By Jeffrey Palma, Head of Multi-Asset Solutions, Rich Hill, Head of Real Estate Strategy & Research, and Joseph Handelman, Vice President, at Cohen & Steers.

Investors with allocations to real estate, stocks, and bonds have outperformed investors with allocations only to stocks and bonds. And they have done so experiencing lower risk. Now, Cohen & Steers is introducing the Real Assets CompassTM to bring those benefits to life.

KEY TAKEAWAYS

- We believe that real estate should be a strategic, long-term allocation for most investors, considering the benefits it has delivered to portfolios.

- In our view, too few investors recognize these benefits, particularly real estate’s strong performance and potential to enhance risk-adjusted returns.

- The Cohen & Steers Real Assets Compass compares historical and expected returns and volatility of traditional stock/bond portfolios with those of a more diversified portfolio with listed and private real estate.

The data are clear: Investors with allocations to real estate, stocks, and bonds have outperformed investors with allocations only to stocks and bonds. And those investors who include real estate in their portfolios have achieved that outperformance while experiencing lower risk.

Yet, too few investors, in our view, recognize the benefits allocations to real estate have historically delivered to portfolios. We believe investors should demand better performance from their portfolios than they can get by investing in stocks and bonds alone.

Indeed, real estate (both listed and private) has delivered strong returns, both on an absolute basis and relative to stocks and bonds while adding income and potential inflation mitigation to a portfolio. Moreover, real estate’s low correlations to stocks and bonds offer the potential for lower volatility in a portfolio and, therefore, enhanced risk-adjusted returns when used to complement traditional stock/bond allocations.

That’s based on both historical data and Cohen & Steers expectations over the next 10 years (Exhibit 1).

To help advisors demonstrate the impacts of real estate allocations to their clients, we developed a proprietary tool: the Cohen & Steers Real Assets Compass. The Compass compares historical and expected returns and volatility of traditional stock/ bond portfolios with portfolios diversified by including listed and private real estate allocations.

We believe that real estate should be a strategic, long-term allocation for most investors, and extensive research supports this assertion. For instance, Morningstar recently reviewed 39 academic studies on REIT allocations and concluded that “allocating at least 5% of your portfolio holdings to real estate leads to greater returns and comes with fewer risks compared with a traditional 60% equity and 40% bond portfolio.”

To help advisors demonstrate the impacts of real estate allocations to their clients, we developed a proprietary tool: the Cohen & Steers Real Assets Compass. The Compass compares historical and expected returns and volatility of traditional stock/bond portfolios with portfolios diversified by including listed and private real estate allocations.

We believe that real estate should be a strategic, long-term allocation for most investors, and extensive research supports this assertion. For instance, Morningstar recently reviewed 39 academic studies on REIT allocations and concluded that “allocating at least 5% of your portfolio holdings to real estate leads to greater returns and comes with fewer risks compared with a traditional 60% equity and 40% bond portfolio.”

The Real Assets Compass illustrates how adding real estate to a portfolio of stocks and bonds improves that portfolio’s total return, as well as its risk-adjusted return (as measured by Sharpe ratio).(1) The tool allows financial advisors and other institutional investors to review historical results and future estimates side by side. Take a moderate investor, for example; someone seeking a balance between growth and income and who has a medium risk tolerance. We assume a typical allocation for this type of investor would be a default portfolio of 60% stocks and 40% bonds.

Cohen & Steers’ best thinking for that same investor is to allocate 12.5% of their portfolio to real estate (5% private and 7.5% listed). The historical result, as shown in the Compass, is that by diversifying with real estate, that investor would have improved performance with a similar level of volatility and a more favorable risk/return profile (Exhibit 2). Compounded over time, these differences are significant.

