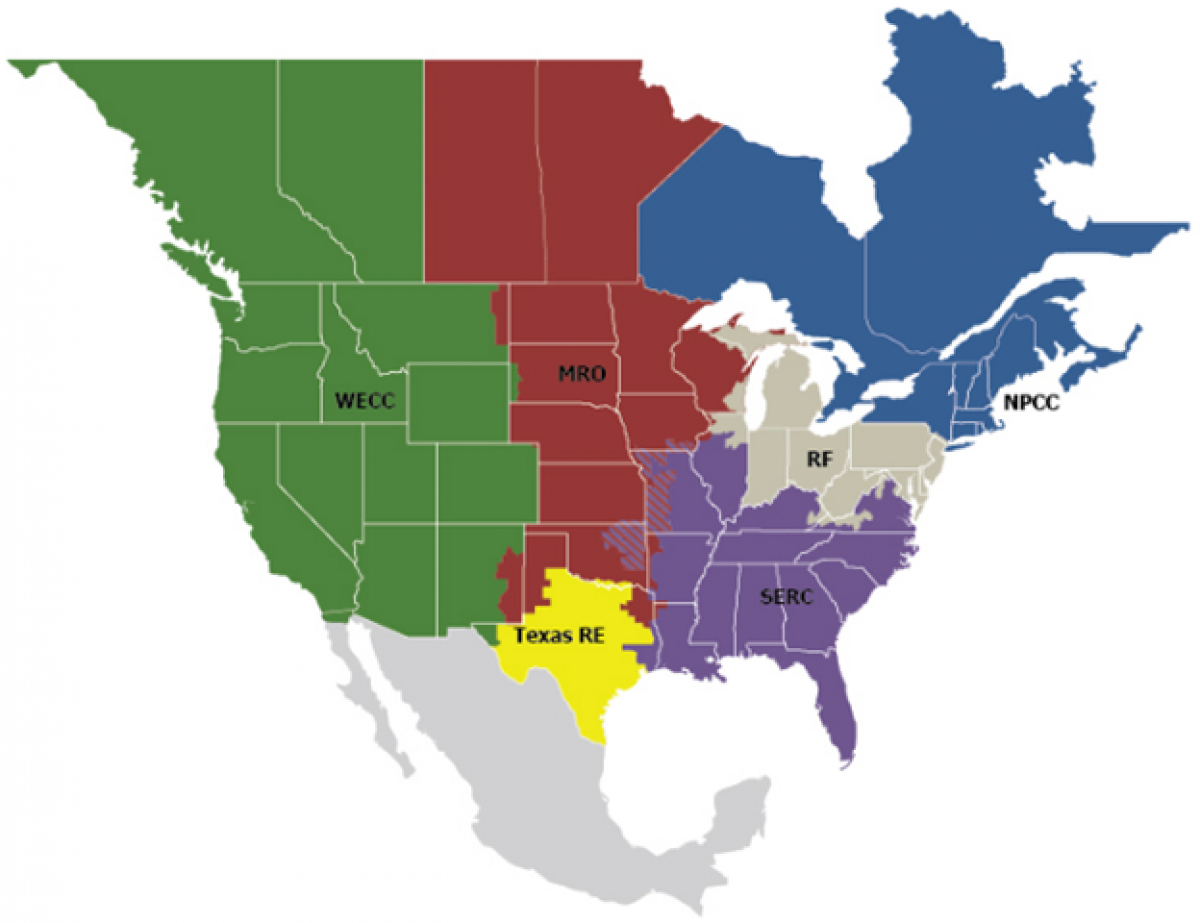

Breakdown of circuit-miles of transmission and distribution infrastructure in North America by NERC Region (see accompanying map for NERC Region locations) (DOE Annual Transmission Review 2018)

Map of NERC Electric Reliability Regions (NERC 2021)

Publicly traded Transmission-forward Utilities

Our transmission opportunity - let us now call it more broadly electrification opportunity - suffers from a major challenge: all transmission and distribution (T&D) in the US is highly regulated, even with the increased competition created by Order 1000. Transmission provides a stable 9-11% regulated return on equity with strong growth prospects, but there are few avenues for direct exposure. Companies are geographically-specific. Regulatory details may have an outsized impact on returns. Government-owned utilities and electric co-operatives are challenging to invest in. Many companies compete across traditional vertically-integrated models, deregulated retail and generation, and even gas and water distribution. For example, NextEra owns traditional utilities Florida Power & Light and Gulf Power, and NextEra Energy Resources, a group of independent power producers, retail energy providers, and independent transmission companies. Very few independent transmission companies exist for investors to directly participate in transmission investment.

