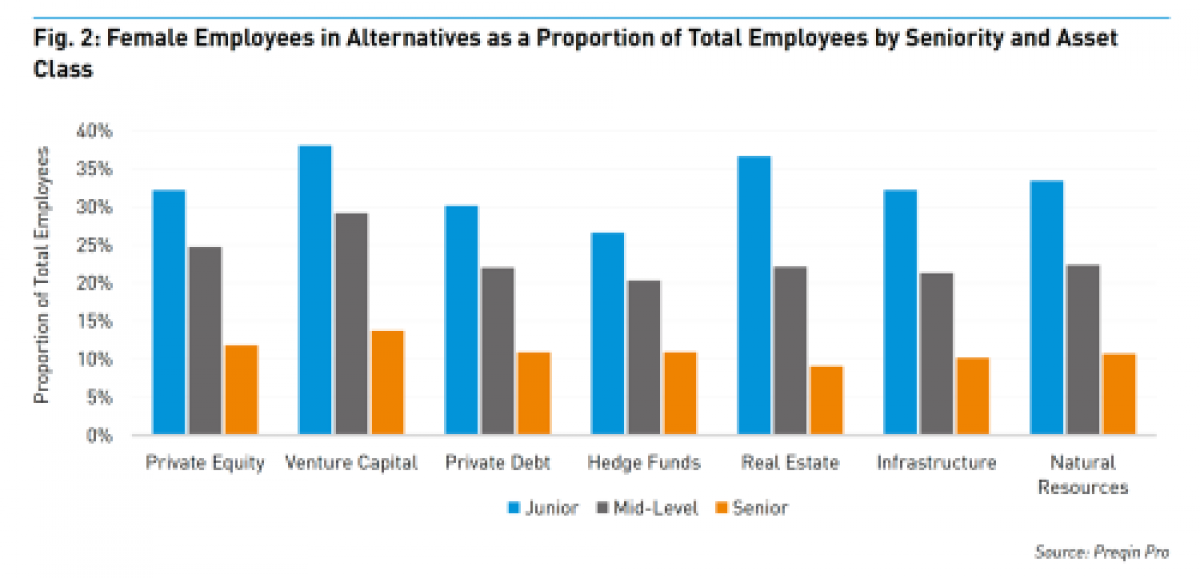

At end of 2020, according to a recent report from Preqin, despite representing half of our global population, women made up only 20.3% of the alternative investment workforce, marking a slight but positive jump from 19.7% at the end of 2019. The percentages fall even lower for women in senior positions, with the highest representation, though still small, at 13.7%, in venture capital relative to other asset classes. Ownership stakes also remain deeply skewed; in the Table Stakes study by Carta3, as of 2020, women own only 47 cents on every dollar of equity that men own, with no significant gains in the last couple of years. On the topics of improving pathways for women within global education systems and increasing workplace flexibility for both men and women, a roundtable of industry experts, in a webcast convened by CAIA Association last month,4 recently shared their views on what’s required to more quickly move the needle for women. Watch the webcast to learn more.

