By Zane Carmean, CFA, CAIA, Lead Research Analyst, Quantitative and Fund Research, PitchBook & Emily Zheng, Senior Research Analyst, Venture Capital, PitchBook

Introduction[1]

The playbook of many private capital firms has been largely the same since the market’s early modernization in the 1960s. An investment firm will typically form a limited partnership, themselves becoming the GPs and managers, and recruit investors—that is, LPs—to commit capital to the fund vehicle. The fund will then call down that capital over a few years as investment opportunities arise, and the GP will manage the portfolio, eventually seek exits for the investments, and distribute the proceeds back to the fund’s LPs until the fund is liquidated. Typically, that all takes place in a 10- to 12-year time frame, with the GP raising new funds every three to five years to keep a fresh stock of dry powder at the ready.

Regulations in the US that were formed by the Securities Act of 1933—and followed up in 1982 with the Security and Exchange Commission’s (SEC) Regulation D— ensured that private fund offerings were hard to access, predominantly to protect ordinary people from the perils and illiquidity of these sophisticated and presumed-to-be riskier investment products.[2] High investment minimums and low accessibility have meant that private funds’ LP bases have principally been made up of investors with large pools of capital, namely pensions, endowments, financial firms, and other so-called “institutional investors.” For nearly everyone else, investment options were limited to stocks, bonds, and cash.

The playbook is now getting rewritten. The tailwind of large institutions allocating more and more capital to private markets has become a gentle breeze. Many of these LPs have come up against their exposure limits for the asset class, resulting in a pullback in fund commitments. That has led the industry to seek new ways to broaden the investor base. Plus, a growing emphasis on fee-related earnings from GP stakes and public market investors has incentivized firms to diversify their product offerings and adopt a pseudo-subscription model. Meanwhile, innovative technologies have unlocked GPs’ abilities to manage funds with larger numbers of LPs, more dynamic liquidity features, and without the need for a mandated finite life. The relatively untapped potential of the private wealth channel has provided the fuel for this structural shift to take off, slowly at first but now accelerating.

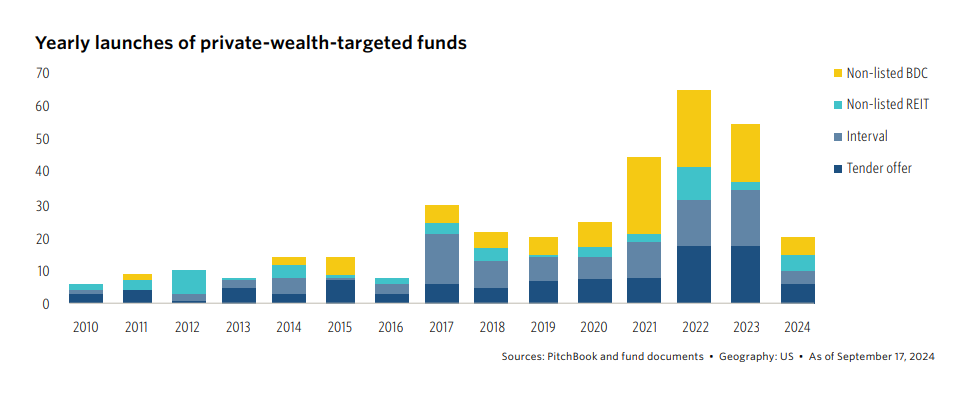

While not new, a growing share of private market investment is being allocated to evergreen and open-ended fund structures. These help GPs avoid the lumpiness of sporadic fund launches and inopportune end-of-life liquidations in the traditional drawdown/finite-life structure. For LPs, these funds provide a simpler way to manage private market allocations and, by gaining full allocation from the subscription date to redemption, more exposure to the benefits of compounding returns. That translates to a more efficient offering for private wealth advisors relative to drawdown funds when managing an array of investor portfolios. Institutional investors have had access to these structures for decades, mainly in real estate and infrastructure strategies, but fund launches targeted at individual investors have increased considerably over the last several years, providing access to private markets and other alternative investments.

