By Chris Solarz, CIO, Digital Assets, Forest Road. The Forest Road Company is an investment platform providing solutions to companies that are capitalizing on disruption, generating great risk-adjusted returns while prioritizing downside protection.

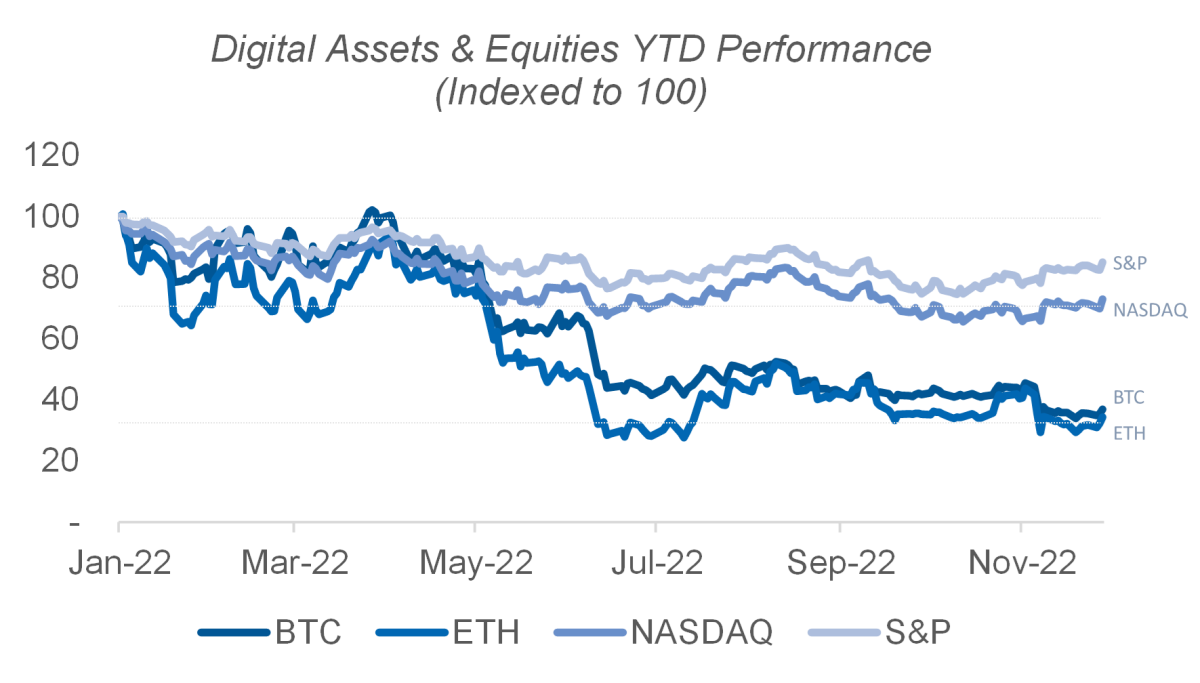

MACRO ENVIRONMENT YEAR-TO-DATE

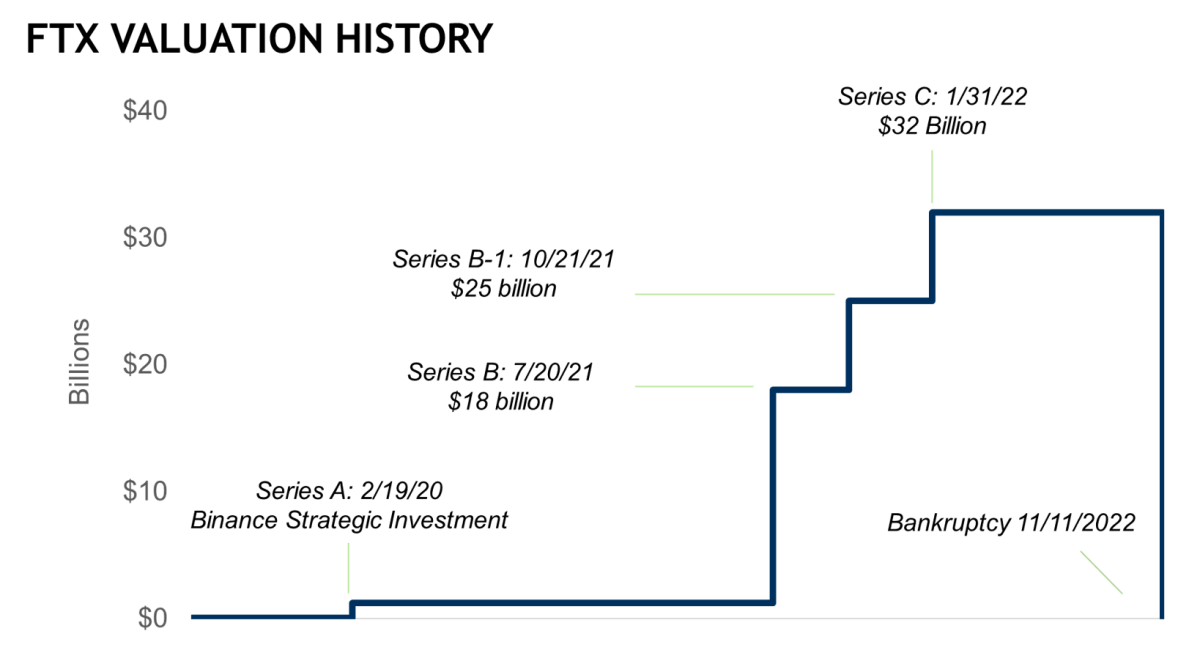

DEEP DIVE ON FTX INSOLVENCY

• The majority of FTX’s post-bankruptcy assets have been revealed to be illiquid self-created tokens, and there is a ~$10 billion hole of customer deposits missing from FTX.

Sources: CoinDesk; NASDAQ, Glassnode, Financial Times; All data shown is as of November 30, 2022 unless specified otherwise

