By Joachim Klement, Head of Strategy, Accounting, and Sustainability at Liberum Capital.

Some time ago, I was asked by a reader to write about Central Bank Digital Currencies (CBDC) and the latest thinking around this new form of payment/asset. And while I am on record as being sceptical about Bitcoin and other first-generation cryptocurrencies, I am quite optimistic that CBDC will become a reality and an important and possibly the dominant form of digital currency in the future. There is a lot of research going on in this field with 86% of all central banks surveyed by the BIS last year stating that they are engaged in CBDC work. That is up from 65% three years earlier. And let’s not forget that in 2020, the central bank of the Bahamas became the first one to issue retail CBDC.

What are CBDC?

To start with, let’s be clear that when I use the term CBDC I will mostly talk about retail CBDC, that is digital currency issued by a central bank, accepted as legal tender in a country, and widely available in public. There are also wholesale CBDC which are designed for special purposes like trade finance that I will ignore in this series. And then there are synthetic CBDC, i.e. digital currencies backed by central bank assets that could be issued by commercial banks or money market funds, in theory. The problem with synthetic CBDC is that they are unlikely to become legal tender while cash and CBDC are. And if you ask me what it means to be legal tender, I will not go into a lengthy discussion of the legal requirements and simply state that for all practical purposes, legal tender is everything that you can pay your taxes with. It is this status as legal tender and the fact that it is issued by a central bank that differentiates CBDC from other forms of electronic money and makes it a form of cash.

Difference between CBDC and other forms of digital and physical currency:

Source: Kiff et al. (2020)

Why CBDCs?

But if CBDC are just a form of digital cash, why do central banks want to issue that in the first place? There are several reasons why CBDC might be a good idea:

-

Financial stability: At the moment, we witness a proliferation of digital currencies. While the supply of any one digital currency like Bitcoin may be limited, there is absolutely no limit to how many digital currencies are created and put into circulation. I once read a story about a guy who wanted to create a cryptocurrency for cosmetic and plastic surgery… You may say that this “democratisation” of finance and money is a good thing, but I can assure you, it is possibly the most dangerous side effect of the current cryptocurrency boom. There is a good reason why central bank currencies were invented in the first place. If you study medieval Europe when every principality issued its own currency, you will quickly learn that trade and economic activity were severely hampered by this plethora of currencies. At every transaction, people had to look up the exchange rate between one currency and another, and the exchange rate varied over time and as a function of distance from the nearest bank who would accept it as a form of payment. Think about a world in which you would have the US Dollar, British Pounds, Euros, Romanian Leus, Mongolian Tögrögs and dozens of other currencies all used at the same time at the same shop. Good luck figuring out how much something costs and if you have been ripped off by the vendor.

In fact, even with one single currency in place, the cost of paying with cash is much larger than most people are aware of. Studies have shown a cost of using physical cash to private businesses (mostly the retail sector and banks) of 0.2% of GDP in Norway and Australia, 0.5% of GDP in Canada, and 0.6% in Belgium. Creating a plethora of digital currencies competing with each other would increase these costs significantly and increase the risk of currency crashes within an economy and reduced financial stability. Thus, if you can’t avoid the rise of digital currencies, you at least can make sure they are designed and managed in the safest and cheapest way possible.

-

Payment efficiency: The significant costs of payments performed with physical cash and other forms of payment may be reduced with digital currencies if they are fast enough to handle the thousands, if not millions of transactions per second that are done in cash every day. First-generation digital currencies are unable to handle these transaction volumes (another reason, why I think they are merely a gimmick), but central bank digital currencies are designed from the get-go as an efficient means of payment and would provide central banks more control over a crucial part of our financial infrastructure and thus further reduce risks of financial instability.

-

Payment safety: Contrary to what private companies may want you to believe, it is in the best interest of businesses to spend as little on IT security as possible. IT is a crucial balancing act. Spend too little on IT security and your data will be stolen and you may even go out of business. Spend too much and your profit margins will shrink and your share price declines. Thus, for a private company, the incentive is to always spend as little as necessary to avoid major disasters. A central bank does not have these profitability concerns and only has to maximise the trust in its digital currency. Thus the incentive of a central bank is to spend as much on IT security as possible in order not to endanger a loss of trust by the public in CBDC.

-

Antitrust: With the use of digital currencies comes the ability to collect an enormous amount of data on how people use the currency. Private companies can use this data to sell it to advertisers and other businesses (see Google or Facebook). Furthermore, if a company is big enough, it can effectively prevent any competition from rising due to its market power (see here for a discussion).

