Authored by Aaron Filbeck, CAIA, CFA, CFP®, CIPM, FDP, Managing Director of Global Content Strategy

“All models are wrong, but some are useful” – George Box, statistician

Models, frameworks, and approaches –three concepts that appear very similar but couldn’t be more different. One of my overarching takeaways from the four investment tenants of the Total Portfolio Approach is that labels really don’t matter and, instead, it’s about finding the best opportunity to fit the needs of the asset pool.

When we first introduced the framework to the world, we explicitly said:

“TPA is not a monolithic methodology that can be applied off the shelf. Rather, it has both hard and soft elements that create a spectrum of process variations.”

By doing this, the investment team achieves the best possible outcome for stakeholders. From an investment perspective, the birth of TPA came from an acknowledgment that the strategic asset allocation model, built upon Modern Portfolio Theory (MPT), is inherently flawed. With the “fill up the bucket” approach of SAA, investors often have overlapping or missing risks, diversification is challenged, and long-term objectives are ignored in the pursuit of fulfilling a model. TPA and its users attempt to mitigate these risks by removing SAA’s arbitrary constraints to choose the most optimal portfolio allocation, raising the orientation of the portfolio’s taxonomy to the highest-level – risk budgeting and reference portfolios instead of asset class allocations and policy portfolios.

However, not every investment office can or will totally embrace TPA. SAA is still baked into so many of our processes that it can be hard to make meaningful moves away from it. But there are other ways asset owners have thought creatively about decreasing costs, improving efficiencies, and enhancing returns... enter the Collaborative Model.

What Is the Collaborative Model?

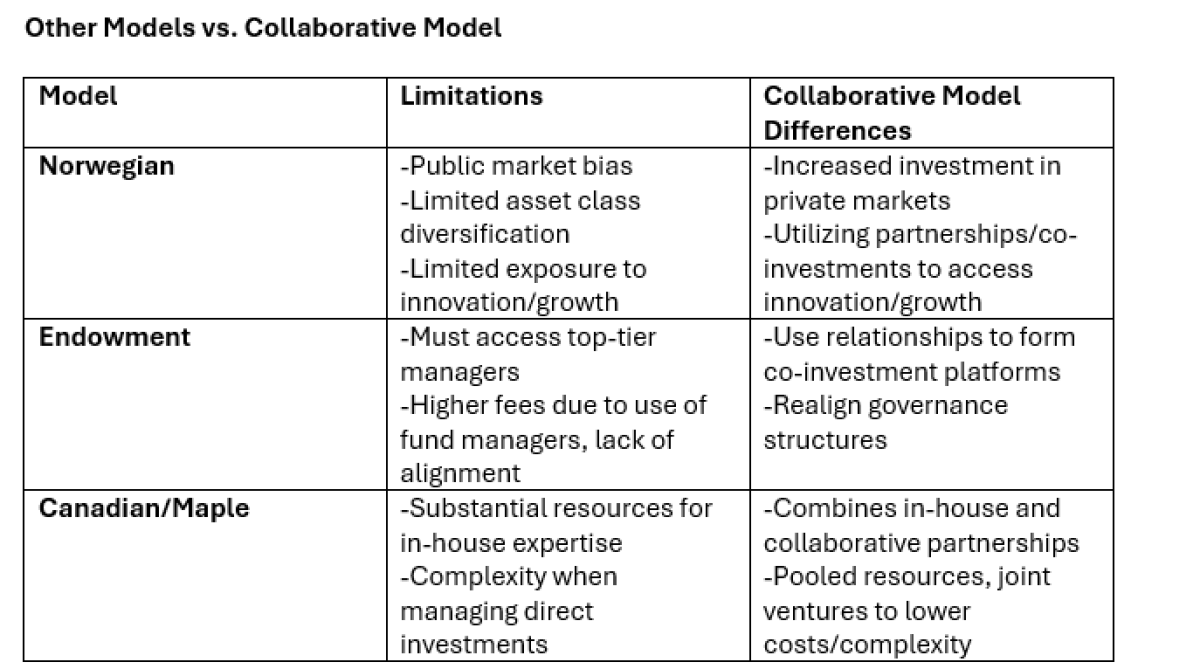

The Collaborative Model is an innovative approach to institutional investment that emphasizes leveraging the competitive advantages of long-term asset owners by building and facilitating relationships with different investment partners. The rationale for adopting what is now known as the Collaborative Model was to do one of two things: reduce fees or improve returns through direct investments, partnerships, and joint ventures. However, the byproduct of adoption was also taking on aspects of existing investment frameworks (namely, the Norwegian, Endowment, and Canadian models) while mitigating their drawbacks and limitations, as summarized in the table below.

Source: Adapted from “From Theory to Practice: The Collaborative Model for Investing in Innovation and Energy” by Bachher, Monk, and Sharma. 2017.

In other words, the Collaborative Model attempts to borrow from the best of these other models while leaving their drawbacks behind. When first learning more about this approach, I read it as an “insource vs outsource” decision, but I quickly learned that it was much more flexible than that due to the introduction of several tools and methods for access. In short, the model combines direct investing and external management with a heavy governance overlay.

