By Graham Capital Management, L.P.

Correlation is one of the most widely used measures of diversification and can be a helpful statistical indicator for investors looking to construct a diversified portfolio. However, there are complexities in analyzing correlation and investors should use caution in interpreting it. Here, we highlight a few of these complexities. Ultimately, rather than passively combining assets with low correlation to achieve diversification, investors should use a range of measures to actively analyze diversification and seek strategies that are structurally designed to perform differently in different market conditions.

Non-Correlation Does Not Imply Independence

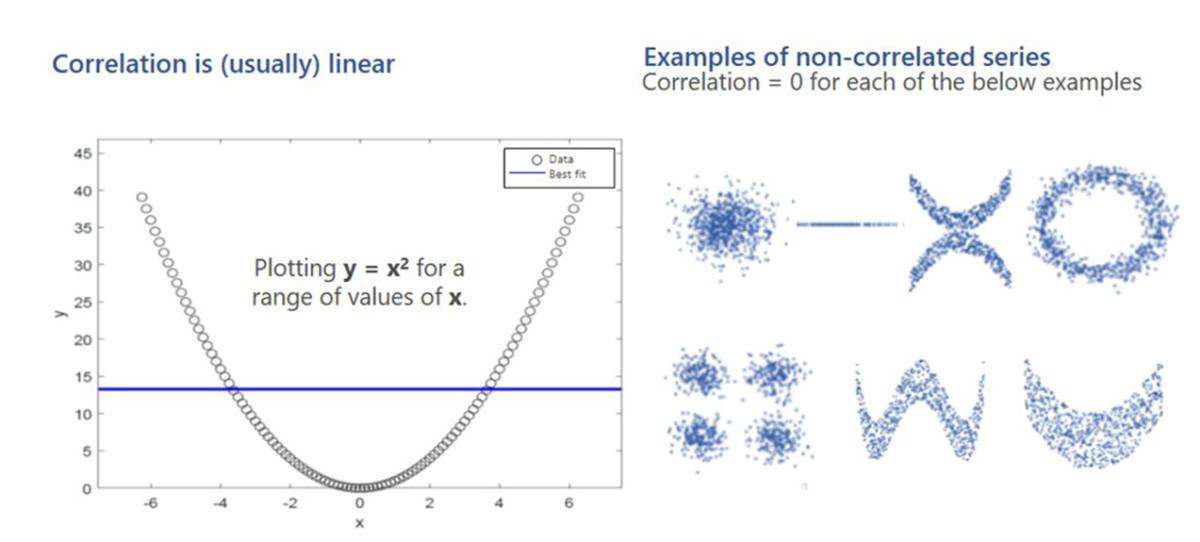

If two variables are independent, then their correlation will be 0. However, it doesn’t go the other way. A correlation of 0 does not imply independence. In the example below (left), while y is fully determined by x, the linear correlation between the two, measured by the slope of the best fit, is zero. There are many paths that can lead to a given correlation, and even assets with zero correlation can have a clear relationship, as shown in below (right).

Correlation Ignores the Mean

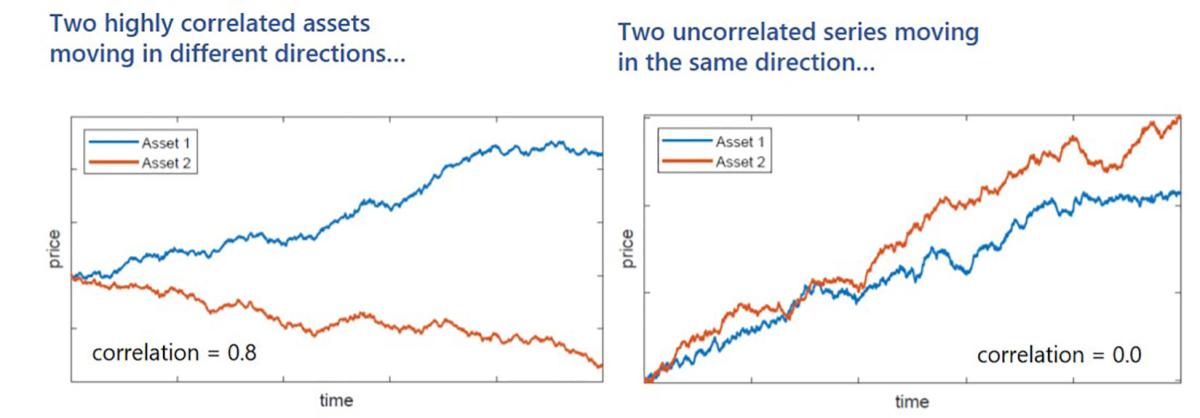

Two price series that are highly correlated may move in different directions due to different average returns and vice versa.

