In partnership with CREATE-Research and KPMG, CAIA Association recently published a new study on the role of the intersection of capital markets, public policy, and climate change. The report was informed by institutional asset owners with a collective $34.5 trillion in assets under management across 20 countries. If you’re interested in watching a recent panel discussion on the findings of the report and the pathway forward, check it out here.

This month’s foreword comes from Tony Cowell, Partner and Head of Asset Management at KPMG, CAIA Association Board Member, and one of the lead authors. In these introductory remarks, he offers some insights from the report and reasons for optimism.

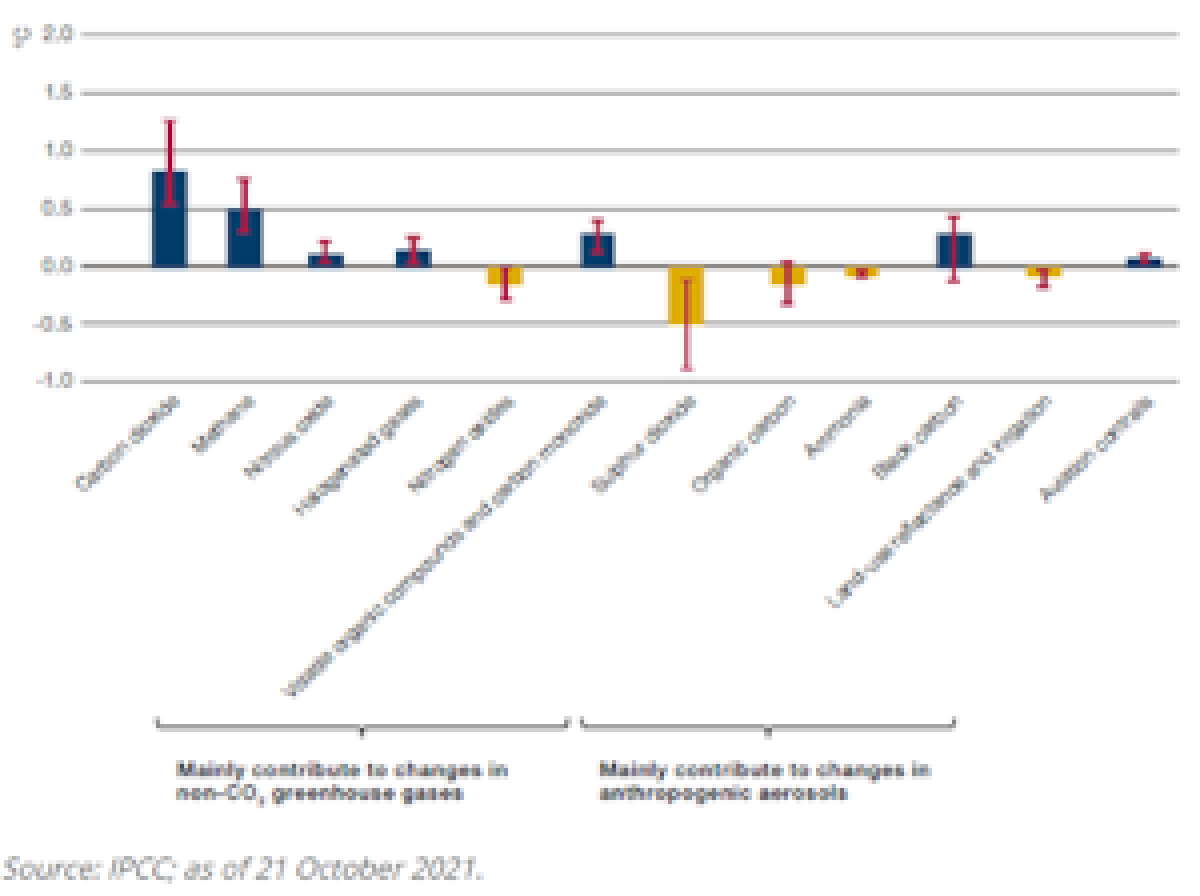

It’s now or never; no ifs, no buts. That is the “code red” warning in the sixth report from the Intergovernmental Panel on Climate Change, published earlier this summer.