-

Financial inclusion: This is arguably not a big issue in developed markets as can be seen in the chart below, but in emerging markets, there are often millions of unbanked citizens and people who are unable to even get access to a bank. The success of electronic payment systems like PayTM in India shows that with the help of digital currencies, millions of people could get easy access to money.

-

Monetary policy implementation: Finally, many central banks think about CBDC as a means to enhance the implementation and effectiveness of monetary policy. This is such a wide-ranging and (in developed markets) important topic, that part 4 of this series will entirely be dedicated to this topic.

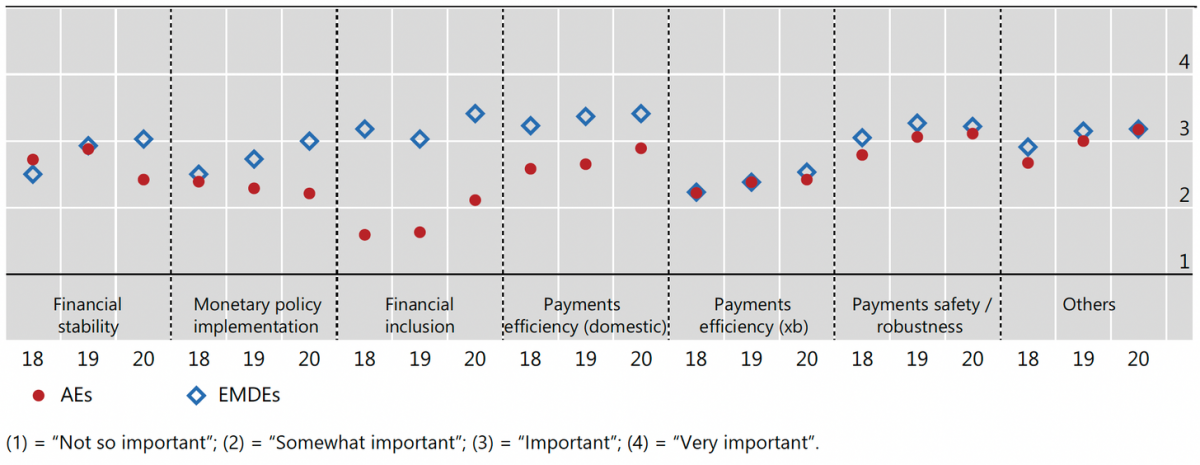

The reasons for CBDC:

Source: BIS

The tradeoffs

In this part, I am going to look at the practical difficulties that CBDC must overcome. I will do this by looking at the three basic functions of cash, namely to act as a medium of exchange, a store of value, and a unit of accounting. Hopefully, by doing this, you will understand why it is so much harder to launch a CBDC than any run-of-the-mill cryptocurrency or electronic payment system and get an appreciation for what a genius invention physical cash really is.

Store of value vs. medium of exchange

When we think of physical cash, we immediately think of it as a store of value and a medium of exchange. Cash is worth the same tomorrow (at least nominally) as it is today, and I can readily buy things with it in a store.

