By Emily Foshag, CFA, Portfolio Manager, at Principal Real Estate, the dedicated real estate unit of Principal Asset Management.

At a glance

- Many investors have achieved infrastructure exposure exclusively through the private markets, yet the asset class can also be accessed through listed infrastructure equity strategies.

- In today’s market environment, the liquidity, diversification, and valuation transparency of listed infrastructure make it an increasingly relevant complement to unlisted infrastructure exposure.

- As attractive income opportunities become more plentiful across the broader investment landscape, the growth emphasis of listed infrastructure may also prove to be a positive differentiator.

- Listed infrastructure can be utilized by institutional investors to enhance a public equity allocation by lowering its expected market beta and providing greater resilience amidst persistent inflation.

Since its emergence as an asset class in the 1990s, infrastructure has increasingly featured as a distinct allocation within institutional investment portfolios. Traditional infrastructure assets typically share specific attributes that support the delivery of steady investment returns throughout an economic cycle. These businesses tend to provide services that are essential to our society and operate under-regulated or contracted frameworks that provide investors with a higher degree of revenue and cash flow visibility.

Historically, many investors have achieved infrastructure exposure through the private markets, either by investing in private equity fund structures or into assets directly. This approach closely aligns with the role other private markets asset classes, such as private equity and private real estate, play in a portfolio. However, it is also possible to access the infrastructure asset class through listed equity strategies, and doing so may prove to be advantageous in certain market environments.

Relative appeal of listed strategies may be amplified today

Given the broader macroeconomic challenges seen at present, we believe the liquidity, diversification, and valuation transparency of listed infrastructure make it an increasingly important alternative to unlisted infrastructure exposure. In addition, the investment returns of listed infrastructure have historically skewed more towards growth compared to unlisted returns. This suggests that listed infrastructure has a lower risk of substitution as other income-oriented investments regain prominence. Further, we contend that the recent underperformance of listed infrastructure may signal an attractive relative valuation opportunity.

Liquidity

The listed infrastructure universe comprises US$4 trillion in market capitalization, and the average daily traded volume exceeds US$14.1 billion.1 Even the largest of institutional investors may have greater confidence in how quickly exposure to the infrastructure asset class can be added or reduced when investing via public equity markets. In contrast, investing in unlisted infrastructure, whether directly or through fund vehicles, generally requires lead times of up to three years for a commitment to be completely called, and usually necessitates the lock-up of capital for years.

Splitting an infrastructure allocation across both listed and unlisted investments can help institutional investors strike the right balance between asset-class exposure and liquidity without sacrificing total exposure to infrastructure. This approach can also prove advantageous through periods when an investor is looking to increase overall liquidity and remain nimble amidst heightened volatility. If an overall infrastructure allocation outperforms other plan assets, it is relatively straightforward to divest from listed infrastructure to bring the overall allocation back in line with a strategic target. There are typically restrictions on redemptions in private vehicles, or it may simply take time to find a buyer for an individual asset.

In addition, the differentiated liquidity offered by listed infrastructure allows investors an opportunity to tactically position portfolios in response to today’s challenging macroeconomic backdrop. For example, our listed infrastructure portfolios currently reflect a bias towards companies with balance sheet positions that we expect to have greater earnings resilience in a recession.

Diversification

Listed infrastructure portfolios typically offer greater diversification than unlisted infrastructure portfolios. A single listed infrastructure company may manage dozens of assets, and a listed infrastructure portfolio may contain exposure to 30-60 companies with representation across a wide range of geographies, sectors, subsectors, regulatory regimes, and stages of development. Entire unlisted infrastructure portfolios typically comprise only 10-15 assets.

In periods characterized by easy monetary policy and steadily rising asset prices across the board as we have experienced for much of the past decade, diversification may matter less. However, with financial conditions having tightened as significantly as they have over the past 12 months, we remain aware of the possibility for ‘unknown unknowns’ to impact our portfolio holdings. Simply put, we believe a more diversified portfolio is more likely to withstand unanticipated shocks.