Direct Investments, Secondaries, and NAV Lending, Oh My!

When we start to move outside the binary decision-making process of “insource” vs “outsource,” the universe of what you can do really begins to open. There are a lot of different tools available to LPs today, and those that follow some of the approaches found in the Collaborative Model attempts to take advantage of some, all, or even a combination of them. These tools include:

Direct Investments

Custom Vehicles

Secondaries

NAV Lending

Joint Ventures

Wholly Owned Subsidiaries and Minority Stakes

Of course, there are different variations of each, but this largely captures the most relevant categories.

So How Does It Work?

This Collaborative Model’s approach to investing has the following characteristics:

A long-term investment philosophy utilizing private markets

A combination of direct investments, external investments, and some of the unique tools mentioned previously

Some form of collaboration among like-minded investors across asset owners, asset managers, GPs, etc. to create a platform for pooled investment

In essence, it’s not enough to just use these tools, it’s about how the tools are used.

Two Case Studies: CalSTRS and OCERS

As mentioned previously, the Collaborative Model often involves the use of multiple tools simultaneously. One of the most notable users is CalSTRS, started under former CIO Chris Ailman and current CIO Scott Chan. Back in 2017, CalSTRS launched its own self-titled “Collaborative Model.” The rationale for this decision was initially to decrease costs to the plan but has led to a creative mix of direct investments, joint ventures, separate accounts, and internal management.

Because of their flexibility, they would often use all the tools at their disposal in a single deal. For example, CalSTRS recently began ramping up its private credit exposure through its “Innovation Sleeve,” but one of its earliest attempts wasn’t just doing so through funds. Instead, they committed capital to the private credit fund directly, engaged in some co-investment opportunities, and took a small ownership stake in the GP.

A second example is Orange County Employee Retirement Systems, under the direction of CIO Molly Murphy, who joined the Capital Constellation consortium of asset owners (including Alaska Permanent, the Public Institution of Social Security of Kuwait, and Railpen, a U.K.-based pension) in partnership with the Wafra to form a permanent capital and GP-stakes business. Later OCERS also helped fund Collective Global, a brand new $1 billion venture capital-focused platform designed to provide greater access to the often hard to access, venture capital market. OCERS was joined by the San Jose Retirement System, and the U.K. pension fund Railpen once again.

How Does the Collaborative Model Intersect with the Tenants of TPA? Or Does It?

While TPA and the Collaborative Model are after the same thing – improving portfolio outcomes – they do so very differently and with one important distinction: philosophy.

Philosophically, TPA outright rejects SAA and focuses on the philosophy and governance of putting a portfolio together using the best combination of tools at their disposal. In contrast, the Collaborative Model embraces SAA but uses different tools and vehicles to access markets. Typically, the rationale is focused on reducing costs and improving returns rather than overhauling the entire investment philosophy.

Where these two approaches seem to overlap is on the implementation front. While TPA doesn’t explicitly call for all the tools found within the Collaborative Model, those tools would certainly help followers of TPA accomplish their objectives. In other words, it seems as though you can implement the Collaborative Model’s activities within a TPA framework, but not the other way around.

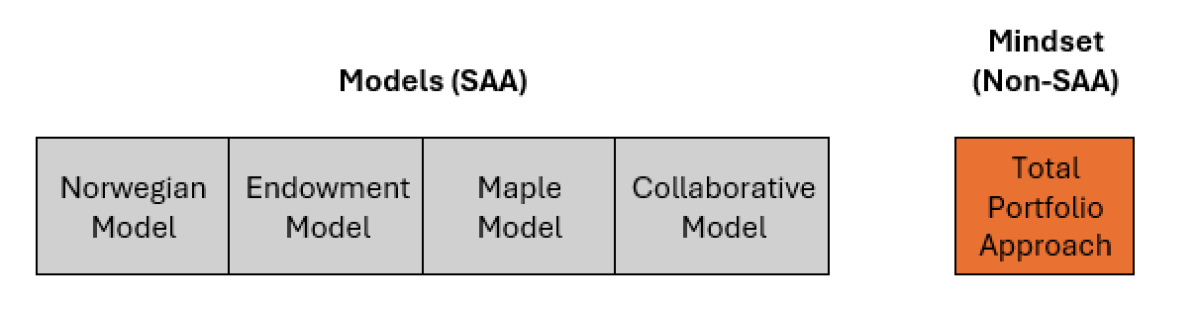

Unlike its Norwegian, Endowment, or Maple contemporaries, TPA is not technically a “model” but instead more of an evolution in philosophy, mindset, and implementation. Perhaps the Collaborative Model is an evolution, while TPA is a revolution.

Resources:

Innovation Unleashed: The Rise of the Total Portfolio Approach

Capital Decanted, Season 2, Episode 5: The Modern Asset Owner – New Tools for a New Regime

A Quick Pour from Capital Decanted

Collaborative Model Savings Surpasses $2 Billion - CalSTRS

From Theory to Practice: The Collaborative Model for Investing in Innovation and Energy