What do artificial intelligence and real estate have in common? A lot, as it turns out. Real estate has been the most fascinating space to watch throughout the global pandemic, and the applications of artificial intelligence are growing faster than housing starts. Working from home has called the value of some commercial real estate into question, and residential housing values have shot through the roof!

This issue of Chronicles of an Allocator is dedicated to property technology (PropTech), or the application of automated tools in real estate and property management. This month’s opening letter guest stars my colleague, Keith Black, PhD, CFA, CAIA, FDP of FDP Institute, who reminds us that machines are not perfect, even when they have all the tools in front of them:

--

Machines are not all-knowing, even when they have lots of data. Translators are needed to ensure the output makes sense and that the algorithms have no blind spots.

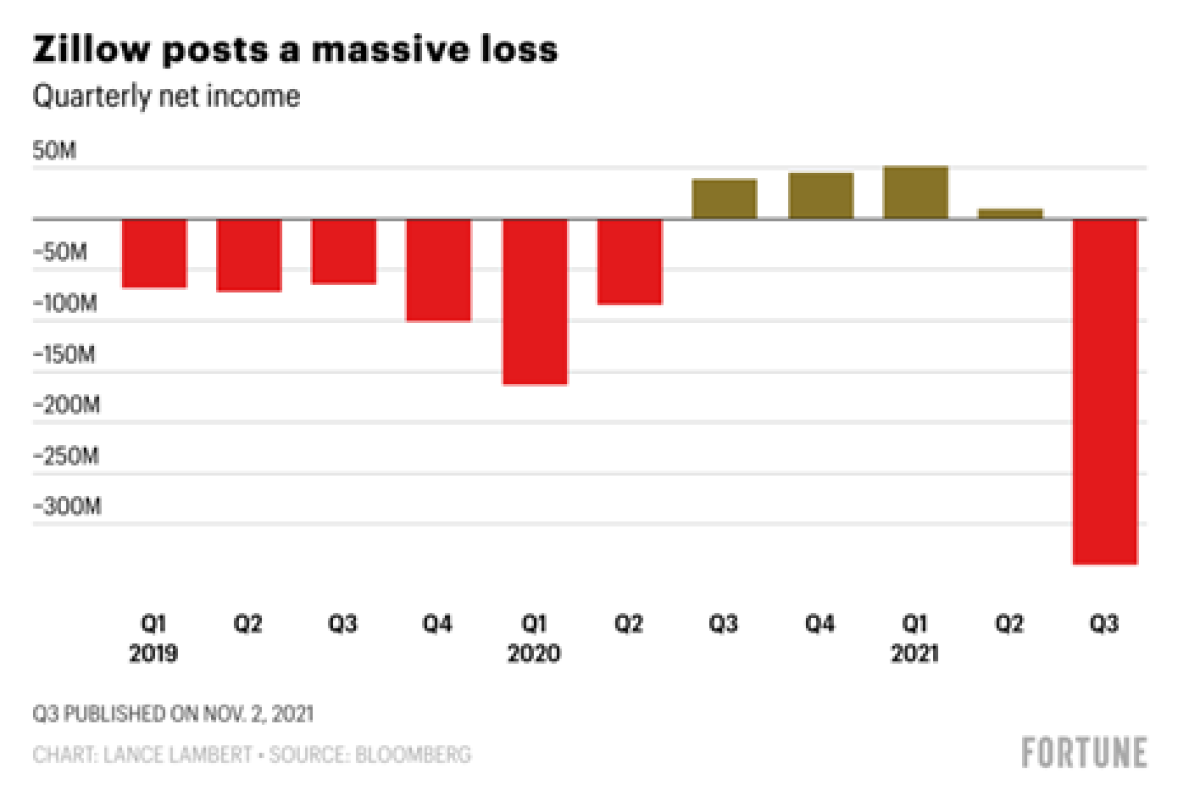

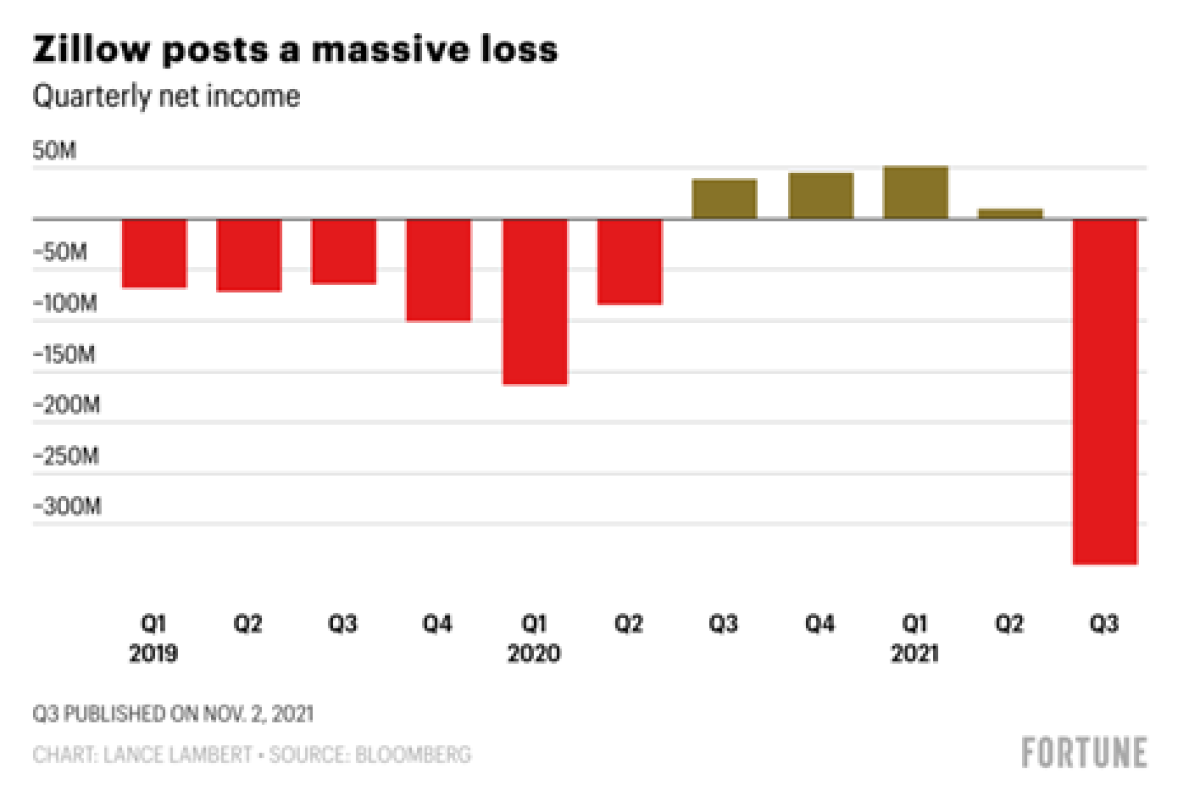

Zillow learned this lesson the hard way through their iBuying program. The program put an estimated value on homes and then solicited the purchase of those homes from their current owners through the Zillow Offers program. To make a long story short, Zillow bought too many homes in the wrong places at prices that were too high, and is now seeking to sell 7,000 homes for $2.8 billion… a loss of more than $300 million. Zillow is underwater on perhaps two-thirds of the homes they bought. There is a human cost to this story, as those losses and the shuttering of the Zillow Offers program will cause Zillow to reduce its headcount by 25%. That is a considerable impact of model risk both in financial and human terms. Apparently, the algorithms deployed by home buying systems Opendoor and Offerpad were able to dodge the pitfalls that Zillow landed in.

While their web page now says, “Zillow Offers is winding down, which means we are not making any new offers on homes,” a prior version of the website said “Get a free, no-obligation cash offer on your home and sell confidently to Zillow.” Perhaps another detail Zillow failed to model was moral hazard. Let’s say Zillow’s buying algorithm was correct on average. That is, what if Zillow priced homes correctly on average, but the only homeowners who sold to Zillow were the ones who were the most confident that Zillow’s price was in error or those who knew the costs of deferred maintenance that Zillow’s algos and in-person inspections may not have noticed. This is the classical model of the market for lemons.

