Authored by Christie Hamilton

Comparison may be the thief of joy, but for better or worse, it’s an ever-present part of how things are done in investments. After a year of tireless research and preparation, our team is excited to release CAIA’s landmark report on a new evolution in portfolio management: Innovation Unleashed: The Total Portfolio Approach. There are a lot of reasons to take note of this report, but one thing you will not find in it is a reference to the relative performance of the organizations with which we partnered. Deliberate omission of performance data is often assumed to be due to a lack of compelling returns; however, in this case, that assumption would only make the proverbial you know what out of you.

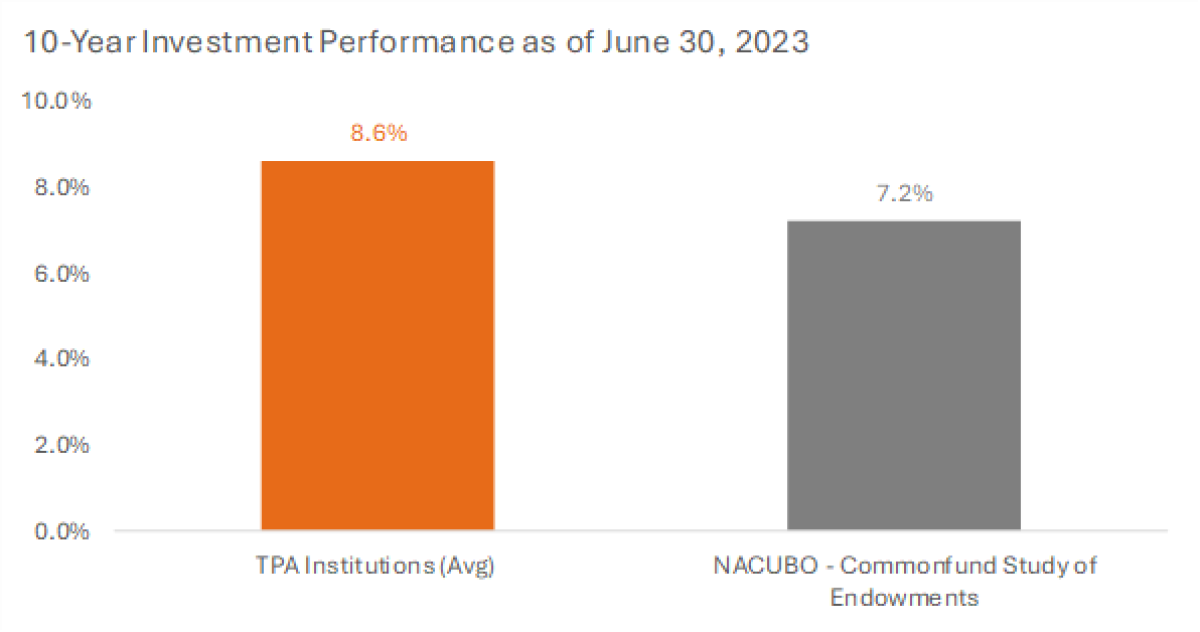

All kidding aside: The average 10-year return for the TPA contributors (CPP Investments, NZ Super, Future Fund, and GIC Singapore, more on these organizations below) as of June 30, 2023, was 8.6%, 140 basis points ahead of the 10-year return average of the 566 organizations in the NACUBO-Commonfund Endowment Study over the same period.

TPA Organizational Comparison

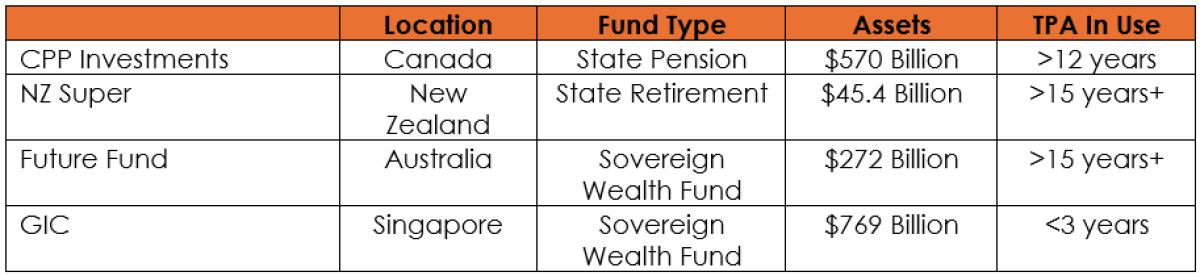

It can’t be overstated that 140 basis points of relative outperformance over the last 10 years is… compelling. However, for those of you who are familiar with profiles of each of the TPA organizations we identified, I can already hear the “but what about” on the fairness of comparing all endowments in the NACUBO study—a group of 500+ organizations with an average size of $1.2B versus the average return of four institutions with a median AUM of $390 billion. That’s totally a fair point, particularly when you look at the profile of TPA organizations.

Note: Assets under management in USD as of most recent reporting from organization (most commonly as of December 31, 2023). TPA in Use” is the approximate amount of time the organization has been actively employing a TPA approach. While the adoption has been progressive vs. precise in every case, this is a good faith estimate on when the language begun to be standard in their public commentary.”

- CPP Investments: The Canadian Pension Plan, a $570 billion pension fund located in Canada

- NZ Super: New Zealand Superannuation Fund with $46 billion under management

- Future Fund: Australian Sovereign Wealth Fund with assets at ~$270billion

- GIC Singapore: Singaporean SWF, and relative newcomer to the Total Portfolio Approach ~3 years ago

It seems fairer and more accurate to disaggregate the individual TPA institutions and compare performance to a cross-section of the NACUBO-Commonfund data that only includes Endowments over $5B, based on the organizational profile above. With these adjustments, data shows that the TPA organizations have a median 10-year investment performance of 9.3% compared to NACUBO $5B+ Endowments at 9.1%. Impressive relative performance that surprised even me.

Note: I do not believe that performance alone makes TPA better than Endowments that lean more heavily on Strategic Asset Allocation merely that overlooking the total portfolio approach—and different ways elements of TPA can be added to your investment process—seems unwise in the face of the performance TPA organizations are realizing.

As an industry, we really do seem to have a love-hate relationship with comparisons. We compare portfolios to benchmarks and dummy portfolios. We compare compensation, fee amounts, assets under management, investor “pedigree,” investment partnership brand prestige, and whether fair or not, we compare portfolio returns versus ‘peers’ as a back of the envelop way of measuring the effectiveness of an internal program. While these comparisons can be powerful indicators, remember that true success comes in the construction, and ongoing improvement, of the best portfolio to meet your personal or organizational needs, irrespective of Yale or Harvard.

Within an industry of relentless comparison, where benchmarks and performance metrics dictate decisions, the concept of Total Portfolio Approach offers a refreshing perspective. It takes into consideration crafting a holistic investment strategy that aligns with unique goals and circumstances. The recent release of CAIA's seminal report, "Innovation Unleashed: The Rise of Total Portfolio Approach," strategically explores the four key dimensions of TPA with industry the aforementioned industry leaders.

But the journey doesn't end with the report. Whether you're a seasoned investor or just beginning to explore the realm of portfolio management, consider these additional resources to explore TPA further:

Capital Decanted: Episode 9 - Total Portfolio Approach: An Unexpected Journey with Ben Samild and Jayne Bok. This is the story of how CAIA convened some of the most reputable and largest asset owners in the world to amplify the benefits of TPA and perhaps, the beginning of a new era.