Keith H. Black, PhD, CFA, CAIA

Associate Director of Curriculum, CAIA Association

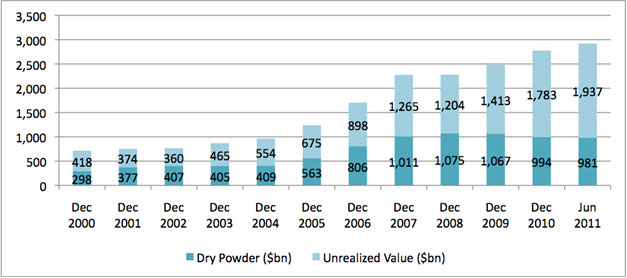

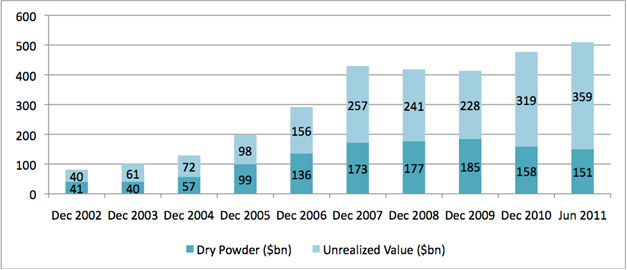

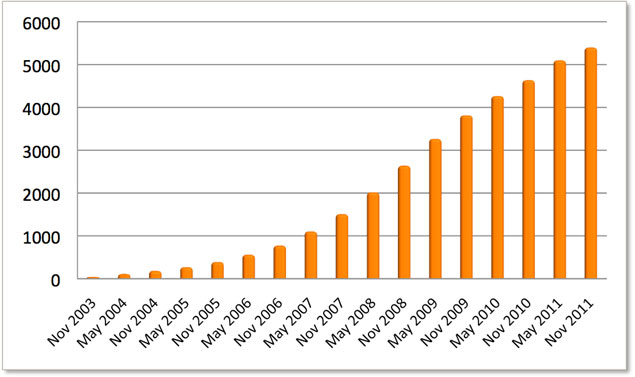

The growth of CAIA, the global benchmark in alternative investment education, from 43 members in 2003 to more than 5,700 members in 10 years closely parallels the growth of the alternative investments industry. In fact, Preqin estimates that private equity assets in December 2002 were $767 billion, while closed-end private real estate assets under management (AUM) totaled just $81 billion. At the same time, Hedge Fund Research estimates that the hedge fund industry managed $625.5 billion. By 2011, assets across all alternative investment types had exploded, with hedge funds managing over $2,000 billion, private equity controlling nearly $3,000 billion, and private real estate investing over $500 billion. In 2003, infrastructure and commodity assets likely totaled less than $20 billion. While these asset classes were nascent in 2003, Preqin now estimates infrastructure assets at $174 billion, while Barclays estimates commodity assets at over $420 billion. In the last 10 years, entire asset classes have been created, with the first commodity exchange-traded fund being offered in November 2004; currently, commodity exchange-traded products hold over $200 billion in assets.

Growth of Private Equity AUM (in billions of dollars)

Source: Preqin

Growth of Closed-End Private Real Estate AUM (in billions of dollars)

Source: Preqin

Growth of CAIA Membership

Source: CAIA Assosiation

In 2002, foreseeing the coming growth in AUM across alternative classes, Florence Lombard, then Chief Executive Officer of Alternative Investment Management Association (AIMA), Dr. Thomas Schneeweis, Director of the Center for the International Securities and Derivatives Markets (CISDM ), and a core group of academic and industry experts pledged to fulfill the unmet need for a standard of education in the bourgeoning sector. What they launched was the CAIA Charter.

Like the sector of the industry it covers, the CAIA Charter grew rapidly. In 2008, the New York Society of Security Analysts recognized CAIA as the fastest-growing financial credential, and in the past three years alone, membership has more than doubled. Fostered by a dedicated chapter relations team, the number of CAIA chapters has tripled to 15 from the first 5 established in 2005; CAIA Chapters now provide a platform for educational, career and networking activities for thousands of AI professionals in the world’s major financial centers. CAIA now has 6 offices globally.

As the Association has grown, its program has evolved and advanced. In 2009, CAIA introduced the first editions the most complete, authoritative desktop reference volumes on alternative investments ever created: CAIA Level I: An Introduction to Core Topics in Alternative Investments and CAIA Level II: Advanced Core Topics in Alternative Investments, written and edited exclusively by leading practitioners and academics. Now, in 2012, CAIA Association has published second editions of these texts to keep pace with the latest strategies and information. These volumes round out a complete education in alternative investments for any finance professional.

CAIA has become the leading-edge alternative investment credential and the unchallenged chief provider of education in alternative investments. Investment professionals in any asset class can benefit from a broad-based education in alternative investments, as it is important to see the big picture of institutional portfolios. An understanding of the investment goals and practices of institutional investors, including pensions, sovereign wealth funds, endowments, and foundations, is important for both institutional investors and managers of alternative investment products.