By Christoph Junge, CAIA, Head of Alternative Investments at Velliv; Denmark’s third-largest commercial pension company.

There were recently quite some discussions on social media platforms about the sense and nonsense of open-ended funds investing in illiquid assets following the gating of withdrawals from the Blackstone Real Estate Income Trust (BREIT), that was covered broadly in newspapers like Wall Street Journal and Financial Times. Some pundits even claimed that the only reason for the existence of open-ended funds is to maximize assets under management by the GP’s – and thereby implicitly saying that investors have no benefit and obviously do not understand finance 101 as they otherwise wouldn’t invest in these types of vehicles.

While there are some risks associated with investing in open-ended funds, I would claim that there in fact are some very good reasons for investing in open-ended funds.

But before looking at the pro’s and con’s of investing in open-ended funds with illiquid underlying investments like real estate or infrastructure, let’s have a brief look at how closed-ended funds and open-ended funds are working.

Closed-ended funds are raising capital during a fixed period and are issuing a fixed number of shares. Closed-ended funds have typically investment periods of 3 to 5 years and a fixed term of 10 years, typically with the possibility of extensions of up to 3 years. When structured as a blind-pool, e.g. without seed assets, investors are not getting fully invested on day one but are drawn into the fund in several installments, every time the fund makes a new investment over the course of the investment period. There is no liquidity besides selling the shares in the secondary market – if allowed by the GP and if any buyer is to be found.

Open-ended funds are constantly raising capital and have no fixed term (evergreen structure). They issue new shares when new investors are drawn into the fund. In- and outflows are handled through a queue system where investors must wait until they are being drawn or redeemed. This can take more than one year (or several years indeed). Some open-ended funds are using cash buffers and credit lines to manage in- and outflows and many funds are matching the flows of redeeming investors with investors waiting to be drawn into the fund, which under normal market conditions should ensure liquidity at NAV. But most often (if not always) some form of gating mechanisms are in place to avoid becoming forced seller.

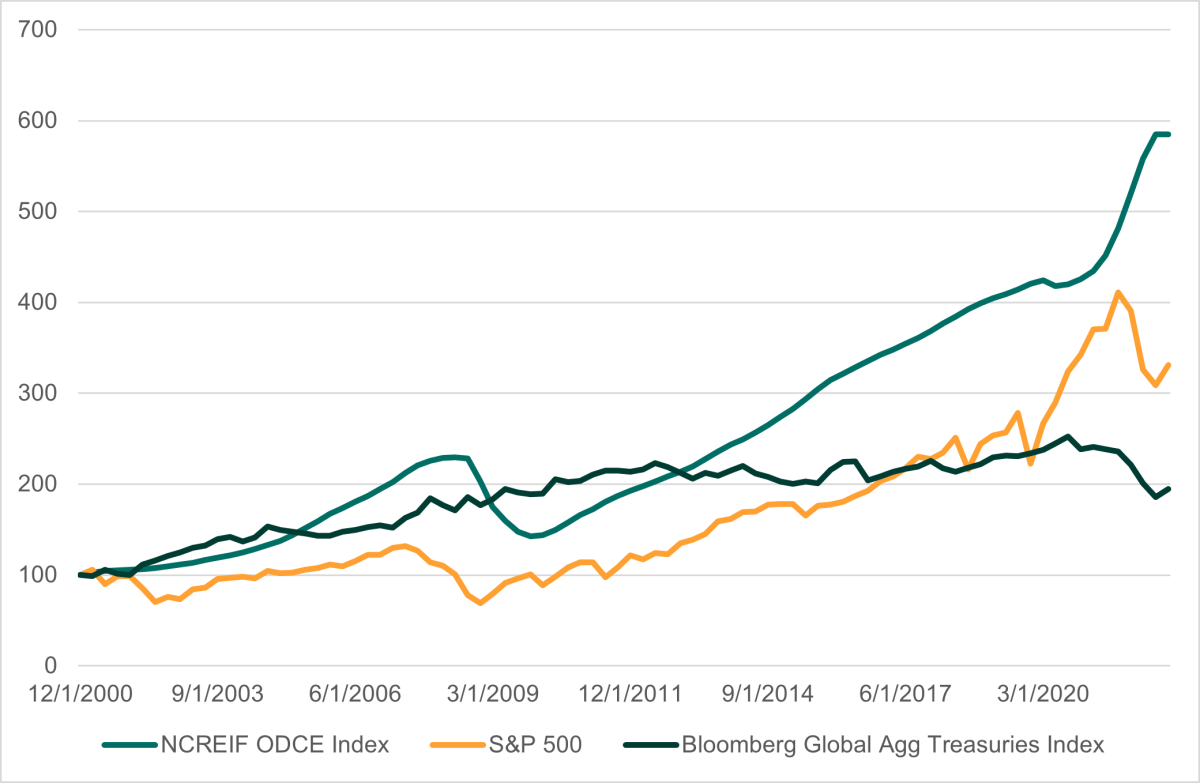

Chart 1: Performance of NCREIF ODCE compared with US equities and Treasuries

Source: Bloomberg

What are the potential issues when investing in open-ended funds?