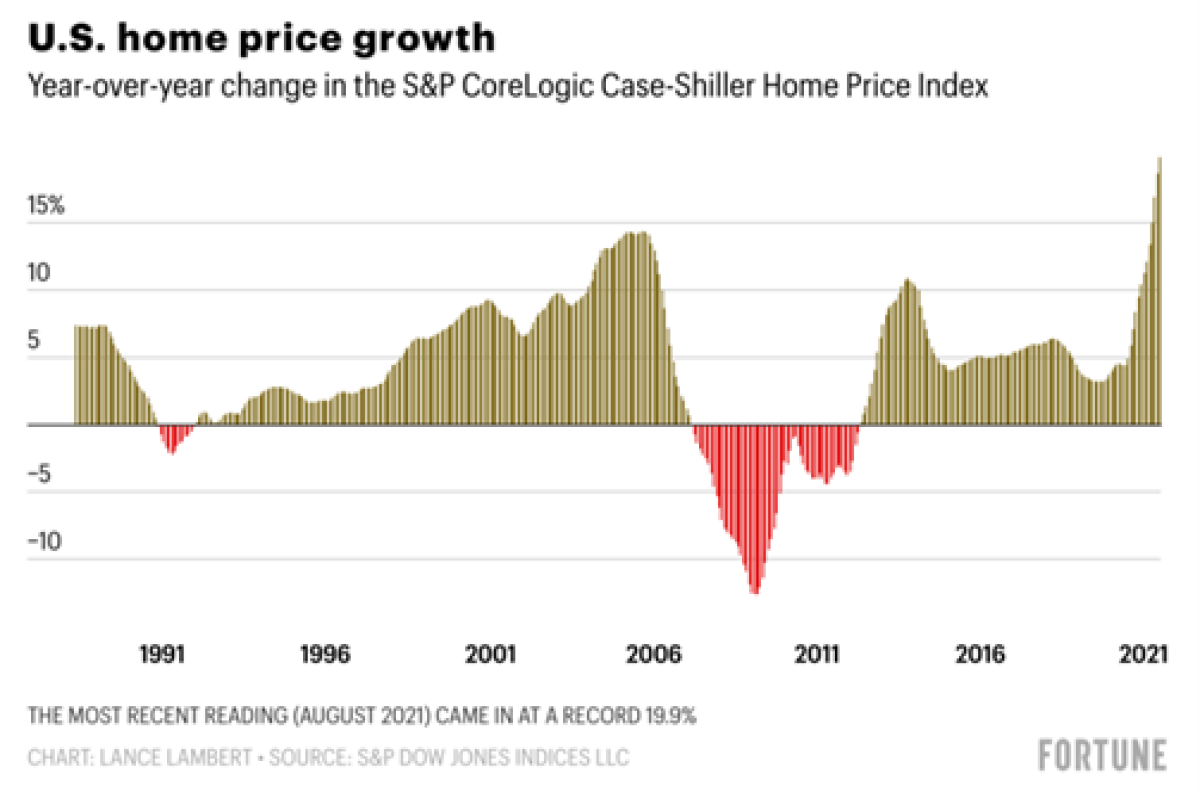

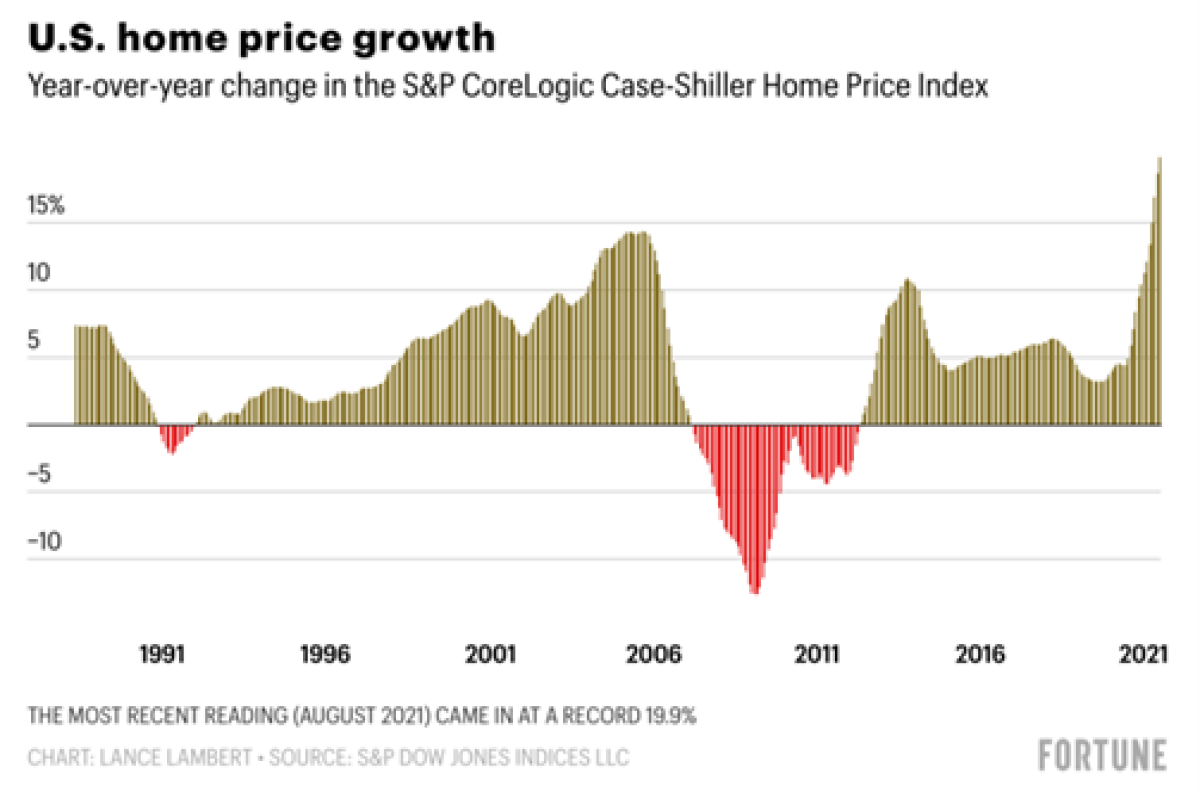

Trend followers know that models can struggle during turning points and volatile markets. It is nearly impossible to buy low and sell high, as it is hard to find a signal that identifies the highest or lowest prices, at least in real time. Markets have been volatile during COVID, and the residential real estate market has been highly impacted. A decades-long trend of the increased desirability of urban living abruptly reversed, as working from home during COVID lockdowns made homeowners desire more space in more affordable, often suburban, or exurban locations. Housing prices stabilized or fell in the most expensive cities, while more affordable and more distant locations, with more space, skyrocketed in price. One turning point in the markets is when people started moving away from cities during the height of COVID fears and a second turning point came when those fears subsided in some geographies with successful vaccination programs.

As they said in Top Gun, “hit the brakes, and he’ll fly right by.” Real estate pricing models may have anticipated continuing price gains even as real-world factors were mitigating this mass migration. The same thing happened to commodity prices in 2008 after China abruptly completed its urbanization program and quickly reduced demand for building materials while supply continued to rise. What happened to Top Gun 2 anyway? I guess we’ll have to wait until at least May for the release, even though we really wanted to see it in July 2019. But I digress…

Keith Black, PhD, CFA, CAIA, FDP

Managing Director, Program Director at FDP Institute

--

Welcome to the February edition of Chronicles of an Allocator. The pieces collected here cover the interesting intersection of data, machine learning, and property. We revisit Zillow, introduce other PropTech models, and discuss A.I. in farming.