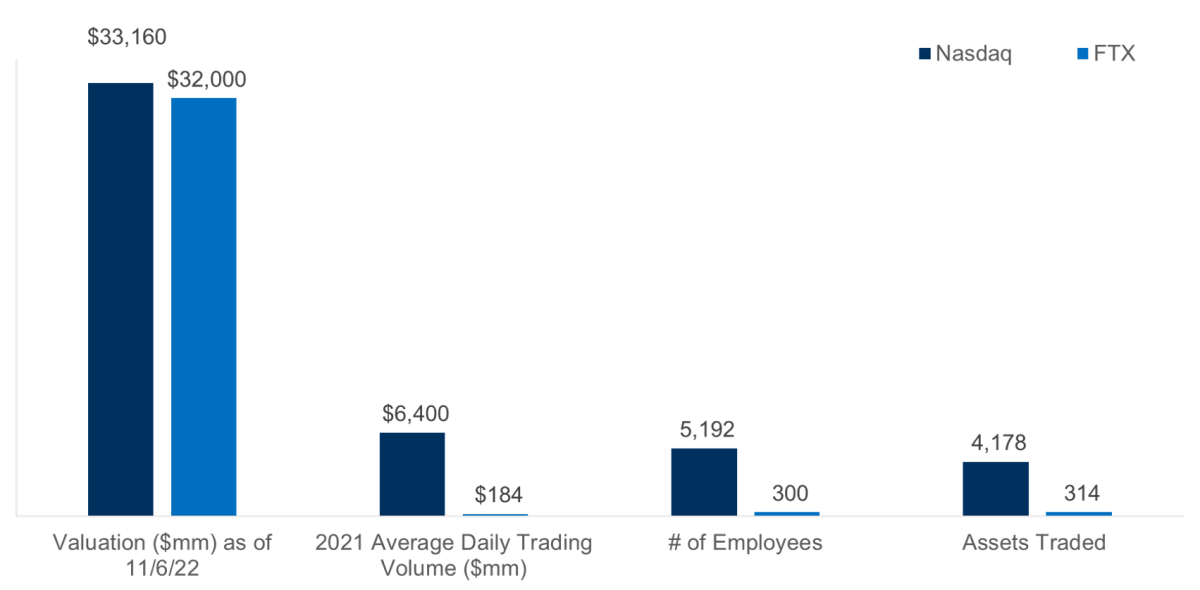

• Nasdaq Inc, the public holding company that operates multiple exchanges, was coincidentally worth the same as FTX a week before its implosion despite having multiples of FTX’s trading volume, assets, and employees.

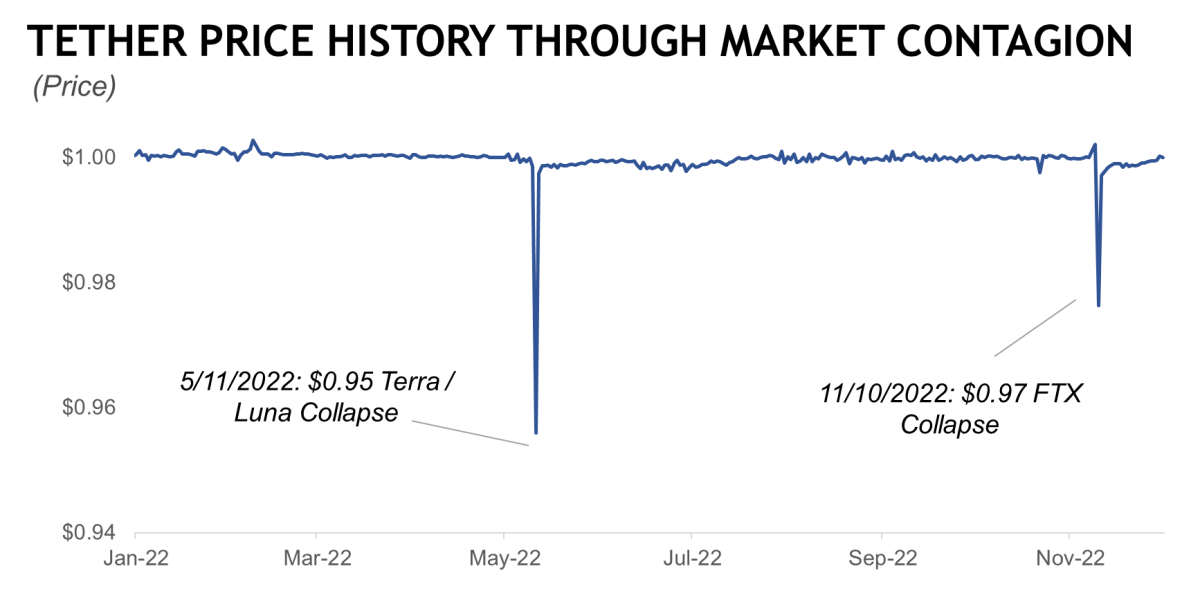

TRADE OF THE MONTH: SHORT TETHER STABLECOIN ($USDT)

MARKET UPDATE

• Digital assets fell sharply amidst FTX’s collapse and market contagion, with most coins down 15-20%.