That 30-year performance is driven by the following annualized returns:

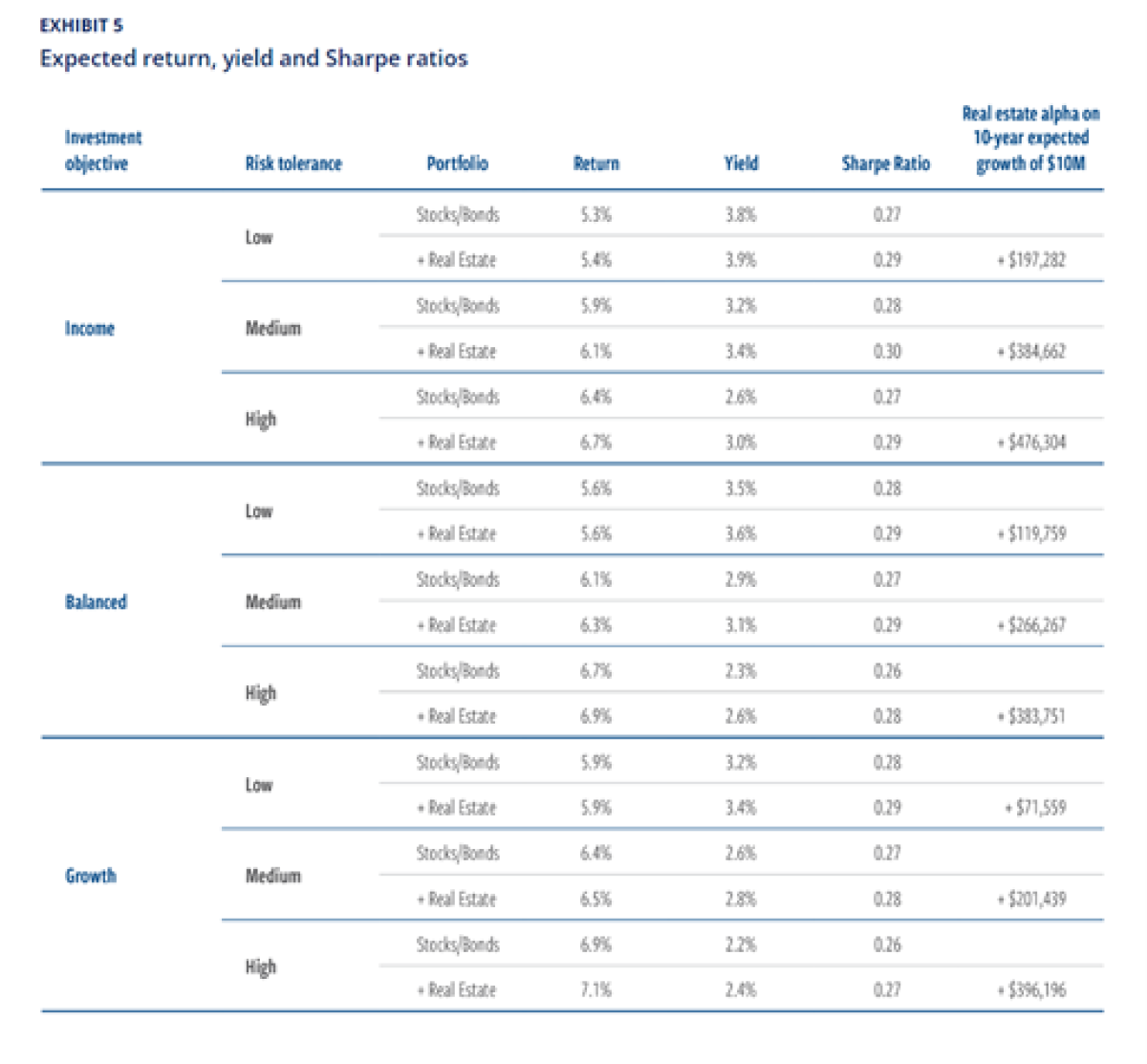

The superior performance of a portfolio diversified with real estate is seen across a wide range of objectives (income, balanced and growth) and risk tolerances (low, medium and high) (see Exhibit 5).

Yet, as noted earlier, individual investors often overlook real estate—the third largest asset class in the world behind stocks and bonds—when diversifying their portfolios beyond the traditional 60/40 mix.

Institutional investors, which have access to extensive research and professional analysts (and often decades of experience), as well as access to vehicles and the ability to invest in private real estate, have been steadily increasing their target real estate allocations, reaching an anticipated allocation of more than 10% at the end of last year, according to the annual Cornell–Hodes Weill Real Estate Allocations Monitor. Institutional investors allocate 3.5 times more of their capital to real estate than individual investors, on average.

Meanwhile, U.S. family offices, which manage the wealth of high-net-worth individuals and their families, have a target real estate allocation of 21%, according to UBS (but they are behind in this goal, with only 13% invested in real estate).

