By Marc H. Iyeki, Head of Listings Strategy, Green Impact Exchange.

The Growing Importance of ESG: Demographics and Investable Assets: ESG (Environmental, Social, and Governance) factors play a significant role in investment, purchasing, and employment decisions globally, with about 80% of institutional investors and consumers considering ESG, and about 70% of employees preferring to work for ESG-minded companies.

The impact of the ESG mindset is set to grow, with ESG-influenced assets under management expected to soar 84% to reach $33.9 trillion by 2026. In addition, over $72 trillion is expected to be inherited by younger generations over the next two decades, making it the largest intergenerational wealth transfer in history.

The huge size of this wealth transfer makes the potential influence of ESG-directed money even more compelling, as the younger generations including Millennials and Gen Z tend to be more focused on ESG than predecessor generations. They have especially strong views on climate change, and are more likely to act on those views.

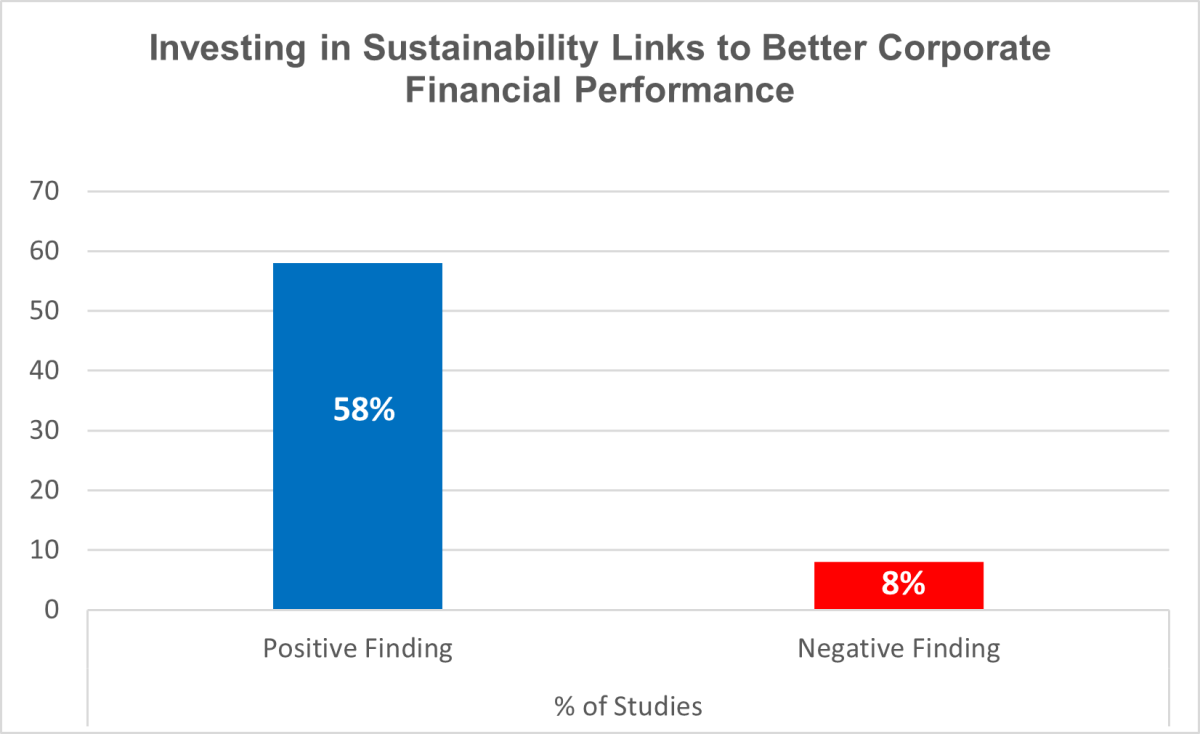

Managing Risks and Opportunities: From a company’s perspective, the label “ESG” is shorthand for the management of the various environmental, social, and governance risks and opportunities they face. Management of such risks has become increasingly crucial due to rising awareness and scrutiny of these matters. Adding to its importance is the robust evidence that good ESG management usually leads to better operational metrics such as ROE, ROA, or stock prices, particularly over the long run. These are strong justifications for companies to invest in sustainability for better corporate financial performance.

Chart based on information from: "ESG and Financial Performance: Uncovering the Relationship by Aggregating Evidence from 1,000 Plus Studies Published between 2015-2020," (NYU Stern Center for Sustainable Business & Rockefeller Asset Management (2021)

Ultimately, ESG is about creating a more sustainable and responsible business model that benefits both the company and its stakeholders. Many companies have already taken steps to integrate ESG considerations into their planning, strategy, and operations, adapting to their stakeholder's increasingly deeply held worldviews on the responsibilities of business in society.

While the path forward may be bumpy, ESG is here to stay. The rise of the ESG worldview, supported by demographics that drive it and investable assets that fuel it, signals not a passing trend, but a permanent shift in the global business landscape.

Despite this, some companies have yet to fully embrace ESG practices, for a variety of reasons. Some companies may drag their feet or balk due to limited resources, but committing to ESG should be viewed as an investment in the company’s future rather than a mere expense.

