By Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP

Managing Director, Global Content Strategy, CAIA Association

“25 Sitting on 25 Mill”

It was the great poet, Aubrey “Drake” Graham, a once very popular now “diss”-graced actor-turned-singer-and-rapper, who self-proclaimed that he was “25 sitting on 25 mill.” Of course, for my fellow millennials, you’ll remember this in his hit song “The Motto.”[1]

Well, in the spirit of retroactively making this pop culture reference work, CAIA Association is (almost) 25 (years old) and sitting on $25 (trillion). As I highlighted in our 2024 year-end wrap up for Chronicles of an Allocator, the alternative investments industry continues to grow substantially across all asset classes, and we’re beginning to see participation across a variety of different investor types.

YOLO: You Only Leverage Opportunity

Looking forward, the industry's growth looks uneven, with the CAGR projections for wealth dominating future opportunities for asset managers. A recent Institutional Investor article highlights the asset management community's continued push and product development efforts towards the ultra-high-net-worth individual client. This comes as no surprise after another period of tough fundraising from institutional asset owners. But just how large is this opportunity?

Currently, that $25 trillion in AUM (as we measure it) is primarily institutional dollars. In fact, only $800 billion is represented in semi-liquid and liquid structures, and $24.2 trillion in private funds. Of course, some UHN clients invest in private funds, but typically these are one-off opportunities and/or reserved for the ultra-high-net worth individuals.

Regardless of the direction of travel, the growth potential is massive on such a small base. So how do we quantify it? In this post, I’ll attempt to show two ways: pure AUM growth and allocation trajectories.(By the way, I recently walked through a crude exercise on a recent podcast, but thought it might be good to show some statistics for visual learners.)

Opportunity #1: Pure AUM Growth

There are a lot of estimates in terms of the alts AUM breakdown for institutional vs. retail assets. Again, this is simply estimating, of that $25 trillion we know is in alts, how much is owned by institutional and how much is owned by individuals?

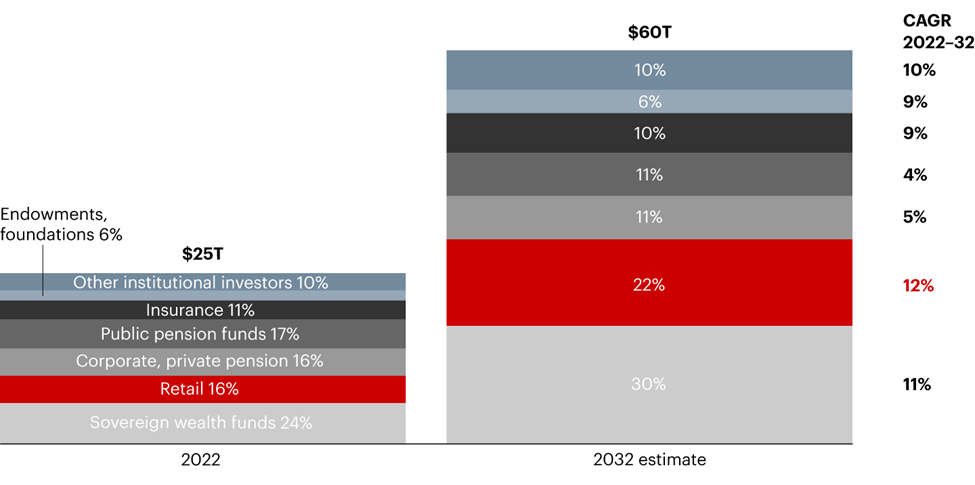

Figure 1: Percentage of Global Alternative Assets Under Management

Source: Bain

As shown in Figure 1, a recent Bain report[2] estimates that wealth management clients, classified as retail investors, represent roughly 16% of alternative investment AUM. Luckily, their total AUM estimates are close to our estimate, which would put this dollar amount at $4 trillion over a $25 trillion denominator.

So, what about future growth? When trying to estimate the AUM opportunity, there are two levers to pull: overall growth (growing the pie) and retail participation (growing the slice) in the future. Bain estimates that by 2032, alternative investment AUM will be $60 trillion, more than doubling today’s denominator, but that retail will be 22% of that of $60 trillion. Further, retail growth in CAGR terms is the highest of all the investor types, right above sovereign wealth funds!