Composition of returns

Income is commonly understood as a key appeal of the infrastructure asset class. Compared to listed infrastructure investments, the return profile of unlisted infrastructure has historically emphasized income to a much greater degree. This difference reflects an underlying bias in the private infrastructure investment universe towards mature assets that require limited incremental investment. It is further evidenced by differences in subsector exposure between the two marketplaces. Over 50% of the listed infrastructure universe comprises regulated utilities, which are investing between 5-10% of their existing asset bases every year while yielding in the low- to mid-single digits depending on the market.2 In contrast, operating renewables assets feature more heavily in private infrastructure portfolios, and these assets generally require no incremental growth investment each year.

Whereas listed infrastructure companies typically pay dividends in the range of 50-80% of earnings, and even lower as a percentage of cash flows, unlisted assets have historically paid out the bulk of operating cash flows as dividends*. We believe the prominence of income for the unlisted infrastructure investment case risks becoming a disadvantage in the current market environment. Other income-producing assets can more readily compete with the income generated from mature, unlisted infrastructure today. We would also note that the focus on new asset development by listed infrastructure companies is a key reason why we are excited about the potential of such investments to drive sustainable impact.

EXHIBIT 2: Listed infrastructure has historically delivered greater capital growth, while total returns have been comparable.

As of 31 December 2022. Average returns shown are those delivered over the period 2017-2022. Listed infrastructure is represented by the FTSE Global Core Infrastructure 50/50 Index. Unlisted infrastructure is represented by EDHEC infra300® (quarterly), EW LCU. Please refer to Important Information section for additional disclosures.

Valuation transparency

There are meaningful differences in both the valuation frequency and methodologies utilized in listed and unlisted infrastructure markets. Specifically, the valuations of listed infrastructure companies reflect the prices at which transactions occur daily. Valuations for non-listed assets are established using appraisal-based methodologies, which are broadly understood to drive meaningful lag and smoothing effects. Unlisted infrastructure valuations are also more susceptible to influence from individual actors, many of which have a commercial incentive to limit write-downs or fluctuations in capital values over time.