The shift is less revolution and more evolution. The largest private asset managers of yesterday have become the leaders in leveraging their platforms, brands, and scale to bring new products to market to meet the needs of a diversifying private market investor base. This structural move is just getting underway, and it represents the next era of modernization for the investment industry as part of the broader convergence of public and private markets.[3]

A (private) wealth of opportunities

Private market AUM held in drawdown funds is nearly $15 trillion globally, up from less than a trillion in 2000, handily outpacing the growth in public markets. However, outside of ultra-high-net-worth individuals (UHNWIs) and those with privileged networks, individual investors have been largely left out of the mix. Investor protection laws are partially to blame, and arguably for good reason. Typically, drawdown funds are exempt from Investment Act of 1940 (’40 Act) registration under Section 3(c)(7), but that limits the number of LPs and translates to high investment minimums and barriers to entry for much of the private wealth channel. Estimated global wealth stands at nearly $450 trillion, with about 90% held by those with at least $100K.5 If 5% of that wealth were to be allocated to private markets, that would represent more than $20 trillion in total capital formation, dwarfing total AUM in drawdown funds today and $1.1 trillion in evergreen LP funds.

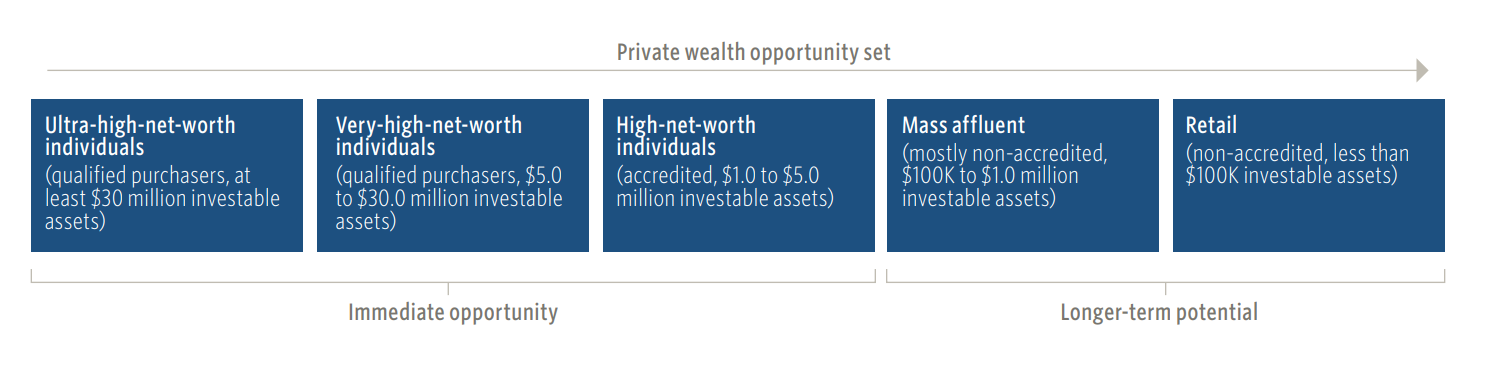

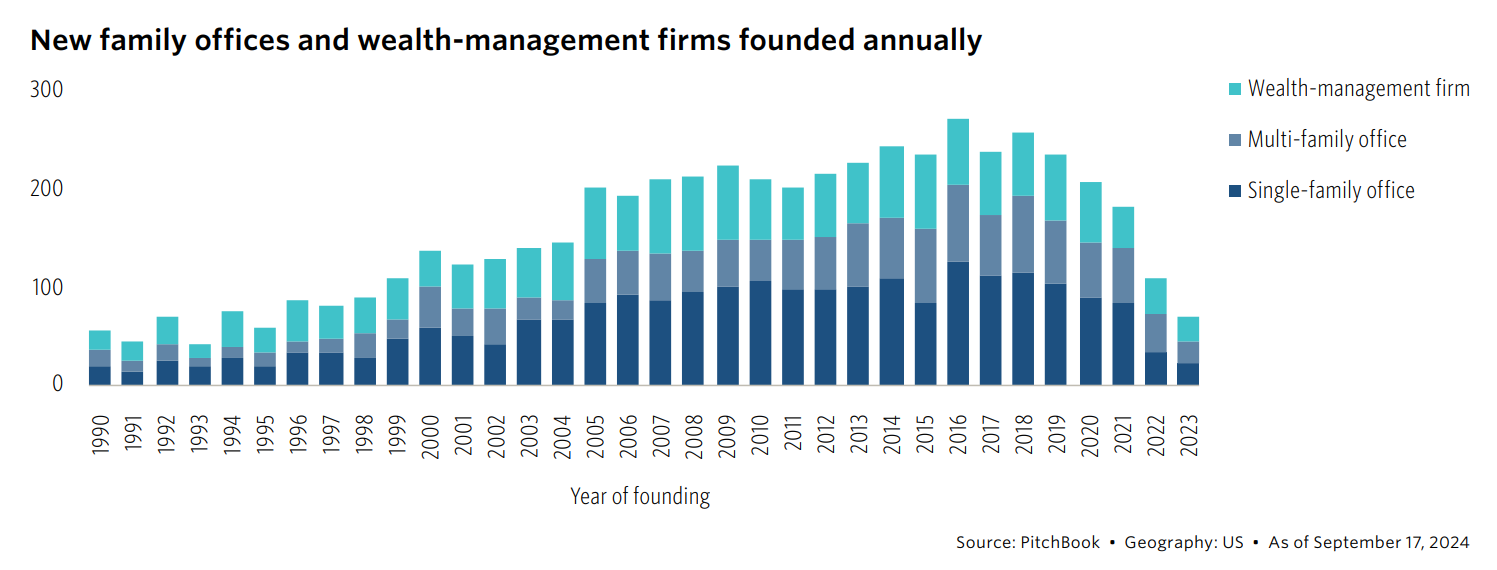

We view the private wealth channel as two broad opportunity sets for GPs. The first is the ongoing adoption by accredited investors and qualified purchasers making up high-net-worth (HNW), very-high-net-worth (VHNW), and the aforementioned UHNW. Together, they are expected to invest over $7 trillion in private market allocations by 2033.[4] That amount represents more than half the $12.6 trillion in fundraising activity in drawdown funds across all private capital for the 10 years ending in 2023. With investor accreditation requirements, most evergreen fund offerings launched today are targeted at these cohorts. The growing ranks of family offices and registered investment advisors (RIAs), as well as the expected wealth transfer to younger generations, means the opportunity set is expanding.[5] These investors are also interested in drawdown funds, and those with scale and access are taking share from institutional investors in the LP base of traditional vehicles.