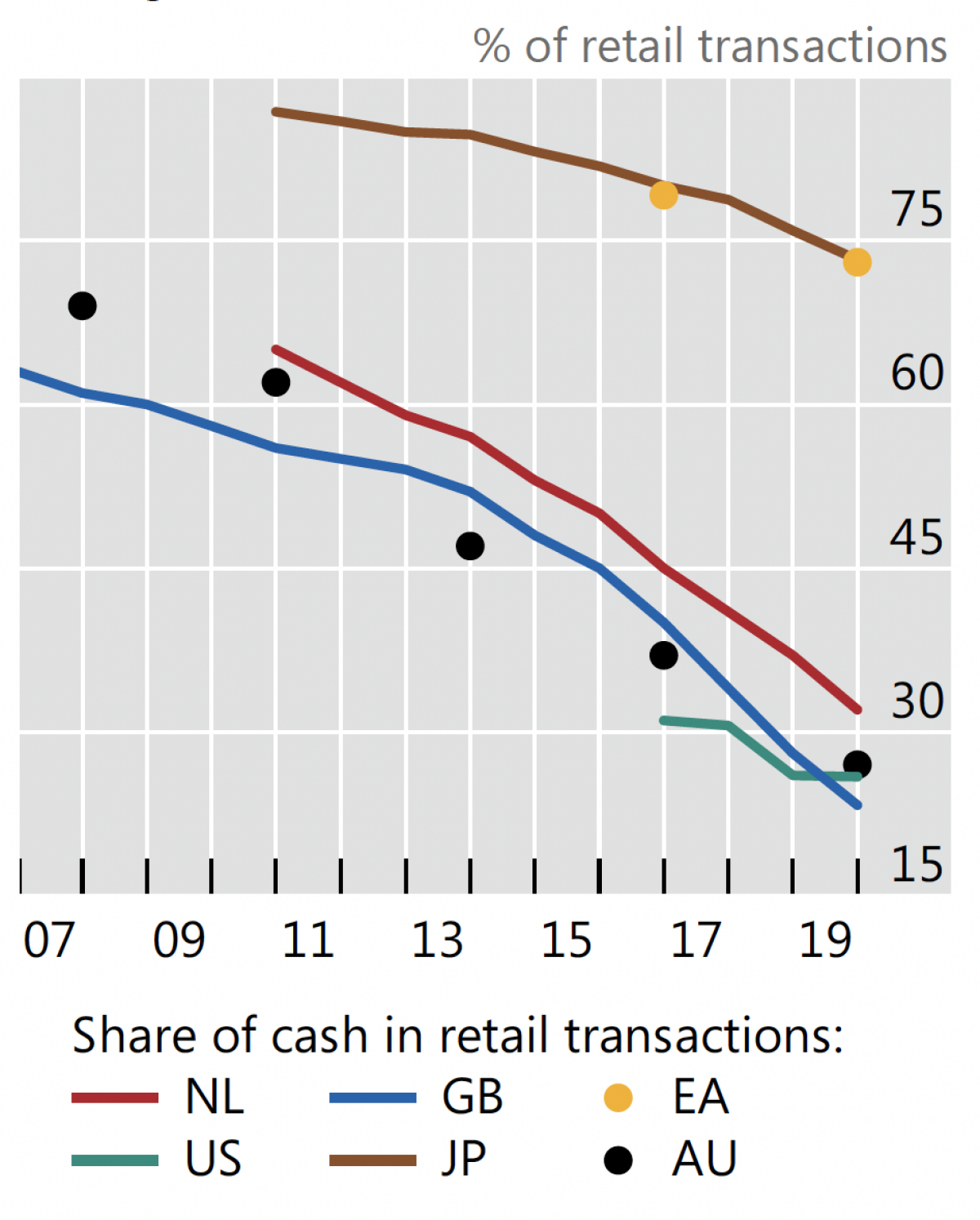

The problem with CBDC is that they are electronic and the folks in Silicon Valley and big cities might not realise this, but there are a lot of people who cannot live without physical cash. In 2019 the Access to Cash Review concluded that 17% of the population in the UK need physical cash to live their lives. Having only electronic cash available to them would cause serious disruptions in their business or make it impossible for them to purchase the goods they need for daily life. And this is in one of the most developed countries in the world. Across the Euro Area (EA) and Japan, the use of physical cash is far more prevalent than in the UK or the United States as the chart below shows.

Share of retail transactions done with cash

Source: BIS

One key reason for this need for physical cash is that the IT and telecom infrastructure is not available to access modern electronic payment systems 24/7. And this is one of the key challenges for CBDC to overcome. A CBDC needs to be available 24/7 and cannot experience server outages or downtimes. This means that either there is an enormously robust IT infrastructure available everywhere (which would require billions in infrastructure investments even in the most developed countries), or the CBDC must be transferable and be usable as a method of exchange offline. The current thinking is that CBDC will likely be transferrable offline in limited amounts to enable its use as a method of exchange even in the absence of internet connections.

But here is the rub. If you can transfer it offline, how do you make sure it is a valid transaction? Distributed ledger technologies that are at the heart of all cryptocurrencies are based on the proof of work or the proof of stake concept where a transaction is validated by calculations on computers that proof you are the rightful owner of a coin. If you don’t have a connection to a computer, how do you come up with a proof of work or proof of stake? This is why there will likely be limits to the amount of CBDC that can change hands before a proof of stake will become necessary. If the proof of stake fails, the transactions can be unwound without disrupting the overall payment system too much.

But here is the next difficulty. If you use distributed ledger technology as the foundation of a CBDC, you increase its security because the information about the CBDC and past transactions is stored on many computers and thus less prone to hacks and cyber-attacks. Yet, by distributing the information about the CBDC tokens (or coins) you also reduce the transaction speed. Payment systems that are handled by a central ledger like every credit card system, electronic payment systems, or bank accounts can handle tens of thousands of transactions per second. Bitcoin can handle only a handful. Progress is being made in enabling cryptocurrencies to perform more transactions, but we are nowhere near the number of transactions that need to be made for a currency to act as a universal replacement for physical cash. If you want to create a CBDC that is a universal method of exchange, you need to compromise its safety and thus reduce the trust people have in it as a store of value.