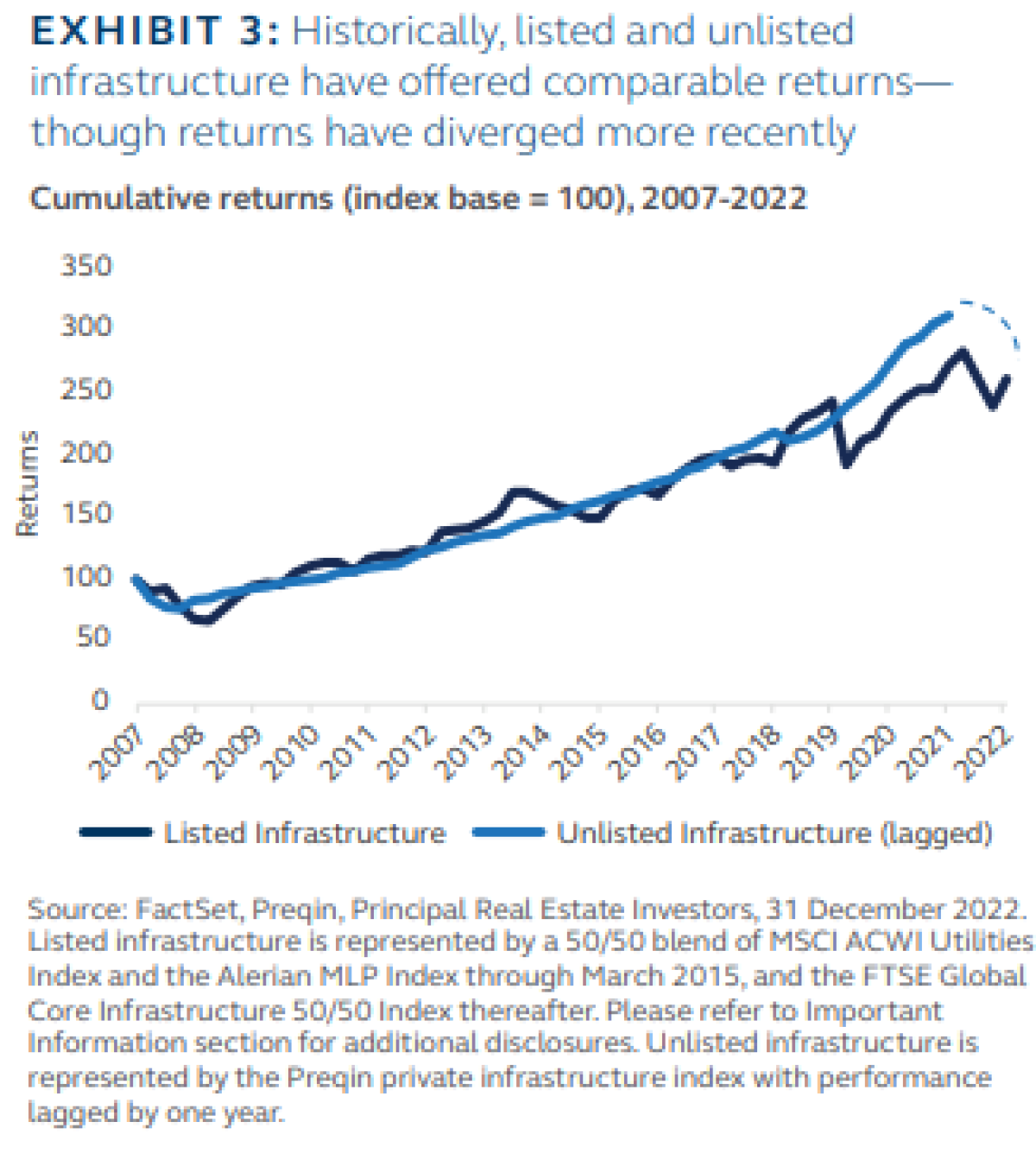

At present, our view is that listed infrastructure valuations likely reflect the current macroeconomic backdrop to a greater extent than unlisted infrastructure valuations. Recent relative performance supports this hypothesis. The long-term return drivers of listed infrastructure closely mirror those of unlisted infrastructure strategies, and as such, long-term investment returns have been comparable. However, we have seen listed infrastructure returns trail since early 2020.

EXHIBIT 3: Historically, listed and unlisted infrastructure have offered comparable returns— though returns have diverged more recently.

We attribute the recent underperformance of listed infrastructure to a confluence of events, the first of which was the public equity market’s reaction to weak transportation infrastructure fundamentals during the depths of the coronavirus pandemic. The resulting decline in cash flow generation, while stark, was never likely to last for as long as was implied in valuations in March 2020. The energy infrastructure sector also experienced a significant downdraft during this time, reflecting a sharp repricing in commodity markets— even though energy infrastructure fundamentals remained resilient. Then, as equity markets rallied from their pandemic lows in late 2020 and 2021, listed infrastructure lagged. Investors expressed a preference for cyclical businesses and avoided sectors historically seen as more rate sensitive. Finally, in 2022, while listed infrastructure held up well relative to broader global equities, it still delivered negative total returns and therefore underperformed unlisted infrastructure.

We ultimately take the view that the recent underperformance of listed infrastructure relative to unlisted strategies has little to do with a divergence in fundamentals, and instead see a temporary dislocation caused by key differences in how the respective markets operate. Regardless of whether one expects unlisted valuations to catch up with what is reflected in public markets, or for listed infrastructure to recover substantially from here, we believe there is now a case for listed infrastructure to outperform over the medium term.

