By Koen van Mierlo, MSc, LLM, CFA, CAIA, Head of Analysis at Bluemetric Wealth Advisory.

A thirst for liquidity

In the current market, investors are recognizing that private equity can be truly illiquid. Challenges in the dealmaking environment have introduced meaningful frictions for the transaction-driven asset class. For example, between 2022 and 2024 distributions as a percentage of NAV have trailed historical norms by roughly 15% (28% vs. 13%)[1]. The resulting distributions to paid-in capital (DPI) of vintages 2018-2021 are 0.2x lower[2] than budgeted. Consequentially, liquidity pressure intensifies for GPs and LPs alike.

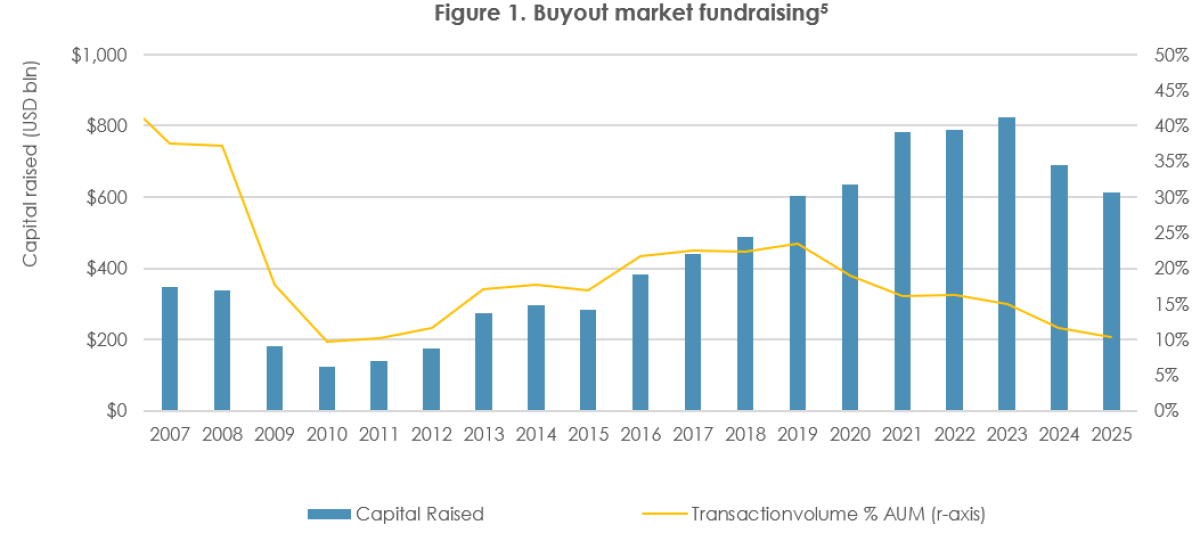

For example, a 2025 survey by McKinsey revealed that 2.5 times as many LPs ranked DPI as the “most critical” performance metric compared to 3 years earlier[3]. GPs are also cognizant of the drought in liquidity given the challenges they face in their fundraising process. As weak distributions have kept LPs’ private markets exposure elevated, they remain selective in allocating new capital. By way of illustration, for every $3 of targeted fundraising, only $1 of capital is currently available to commit (historically this ratio is 1.3:1)[4]. Last year, buyout fundraising reached its lowest level relative to NAV since the GFC (see Figure 1).

Against this backdrop, the secondary PE market has expanded rapidly, introducing new transaction structures to benefit from structural imbalances. Initially focused on providing liquidity to LPs, secondaries have evolved into a significant liquidity source for GPs. They have increasingly turned to GP-led secondary transactions to access liquidity and manage portfolio exposure in the absence of traditional exit options.

[Figure 1[5]]