The simplest path to investing in transmission infrastructure growth is investing in publicly traded regulated utilities that derive more of their business from transmission. NextEra Energy (NYSE:NEE) is taking a notable leadership position in merchant transmission investment as a natural complement to its merchant renewables development business. NEE purchased the high-voltage direct current (HVDC) Trans Bay Cable (TBC) in California, its HorizonWest competitively bid transmission projects, and the HVDC development assets acquired from Clean Line Partners, a well-known early mover in independent transmission development. AEP has developed the most “competitive” transmission assets - assets outside its traditional regulated monopoly territory. AEP also has a large regulated transmission and distribution footprint. Duke Energy (NYSE:DUK) has both a large traditional regulated transmission footprint, a joint venture called Duke-American Transmission Company with a unique independent transmission company called American Transmission Company, introduced below, and another joint venture with AEP called Pioneer. Certain international investor-owned utilities also derive a greater than usual share of their revenue from transmission, albeit outside the US, including Enel (BIT:ENEL) and Iberdrola (BMAD:IBE). Iberdrola's US arm, Avangrid (NYSE:AGR), has a small share of traditional regulated assets, and is bidding on competitive projects now. Berkshire Hathaway (NYSE:BRK) is a major player in merchant renewables and regulated utilities through its subsidiary BHE Energy, but these businesses account for under 5% of the holding company's earnings, providing little direct exposure to transmission investment tailwinds.

ITC Holdings is a rare "independent transmission company. ITC was the regulated transmission subsidiary of Detroit, MI utility DTE Energy (NYSE:DTE), spun off in 2003 into a unique competitive transmission-only business. ITC has since developed various merchant and joint-venture competitive transmission projects outside the DTE footprint. Canadian utility Fortis (TSX:FTS) acquired ITC in 2016. American Transmission Company (ATC) is a privately held pool of transmission assets serving regulated utilities in WI, MI, MN, and IL, including publicly traded utilities Allete (NYSE:ALE), WEC Energy Group (NYSE:WEC), MGE Energy (NASDAQ:MGEE), and Alliant (NASDAQ:LNT). Each of these utilities benefits from new transmission investment by ATC, in lieu of directly owning and operating their own transmission assets.

California regulated utility Sempra Energy (NYSE:SRE) owns regulated utilities SDG&E and SoCalGas, and various international assets. In 2017 SRE acquired Oncor, the regulated transmission assets of bankrupt utility TXU. In 2019, SRE also acquired InfraREIT (previously NYSE:HIFR), a unique real estate investment trust (REIT) for transmission assets including Sharyland Utilities managed by Hunt Enterprises. The acquisition resulted in a "de-REIT" process that was beneficial at the time, given the pending outcome of a 2020 rate case, and the lower tax savings from the REIT structure post-Tax Cuts and Jobs Act (TCJA) of 2017. Recent developments in US and international taxes may make structures similar to HIFR popular over the coming years.

US Electrical Utility Transmission & Distribution Exposure

Publicly traded Transmission Service Providers

Several manufacturers and technology owners are likely to benefit from increasing demand for HVDC and traditional transmission products. Prysmian Group (BIT:PRY) manufactures cable and provides Engineering Procurement and Construction (EPC) for HVDC projects including the TBC. Prysmian previously acquired General Cable, one of the largest US manufacturers of transmission cable. Nexans (EPA:NEX) and Bekaert (ETR:BEKB) also manufacture cables and coatings for transmission. Siemens (ETR:SIE) owns one of the most widely deployed traditional HVDC technologies. ABB (NYSE:ABB) owns and manufactures a competing HVDC technology deployed by the CSC HVDC line in the US, as well as many other bulk transmission technologies. ABB also provides transmission EPC services. Alstom (EPA:ALO) owns and manufactures another competing HVDC technology attached to several in-development projects. General Electric (NYSE:GE) has a power division that has downsized following years of underperformance, but still owns technology, manufacturing, and EPC services that will benefit from an increase in transmission investment.