In other words, both levers are being pulled. This math would put retail at $13.2 trillion in AUM over the next 10 years, tripling in dollar terms!

Opportunity #2: Allocation Trajectories

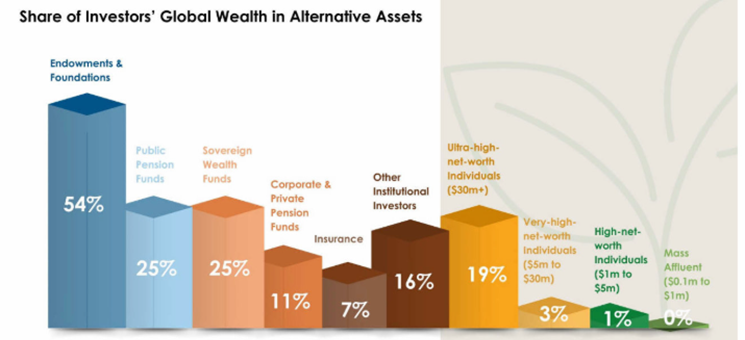

The other way to look at this would be to look at the percentage of investors' wealth in alternatives. In Crossing the Threshold, we shared a breakdown of allocations by investor type, shown in Figure 2. As shown, there is a stark allocation difference between institutional and individual portfolios, and large decline the further you move “down market.”

Figure 2: Share of Investors’ Global Wealth in Alternative Assets

Source: CAIA Association, Crossing the Threshold

So, what happens to the dollar opportunity if these allocations grow? Estimating the fund-level dollar impact is more of an art than a science since allocations to alternative investments can be much broader in terms of access points (i.e., direct investments). Further, not every investor type is eligible for or has access to alternatives. While global household wealth is estimated to be about $150 trillion, not all $150 trillion can or will participate any time soon.

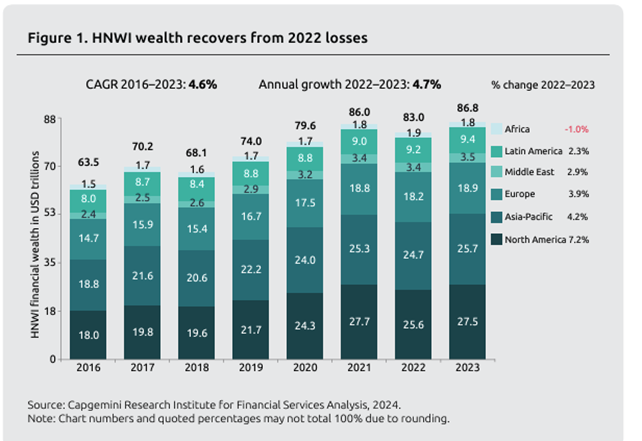

Figure 3: Global HNW Wealth

Source: Capgemini Research Institute for Financial Service Analysis, 2024

Therefore, I decided to make some estimations using a combination of the allocations in Figure 3 and a recent report from Capgemini that measures the total wealth of high net worth. This Global Wealth Report is released every year and measures the growth and composition of the total wealth of high-net-worth individuals globally.

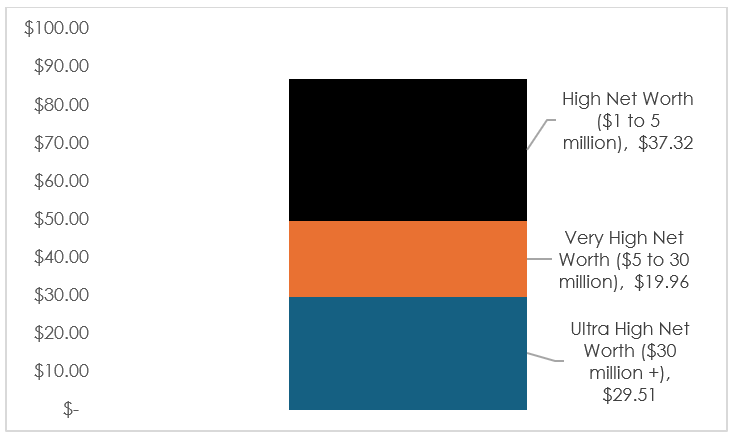

As of 2024, the total wealth for high-net-worth individuals sits at $86.8 trillion. Similar to Figure 2, Capgemini buckets high net worth investors into three categories: UHNW ($30 million+), VHNW ($5-30 million), and HNW ($1-5 million). The proportion of assets across these three groups is roughly 34%, 23%, and 43%, respectively. This breakdown is shown in Figure 4.