An oasis in the exit desert

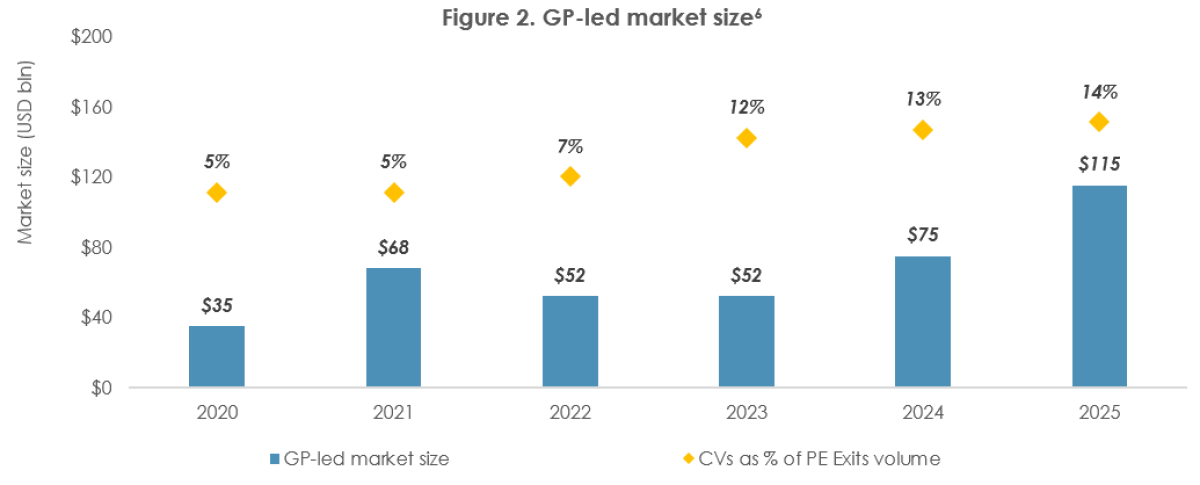

GP-led secondary activity has expanded rapidly, with continuation vehicles (CVs) emerging as the dominant structure within this segment. In 2025, GP-led transaction volume reached $115 billion. CVs accounted for the majority of this activity, representing 89% of GP-led volume and ~43% of total secondary market volume[6]. CVs enable sponsors to retain control over high-conviction assets while providing liquidity to investors, positioning CVs as an increasingly common route to exit (see Figure 2). These figures reflect both (i) a greater reliance on secondary solutions amid constraint exit markets and (ii) a potential structural shift in exit behaviour.

[Figure 26]

The adoption of GP-led CVs has broadened across GPs and investors. Nearly 75% of the largest global private equity firms have executed at least one continuation transaction[7]. Moreover, the investor base has widened materially, with direct LP investments and evergreen vehicles increasingly participating alongside traditional secondary funds. Continuation fund syndications have become more frequent and represented the largest share of LP direct secondary investments in the first half of 2025[8].Together, these developments indicate that continuation vehicles have become an embedded component of PE liquidity management, reshaping liquidity options for both LPs and GPs.

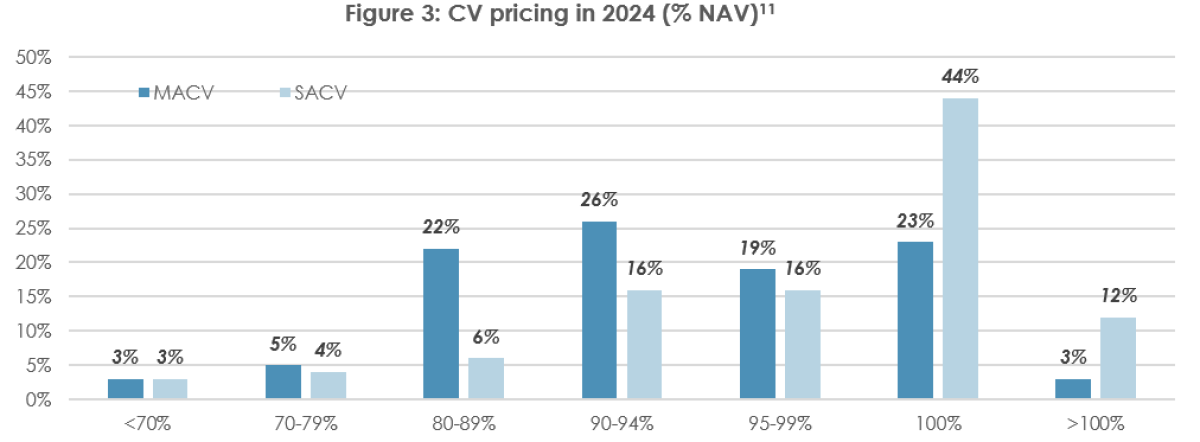

Furthermore, the continuation vehicle market has increasingly differentiated into two distinct structures: multi-asset continuation vehicles (MACVs) and single-asset continuation vehicles (SACVs). MACVs are often used to facilitate liquidity across a fund’s remaining assets, including in wind-down transactions[9]. SACVs are more commonly used for high conviction “trophy” assets that sponsors prefer to retain beyond the original fund life. Early empirical evidence supports this differentiation, as SACVs are associated with stronger asset performance and higher valuation metrics than MACVs[10]. As a result, these structures differ materially in their pricing (Figure 3), reflecting the higher asset quality and longer value-creation timelines of SACVs. The combination of single-asset exposure and higher pricing shifts the required skill set from manager selection toward underwriting of the underlying asset. This shift expands the scope for conflicts of interest and warrants closer examination.

[Figure 3[11]]

Conflicts of Interest - GP

In practice, CVs introduce potential conflicts of interest that warrant closer scrutiny. These conflicts arise from the GP’s dual role, resulting in the following issues:

Pricing – In a CV transaction, the GP effectively acts as both seller and buyer. They steer the valuations process and gain significant share in the new vehicle. The asset is transferred from the legacy fund to a new vehicle managed by the same sponsor. This dual role creates inherent tension around valuation, particularly as pricing often reflects expected future value creation.

