By Jeffrey Glass, Hometap CEO and Cofounder.

Residential real estate is playing more of a part in institutional portfolios—and in more ways—than ever before.

Over the long term, single-family home prices have shown resiliency through decades of economic cycles and remain one of the most valuable property types. Moreover, investors are willing to accept a level of illiquidity and a longer time horizon to realize stable risk-adjusted returns over the long term. Finally, residential real estate, just like the broader real estate investment market, offers alternative investment assets that have a lower correlation to public markets and provide potential inflation protection.

These characteristics draw the interest of investors seeking diversification strategies that offer attractive risk-adjusted returns and diverse cash flows. New investment products have also helped improve access to the residential home market.

Traditional Residential Investment Approaches

Conventional routes include direct purchases, single-family rental vehicles (SFRs), residential mortgage or asset-backed securities (RMBS/ABS), or residential and mortgage Real Estate Investment Trusts (REITs). However, such approaches also come with additional constraints.

For example, direct purchases of homes require sizable capital outlays to acquire and maintain the properties, making them difficult to scale. SFRs, SFR REITs, and residential REITs depend on renters and stable rent growth. Some of these products, such as RMBS/ABS and mortgage REITs, are sensitive to fluctuations in interest rates or underlying borrower credit scores.

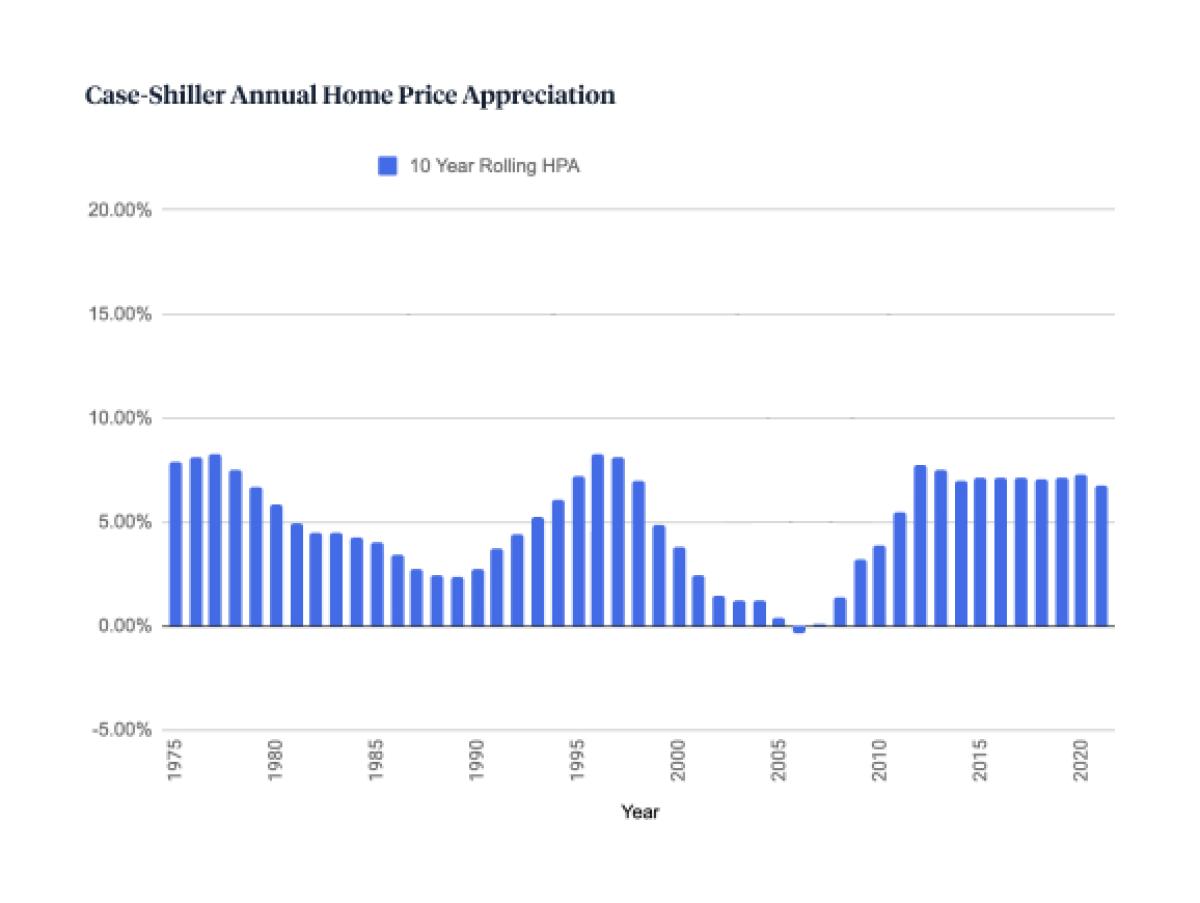

In addition, none of these products offer exposure to a deep pool of value in owner-occupied homes — untapped home equity. The value of this equity is the amount homeowners can access while keeping at least 20% equity in their homes. It stood at $9.3 trillion as of February 2023. Also buoying home equity is the resiliency of long-term home price growth, which has averaged 5.4% annually since 1975.