Dear Investment Professional,

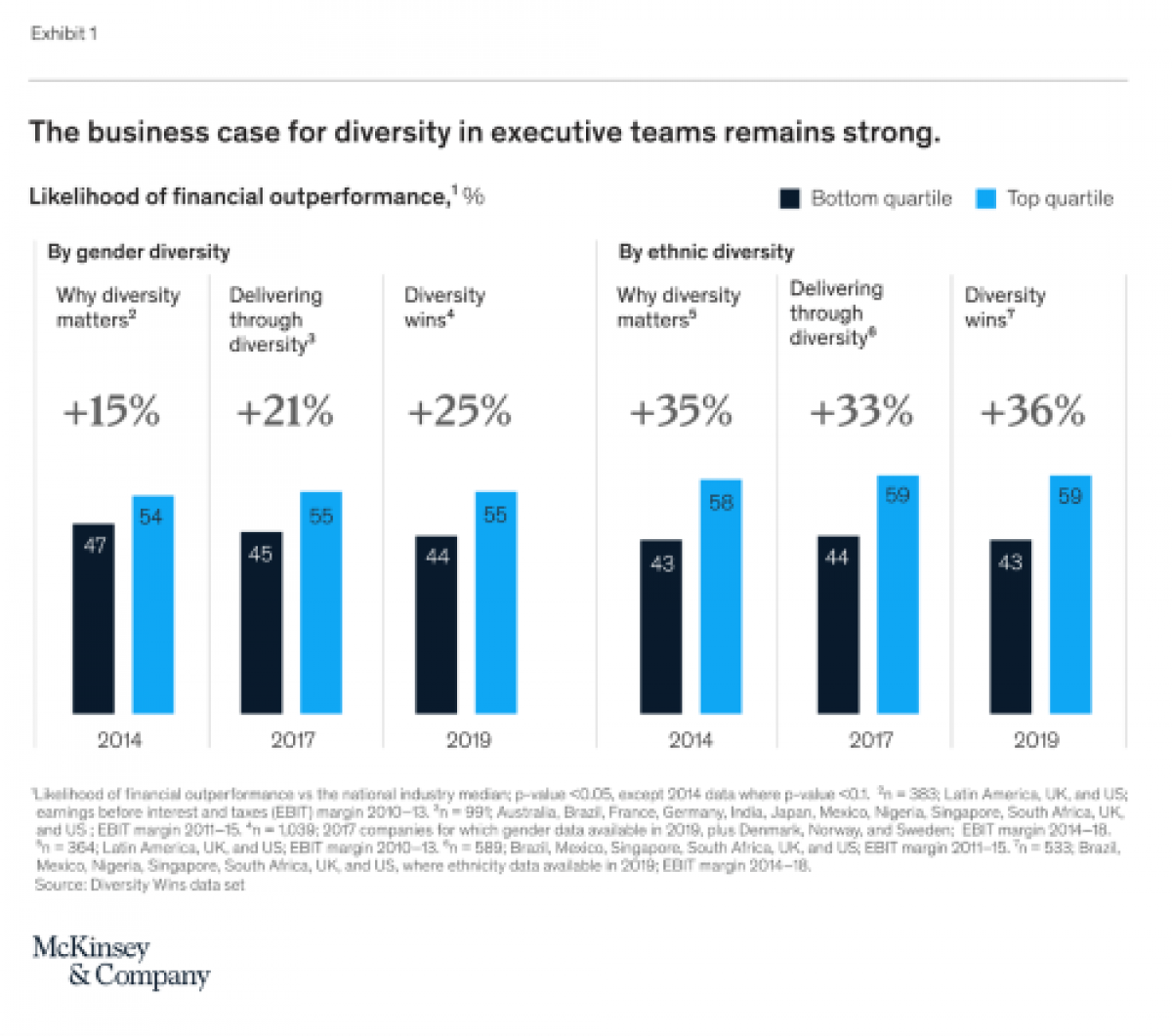

It’s been widely acknowledged throughout the investment industry that increased diversity leads not only to better business outcomes1 but also to better investment outcomes too. Nevertheless, the rate of change in diversifying the racial and gender make up of our industry and our portfolios continues to be slow. Several organizations, like CAIA Association2, have recently issued statements and taken initial steps to build diversity, equity, and inclusion (DEI), yet the question remains: how can our industry’s leaders build the processes and encourage the long-term cultural changes required for genuine transformation in these areas?

This issue of Chronicles features articles and webcasts that explore the state of DEI in asset management and the ways that the industry can better welcome and advance new, more diverse voices and talents.

The CAIA Content Team

John L. Bowman, CFA, Senior Managing Director, Twitter, LinkedIn

Keith Black, PhD, CFA, CAIA, FDP, Managing Director Content Strategy, Twitter, LinkedIn

Guowei Jack Wu, CFA, CAIA, Content Director, APAC, Twitter, LinkedIn

Aaron Filbeck, CFA, CAIA, CIPM, FDP, Director, Global Content Development, Twitter, LinkedIn