Correlation ≠ Causation

Causation means that one event causes another event to occur. Correlation means there is a relationship or pattern between the values of two variables. However, even if the historical correlation is +1, this does not mean that the asset prices will move the same way in the future. It only means that they have done so in the past.

Source: https://www.tylervigen.com/spurious-correlations

Correlations Change Over Time

Correlations can change dynamically over time and can fluctuate during short-term or long-term periods. For example, while negative stock/bond correlation has been the bedrock of many asset allocation strategies since 2000, over a longer time frame there have been prolonged periods where stock/bond correlation was positive. In addition, in periods of high market volatility, shorter-term market correlations tend to move toward a positive coefficient.

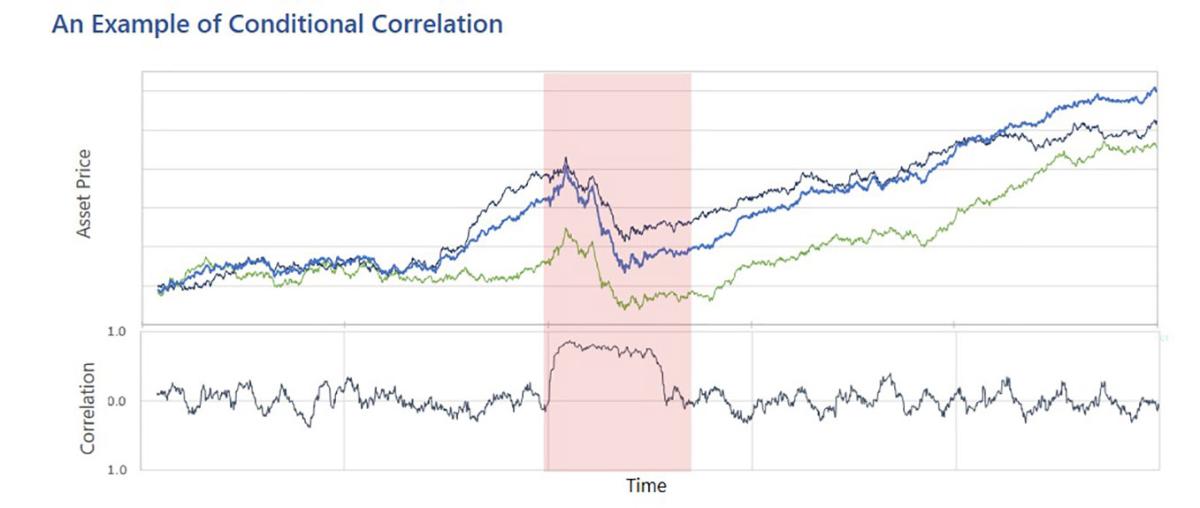

Correlations May Be Conditional on the Market Environment

Sometimes asset owners face the worst of all worlds – portfolio diversifiers that are only uncorrelated with their core portfolio in normal market conditions, but become correlated when most needed, when the core is under stress. Conditional correlation may reveal that strategies with high or low overall correlation may behave very differently in down markets (when diversification is needed most):

THE BOTTOM LINE

- Correlation is a widely misunderstood and highly dynamic measure, and this can result in investors getting much less diversification than they had hoped for.

- Rather than passively combining assets with low correlation to achieve diversification, investors should use a range of measures to actively analyze diversification and seek strategies that are structurally designed to perform differently in different market conditions.

- A well-constructed portfolio seeks to incorporate diversification by design rather than by accident.

About the Firm: Graham Capital Management, L.P. is an alternative investment firm founded in 1994 by Kenneth G. Tropin. The firm’s core investment capabilities span discretionary and quantitative trading across a broad range of global markets, including global interest rates, currencies, commodities, and equities. Strategies are designed to produce attractive absolute and risk-adjusted returns with low correlation to traditional assets and other alternative strategies.