A defensive substitute for global equity exposure

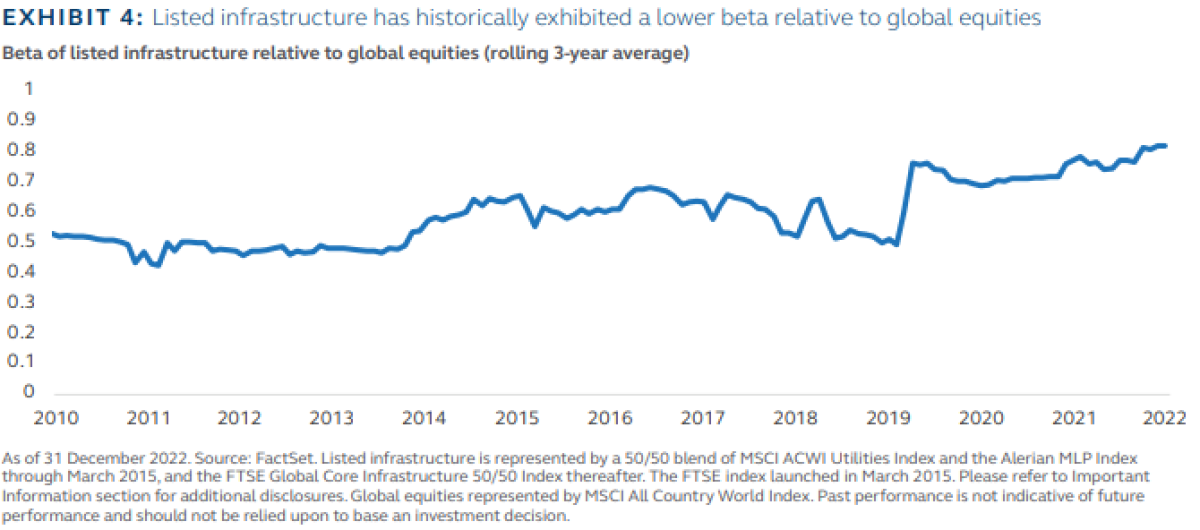

Beyond its ability to add value to a broader infrastructure allocation, listed infrastructure also has the potential to deliver differentiated outcomes within a global public equity allocation. We believe listed infrastructure continues to be well positioned relative to global equities in the current environment, largely because of the expected defensiveness of infrastructure business models through a variety of macroeconomic scenarios. See Exhibit 4.

EXHIBIT 4: Listed infrastructure has historically exhibited a lower beta relative to global equities. Beta of listed infrastructure relative to global equities (rolling 3-year average)