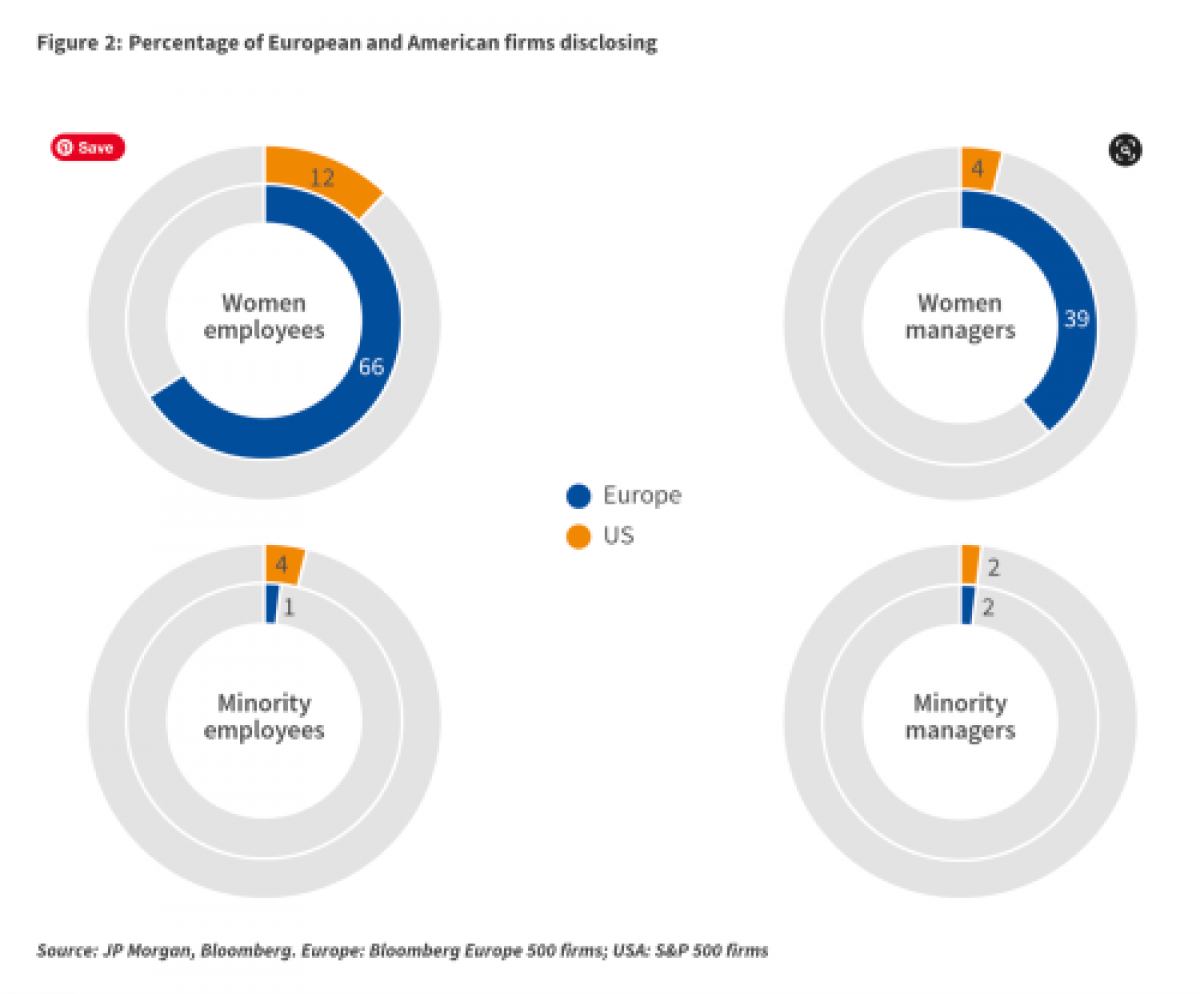

Last year, McKinsey’s report, Diversity Wins, showcased a significant correlation between diversity in executive teams and financial outperformance across corporations worldwide. According to a recent podcast by Lazard Asset Management,5 thanks to emerging empirical data like this, investors might now think of both gender and ethnic diversity as part of the quality premium. In other words, diversity can play a demonstrable part in helping companies build the competitive advantages that lead to profitability. So, what’s stopping companies from taking action or measuring progress? Perhaps the short-term focus on quarterly returns, as well as the embarrassment of many leadership teams surrounding their current diversity statistics, are hampering the long-term, persistent efforts required to create more diverse, inclusive work environments. Globally, there’s also a need for greater multistakeholder momentum, from governments, companies, investors, and consumers alike, in working together to advance diversity.

The COVID-19 pandemic took a persistent societal problem—racial, ethnic, and gender inequality—and made it much worse. Racial and ethnic minority groups in the United States have faced an increased risk of severe illness or death from COVID-19. In addition, such groups, along with women, have been overrepresented among front-line workers who were most directly impacted by the pandemic, such as those in retail, hospitality, recreation, and manufacturing. When comparing race and gender in the United States, Black women saw the greatest drop in employment during the pandemic. According to a recent series of articles by Hermes Investment,6 though the widened gaps in inequality are disheartening, the pandemic also offers organizations a chance to “reset working habits” and ensure greater inclusion and flexibility in their decision-making processes for the benefit of these groups.