By Shaul Rosten, Analyst, Redwheel

Ah, January. Just the word sends shivers of excitement down the spines of gym-proprietors across the world, salivating at the prospect of New-Year’s resolutioners confidently paying for a full year’s membership, only to slink away sometime in March. Yes, it is the season for attempting to better oneself, working on those bad habits, and trying to create some good ones. Crucial to that effort is self-control and discipline: being able to say no to that sweet treat and dragging yourself out of bed for the early morning run you promised you’d get done.

So critical is self-control to success in many areas that it has been a topic of extensive study, one of the most famous involving four-year-olds and marshmallows. In the experiment[1], Walter Mischel, a psychology professor at Stanford University, placed a single marshmallow in front of several hundred children (one at a time, mind you). He then posed a challenge: he would leave the room for a few minutes, and if, by the time he came back, the child had resisted the urge to eat the marshmallow, they would get to eat the first marshmallow and earn a second as a reward. While many succumbed instantly, others were able to wait a few minutes before caving in, and some resilient children waited the whole duration for the second marshmallow.

As fun as this experiment must have been – at least for the children – the most interesting results came years later, when the researchers followed up with the now-grown subjects of their study, looking at a range of life outcomes. Startlingly, there was a strong correlation shown between the length of time that a child was able to resist eating the marshmallow – taken as a proxy for intrinsic capacity for self-control – and their academic test results, weight, life satisfaction, mental health, and earnings. The longer the wait, the better the outcome.

While some quibble with the methods of this study, the general principle of self-control – restricting yourself today for jam tomorrow – as a route to success in life is hardly controversial. When it comes to investing, however, we would caution against the alluring promise of abundant sweets in the future and advise instead: just eat the marshmallow.

As value investors, we look to buy companies at a significant discount to what we and others term “intrinsic value”: the true worth of the business, based on a conservative assessment of its earnings power over time, and the money that will need to be reinvested to sustain that earnings power. A key part of that process is in trying to figure out what the business can earn realistically, not getting too excited with expectations for sky-high earnings growth. Helpfully, earnings tend to be somewhat tied to several factors, including the assets that the business can utilise and, importantly, what the business has previously demonstrated that it can earn. After all, paying a reasonable price for established earnings doesn’t require great feats of corporate athleticism to produce a good result for investors.

By contrast, when you pay a large price relative to the historic earnings power, you are baking in assumptions of good-to-exceptional growth. Figuring out ahead of time which companies are going to deliver that growth, and which will disappoint, is an almost impossible task. Paying for that growth upfront leaves no room for error: you likely won’t beat the market by being right most of the time if you are betting on the outcomes as certain.

And here is where the key difference between the experimental bonus marshmallow and corporate earnings comes in: waiting for the extra marshmallow is a good use of your self-control when it is promised by a psychologist in a white coat, because you know that it’s coming, if you can only hang on. The same, alas, is not true with companies. Many darlings of the market, beloved for their promise of guaranteed future growth, fail and disappoint. Predicting the future too precisely, and acting accordingly, is a highly risky activity for investors – even if not for four-year-old study subjects.

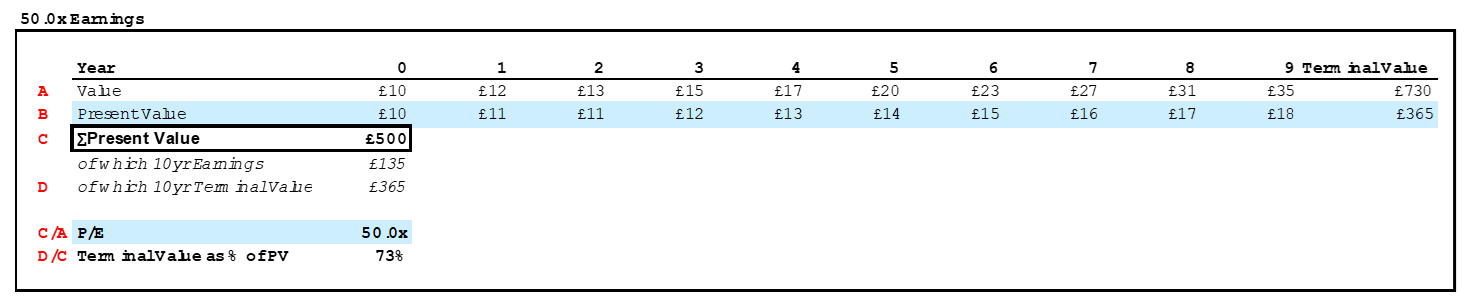

For example, consider a company priced at 50x its most recent earnings[2]. To justify that price, we need to distil into a single value all the future earnings of the business. The way that this is typically done is by taking a nearer-term picture of income, say, over the next 10 years, and then adding on a “terminal value,” the net worth of the business after that forecast, a sum intended to reflect long-term value. These figures are then expressed as a present value – namely, what the sum of the cashflows is worth today – and that present value is the price at which investors buy and sell companies in the market.

