Authored by Steven Novakovic, CFA, CAIA

You may know the saying, "the more things change, the more they stay the same." It's a bit of a paradox, but it rings especially true for investors navigating the shifting landscape of private equity post-COVID. While these markets are in a constant state of evolution, they are still just in their early days—like teenagers trying to figure out their place in the world. Despite all the change, we are still at the beginning of this journey, with much to learn and even more to discover.

Keeping Up with VC

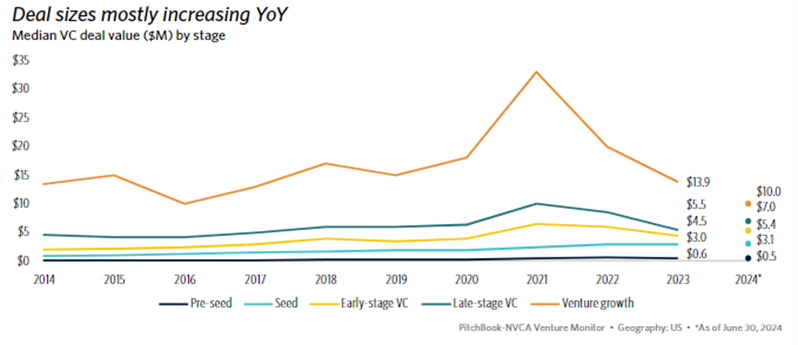

For investors, this means there is a lot to keep up with, and falling behind can be dangerous and introduce unintended risks. I felt that way last year when I discovered there was a new stage of venture capital called pre-seed. My first reaction was the facepalm emoji. But the more I learned about it and reflected on it, I was reminded how important it is for investors to stay on top of market changes. What took place in this instance was VC funds migrating upwards in size and leaving behind their prior markets space. As Series A investors grew, seed investors followed suit, filling the gap. This shift opened the door for a new generation of investors (pre-seed) to step in and take their place.

Not to dwell on this issue for too long but missing this shift in the VC landscape could mean you are not fully aware of the true risks in your portfolio's market segments. (i.e., a decade ago, less than 5% of all early-stage deals were larger than $25M, in the last four years this is closer to 20% of all early-stage deals) [i].

However, if you invest in a few pre-seed funds managers, et voilà, you are back to where you started. Indeed, the underlying opportunity set has not changed, rather the labels have changed along with the managers traditionally used to access those market segments.

If you’re curious about navigating the evolving world of venture capital, check out this podcast. It offers insightful discussion on the industry, including a fascinating dive into the emotional side of VC investing.

Liquidity Woes

In responding to changing market conditions (i.e., a weak exit environment resulting in minimal liquidity which in turn harms fundraising), GPs have become more innovative in creating liquidity events and in creating more permanent pools of capital. One such means has been the use of NAV loans. Our friends at ILPA recently released guidance on the best practices around NAV-based facilities. ILPA estimates this as a $100 billion market, expected to grow to $600 billion by 2030!

Liquidity will always be required for traditional closed-end drawdown style funds but of less concern (perhaps?) for perpetual investors. Hence, the increased growth and use of evergreen funds. Put money in an evergreen fund and it can stay there for as long as you want. This helpful article takes a closer look at evergreen funds and does a deep dive into costs and comparisons to traditional private market funds.

Speaking of liquidity, an unexpected source of liquidity may be back in the form of SPACs. I had the opportunity to discuss the return of SPACs during a recent CAIA Virtual Chapter Webcast. Needless to say, after a boom-and-bust period, the SPAC market has normalized and should once again be viewed as a viable exit option for private companies.

From Page to Chapter: AI’s Impact on Alternative Investment

One of the most significant drivers of ongoing change is artificial intelligence. A question I often wrestle with is how AI is transforming the way we invest in alternatives. For many, the answer might be that it has not—yet. But I’m far from alone in pondering this, and some of the brightest minds in the field are exploring it too.

A few of those smart people recently discussed, on McKinsey podcast, just how PE firms are using and incorporating AI. While it is exciting to think about all the potential ways AI can be used, I think this line sums up where most investors are in their lifecycle: “Our diligence on gen AI today is roughly a page, but before long, it will be a chapter.” If you are looking for more specific and actionable advice, GeekWire polled investors on how they use various AI tools in practical applications.

Enduring Principles

And yet, with all these changes afoot, this wonderful study prepared by Dimensional reminds us that investors can continue to count on some of the core tenets of private markets that we at CAIA have espoused since day one.

“1) There remains a substantial dispersion in lifetime absolute performance across funds in all asset classes.

2) Outperformance relative to public markets depends crucially on the choice of benchmark.

3) Private funds have in aggregate offered meaningful diversification benefits to public investors, even in more recent decades.”

While the world of alts continues to evolve, the underlying fundamental truth persists: a sound diligence process and ongoing education are essential in navigating the complexities of private markets. For those successful in that endeavor, the reward is a more diversified portfolio with improved outcomes. Happily, for alts investors, the more things change, the more they stay the same.

[i] https://nvca.org/pitchbook-nvca-venture-monitor/