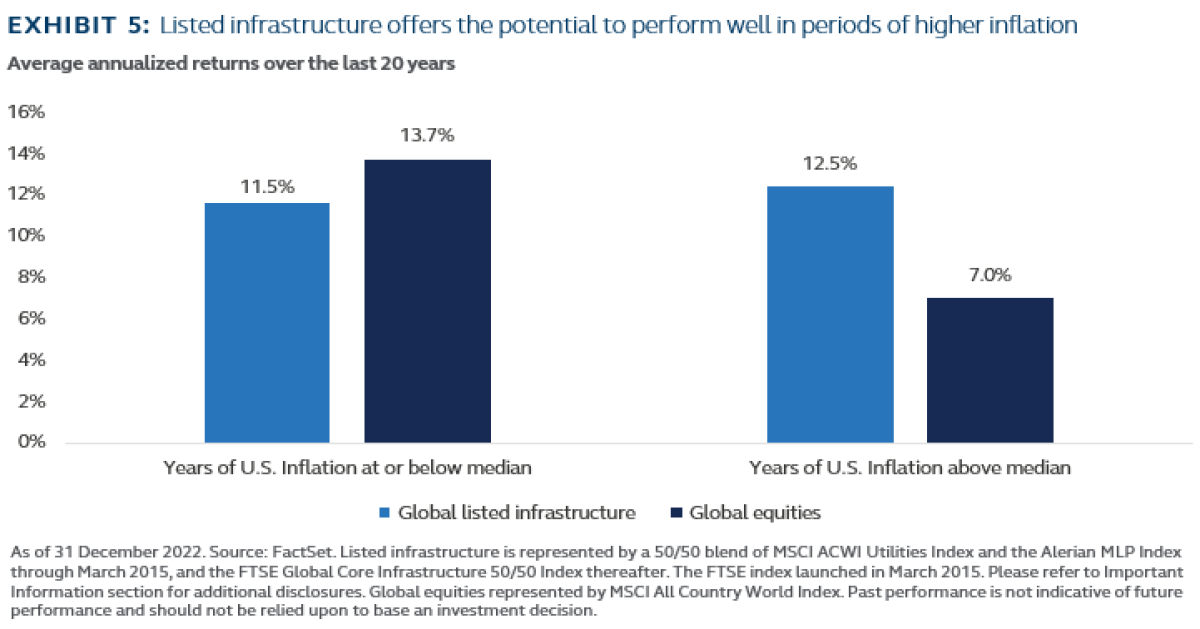

Further, as regulated monopolies or monopoly-like businesses delivering essential services, most listed infrastructure companies have a differentiated ability to preserve margins during periods of rising inflation. Listed infrastructure has historically outperformed global equities during periods of above-average inflation, suggesting that the structural advantages these businesses enjoy have the potential to flow through to relative share price performance.

EXHIBIT 5: Listed infrastructure offers the potential to perform well in periods of higher inflation.

FINAL THOUGHTS:

Infrastructure has increasingly been featured as a distinct allocation within institutional investment portfolios, though to date, many investors have achieved infrastructure exposure exclusively through the private markets. In our view, the liquidity, diversification, and valuation transparency of listed infrastructure make it an important complement to unlisted infrastructure exposure in today’s market environment. In addition, because listed infrastructure has lagged unlisted investments materially in recent years, we now see a case for listed infrastructure to outperform over the medium term. Alternatively, listed infrastructure can be utilized in a manner that seeks to enhance a public equity allocation. Regardless of how exposure is achieved, we believe listed infrastructure has the potential to deliver attractive risk-adjusted returns through a range of macroeconomic scenarios.

Footnotes:

1 As of March 31, 2023. FactSet, Principal Real Estate

2 Utilities make up over 50% of the FTSE Global Core Infra 50/50 index. Source: Principal Real Estate, March 2023.

More from Principal Asset Management

About the Author:

EMILY FOSHAG, CFA is a portfolio manager at Principal Real Estate, the dedicated real estate unit of Principal Asset Management.

She is responsible for the firm’s global listed infrastructure capability and is also a member of Principal Asset Management’s ESG Investment Council. Emily joined the firm in 2019. Prior to her current role, Emily served as a portfolio manager and research analyst for the listed infrastructure strategy at Franklin Templeton, where she was a member of the investment team since the strategy’s inception. At Franklin Templeton, she held primary responsibility for the research and analysis of listed infrastructure securities in Europe, Asia and Latin America in addition to global portfolio management and risk management responsibilities. Emily led the integration of ESG factors in listed infrastructure and REITs investment processes and co-led the Alternatives Sustainable Investing Platform. She also oversaw the research of private infrastructure strategy investments on behalf of institutional clients globally. Emily received a bachelor's degree in accounting from New York University and an MS degree with distinction from New York University with a concentration in global energy and environmental policy. Her master’s thesis research focused on Germany’s renewable energy transition and as part of her degree requirements she conducted sustainability-related fieldwork in the UAE, Chile, Russia, California. Emily is a Chartered Financial Analyst (CFA) Charterholder and a member of the New York Society of Security Analysts.