To justify a price of 50x current earnings, investors would have to assume that earnings per share grow at 15% each year for the next 10 years – a herculean feat – and assume a longer-term growth rate of about 3.0%. Even then, with such staggering success, the price can still only be justified by using a required rate of return of 8.0%, which some may see as insufficiently low for the associated risk[3]. Finally, even after generating such incredible earnings growth for 10 years, paying 50x today’s earnings means that today’s present value is still mostly made up of the “terminal value”, which represents a whopping 73% of the current asking price:

Source: Redwheel. The information shown above is for illustrative purposes.

To pay such a price, investors need to feel certain of the future, certain that by ignoring more reasonably priced companies today – the lonely single marshmallow presented at the start of our experiment – they are going to be rewarded with phenomenal growth for a very long time into the future and earn themselves an extra marshmallow.

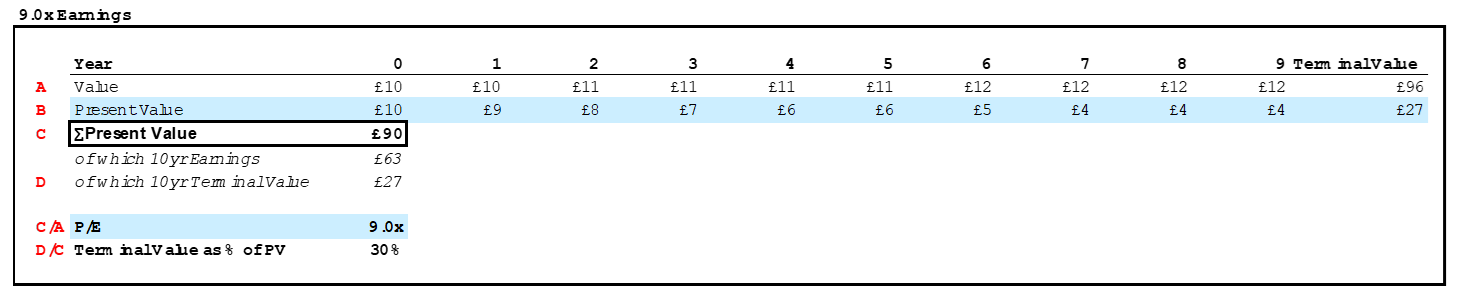

Assuming such extreme growth for such a long time makes value investors like us nervous. If we don’t make any heroic assumptions[4], and pay a much lower price relative to current earnings, the reliance of our current business value on the outcome of the long-term future falls fast, with the “terminal value” comprising only 30% of today’s price, if we pay only 9x current earnings. That means that if both our theoretical companies announced that they would cease to exist in 10 years, our investment would retain 70% of its value, compared with the higher-priced company, which would be worth only 27% of the price paid. There is risk in gambling on ever more marshmallows in the market.

Source: Redwheel. The information shown above is for illustrative purposes.

We make this point to underscore the importance of thinking carefully about the expectations – explicit or implicit – that are built into market prices for businesses, and the chances of those expectations paying off. Unlike a lab, in the real economy it is foolish to assume that more marshmallows will always be forthcoming; we believe investors should think carefully before turning one down today. So, the next time someone confidently tells you that Company X or Y is going to make $25 per share of earnings in 10 years’ time, and $250 in 20 years’ time, ask them to take out their wallet and bet on it. After all, if they’re investing your money on that basis, then that’s what they’re doing anyway. If you tried the same gambit on us, we would gladly tell you that we hadn’t the faintest idea what earnings would precisely be in 10- or 20-years’ time, and we didn’t need to – because we haven’t paid much for them in advance, preferring to base our view of sustainable earnings power on the demonstrated historical earnings capabilities of an enterprise. While many are trying to predict the future, we are simply trying to put the present in the context of the past. In the investment world, simply eating the marshmallow in front of us, we find, in fact requires the most self-control – and often makes the most sense.

About the Contributor

Shaul joined the Redwheel Value & Income team in October 2022, having previously worked as an Analyst in public markets at Man Group and private markets at Maddox Capital Partners. Prior to starting his career in finance, Shaul studied Biological Sciences at Imperial College London, where he specialised in computational systems biology. Outside of his passion for value investing, Shaul is an avid reader - including books and an array of varied blogs. He also enjoys spending his free time with his wife and three young kids.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/

[1] Mischel W, Ebbesen EB, Zeiss AR. Cognitive and attentional mechanisms in delay of gratification. J Pers Soc Psychol. 1972 Feb;21(2):204-18. doi: 10.1037/h0032198. PMID: 5010404. (https://pubmed.ncbi.nlm.nih.gov/5010404/)

[2]We can think of a few culprits, who shall remain nameless; one rhymes with Badobe

[3] I would be one of those people

[4] In this case, 2.5% annualised per share earnings growth, a 2.0% perpetual growth rate, and a 15.0% discount rate