The second, longer-term potential for private capital’s growth will come from the lower end of the wealth channel: mass affluent and retail investors. This growth will be sustained in part by the shrinking share of investment dollars coming from pension plans. Money that would previously have been accumulated and managed by large defined-benefit (DB) pensions is now in the hands of individuals or managed in defined-contribution (DC) 401(k) plans and retirement programs. In the US, individual retirement accounts and DC plans have eclipsed $25 trillion, and almost all this capital is invested in highly liquid bonds and stocks, even though in many cases the investment horizon is decades long, based on when the individual expects to retire.[6]

Since June 2020, 401(k) plans have been allowed to include certain types of managed PE funds, although in 2021, the US Department of Labor provided a supplemental statement indicating that their allowing PE in 401(k) plans was not meant to be taken as a broad endorsement of the funds.[7] Four years after the 2020 decision, very few products had been created for this channel, but there is little doubt that asset managers are highly motivated to find a model that will work for this source of capital where assets are increasing with employee and employer contributions every paycheck. SEC rules do allow for up to 15% of private assets to be held in public funds, an allowance that a few traditional mutual fund providers have used to invest in pre-IPO unicorns.[8] More recently, Apollo and State Street are attempting to team up for a unique public and private credit exchange traded fund (ETF) offering, although it remains to be seen if the proposed retail structure will receive approval.[9]

Wherever an investor is on the wealth spectrum, individuals and their advisors must balance short-term liquidity needs and long-term wealth goals. By incorporating private capital into their portfolios, individual investors with a long horizon and appropriate risk tolerance can allocate a portion of their assets to capitalize on the diversification benefits and potential for outsized returns, while leaving the rest of their portfolio in more traditional assets such as stocks and bonds. Size matters when determining the appropriate asset allocation. Individuals on the highest end of the wealth spectrum can afford to behave similarly to institutional investors. UBS reports that global single-family offices with an average net worth of $2.6 billion allocate 37% to the private markets.[10] By comparison, DB pensions with at least $1 billion in AUM have a 16.9% average allocation to private markets, increasing to more than 20% for the largest 100. For some endowments, allocation targets can reach upward of 30%.[11]