Product Innovation: Home Equity Investments

An emerging asset class, known as home equity investments (HEIs), offers a way for investors to access this untapped equity. HEIs are agreements that give investors a minority stake in residential homes, providing debt-free liquidity to homeowners for a set period, typically 10-30 years. HEIs provide scalable, capital-efficient exposure to long-term home price appreciation, typically by bundling HEI agreements into a fund. HEI investors benefit from portfolio diversification with low correlation to public markets, potential inflation protection, and capital preservation. With investments across the U.S., HEIs provide broad geographic diversification, which helps normalize fluctuations across various housing markets.

The HEI structure offers significant advantages. Compared to other residential real estate investment vehicles, HEIs do not require the sizable capital outlays for acquisition and maintenance that direct home purchases do. Investment performance does not depend on renters with associated risk profiles that do not compare to homeowners, and HEIs are less sensitive to credit or interest rate risks.

Moreover, a typical HEI fund will provide meaningful downside protection during home price declines. This feature is specific to HEIs and is not typical of other real estate investments in which lower property values typically result in investor losses.

Finally, HEIs also unite investors and homeowners in a unique partnership where incentives align and both groups share the benefits. They offer a socially-responsible approach to real estate investment that helps keep people in their homes while delivering potentially attractive returns.

Supporting American Homeowners

For average Americans, homeownership represents their most significant source of wealth creation. Home values increase over time, translating into home equity wealth. But home equity is not cash liquidity. When homeowners need large sums of cash, their options involve more borrowing and debt via home equity loans, refinancing, or lines of credit.

With HEIs, homeowners can get the cash they need upfront in exchange for sharing a percentage of their home’s future value with investors. They can tap into their home equity while avoiding the stress of monthly payments (plus interest) that come with traditional financing.

For homeowners with good credit and quality homes but who do not meet the criteria for other financing options or do not want to incur more debt, HEIs may be a smart alternative. Credit requirements for HEIs are unique from traditional financing, but homeowners need significant home equity — typically around 25%. Investments generally are 30% or less of total home value but may vary by provider.

HEIs allow homeowners to use the funds for any reason, unlike an equity loan or HELOC. This flexibility empowers even more homeowners to put their equity to work for them, often in life-changing ways. For example, some homeowners leverage the funds from their HEIs to pay down or eliminate debt, renovate or otherwise add value to their home, or fund a business. With this level of optionality, HEIs give many homeowners the springboard to achieve newfound financial flexibility.

Scalable Access for Investors

With the capital-efficient and scalable HEI structure, credit-oriented investors gain exposure to home value growth and stable returns over time with a structured asset fund. A typical arrangement entails an HEI company acting as a general partner (GP) who then pools capital from limited partner (LP) investors into asset investment funds. The HEI company deploys that capital into making minority investments in select homes (i.e., entering into HEI agreements with homeowners).

HEI asset funds differ fundamentally from debt products. Rather than receiving contractual interest payments or dividends (like SFRs or RMBS), investors receive passive cash flow distributions from settled HEIs annually. HEI terms vary from 10-30 years, depending on the provider. However, many HEIs are settled in less time.