This disparity is especially interesting in the context of our recently published Capital Market Assumptions, which form the basis of our expected returns in the Compass. Our forecast is for a regime shift over the next decade, marked by higher inflation and higher interest rates alongside slower growth.

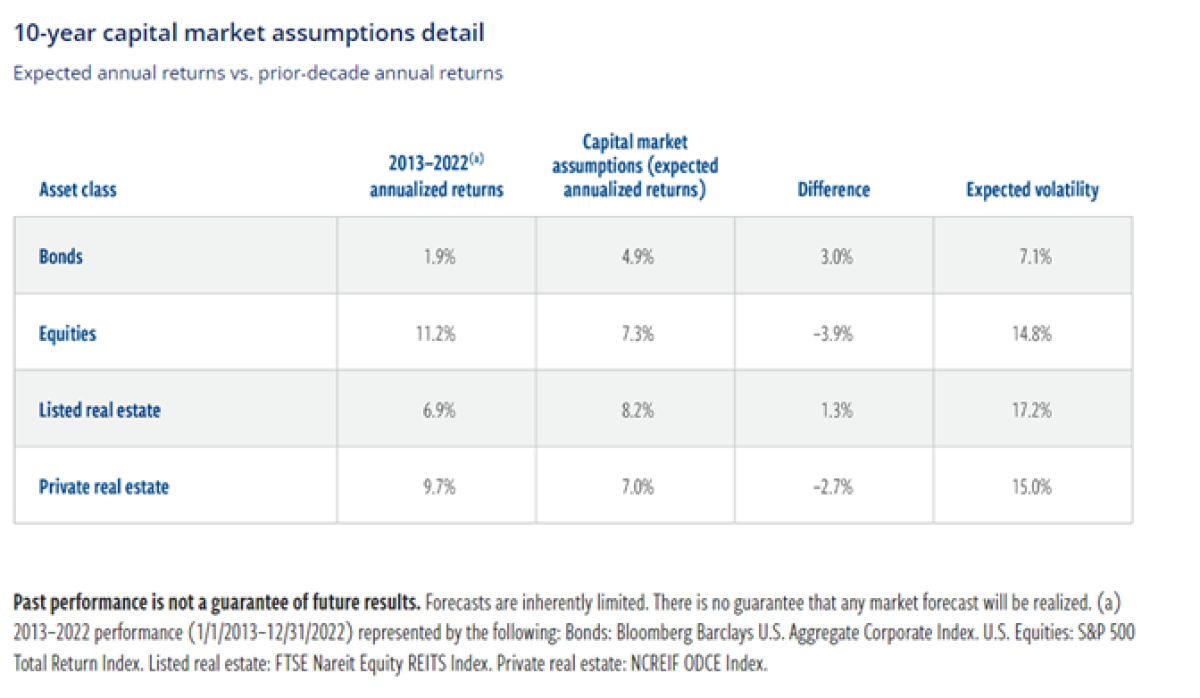

Compared with the last decade, fixed income will benefit from the current higher starting point of interest rates, while equity returns are expected to be lower over the next 10 years amid slower real GDP growth, lower profit margins (given higher operating expenses) and a higher cost of capital (Exhibit 3). We believe the new regime offers a more favorable outlook for listed real estate returns. We also expect this shift to increase the need for portfolio diversification—something real estate has historically helped investors achieve.

