Authored by Laura Merlini, CAIA, CIFD

Herodotus was the Lonely Planet contributor ante litteram. He was born around 490 BC in Halicarnassus (now Bodrum, Turkey) in a wealthy and prominent family. Herodotus left his hometown because of a tyrannical regime and political turmoil. This allowed him to travel and become an experienced ethnographer. He is universally known as the “father of history” because, through several Persian military expeditions, he had the opportunity to record information about distant lands and peoples. Herodotus wrote with an analytical mind, even though the accuracy of the information provided was negatively correlated to the geographical distance from his center.

When describing Ethiopia, he gave a concise summary; "This country produces great quantities of gold, has an abundance of elephants, woodland trees, and ebony, and its men are the tallest, the most handsome, and the longest-lived." These stereotypes might steal us a smile even after 2,500 years, but I am sure that if Herodotus were here today, he would describe Africa more accurately than we—digital nomads, could do.

Let's then look beyond preconceived ideas and explore a Continent that is a diverse mosaic of 54 countries offering emerging market premia to the patient, smart and informed investor.

If we had to provide a summary, Africa is prioritizing the development of a green economy and contributing to global decarbonization with renewable energy, critical minerals, and agriculture. Investment interest is growing in commodities like lithium, bauxite, and "green hydrogen" with efforts to ensure local benefits and prevent exploitation. Digitalization is expanding rapidly, driven by innovation and increasing smartphone use, and is projected to grow the digital economy significantly by 2050. The African Development Bank forecasts that the digital economy will reach $712 billion by 2050, up from $115 billion in 2023. Mobile money platforms and e-commerce are expanding. Debates on digital rights and efforts to bridge digital divides will be central.

2024 is a critical year for the Continent. African policymakers are prioritizing regional economic integration to unlock economic growth and sustainable development. It has also been defined as a "super election year" globally because half of the world's adult population will have the chance to vote. Several potentially relevant elections pertain to Africa (at least 19) happening in countries like Ghana, Rwanda, South Africa, Tunisia, and others. Each election presents unique risks and opportunities as their outcomes will profoundly impact both their respective countries and the Continent as a whole.

Additionally, one of the challenging aspects that needs to be addressed is the role of Development Finance Institutions (DFIs). They are crucial for funding many initiatives, but there are concerns about over-reliance, as it can potentially hinder local ownership and private sector growth.

Overall, asset managers are optimistic about Africa’s investment potential, focusing on infrastructure, renewable energy, and digital technology sectors.

But what is happening in private markets?

Private markets should be given more attention, but it should also be noted that while GDP has grown in most African countries, stock markets have disappointed, highlighting the minimal correlation between GDP and stock prices in emerging markets.

