AIMA and CAIA Release Fourth Edition of Risk Rating Guidelines for Hedge Funds,

Alternative Mutual Funds and Private Credit Funds in Canada

- AIMA & CAIA update risk rating guidelines for alternative strategies in Canada

- Now in its fourth edition, risk ratings remain unchanged, providing benchmark for dealers

- Newly added this year: risk ratings for Convertible Arbitrage and Volatility Arbitrage

AIMA and CAIA (‘the Associations’) have today published an updated risk rating system to advocate for better alignment of retail risk ratings at investment dealer firms with the historical risk-adjusted returns of funds within strategy indices.

In the four editions, no strategies have changed category, despite markets experiencing enhanced volatility throughout. New additions to this edition include Convertible Arbitrage and Volatility Arbitrage. The Associations’ updated risk rating guidelines for hedge funds, alternative mutual funds and private credit are outlined below, with the full guidelines available here.

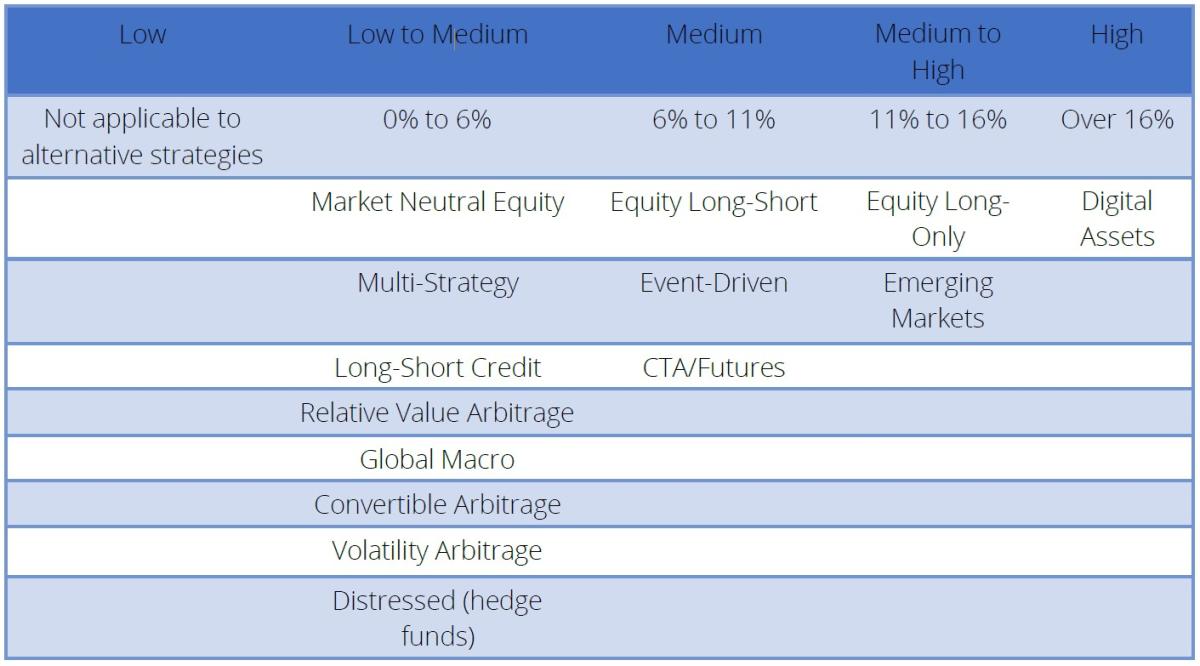

Proposed risk rating for hedge funds and alternative mutual funds based on the median trailing standard deviation of funds within indices

Source: CAIA Association, AIMA, CISDM, HFRI. Data as of 12/31/2022.

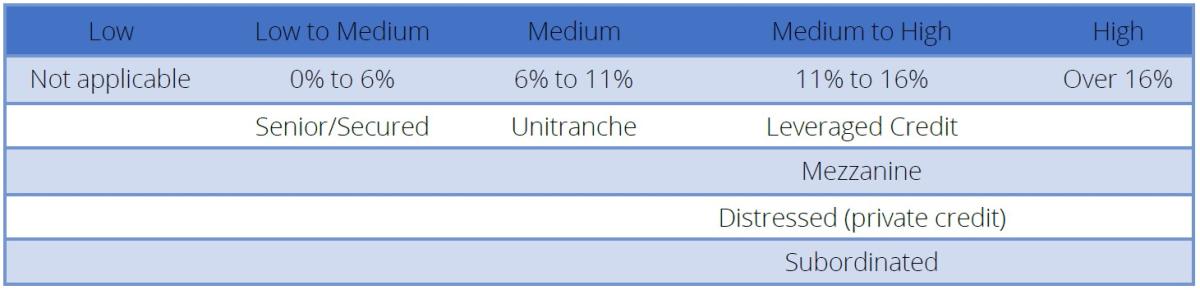

Proposed risk rating for private credit funds based on S&P & Cliffwater indices

Source: CAIA Association, AIMA/ACC, 2022.

