By Allen Sukholitsky, CFA, Chief Investment Officer at Masterworks. Masterworks offers institutional investors, wealth managers, and self-directed investors access to art as an investable asset class.

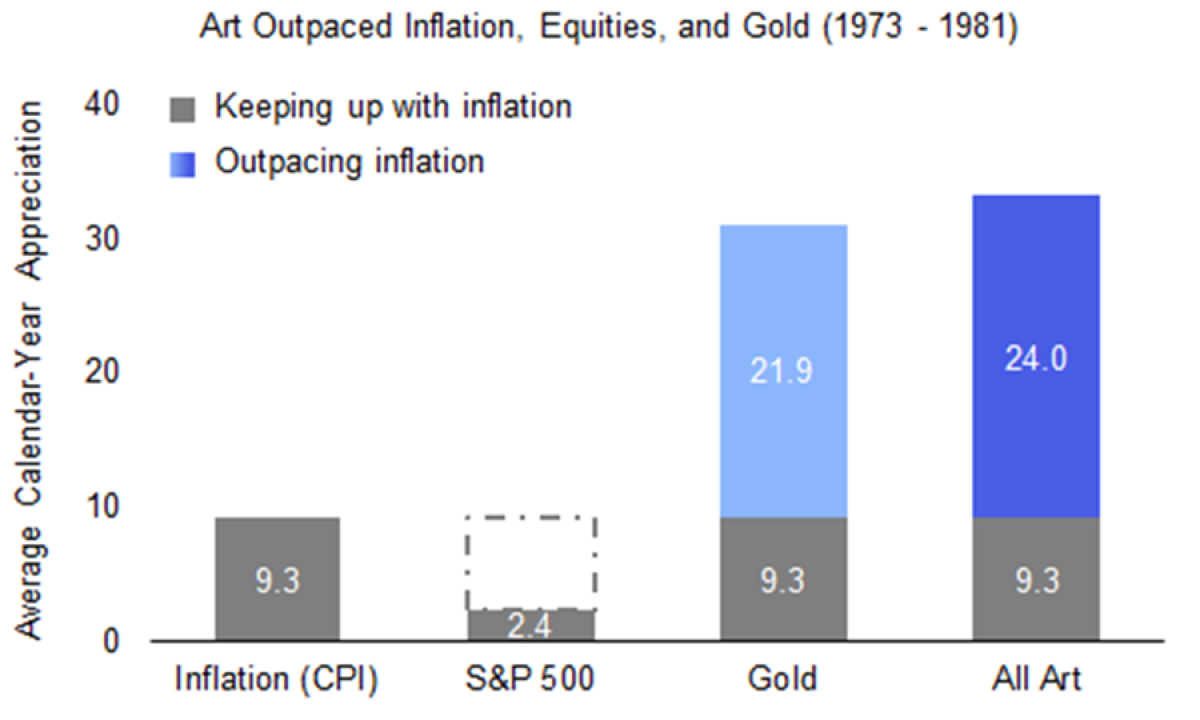

Art outpaced inflation, equities, and gold, from 1973 - 1981

Inflation is running hot, registering a 8.5% year-over-year increase as of May 2022, which now marks the most inflationary environment in the US since the early 1980s. Although elevated inflation has occurred infrequently, it can and has persisted for longer than desirable, such as from 1973 - 1981.

Investors worry about inflation because it erodes real investment performance. For example, if your investment returns are 2% and the prices of everything around you also rise by 2%, then your “real” return was effectively 0%. In other words, you do not come out ahead, despite your 2% return.

Traditionally, investors have turned to gold, as a hedge, during periods of elevated inflation. Since gold is a real asset with fixed supply, investors consider it to be one type of investment that can maintain its value when inflation is elevated.

Art appreciated meaningfully the last time the US experienced elevated inflation

Many investors have overlooked art as a form of protection against inflation. As shown in the chart below, inflation averaged 9.3% from 1973 - 1981. During this period, equities were a laggard, while gold performed well. Nevertheless, art was an even bigger standout, with an average calendar-year appreciation of 33.2%.

Source: Bloomberg, Masterworks. All Art defined as the Masterworks All Art Index.