This tension between store of value and medium of exchange is nothing new, by the way. In the days of the gold standard, a central bank could only increase the amount of money in circulation if it had enough gold bullions in its safe. This meant that if cash became scarce (e.g. during a recession or a run on banks), central banks had to increase interest rates to incentivise people to put more gold into its safe so it could issue more cash to the public. This is one of the key reasons why the Great Depression turned out so bad. The moment the economy faced a liquidity crunch, the central bank had to reduce liquidity even more to protect its gold holdings. This is unfortunately something gold fetishists forget all too often. It is only with the introduction of fiat money and the end of the gold standard that we could start to manage recession better and prevent waves of default during every economic downturn. Look at the decline in economic activity and the spike in unemployment during economic downturns in the era of the gold standard and the years since and you will see what we have gained by abandoning it.

The current thinking is that with CBDC it is probably best to err on the side of enabling more transactions rather than making it an incredibly safe store of value. Probably the best way to strike a balance is the use of CBDC that are either based on a centralised ledger or a distributed ledger technology but with a limited number of permissioned participants in the distributed ledger. Most likely such a technology would use commercial banks that are regulated by the central bank as the nodes of a distributed ledger network.

Even so, if you have a generally accepted store of value that can handle many transactions per second, you suddenly run into another problem. If CBDC are proper stores of value like physical cash, they could be used like traditional bank accounts. People could transfer electronic money from their bank accounts into CBDC and store their wealth there. You may say that this surely isn’t a problem, since you can just go to your bank and ask to get all the money in your bank account paid out in cash and your bank teller will readily oblige. That may be true for you and me, but in practice, there are limits to how much physical cash you can hold. First, there are the obvious limits that physical cash takes up space and you need to store it safely (you can also opt to leave it out in the open, but then its characteristic as a store of value may be undermined by its extreme fungibility as other people will help themselves to your stored value). But even if you managed to build a massive safe and hire a couple of security people and armoured vehicles to transport the cash from your bank to your safe, try getting any large amounts paid out to you. Why do you think there are no ETFs backed by physical cash anywhere in the world? In theory, these ETFs would accept people’s electronic money and invest it into physical cash stored in a vault. It’s a remarkably simple concept and in a world of negative interest rates, it can become a profitable investment since the cost of safekeeping for these large amounts is a few basis points compared to the 40 basis points or so people have to pay on bank deposits in the Eurozone, for example.

So, if we accept that in practice, you cannot hold unlimited amounts of physical cash, but with CBDC, it is easily possible to accumulate enormous amounts in a few seconds or minutes, we have to think about how we can limit the amount of CBDC held by any individual. This means limiting the amount of CBDC that can be held in any one electronic wallet. But more than that, it means that central banks or commercial banks have to be able to identify many different electronic wallets that belong to the same owner because otherwise, we would quickly see a virtual run on banks where bank deposits would be raided and moved into CBDC wallets thus creating a universal financial crisis that would make 2008 look like child’s play. But if we want to be able to control how much CBDC any one user can own across many different electronic wallets, we have to be able to identify the owner of each wallet. And this means that CBDC is no longer anonymous, but ownership can be linked to an individual. It’s like having to sign every bill you get in the shop with your name and the shopkeeper notifying the central bank of the new owner of the bill.

Now assume we introduce such an identification mechanism (even if it is anonymised) and combine it with distributed ledger technology. This means that the ownership of every unit of CBDC is not only stored at a computer in the central bank but a copy of it is stored on every computer participating in the network. And if that computer gets hacked, it might not bring down the network, but it will expose ownership of the different CBDC units. To make things even more fun, the GDPR in Europe enshrined a right to be forgotten into law. But a blockchain-based distributed ledger technology doesn’t forget. One of the components that makes it so safe and trustworthy is that it has an eternal memory of all transactions ever made with an electronic coin. But if you ingrain that technology into a CBDC and only one person in the EU buys one of these coins, the GDPR becomes applicable and with it this person’s right to be forgotten. Now you go deal with all the privacy lawyers in the world to sort that one out.

Currently, the only way out of this misery is to rely on centralised ledgers owned by the central bank or use distributed ledgers with only commercial banks permitted as nodes after they have done a proper KYC on their clients. For emerging markets with millions of unbanked people, a distributed ledger technology is probably not feasible anyway due to the required infrastructure. so, in these countries, one would expect a CBDC to be based on one central ledger held by the central bank. But that still means that the central bank can see your identity. The Chinese efforts in developing a CBDC go down this route by allowing every user of the CBDC to control who can see their identity. This way, users of CBDC can remain anonymous with the exception of one counterparty: The People’s Bank of China will always know who each user is. This is necessary to run the ledger but of course, it potentially could prove to be a weak point if a central bank is not independent of the government and may be forced by governments to hand over identifying information about CBDC ownership.