Since the first edition was published in January 2019, there has been some positive alignment of internal risk ratings with investment funds’ historical, risk-adjusted returns, challenges remain, with many instances where private funds are automatically rated high risk, despite low historical volatility. This limits the number of retail investors who can allocate to these products, and limits how much they can allocate, despite these strategies often demonstrating lower volatility than broad indices.

To facilitate fair investor access to diversified, risk-reducing fund structures with non-correlated returns, the Associations advocate that internal dealer risk ratings systems be revised to better reflect historical risk-adjusted data from funds within indices.

Claire Van-Wyk-Allan, Managing Director & Head of Canada, AIMA, commented: “With proven methodology through recent market activity, AIMA and CAIA stand behind our risk rating guidelines that more accurately reflect the historical risk-adjusted returns that these strategies can provide balanced portfolios. With four additional years of data captured, the recommended risk ratings for hedge funds, alternative mutual funds and private credit remain unchanged, a testament to the soundness of this methodology. Following enhanced market volatility, it is imperative that retail investors have fair access to alternative investment funds that can provide diversification, risk reduction and non-correlated returns to their asset allocation mix. Canadian investors deserve the fair opportunity to access these strategies without requiring an unjustly high-risk investing profile to do so.”

Steven Novakovic, Managing Director, CAIA Curriculum, CAIA Association, commented: "Alternative investments can be complex, in both liquid alternatives and lock-up fund structures. The CAIA Association advocates that all market participants become fully informed regarding the new Canadian fund structure, including the benefits, drawbacks, and complexities. We are pleased to be working with AIMA to further the education of investors, especially those in Canada who choose to embrace the new investment opportunities now available under NI 81-102."

Belle Kaura, Chair, AIMA Canada Executive Committee, commented: “The AIMA / CAIA risk rating model has been tested by enhanced market volatility over the past few years and the methodology has proven to be sound. Dealer risk ratings of liquid alts have improved since inception of the guideline in 2019 through greater alignment with historical risk adjusted returns. However, fair access to alternatives remains a serious issue with private funds still being defaulted to high risk, despite low historical volatility. Automatic high-risk ratings deny retail investors fair access to the benefits of private funds by severely limiting inclusion in portfolios. True risk ratings are imperative to ensuring fair access and eliminating barriers to distribution. Alternatives resoundingly proved their resilience and ability to deliver lower volatility than public markets through uncertain and unprecedented volatile market conditions, solidifying the place of alternatives in a balanced portfolio. Retail investor access to uncorrelated strategies that reduce risk and diversify portfolios is crucial in the current market environment. We urge dealers to adopt the risk rating guideline for better alignment of risk ratings with historical risk-adjusted returns.”

###

AIMA

The Alternative Investment Management Association (AIMA) is the global representative of the alternative investment industry, with around 2,100 corporate members in over 60 countries. AIMA’s fund manager members collectively manage more than US$2.5 trillion in hedge fund and private credit assets. AIMA draws upon the expertise and diversity of its membership to provide leadership in industry initiatives such as advocacy, policy and regulatory engagement, educational programmes and sound practice guides. AIMA works to raise media and public awareness of the value of the industry. AIMA set up the Alternative Credit Council (ACC) to help firms focused in the private credit and direct lending space. The ACC currently represents over 250 members that manage US$800 billion of private credit assets globally. AIMA is committed to developing skills and education standards and is a co-founder of the Chartered Alternative Investment Analyst designation (CAIA) – the first and only specialised educational standard for alternative investment specialists. AIMA is governed by its Council (Board of Directors). For more information, visit www.aima.org.

CAIA Association

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. A Member-driven organization representing nearly 13,000 professionals in 100 countries, CAIA Association advocates for the highest ethical standards. The organization provides unbiased insight on a broad range of investment strategies and industry issues, key among them being efforts to bring greater diversification to portfolio construction decisions to achieve better long-term investor outcomes. To learn more about the CAIA Association and how to become part of the organization’s mission, please visit https://caia.org/.

Media Contacts:

• Tom Kehoe, Managing Director & Global Head of Research and Communications, AIMA

• Claire Van Wyk-Allan, Managing Director & Head of Canada, AIMA

• Belle Kaura, Chair, AIMA Canada Executive Committee & VP Legal & CCO, Third Eye Capital

• Chris Sullivan, Craft & Capital (CAIA Association)