Quanta (NYSE:PWR) and MYR Group (NYSE:MYRG) are two of the most transmission-focused publicly-traded EPC's. Other EPC majors with substantial transmission construction experience include Fluor (NYSE:FLR), MasTec (NYSE:MTZ), and EMCOR (NYSE:EME). AECOM (NYSE:ACM) sold its power division to private equity firm CriticalPoint Capital in 2020. Many competitors are private, including Bechtel, Kiewit, Wilson, and Burns & McDonnell.

Valmont (NYSE:VMI) manufactures support structures and coatings for construction, irrigation, and transmission; most of its direct competitors are private companies, including Sabre Industries (acquired by Blackstone 2021), Nello, and Pelco. Palfinger (VIE:PAL) is one of the largest manufacturers of the bucket trucks used by utilities. Time Manufacturing (Versalift) is a private US competitor. Custom Truck One Source (NYSE:CTOS, acquired by Blackstone 2021) and Herc Rentals (NYSE:HRI) both lease specialty trucks for various industries, including utilities.

Considering our broader electrification theme, many other public companies are worth consideration: Smart meters; Electricity storage, electric vehicles, and battery charging; Renewable generation (distributed, commercial, and utility-scale); Micro-grids and decentralized network control; Energy efficiency and demand response; Waste disposal.

Private Equity in Transmission Development

The developing regulatory landscape opens up new private investment opportunities that will benefit from growth in transmission infrastructure. Pre-commercial development of new transmission assets is the most direct exposure to this opportunity. Private developers can avoid certain early-stage development challenges by building HVDC lines where power flow can be controlled, and developers can underwrite the projects against long-term offtake contracts with utilities called Firm Transmission Capacity Purchase Agreement (FTCPA), an analog of the Power Purchase Agreement (PPA). Developers can also bid on traditional transmission projects issued by RTO's, individual state utility commissions, or multi-state groups with joint interests, earning a regulated rate of return by partnering with a utility and/or registering as a FERC Participating Transmission Owner (PTO).

Pre-construction transmission development is a long-term focused capital-intensive business. Illiquidity is similar to commercial real estate development, but with more complex technical and permitting challenges. In exchange, private transmission development offers the promise of stable high single-digit regulated returns on equity from high-quality counterparties (RTO's or utilities) over 20 or more years. Most developers are attached to a major pension fund: Anbaric is partnered with Ontario Teachers' Pension Plan (OTPP); Pattern Energy is wholly owned by Canada Pension Plan Investment Board (CPPIB); and Invenergy is majority owned by large pension managers CDPQ and AMP Capital. Two developers, LS Power, and Blackstone (NYSE:BX) through its subsidiaries GridLiance (sold to NextEra in 2020) and Transmission Developers Inc. (TDI), are involved in pre-construction development, and may raise private equity funds that provide exposure to this early stage development. Other competitors include the previously-mentioned transmission-focused utilities, and emerging competitors such as wind farm developer RES, and Related Companies through subsidiary energyRe. Post-construction buyers include Argo Infrastructure Partners, a private equity fund sponsored by Crow Holdings (owns the Cross Sound Cable and Hudson HVDC lines), Ares Management (NYSE:ARES) through subsidiary Energy Investors Fund, and Starwood Capital through Starwood Energy Group.

Venture Funding of Emerging Technologies

Over the coming decades, emerging technologies are likely to benefit from transmission investment constraining the growth of renewable energy. "Grid Enhancing Technologies" including Topology Optimization, Dynamic Line Ratings, and Advanced Power Flow Control, assist utilities and RTO's to optimize their existing transmission capacity using advanced models and sensors. Private companies developing these technologies include NewGrid, Lindsey Systems, LineVision, and SmartWires. Other companies are engineering new materials and systems that maximize transmission efficiency, such as VEIR's high temperature superconductor system. Still others may unlock the unique use cases for wireless transmission, such as Emrod Energy's trial in New Zealand. A large growth in new transmission investment may create new cybersecurity threats, challenges, or FERC rule changes which create additional software investment opportunities, although this is a small and insular market. Angel and venture capital funds that have invested along these themes include: Korys, Noshaq, The Engine, Breakthrough Energy Ventures, Congruent Ventures, and Clean Energy Ventures.