Under any policy scenario, the private sector’s availability of talent, innovation, and capital holds the keys to leading the transition to a low-carbon world. Historically, capital markets have been at the forefront of mega themes that reshape our economies and societies. Mitigating the devastating impact of climate change is no exception.

Several private sector-led initiatives are already underway to align capital to sustainable markets and opportunities. In fact, long-term investors have already been rechanneling trillions of dollars towards mitigation and adaptation activities in order to achieve the goals set by the Paris Agreement in 2015. Today, addressing climate change through investment is predicated in a new belief about value creation – it is essential to look beyond the blind spots that come from short-termism and be laser-focused on the longer-term risks. With this view, social, human, and natural capital will likely influence economic value creation as much as traditional financial capital does.

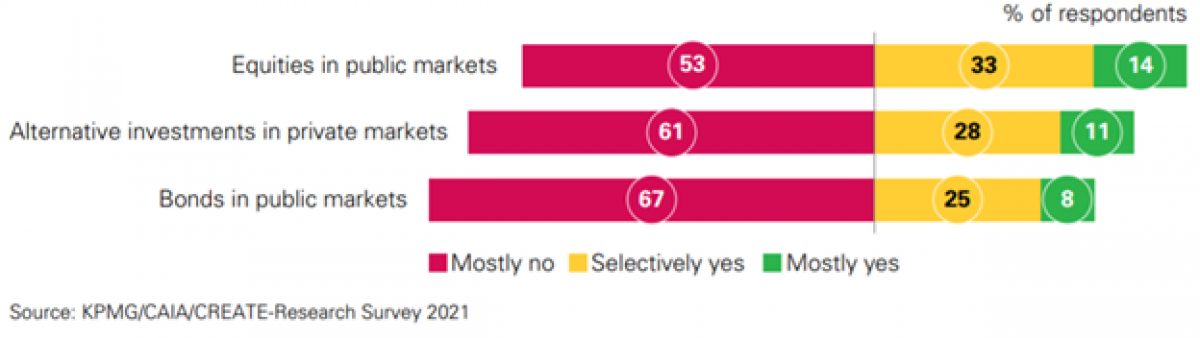

So far, capital markets have been slow to price in climate risks, a thought supported by almost 100 survey participants representing the largest players in the global investment industry:

In your experience, are global capital markets adequately factoring climate risks in securities prices currently?

Its key message is that a green portfolio does not equate with a green planet – yet. Progress in this direction has been slow and is more evident in public equities than other asset classes. In alternative investments, progress is evident in infrastructure, real estate, and private equity, where custom-built mandates have been more closely linked with green outcomes. Our survey respondents believe that there may be a misallocation of capital to address these issues due to market failure and market inefficiency.

The root causes are due to two main barriers:

- Climate change is an inexact science with its multiple scenarios. The data required for its robust modelling are still a work in progress, as widely acceptable standards and definitions are slow in evolving.

- Public policies in essential areas like carbon pricing, alternative energy, and mandatory data reporting by companies have also been slow to evolve in the face of other more immediate priorities. The urgent has come in the way of the important.

In this context, three recent seminal developments are likely to prove pivotal for successful climate mitigation success: COVID-19, which has exposed the disharmony between humans and their planet; a global move towards a strong green agenda; and the United Nations COP26, which recently took place in Glasgow.

Together, they are expected to enhance policy clarity through a raft of new initiatives that will serve to ease barriers that have so far slowed down progress across the value chain of climate investing. Hence, we should expect to make further advances towards pricing climate risks over the next three years. With this clarity, and by working together, investors, governments, organizations, and consumers can then take giant leaps to a more sustainable world.

For the first time since the Paris Agreement, the stars are aligned.

Partner and Head of Asset Management

KPMG