Other companies are uncertain about how to implement ESG considerations in a way that aligns with their business goals and values. They can begin implementing ESG by assessing their unique risks, opportunities, and stakeholder expectations, developing a tailored strategy that aligns with their business goals and values, integrating ESG considerations into decision-making, and regularly monitoring and reporting on their performance. They can build trust by disclosing material deviations as well as the steps they are taking to get back on track, given that things often do not go according to plan.

Still other companies are simply resistant to change or may not fully appreciate the concept of ESG and how it can drive the long-term sustainability of their businesses.

A high-profile group of “feet draggers” try to benefit from being perceived as an ESG-focused company by engaging in a practice called “greenwashing.” Greenwashing involves falsely marketing a company, its products or services, as environmentally or socially responsible in order to appeal to ESG-minded stakeholders. This can deceive investors, for example, into believing they are investing in a “green” company when in reality the company is not environmentally friendly.

Greenwashing undermines investor and consumer confidence and misallocates capital intended to support pro-environmental and social outcomes. Companies that engage in greenwashing may face significant backlash from stakeholders and regulators, as this practice is viewed as deceptive and unethical. Such companies may face legal and financial liabilities, reputational degradation, and weakening of their ESG efforts.

The Pitfalls of Greenwashing: Volkswagen’s Example: A extreme example of greenwashing and its consequences was the so-called Volkswagen “Dieselgate.” In 2015, it was discovered that cars the company had spent millions of dollars to advertise as being environmentally friendly were actually spewing up to 40 times the legal limit of pollution

Volkswagen’s reputation took a huge hit. The 2016 Harris Poll survey of corporate reputations of the 100 most visible companies in the US, which rated Volkswagen’s reputation as “very good” in 2015, dropped it to “very poor” in 2016, sinking the company to the bottom of the rankings. The company’s financials also suffered. By March 2020, the cost of resolving its legal and regulatory problems had reached a total of $34.69 billion.

As trillions of USD are pouring into green companies, products, and services, regulators are scrutinizing potential greenwashing activities more closely, and have ramped up efforts to ensure that green investments and purchases live up to their advertised promise.

ESG Leaders Can Capitalize on the Widening Opportunity Gap with Laggards: For companies genuinely dedicated to ESG, however, the gap between ESG leaders and laggards is an opportunity to rise above their peers. By establishing themselves as ESG leaders, these companies can enhance their competitiveness in attracting stakeholders who value environmental and social responsibility and prefer to align with companies that prioritize those values.

How does a strong ESG proposition connect to value creation? In a study about how ESG creates value, McKinsey concluded that ESG links to cash flow in five important ways: (1) driving top-line growth, (2) reducing costs, (3) minimizing regulatory and legal risks, (4) increasing employee productivity, and (5) optimizing investment and capital expenditures.

Essentially, ESG-focused companies tend to be well-governed with good controls and processes. This makes them more likely to be aware of the environmental and social risks and opportunities they face, and actively address them. By planning and preparing in advance, companies can better mitigate risks, overcome challenges, and seize opportunities, ultimately enhancing their potential for long-term growth and success. These are precisely the qualities that long-term investors seek in companies.

ESG-focused companies are also better able to attract customers, especially those in the younger generations, who are seeking values-based products and services. Establishing a connection with customers that appeals to both their rational and emotional needs can increase brand loyalty and long-term support

They also have a distinct advantage in attracting and retaining talent, particularly among younger workers who are more likely to value and act on social and environmental considerations. Having an engaged and mission-aligned workforce can lead to increased employee satisfaction, reduced turnover, and improved overall performance, all of which are important to a company’s long-term success.

Embracing the ESG shift: A Key to Long-Term Success in a Changing World: Clearly, ESG leaders should triumph over laggards in the competition for long-term investors, values-driven customers, and mission-driven employees. The leadership advantage can be expected to become even more pronounced as some companies continue to lag behind while the pool of ESG-minded stakeholders gets only larger, wealthier, and more demanding.

Companies have a choice to make: lead or fall behind. Those that embrace the shift in stakeholder perspectives, will be better positioned for long-term success. Those that resist, risk alienating key drivers of business success.

Choosing to lead is good for both society and business. That choice is a moral as well as a fiduciary obligation, and is essential for environmental and social prosperity as well as for sustainable positive financial performance.

About the Author:

Marc H. Iyeki is Head of Listings Strategy at the Green Impact Exchange, a specialized stock exchange for green-focused companies and investors. Marc is also a capital markets educator and advisor for Global Markets Advisory Group and Deltec Investment Advisory Ltd. Previously, Marc was an independent director at Vistas Media Acquisition Company. Before that, Marc had over thirty years of experience at the New York Stock Exchange, including as Head of Asia Pacific, Global Listings; Chief Representative, Beijing Office; and Trial Counsel, Enforcement Division. Before that, he served as an Assistant Public Advocate at the New Jersey Department of the Public Advocate.

Marc attended Austin College, earned a B.A. in economics from Washington University in St. Louis, attended the master’s degree program in public policy analysis at the University of Pennsylvania, and earned a J.D. from the New York University School of Law.