- Packaging illiquid investments in liquid vehicles: This is a valid point of criticism and history has shown, that this can end in tears for investors, like for example some widely used real estate funds aimed at German retail investors that offered daily liquidity and came into trouble during the Great Financial Crisis as investors wanted to pull their money out. If no effective gating mechanisms are in place, this can lead to forced selling. But not all open-ended funds came into trouble. A look into the constituents of the NCREIF ODCE (Open-End Diversified Core Equity) index, a widely used benchmark for core open-ended real estate funds, reveals that in fact most of the constituents have inception dates before the GFC – and some even dating back to the 1970’s. One major difference between BREIT and the ODCE funds is that the former is targeting private investors while the latter targets institutional investors.

- Uncertainty about valuations: Closed-ended funds buy the assets after raising capital and sell them again once the fund liquidates. This leaves no doubt about the valuations as this happens at market prices (thereby not saying that every GP is equally talented, and some might buy too expensive and sell too cheap). Open-ended funds, on the other hand, are constantly raising capital and drawing new investors into the funds and redeeming existing investors – all based on book values and not transaction-based prices. If the valuations are not accurate and hence the NAV’s wrong, investors risk paying too much or not getting their fair share when redeeming. This is not exclusive to unlisted funds, as also listed REITs can and do trade at premiums and discounts to their NAV.

- Costs: When new investors are drawn into the fund, costs are incurred for putting the money to work. Only a minority of funds are using the offer spread method, where new investors are charged the approximate costs of their money being put to work. Most funds are using the amortization method, where all investors are bearing the costs. A study by Willis Tower Watson showed, that long-term investors in open-ended vehicles using the amortization method end up paying more than double of their fair share in costs.

Some of the above-mentioned potential issues can – at least partly - be mitigated by effective gating procedures. This is shown in an interesting research paper, called Liquidity Transformation Risks and Stabilization Tools: Evidence from Open-end Private Equity Real Estate Funds. In this paper, the author investigates how to best avoid the risk of wealth transfer due to NAV-timing strategies employed by some investors. He found that discretionary liquidity restrictions protect against these NAV-timing risks while liquidity buffers do not. In fact, liquidity buffers amplify them when added to liquidity restrictions. Discretionary liquidity restrictions can hence be a mitigating factor to the first argument above and even partly to the second, as it will be hard or even impossible to exploit any potential mispricing in a systematic way when it is unknown when the subscription or redemption request will be executed.

But if open-ended funds have these potential issues, why are sophisticated investors investing in them? Well, it’s not all bad – quite to the contrary in fact.

- Diversification: The more established open-ended funds have gathered several billions of USD in assets and invested in broadly diversified portfolios. Especially, when building a new private markets portfolio, by investing in a couple of open-ended funds, an investor can relatively quickly build a well-diversified portfolio consisting of hundreds of assets. Something that would take several years with closed-ended funds. With open-ended funds as the foundations, investors can build more opportunistic investments around that foundation.

- No blind pool risk: What you see is what you get. You are buying into an existing portfolio of assets, while closed-ended funds are typically blind pools with no existing assets. Decisions to invest or not in closed-ended funds are typically taken based on historical funds and the strategy outlined in the private placement memorandum (PPM).

- Strategy: To the best of my knowledge, most of the open-ended funds across real estate and infrastructure are in the core/core+ space. Most of the returns in the core space are expected to come from the income generated, not by development projects. “PE-style” asset flipping is not really part of the strategy. As a long-term investor, I would rather keep high-quality assets for longer and benefit from running income and not being forced to sell just because the term of a closed-ended fund is over - especially if this coincides with a bad market environment.

- Avoiding the J-Curve: By buying a small fraction of an existing and already yielding portfolio, investors avoid the dreaded J-curve, which is well-known from closed-ended funds. While closed-ended funds charge management fees on committed capital during the investment period without having made a single investment, open-ended funds typically charge management fee on NAV – and only after the investor has been drawn. No investment = no fees. This is also most important when building up a private markets portfolio.

- Fees: The management fee of open-ended funds is often lower than that of closed-ended funds but has to be compared on a like-for-like basis as closed-ended funds, as mentioned, charge management fees typically on committed capital in the beginning and on invested capital later on while open-ended funds charge management fees on NAV (which also introduces a risk of overpaying if NAVs are inflated).

- Fund terms: Given the open-ended nature, there is continuous fund raising and hence negotiations of side letters. Through the MFN (most favored nations) process, existing investors get access to the side letter terms of new investors with the same size and can improve their governance rights.

I hope that I could add some nuance to the debate and could show that there indeed are several very good reasons for investing in open-ended funds, even though the underlying is illiquid. Most – if not all – open-ended funds have some form of gating mechanism in place. At least those that I have seen, which are the ones targeting institutional investors. The decision to invest in any alternative investment fund of course requires a solid due diligence of the fund and the gating mechanisms in place as there can be substantial differences from fund to fund. It is crucial to understand the legal language to avoid investing in funds that potentially could allow other investors to exploit NAV-timing strategies. While the potential liquidity of open-ended funds is often framed as being the sole benefit, I would argue that for income-oriented strategies the open-ended nature and hence the unlimited holding period is the main benefit. For more development-oriented strategies (value-add & opportunistic real estate & infrastructure as well as Private Equity) the closed-ended fund is still the way to go.

About the Author:

Christoph Junge is Head of Alternative Investments at Velliv; Denmark’s third-largest commercial pension company. He is a Chartered Alternative Investment Analyst and has more than 20 years of experience from the financial industry in both Denmark and Germany. He has worked with Asset Allocation, Manager Selection as well as investment advice in, among others, Nordea, Tryg and Jyske Bank.

Besides working as a Head of Alternatives, Christoph teaches a top-rated course on Alternative Investments. Read more at http://www.christoph-junge.de