Meanwhile, the ECB has experimented with ‘anonymity vouchers’ that allow users of CBDC to transfer ownership of a limited amount of currency over a limited amount of time without their identity being known to counterparties or the central bank. But the problem here is still that the vouchers themselves have to be monitored and audited, which opens up the possibility to identify the users of these vouchers.

Method of exchange vs. unit of accounting

By now you have probably thrown your hands into the air about the difficulties of CBDC and their prospects of replacing physical cash. But let me throw one more obstacle at you. Physical cash is a natural unit of accounting in a way that most electronic cash is not. If you go to PayPal, for example, and you deposit money on your account, it becomes part of PayPal’s balance sheet. This is fine most of the time, but as I have discussed here, it can become a massive problem if PayPal becomes illiquid or bankrupt. Then, your money becomes part of the insolvency proceedings and you become an unsecured creditor of PayPal. This is not the case with physical cash or central bank-issued electronic money. That stuff has to stay around even if the payment provider goes under. One natural way to roll out a CBDC is for the central bank to issue the currency to commercial banks just like they do at the moment with traditional money (both physical and electronic). These commercial banks then distribute the money through loans, etc. Because of the fractional reserve system, the amount of money distributed across the economy is a multiple of the actual central bank money created in the first place. Because CBDC would be a replacement for physical cash, we have to assume that to roll out the CBDC, the commercial banks would be the distributors. Then, either these commercial banks or third-party firms would develop technologies like payment systems and electronic wallets to enable people to use CBDC as a method of exchange.

But these third-party firms that develop payment systems and electronic wallets can (and will) go bankrupt. And the CBDC has to be still in place after these companies have gone bankrupt. In fact, there has to be an easy mechanism to transfer CBDC from an insolvent payment provider to a solvent one in order to keep the financial system stable and avoid a run on banks.

But to do this, every payment provider needs to have separate accounts for its electronic cash and payments and for the CBDC so that it is straightforward to identify the CBDC if needed. That also means that every payment provider needs to know who owns which CBDC at any given point in time. Et voila, we are back to the privacy issue because now, all of a sudden, every CBDC coin has to be at least linked to a private key and ultimately an owner and that reduces privacy and makes it inferior to physical cash. I can already hear the cryptocurrency fans shouting at me that private keys for a token are anonymous, but these keys are either held in e-wallets or in accounts on crypto exchanges. Next week, I will talk about the security risks associated with these storage systems and why they may not be as anonymous as many people think.

If all of this feels like we are going in circles it’s because we are. The latest thinking is that CBDC will be less private than physical cash and that with the ownership of a CBDC coin will come an anonymised identifier of current ownership. This way, it is possible to track who owns the coins without identifying the person by name. Only once the person demands access to the CBDC can he or she show the identifier and proof of ownership. Nevertheless, the translation mechanism between the anonymous identifier and the name of the owner can be hacked and provides another security risk. But this is where we stop this week in order to pick it up next week to discuss the myriads of IT security issues with CBDC.

Original article Part 1: https://klementoninvesting.substack.com/p/cbdc-part-1-the-what-and-why

Original article Part 2: https://klementoninvesting.substack.com/p/cbdc-part-2-the-how

About the Author:

Joachim Klement is an investment strategist based in London working at Liberum Capital. Throughout his professional career, Joachim focused on asset allocation, economics, equities and alternative investments. But no matter the focus, he always looked at markets with the lens of a trained physicist who became obsessed with the human side of financial markets.

Joachim studied mathematics and physics at the Swiss Federal Institute of Technology (ETH) in Zurich, Switzerland and graduated with a master’s degree in mathematics. During his time at ETH, Joachim experienced the technology bubble of the late 1990s firsthand through his work at internet job exchange board Telejob.

Through this work, he became interested in finance and investments and studied business administration at the Universities of Zurich and Hagen, Germany, graduating with a master’s degree in economics and finance and switching into the financial services industry in time for the run-up to the financial crisis.

During his career in the financial services industry, Joachim worked as investment strategist in a Swiss private bank and as Chief Investment Officer for Wellershoff & Partners, an independent consulting company for family offices and institutional investors as well as Head of Investment Research for Fidante Partners.