Transmission-linked Commodities

Penetration of renewable resources continues to grow quickly, and we expect to continue to see growth in local power plants ramping up temporarily to fill in for fluctuations in renewable supply, a phenomenon called congestion. In recent years, congestion accounted for $5b of the $100b of wholesale energy costs in ISO's (ISO's account for 60% of US electricity sales in GWh, the remainder being traditional regulated utilities). Utility scale batteries and active load management may alleviate these costs in the future, but growth will be slow.

Congestion prices in wholesale energy markets are the closest measure we have for transmission demand: the higher the congestion, the more that transmission is limiting cheaper power plants from serving customer needs. Financial transmission rights, auction revenue rights, and congestion revenue rights are financial contracts that the wholesale markets use to insure energy consumers against rising congestion costs. The annual revenues from these contracts in US wholesale markets are similar to annual congestion costs, $5b. Regulated utilities and independent power producers such as Vistra Corp (NYSE:VST) and NRG Energy (NYSE:NRG) are major participants in these monthly and annual auctions because these companies have natural congestion exposure. Private traders also speculate on congestion prices. Hedge funds and banks have reduced their involvement in these markets due to their small size, competitiveness, and regulatory complexity. Market returns are much more volatile than public markets, with cash returns and losses often exceeding 100% of posted collateral. As more renewables join the grid and transmission constraints increase, increasing congestion should in turn lead to a larger market for these contracts.

Natural gas combined cycle power plants will also continue to be the price-setting resources in most US markets for the next 10 years or more, until battery prices are competitive and more broadly deployed. Gas power plants offer their energy at a spread over their fuel costs, so congestion costs are correlated with regional gas prices. Speculating on currently rallying gas prices, or investing in upstream developers with lighter hedge books like Antero (NYSE:AR) for even more convexity, can provide indirect exposure to increasing congestion, and increasing transmission demand.

Another article that may be of interest: https://www.bankrate.com/insurance/car/the-rise-of-electric-vehicles/

Footnotes:

[i] The average electric vehicle requires 30 kilowatt-hours to travel 100 miles — the same amount of electricity an average American home uses each day to run appliances, computers, lights and heating and air conditioning. See: https://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2020/01/09/electric-cars-will-challenge-state-power-grids(EEI Public Investor-Owned Utility Transmission Forecasts 2021

[ii] "Competitive Transmission" is the author's definition; it includes transmission assets financed in non-traditional ways, such as merchant direct-current or assets outside a utility's regulated footprint

[iii] Underground lines are more expensive and resilient, and may indicate relative T&D investment; areas with severe weather may have a lower hurdle for burying lines; where not reported by the utility, "NR"

About the Authors

Eric Butter is an independent consultant and investor with experience in finance, statistics, and data engineering. Eric was previously a partner at Modern Energy Group, a renewable energy investment company where he led a business unit developing quantitative power trading strategies, and served as a drop-in COO/CTO for renewable energy developers. Eric was previously the Head of Technology for Tenor Capital, an investment adviser specializing in event-driven relative value trading strategies, including convertible arbitrage, international commercial arbitration, alternative energy, and structured products. He lives in North Carolina.

Ron McNamara has successfully designed, implemented, operated, monitored, and regulated two separate wholesale electricity markets (New Zealand and the Midwest ISO). He has also successfully traded all of the organized electricity markets in the U.S. and has direct experience working with, and for, electricity market operators, electricity system operators, vertically integrated regulated utilities, government agencies including regulatory bodies, international financial institutions, government-owned corporations, state-owned enterprises, electric co-operatives, independent power producers, power marketers, investment banks, proprietary traders and hedge funds. Ron has been involved in energy sector projects in 30+ countries (North America, Central America, Asia, Asia/Pacific, Africa and Europe) at all stages of economic development. His experience spans physical energy market design, implementation, operation regulation and financial contracting, hedging, trading and risk management.

The contents of this article do not constitute investment advice, and the views expressed herein are those of the author, and not of Modern Energy or any of its affiliates or other personnel.

Ron White photo credit: Organica Music Group