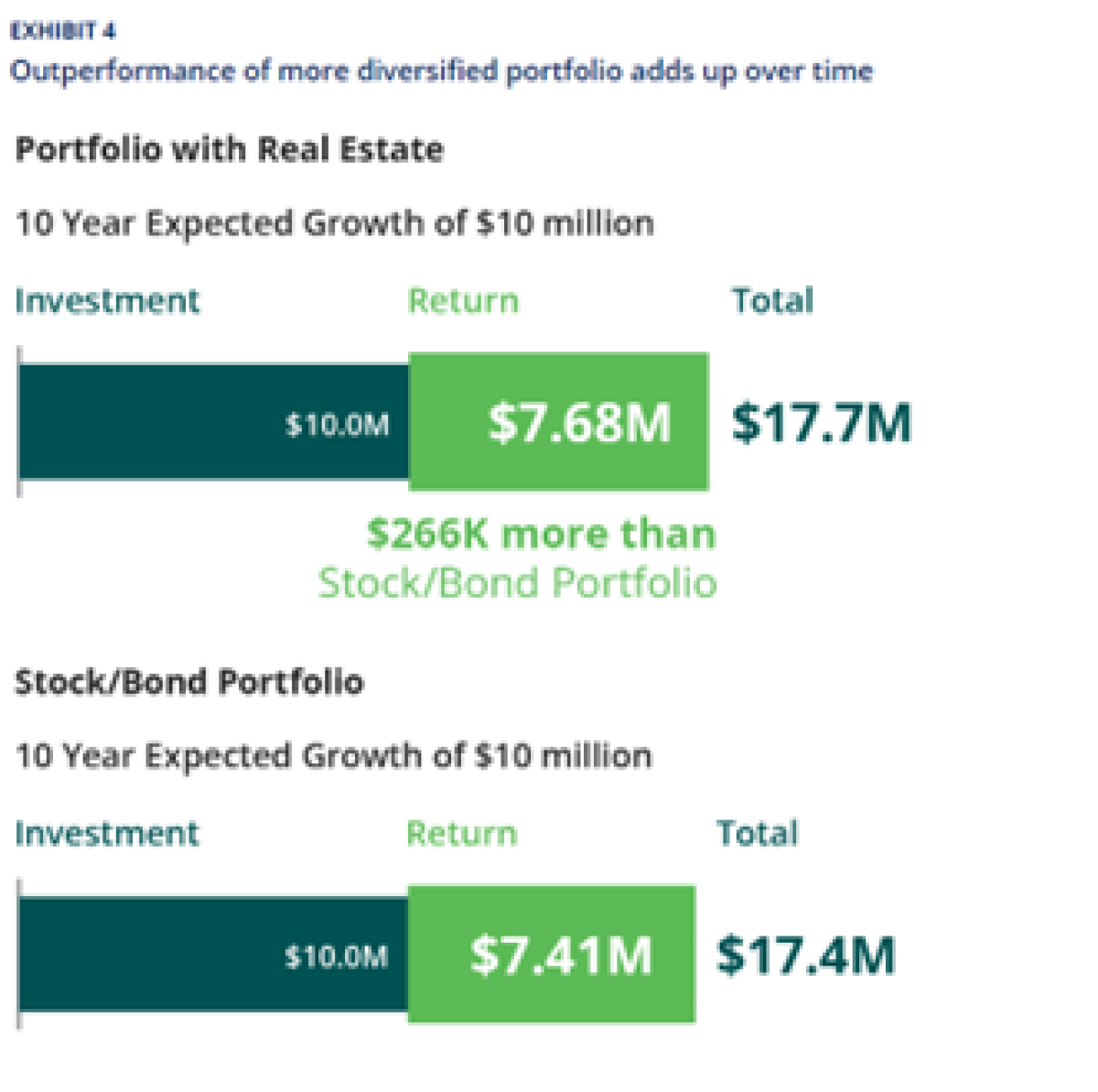

Returning to the moderate investor discussed earlier, a more diversified portfolio with 51% equity, 36.5% bonds, 5% private real estate and 7.5% listed real estate, is expected to outperform the traditional 60/40 portfolio by an average 20 bp per year over the next decade, with lower volatility (Exhibit 4). With a starting investment of $10 million, that investor is expected to have $266,000 more than an investor who allocated to stocks and bonds alone.

Bottom line: We believe many investors are under- allocated to real estate despite history showing— and our expectations that suggest—that it can be a source of diversification without sacrificing return potential. Cohen & Steers launched the Real Assets Compass to enable financial advisors to compare the historical and expected risk and return of a portfolio that includes a strategic allocation to listed and private real estate with one that does not. A financial advisor can also customize the portfolio value and download easy-to-understand reports to review with clients.

The potential benefits of real estate allocations are seen in portfolios with a variety of objectives and risk tolerances, ranging from aggressive growth to conservative income (Exhibit 5).

We believe many investors are underallocated to real estate despite history showing—and our expectations that suggest—that it can be a source of diversification without sacrificing return potential.

What is the Real Assets Compass?

The Cohen & Steers Real Assets Compass is an interactive tool designed to help financial advisors and institutional investors improve portfolio risk-return profiles. In particular, it can help advisors consider the common investor question: “How much real estate should I hold in my portfolio?”