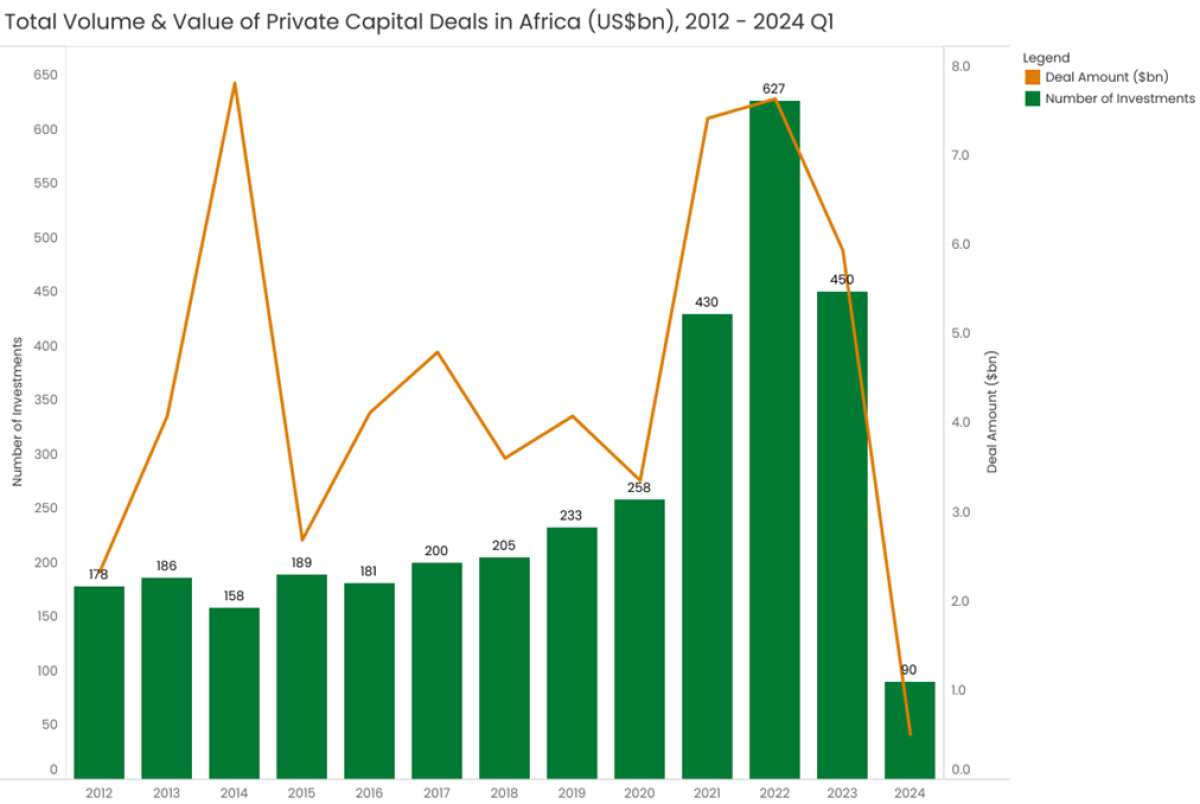

The chart below shows that the volume and value of private capital deals in Africa peaked in 2021 with a record 627 deals and a value of around $7.5 billion. This marked a significant increase compared to previous years. Despite fluctuations, 2024 indicates a cautious investment environment depending on the evolution of the political and economic landscape.

Source: The African Private Capital Association (AVCA)

Within the interesting chart below, we can see that venture capital dominates in West Africa (484 deals), followed by private equity in Southern Africa (421 deals). Infrastructure, private debt, and real estate have significantly lower deal volumes. The distribution highlights regional preferences and the prominence of venture capital and private equity in African investments.

Source: The African Private Capital Association (AVCA)

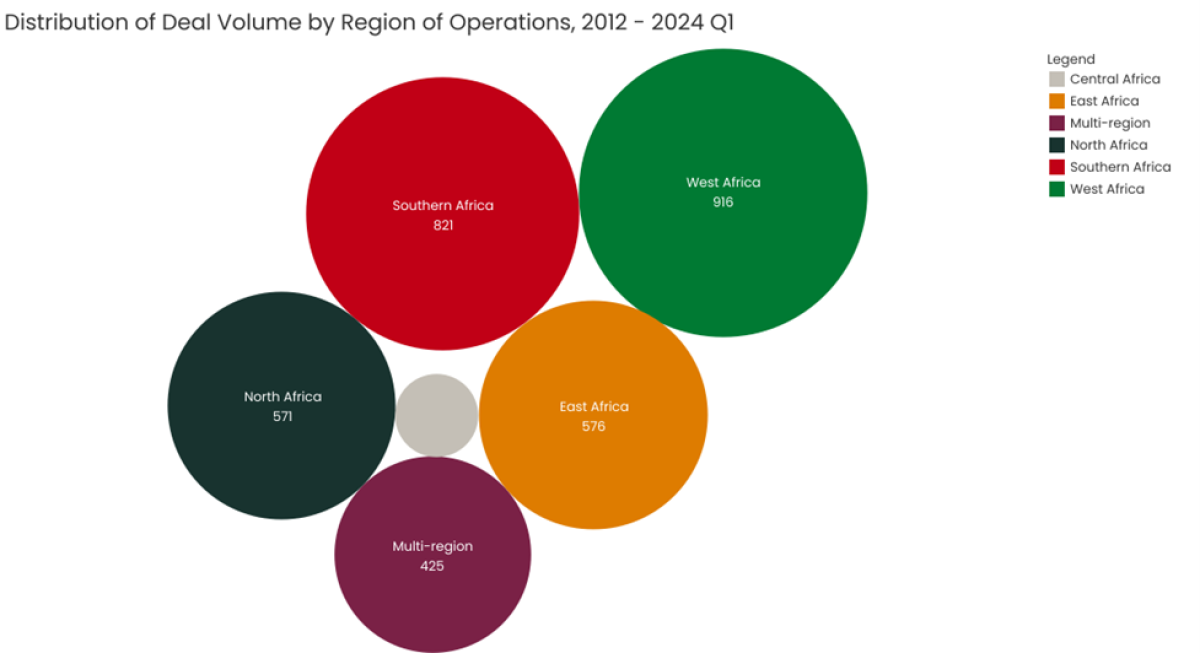

The distribution of deal volume by region of operations in Africa from 2012 to Q1 2024 is illustrated in the graph below. West Africa leads with 916 deals, followed by Southern Africa with 821 deals and East Africa with 576 deals. North Africa has 571 deals, while multi-region operations account for 425 deals. Central Africa has the lowest volume with 17 deals. This distribution highlights the varying levels of investment activity across different regions in Africa.

Source: The African Private Capital Association (AVCA)

Investing in Africa is favorable due to its abundant natural resources, growing technology sector and expanding consumer market. Additionally, the Continent's demographic dividend and ongoing economic reforms create significant potential for long-term growth.

Herodotus was hindered by a lack of infrastructure and technology during his peregrinations across the continent, but today we have no excuse not to recognize Africa as a key investment destination. Below are a few reports meaningfully selected to help unveil the potential of the African continent, which has the greatest of all chances—the possibility to shape its future.