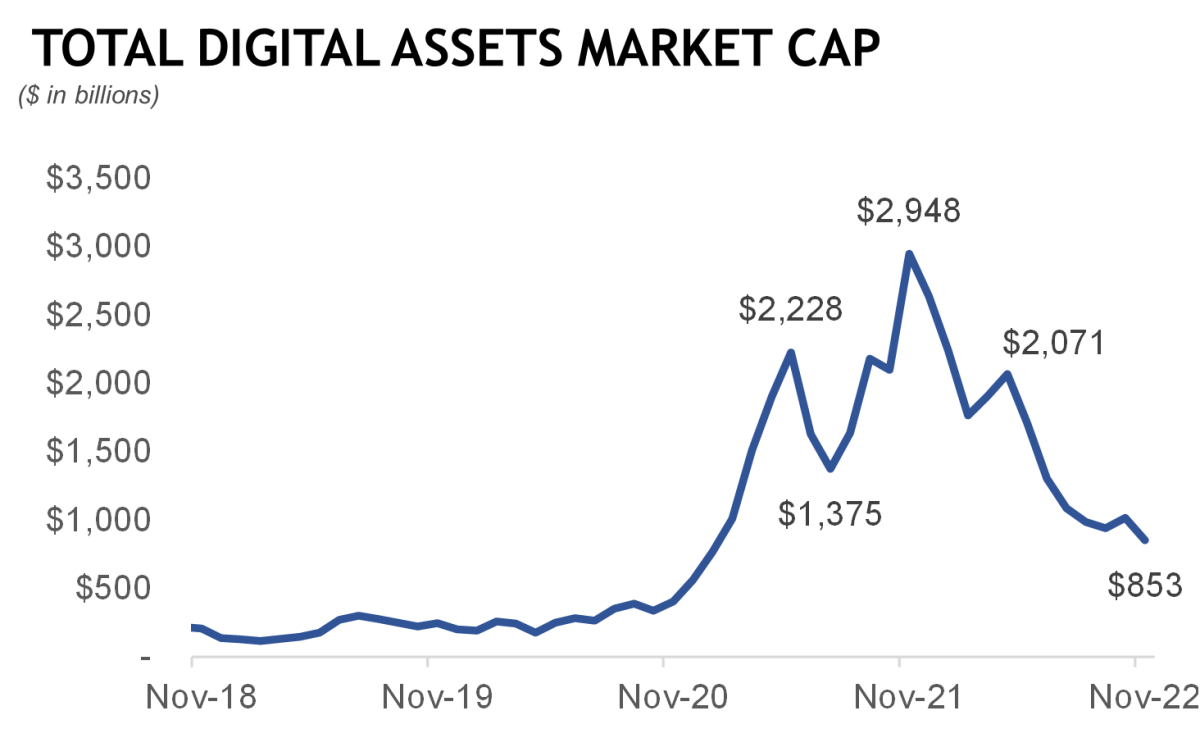

• Polygon was the top large-cap performer because of its announcements of integrations with large Web2 firms, including Starbucks, Reddit, and Instagram. The digital assets market cap first surpassed $1 trillion in Jan ‘21, peaked at over $2.9 trillion in Nov ‘21, but has since lost over 2/3rd of its value, now fluctuating around $850 billion.

• Bitcoin and Ethereum continue to remain the flagbearers of the industry, maintaining 56% of the industry’s market share.

ADOPTION RATE - RETAIL ADOPTION

• Crypto adoption includes the number of unique on-chain wallets plus unique centralized exchange wallets.

ADOPTION RATE - INSTITUTIONAL ADOPTION

• Most of the world’s largest asset managers have started to embrace digital assets; Blackrock, the world’s largest asset manager, has partnered with Coinbase to offer clients direct access to crypto, while Fidelity, the largest 401(k) provider in the US, announced customers can invest up to 20% of their 401(k)s in Bitcoin.

To read the rest of the report: Here's a link to the chart book directly, a link to subscribe, and the author's email: csolarz@forestroadco.com.

About the Author:

Chris Solarz leads Forest Road's research process across the digital assets ecosystem, and he is responsible for Forest Road Digital Fund's portfolio construction, manager selection, and due diligence.

Chris brings 18 years of experience as a fund allocator, bridging his institutional expertise to this nascent asset class. Chris has a BA from the University of Pennsylvania and an MComm in Finance from the University of New South Wales. He also has CFA, CAIA, and CPA credentials.