Carried interest – The crystallization of carried interest at the point of transfer introduces another opportunity for misalignment. This is typically mitigated by the industry standard that GPs roll over crystallized carry into the continuation vehicle, with deviations requiring a clear justification[12].

Value creation plan – To mitigate alignment concerns, GPs often commit significantly more capital to continuation vehicles than to their original funds. In the first half of 2024, around 80% of continuation vehicles included GP commitments of 5% or more[13]. While this strengthens alignment in the new vehicle, it may create incentives to defer value-creation initiatives until after the transfer.

From an LP perspective, these conflicts can be partially mitigated through independent valuations, adequate review periods, and reinvestment of crystallized carry. However, LPs must rely on sponsor discipline to ensure that implementation of value-creation initiatives is not delayed.

Conflicts of Interest – LP

From the perspective of LPs, continuation vehicles impose a more complex decision process. LPs experience that timelines in GP-led processes are frequently compressed due to the additional re-underwriting and asset diligence required[14]. GPs aim to execute transactions efficiently, while LPs must assess sell-or-roll requests across multiple funds. For LPs without dedicated expertise in deal underwriting, this limits the depth of review that can be performed. Short decision windows can limit effective diligence and force LPs to choose liquidity over future (uncertain) returns.

Furthermore, these transactions alter the traditional risk and return profile of secondary exposure. Single-asset continuation vehicles shift secondaries away from diversified and shorter-duration portfolios toward more concentrated positions with extended holding periods. This change weakens historical portfolio characteristics that have underpinned secondary allocations. Challenging their traditional role as a source of early liquidity and diversification. As a result, LPs face (i) lower diversification benefits, (ii) slower distributions and (iii) less countercyclical protection due to elevated discounts.

As continuation vehicles become embedded within private markets, their impact extends to a portfolio’s liquidity profile. Within buyout strategies, continuation vehicles have been used as an additional liquidity mechanism when traditional exit routes are constrained. However, transaction pricing in continuation vehicles is skewed below prior reported NAV (see Figure 3), which may result in realized returns at levels below prior valuation assumptions compared with a traditional exit. In addition, by extending the holding periods, continuation vehicles alter the liquidity characteristics of secondary investments. This has implications for cash management, as slower distributions can compound the already limited liquidity of primary investments. As GP-led secondary activity expands, shorter holding periods and early liquidity can no longer be assumed.

Conclusions

Continuation vehicles have reshaped the private markets landscape by creating a new exit route for sponsors. Under constrained exit markets, GP-led transactions have provided an additional mechanism to generate liquidity and manage portfolio exposure - accounting for 14% of exits during of 2025[15]. This has supported execution in periods when traditional exits have been harder to realize.

At the same time, this shift introduces challenges that warrant closer scrutiny. Continuation vehicles are increasingly extending asset holding periods beyond the original fund mandate, blurring the economic boundaries of closed-ended structures. This challenges both the traditional role of secondaries within a portfolio and the assumptions around liquidity embedded in private market allocations. As a result, LPs need to revisit their strategic asset allocation assumptions to reflect longer value creation timelines.

In turn, GPs should treat continuation vehicles as a clearly defined component of their exit toolkit. This requires transparency around when a continuation vehicle is preferred over traditional exit routes and how such decisions align with predetermined value creation objectives. Accordingly, LPs must assess how GPs incorporate continuation vehicles into their investment and exit frameworks and what this implies for expected liquidity timing. While continuation vehicles have supported execution under difficult exit conditions, their broader implications require careful management.

Learn more about CAIA Association and how to become part of a professional network that is shaping the future of investing, by visiting https://caia.org/

[2] Bain & Company. (2025). Leaning into the turbulence: Private equity midyear report 2025. Bain & Company. P.4.

[3] McKinsey & Company. (2025). Global Private Markets Report 2025: Braced for shifting weather. McKinsey & Company. P.5.

[4] Bain & Company. (2025). Leaning into the turbulence: Private equity midyear report 2025. Bain & Company. P.7.

[5] Preqin. (2025).

[6] Jefferies. (2026). Global secondary market review: January 2026. Jefferies Private Capital Advisory. P.3.

[7] Jefferies. (2025). Global secondary market review: July 2025. Jefferies Private Capital Advisory. P.7.

[8] Jefferies. (2025). Global secondary market review: July 2025. Jefferies Private Capital Advisory. P.10.

[9] Jefferies. (2024). Global secondary market review: July 2024. Jefferies Private Capital Advisory. P.8.

[10] Luepertz, L., Roosenboom, P., & Verbeek, M. (2026). From exit to extension: The rise of continuation vehicles in private equity. Rotterdam School of Management, Erasmus University. PP. 12-13.

[12] Institutional Limited Partners Association. (2023). Continuation Funds: Considerations for Limited Partners and General Partners. ILPA. P. 4.

[13] Jefferies. (2024). Global secondary market review: July 2024. Jefferies Private Capital Advisory. P.9.