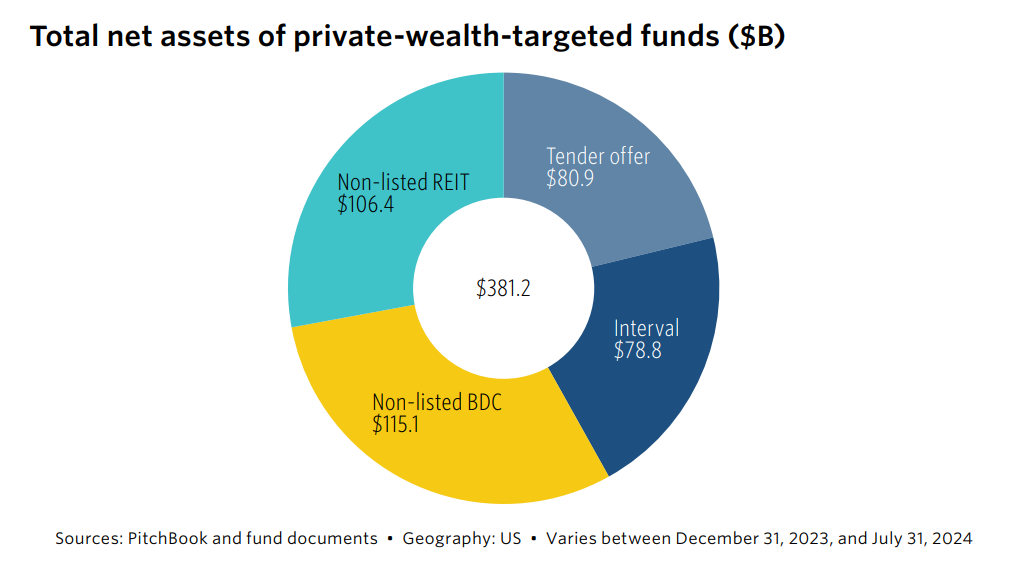

For most HNWIs and VHNWIs, recommended private allocations range from 8% to 22%, depending on the overall portfolio size, investors’ risk tolerance and objectives, and the institution making the recommendation.[12][13][14] Best practices include diversification across investment years, asset classes, and managers, which historically has been resource intensive when using drawdown funds. Evergreen funds are shifting this narrative by lowering the barrier to entry. We have tracked 230 private market funds launched since 2019 targeting the private wealth channel across interval, tender offer, non-listed BDCs, and non-listed REITs, and total net assets in these vehicles is nearly $400 billion.