Standard portfolio construction tools have their place, but they often omit alternative asset classes and overlook real estate. The Compass, meanwhile, makes it easy to compare historical and expected risk and return for traditional stock/bond portfolios versus portfolios diversified with listed and private real estate.

The tool’s portfolio examples are constructed based on investor objectives and tolerance for risk. The Compass also allows financial advisors and institutional investors to customize portfolios by changing either their total real estate allocation or the allocation mix between listed and private. It uses historical data (based on index returns) and expectations informed by Cohen & Steers’ Capital Market Assumptions to compare the total return, yield, volatility and Sharpe ratio of portfolios with and without real estate.

It’s important to note that the example portfolios treat real estate as a long-term strategic allocation, not a tactical investment. And the Compass is not an optimization tool; it simply demonstrates historical returns and expectations (using Cohen & Steers analysis), aligned to investor risk and return objectives.

The methodology behind the Real Assets Compass

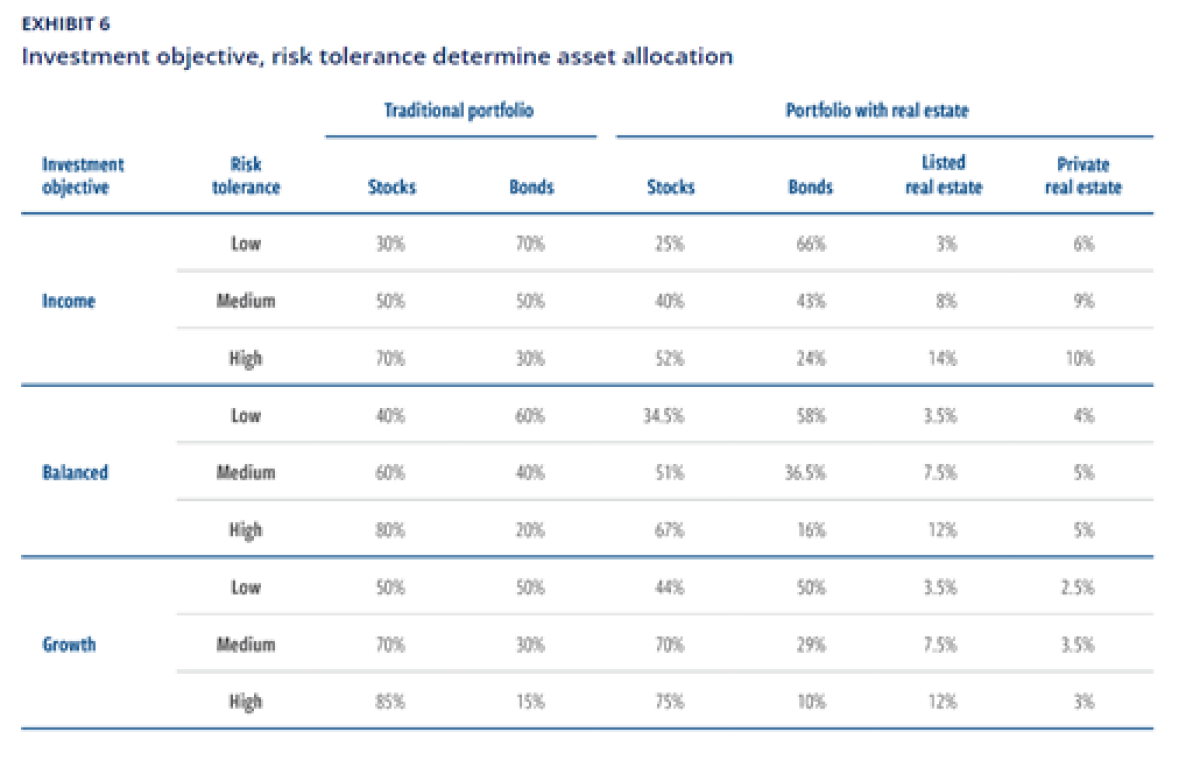

As is typical in portfolio construction, the Real Assets Compass uses the investor’s objectives as a starting point. The objectives are categorized as “income,” “balanced” and “growth” (corresponding to largely accepted industry categorization).