Figure 4: High Net Worth Breakdown 2024

Source: Gapgemini, CAIA Association

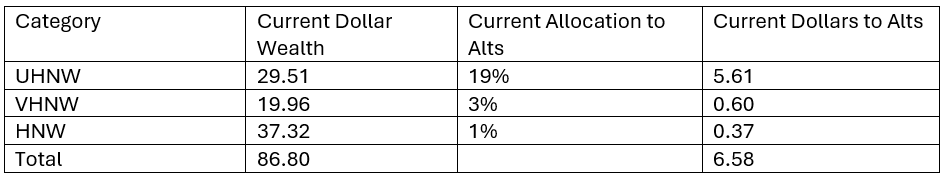

With the average allocations to alternatives as a percentage of wealth in hand and the dollar amounts of each category from Capgemini, we can start to get a picture of what happens to alts AUM if allocations change. Let’s first start with our current position, as shown in Figure 5.

Figure 5: The Current Dollar Allocations to Alternatives

Source: CAIA Association, Dollar figures are in USD Trillions

Remember that Bain estimates $4 trillion in fund AUM, so the extra $2.6 trillion likely includes other things like direct investments, other investments not counted, or simply a rounding error (again, this is an art, not a science!)

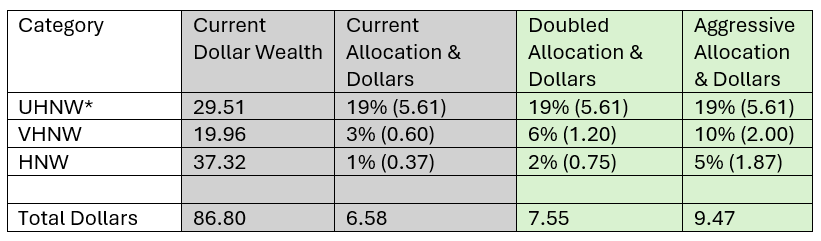

So, what happens to the alts opportunity if you were to suddenly increase those allocations tomorrow? For this exercise, I held the top category, UHNW, constant. This felt appropriate given that 19% is where a lot of institutional allocations sit. Instead, I focused on the bottom two, where, arguably, a lot of the focus has been for GPs when building out their private wealth capabilities.

In this case, I made two hypotheticals: doubling the current allocation and an even more aggressive allocation change from 3% to 10% and 1% to 5%. The results are in Figure 6.

Figure 6: Increasing Allocations to Alternatives by HNW Type

Source: CAIA Association, UHNW allocations and dollars did not change in this scenario

If you roughly double the allocation as shown in Figure 6, the alts dollar amount grows $1 trillion overnight! (FWIW, that’s the entire AUM of Blackstone). Further, if you adjust the allocations to 10% and 5%, respectively, that growth triples to $3 trillion.

Can’t See ‘Em Cause the Money’s in the Way

While both exercises have a lot of estimation errors and a little bit of art behind them, you can see the direction of travel for either approach (hint: it’s up). Most of the VHNW and HNW opportunity lies in funds, especially the further down market you go where scale is important and dollar commitments are smaller.

Of course, these changes won’t (and haven’t) happened overnight. There’s still substantial infrastructure and education needed. When you look back at the history of private wealth distribution efforts, the earliest started in the mid-2010s, and most haven’t even been at it for a decade yet!

However, you can begin to see why there’s such a large focus on this space, whether it’s through product development, talent acquisition, or shifts in messaging – the private wealth channel has the type of money where everybody acting like they knew ya.

About the Contributor

Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP, is Managing Director, Global Content Strategy at CAIA Association. His industry experience lies in private wealth management, where he was responsible for asset allocation, portfolio construction, and manager research efforts for high-net-worth individuals. He earned a BS with distinction in finance and a master of finance from Pennsylvania State University.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/

[1] Don’t try and play this or read the lyrics on a work computer. This is not an endorsement.

[2] Avoiding the Wipeout: How to Ride the Wave of Private Markets. Bain. Found here: https://www.bain.com/insights/avoiding-wipeout-how-to-ride-the-wave-of-private-markets/