|

What do resilient investors look like? They share at least five key characteristics:

- More diversified resilient long-term portfolios

- More heavily invested in private markets (and consequently less liquid)

- Rooted in a fiduciary mindset

- Take an active approach to engagement with their assets

- Focused on generating operational alpha by using big data to support functions like risk management and operations

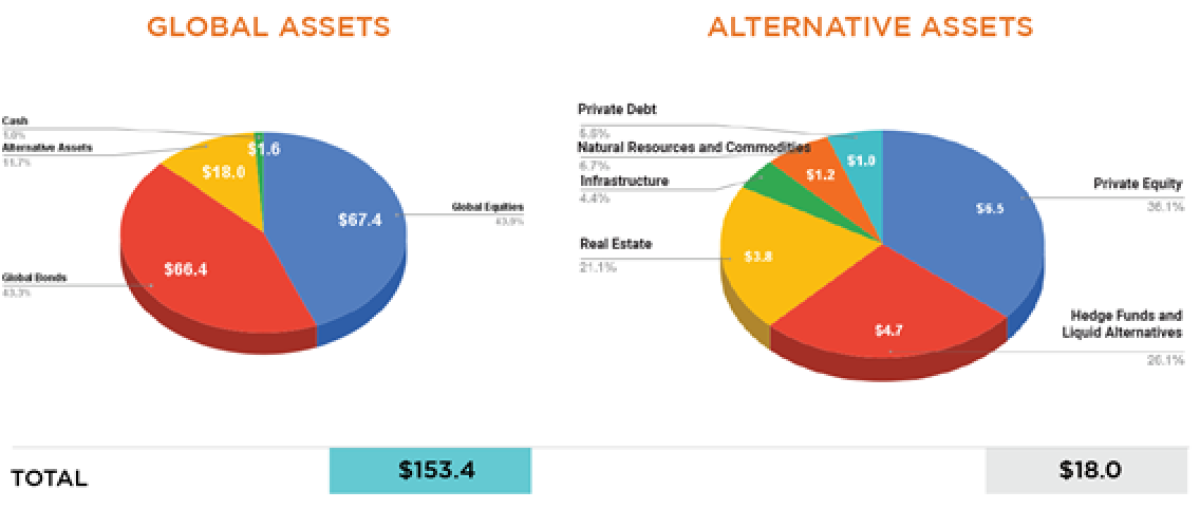

The benefits of diversification are well documented, but how we define diversification is evolving. With the advent of indexed investing, everyone can own the market portfolio—diversification is cheap, and even free in some cases. Long-term investors define diversification differently, looking across asset classes and paying close attention to the interactions of investments in different parts of the portfolio.

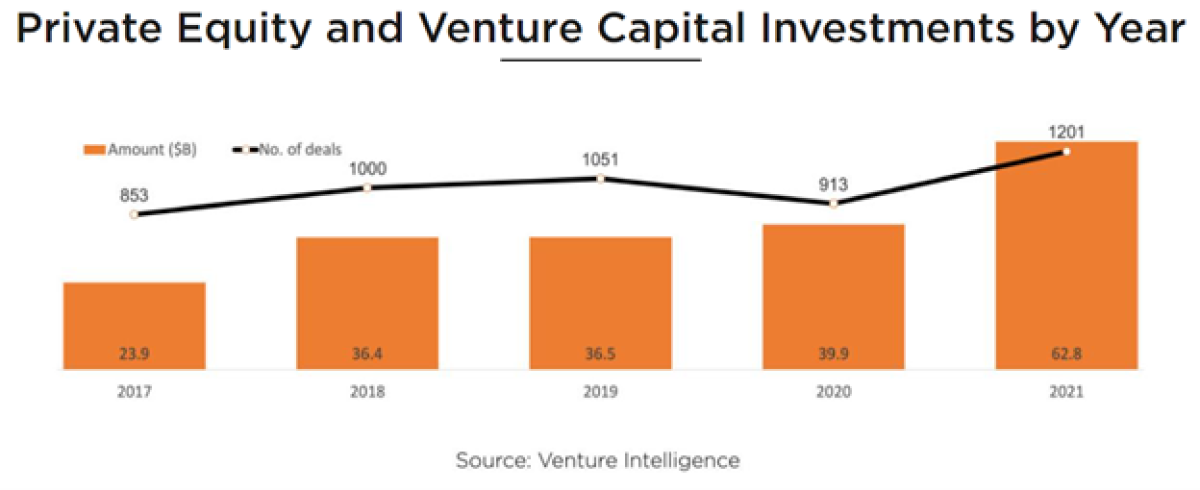

The top-down whole portfolio approach to diversification is even more important as portfolios become less liquid. Increasing allocations to private assets—private equity and venture capital, but also things like real estate, infrastructure, and timberlands—give long-term portfolios access to new sources of return. And those returns from private assets—alternatives—come with holding periods that are often better aligned with long-term investment objectives.

At its core, that alignment is a result of a relentless focus on the purpose of the capital and a desire to deliver client-centered outcomes in a transparent way. This is the new face of responsible investing. Investors today face expectations that go well beyond traditional notions of fiduciary duty or asset stewardship. Understanding and fulfilling these responsibilities has considerable impact on the success of both the strategy and the organization. Fundamentally evolving expectations mean how returns are earned is just as important as what returns are earned.

Active engagement with portfolio assets is a primary tool for exercising these evolving responsibilities. Investors increasingly realize that their responsible behavior extends to the companies and assets in their portfolios. Done well, engagement communicates investor expectations to those portfolio companies and encourages growth initiatives that align with long-term value creation. That engagement is not limited to assets in the public portfolio. In the absence of easy exit, private investors are using engagement and stewardship tools to generate value with their private holdings, too.

Finally, forward-looking investors have realized that there is alpha to be generated by not only remaking their portfolios for the future, but also remaking themselves. Turning data analytics tools inward and adapting processes to identify operational risks makes investment organizations more resilient. Similarly, reviewing their own organizations’ performance on the same non-financial metrics investors have been pushing companies to disclose reveals opportunities to improve organizational culture and diversity in ways that attract and retain talent, and bring performance benefits.

These marks may not be particularly surprising on an individual basis. But they are also not accidents: They have been honed and invested in on a continuous basis to develop organizational focus. Taken together, the combination produces an emerging picture of the truly resilient long-term portfolio—and investment organization—for the future.

Ariel Babcock, CFA

Head of Research at FCLT Global

--

|