The second key question: What is the investor’s risk tolerance? The tool offers options of “low,” “medium” and “high.” The risk tolerance corresponds to a portfolio’s expected volatility and determines a starting allocation. Baseline allocations to stocks and bonds are 80/20 for high risk, 60/40 for medium risk and 40/60 for low risk.

The answers to these two questions determine an investment profile and, consequently, a starting allocation in a traditional portfolio of just stocks and bonds (Exhibit 6, “traditional portfolio”). In short, more risk-tolerant portfolios will have higher equity allocations. More conservative portfolios will have higher fixed income allocations. Similarly, portfolios seeking more income generally have higher fixed income allocations, and vice versa.

In our tool, an investor with a growth objective and a high risk tolerance has a starting allocation of 85% stocks and 15% bonds. By comparison, an investor with a balanced objective (seeking both growth and income) and a medium risk tolerance has an allocation of 60% stocks and 40% bonds.

The Cohen & Steers Real Assets Compass is an interactive tool designed to help financial advisors and institutional investors address the common question: “How much real estate should I hold in my portfolio?”

A more diversified allocation, using listed and private real estate, is then developed (Exhibit 6, “portfolio with real estate”). Those allocations also change based on objective and risk tolerance. All else equal:

- Higher risk tolerance results in a larger allocation to real estate.

- Higher risk tolerance results in a larger allocation to listed real estate (vs. private real estate) given higher volatility and return potential.

- An income-seeking investment objective results in a larger real estate allocation.

- A growth-seeking investment objective results in a smaller real estate allocation.

- An income objective boosts the allocation to private real estate (vs. listed).

The Compass then calculates historical returns and volatility, and it follows principles of portfolio theory to calculate expected future returns and volatility. To that end, the return of a portfolio is the weighted average of returns of the individual asset classes. Expected volatility of a portfolio is a function of the forecast volatility of each asset class but also the correlation of each asset class to the others.

Historical returns are based on index returns for the S&P 500 for equities, the Bloomberg Barclays U.S. Aggregate Corporate Index for bonds, the FTSE Nareit Equity REITs Index for listed real estate, and the NCREIF ODCE Index for private real estate.

Expected 10-year returns are calculated based on Cohen & Steers’ Capital Market Assumptions as of December 31, 2022, which are updated annually.

Volatility is calculated based on historical results, and volatility assumptions are driven by historical experience as well as expectations noted in our Capital Market Assumptions. Due to the illiquid nature of private real estate, reported volatility of returns for this asset class is generally lower than would be seen if assets were valued more frequently. As a result, both “reported” and “adjusted” real estate volatility are shown in the tool. (See box for explanation of adjusted volatility.)

EXPLAINING ADJUSTED VOLATILITY

Private real estate funds are not priced daily (this is typically done monthly or quarterly), and the underlying property values are based on manager-led DCF analysis and/or appraisal values. As a result, the funds’ reported volatility does not reflect changing values of the underlying assets in the same way that listed REITs’ reported volatility does. When using historical data for portfolios with private real estate, we apply a method first published by MIT to “de-smooth” the volatility in an attempt to better reflect actual swings in asset values.

Adjusted volatility shows this recalculated measure of volatility, whereas reported volatility reflects what was reported by funds.

What are Cohen & Steers’ Capital Market Assumptions?

Cohen & Steers publishes its Capital Market Assumptions annually, capturing the firm’s expectations for 10-year returns for a range of asset classes (including stocks, bonds and real assets). The Capital Market Assumptions are intended as a guide to help financial advisors and other institutional investors make informed decisions about their investment portfolios, providing a framework of potential risks and rewards associated with different asset classes.

You can view the 2023 Capital Market Assumptions, for more detail on the methodology behind this analysis.

Inputs to these expectations for asset class returns include volatility as well as correlation across asset classes. The Capital Market Assumptions also forecast expected macroeconomic data, notably inflation(as measured by the Consumer Price Index) and economic growth (as measured by growth in gross domestic product).