Evergreen fund structures overview

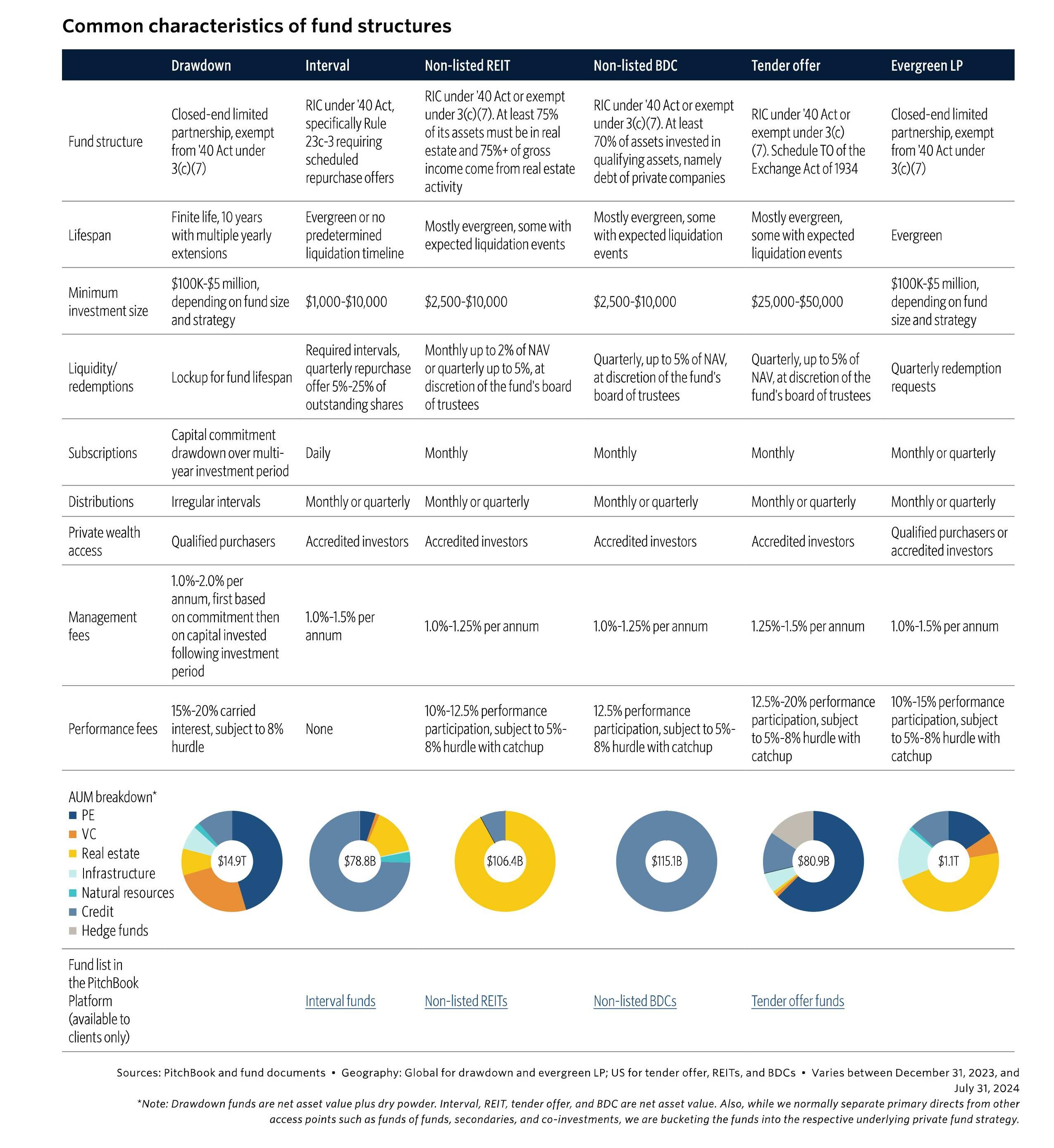

Evergreen funds can have wide-ranging terms, fees, accessibility, and liquidity characteristics, even in the same category. Therefore, RIAs and investors should diligence funds and their fund managers carefully when selecting which vehicles to use or when choosing to include these funds in portfolios at all. The accompanying table provides some common characteristics, but it is important to note that there can be wide variation depending on the specific fund, and fees can be substantially higher than funds in public markets.[15]

Conclusion

All told, we are still in the early innings of private market’s evergreen evolution and its accessibility for the private wealth channel. As the landscape of investment opportunities continues to shift, HNWIs and family offices are increasingly seeking exposure to alternative assets traditionally reserved for institutional investors. This democratization of private markets is driven by a confluence of factors, including technological advancements, regulatory changes, and a growing appetite for diversification beyond public equities. However, challenges remain in terms of liquidity, transparency, expense, and education. As fund structures evolve and platforms emerge to facilitate easier access, we can expect to see a significant transformation in how private wealth is allocated and managed over the coming years, potentially reshaping the entire investment ecosystem.

About the Contributors

Zane Carmean, CFA, CAIA is Director of Quantitative Research at PitchBook, where he conducts data analysis, creates financial models, and authors research reports and thematic analyst notes covering private markets. He helped launch PitchBook’s Quantitative Perspective series and build PitchBook’s proprietary valuation models. He also helps build new capabilities for clients to leverage PitchBook data sets. Prior to PitchBook, he was a senior associate at Green Street Advisors. He received bachelor’s degrees in finance and economics from Loyala University Chicago and a master’s degree in finance from the Bocconi University in Milan. He is also a CFA charterholder and a CAIA charterholder.

Emily Zheng is a Senior Research Analyst at PitchBook, where she covers major trends and evolving themes in US venture capital through quarterly core reports and thematic analyst notes. Prior to this role, she was a Private Banker at J.P. Morgan, where she provided wealth management solutions and advice to affluent individuals, families, endowments, and foundations throughout the Pacific Northwest. She received a bachelor’s degree, magna cum laude, in Public Policy Analysis and Economics from Pomona College. She also holds the Securities Industry Essentials, Series 7, Series 63, and Series 65 licenses.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/

[1] This article contains excerpts from PitchBook’s The Evergreen Evolution.

[2] You can read more about US regulations regarding private fund retail investors in our 2021 PitchBook Analyst Note: Access Points for the Masses.

[7] https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/information-letters/06-03-2020

[11] https://publishedresearch.cambridgeassociates.com/wp-content/uploads/2023/03/2023-03-Endowments-Quarterly-4Q2022.pdf

[12] “Does Market Upheaval Tarnish the Golden Age?” Morgan Stanley, October 7, 2022.