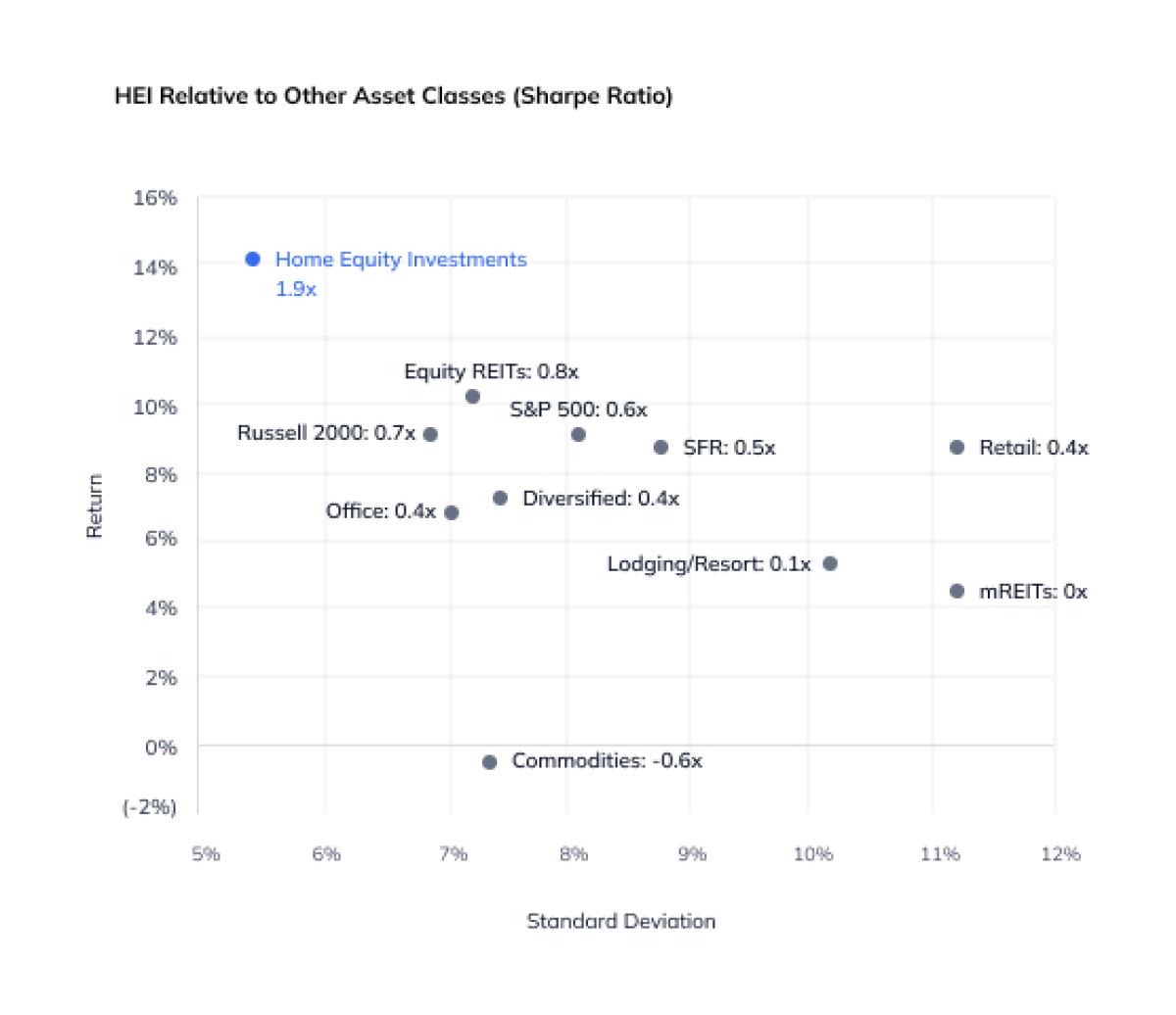

Structuring HEI asset funds involves several investor considerations, including enhanced risk-adjusted returns, downside protection, inflation protection, and the potential for long-term capital gain treatment. While performance may vary by provider, historical risk-adjusted returns are known to generate Sharpe Ratios at a premium to other alternative and traditional asset classes.

Typical HEI structures incorporate meaningful downside protections. They also feature a rigorous selection process and standard lending security. HEI companies use strict underwriting rules to screen investments. An HEI fund portfolio should include high-quality homeowners with good FICO credit and risk characteristics, as well as quality homes with low loan-to-value (LTV).

Homeowners must typically also agree in their HEI documents that they will not incur debt that could jeopardize the value of the company’s interest. The above factors help to minimize potential losses and provide investors with downside protection. Similar to loans, HEIs are secured using a lien on the title, which is recorded in the homeowner’s local jurisdiction. Strict recordkeeping ensures investments are settled according to the HEI terms.

Conclusion: Returns with Positive Impact

HEI funds are an emerging alternative investment asset class that brings homeowners and investors together in a unique partnership for mutual benefit. They allow homeowners to tap into their home equity and get the cash they need upfront by sharing a percentage of their home’s future value with investors. They also help homeowners become less dependent on lending and debt by providing an accessible, transparent, debt-free way to tap into their home equity.

HEI funds represent an innovative alternative investing opportunity for credit-oriented investors seeking a capital-efficient, scalable route to the multi-trillion-dollar pool of untapped home equity. Among many investor benefits, structured HEI vehicles have a track record of enhanced risk-adjusted returns with meaningful downside protection. Investing in HEI funds also presents an opportunity to support mission-driven businesses that help average American homeowners strengthen their financial position and improve their livelihoods.

About the Author:

Jeffrey Glass, Hometap CEO and Cofounder, is a serial entrepreneur, business operator, and investor. He has been the founder and CEO of multiple successful technology-driven companies over the past three decades, leading businesses through difficult moments, as well as periods of hyper growth. He has also been an investor in a broad set of businesses during his tenure as a Managing Director at Bain Capital. Jeffrey holds an MBA from Harvard Business School and a Bachelor’s Degree in Economics and Political Science from Amherst College.