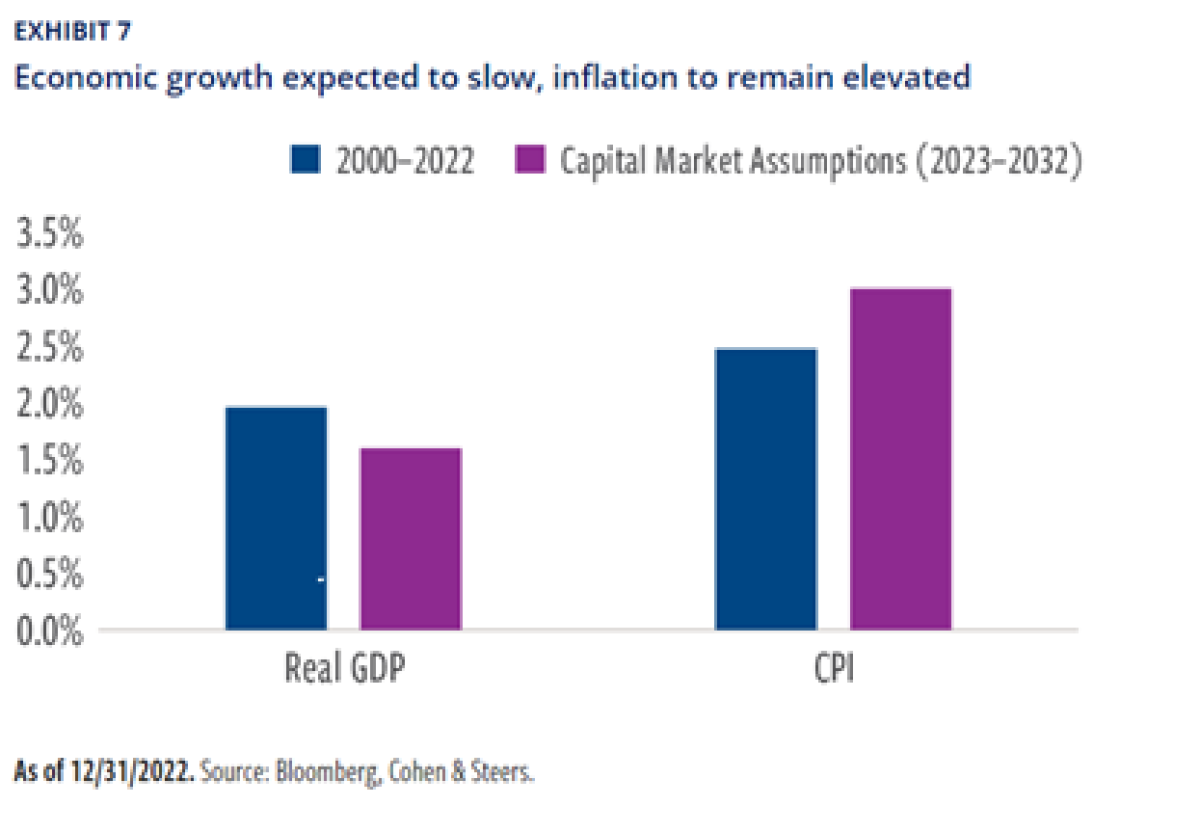

Cohen & Steers’ 2023 Capital Market Assumptions suggest that, though we are likely past peak inflation, the risks of bouts of inflationary shocks over the next decade have increased. In our view, this new period will be marked by labor scarcity, commodity underinvestment, increased geopolitical uncertainty, and a move away from globalization and toward “friend-shoring” (i.e., trade partner selectivity). Stubbornly higher inflation will likely result, with average annual CPI inflation of 3% forecast for the next 10 years (Exhibit 7).

We expect real gross domestic product (GDP) growth in the United States to slow to 1.6% annually and global GDP growth to average 3.1% annually. We also forecast more volatility (particularly in macroeconomic factors) as the world moves away from peak globalization, relative geopolitical stability, quantitative easing and central bank accommodation.

Though we are likely past peak inflation, the risks of bouts of inflationary shocks over the next decade have increased.

This, in turn, drives several differences between our 10- year assumptions and the prior decade’s results—including higher yields, generally lower multiples and higher premiums for risk assets.

About the Authors:

Jeffrey Palma, Senior Vice President, is Head of Multi-Asset Solutions at Cohen & Steers, responsible for leading the firm’s asset allocation strategy and macroeconomic research.

Rich Hill, Senior Vice President, is Head of Real Estate Strategy & Research at Cohen & Steers, responsible for identifying allocation opportunities in both listed and private real estate and related thematic and strategic research.

Joseph Handelman, Vice President, is a managing analyst for the Cohen & Steers’ real assets multi-strategy and serves as Head of Portfolio Solutions.