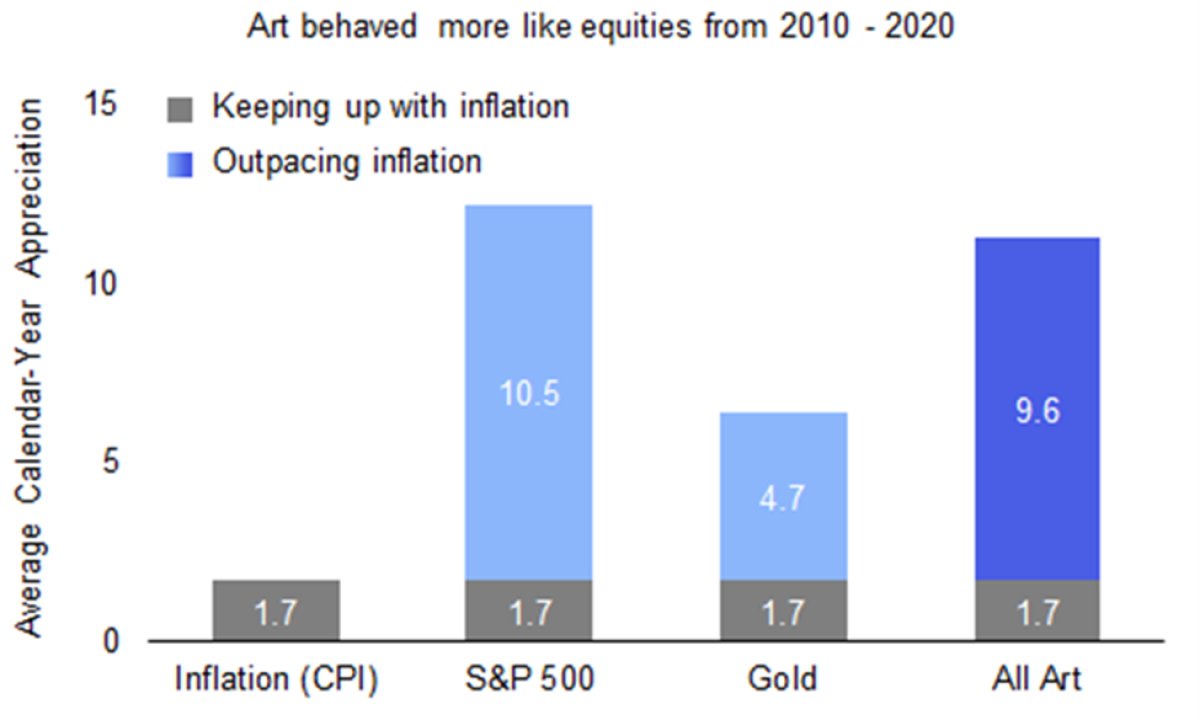

Don’t assume that art is just an inflation hedge

After the Global Financial Crisis, inflation averaged 1.7% from 2010 to 2020, as measured by the CPI. This was reasonably close to the Federal Reserve’s 2% target and can be thought of as a period of “normal” inflation. In contrast to 1973 - 1981, this normal inflation environment generated strong equity performance and weak gold performance, as investors might expect.

What about art? It went from looking like gold during the inflationary 1970s, to looking like equities during the normal 2010s. As shown in the chart below, gold was the laggard while equities and art were the standouts.

Source: Bloomberg, Masterworks. All Art defined as the Masterworks All Art Index.

Art is worthy of consideration as a strategic asset class

Over the last year, inflation has risen from under 2% to almost 8%. History has shown that while elevated inflation does not occur frequently, it has had a tendency to persist when it does occur. Historically, art has performed well not only in both normal and elevated inflation environments, but also on a relative and absolute basis. Much like equities and many other commonly-held asset classes, art deserves to be part of investors’ portfolio construction considerations.

About the Author:

Allen Sukholitsky, CFA is the Chief Investment Officer at Masterworks. Masterworks offers institutional investors, wealth managers, and self-directed investors access to art as an investable asset class. To date, the firm has securitized 120+ paintings totaling $500M+ and anticipates buying ~$800M in art in 2022. By combining art market research with the securitization of the asset class, Masterworks aims to serve as a resource and market leader in the growth of art investing. Prior to Masterworks, Allen was a Senior Market Strategist at Goldman Sachs, focused on investment strategy, portfolio construction, and investment implementation. He was also previously an Investment Counselor at Citi Private Bank, working with UHNW clients on asset allocation and manager selection.

Important Disclosure Information

This document is confidential and is for informational purposes only. It should not be construed as investment advice or an offer to sell or buy any interest in any securities product, investment or instrument, which offer may only be made by means of a confidential private placement memorandum or other similar documents containing a description of the material terms thereof. You are strongly encouraged to read the confidential private placement memorandum before making a decision to invest. This information is provided for the benefit of certain sophisticated institutional and select individual accredited investors and is intended only for the person to whom it is given and is not to be reproduced or redistributed in any manner whatsoever. Any investment is subject to execution and delivery of the relevant subscription materials and the approval of Masterworks.

Art as an investment described in this document is speculative, involves a significant degree of risk, and is not suitable for all investors. An investor could lose all or a substantial amount of his, her or its investment. Any investment of a type described in this document may be highly illiquid and may be subject to restrictions on transfer. There may be no secondary market for the investment interest and none is expected to develop. The relevant investment may involve complex or specialized tax structures. Such investments are suitable only for sophisticated investors and require the financial ability and willingness to accept the significant risks inherent in such an investment for an indefinite period of time. Investors should consult their own finance, legal, accounting and tax advisor prior to making any investment.

This document contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain and actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. You are cautioned not to place undue reliance on any of these forward-looking statements.

Materials may include composite returns of similar works selected by Masterworks based on public auction sales data. The data is used for comparative modeling purposes only. Each painting is unique and historical performance of the similar works is not a direct proxy for performance of the specific painting or the shares. There is no current market for the shares and performance of the shares will reflect costs and fees described in our confidential private placement memorandum.

In these materials we may present comparisons of Artwork to other asset classes, however any such comparison is of limited value due to the fact that there are significant differences between these asset classes. Artwork is held exclusively for capital appreciation, similar to Gold and most private equity investments. The S&P 500, which represents a collection of stocks, Hedge Funds and Real Estate are typically held for a combination of current dividend yield and capital appreciation. Oil is a commodity that is traded by speculators and end users. Stocks and Gold are highly liquid and valuation is driven by price discovery through continuous trading among large and diverse pools of capital. Artwork, Real Estate, investments in Hedge Funds and Private Equity, all represent unique opportunities and are typically relatively illiquid. These types of investments are therefore more difficult to value and price than assets that trade regularly. In addition, the costs of art ownership and buying and selling artwork may differ materially from ownership and transactional costs associated with investing in the other asset categories presented in the table.

The value of investments may go down as well as up.

Past performance is not indicative of future results.