Introduction to Khosla Price Sensitivity RatioTM (KPSR)

By Tanuj Khosla, CFA, CAIA, MBA

A typical issue of a Eurobond in Asian bond markets follows the below mentioned steps:

- The bookrunners take a company on an investor ‘roadshow’ across different global locations including but not limited to Hong Kong, Singapore, London and US (mostly New York and Boston) if it is a RegS/144a issue.

- The credit sales coverage personnel of those bookrunners collect feedback/thoughts on the credit quality, expected deal size and pricing from the investors and pass it on to the Syndicate bankers.

- Some investor accounts put in IOIs (Indication of Interest), a conditional, non-binding interest in buying the proposed bond.

- The bankers show the IOIs to the CFO and/or the Treasury team of the bond issuer as a ‘temperature check’ of the market and gauge of investor interest.

- The banks in consultation with the issuer announce the Initial Price Guidance (IPG). It is worth mentioning here that while the international banks in this business market and place the deal mostly on a ‘best efforts’ basis wherein IPG is based in market conditions and investor feedback, the new entrants in the space namely the Chinese and Indonesian banks and security houses have been known to commit a hard price to the issuer in order to win a mandate, especially when it is an issuer from their own country. In case the deal is done with an underwriting commitment (and not on ‘best efforts’), the committed level may or may not be the IPG level.

- Investors put in their orders with the banks. Orders can be of two types – sole and pot. The former is when the investor puts in his/her order with only one bank on the deal while the latter is when he/she gives the same order to all the bookrunners on the deal and it goes into a common ‘pot’ of orders. International banks follow the best practice of sharing the details of all the sole order they receive with each other. However the new entrants to the market, again namely Chinese and Indonesian banks and security houses are still rooted in their respective domestic practices and try to covertly get sole orders which they don’t share with other bookrunners on the deal. They promise the investors placing the sole orders a good allocation and triumphantly show the list and volume of the sole orders to the issuer to ‘demonstrate their value’ and hopefully be the preferred bookrunner on the next deal!

- Final Price Guidance (FPG) is announced. The compression in spread from Initial Price Guidance (IPG) is based on various factors like size and quality of the orders received, number of times the book is covered etc.

- Some investors pull out their order after the announcement of Final Price Guidance (FPG) on account of final pricing being tighter than their internal expectations.

- Deal is priced and investors are allocated the bonds.

- The allocation of bonds depends on a variety of factors (more on that below) like size of the order put in by the investor, brand name of the investor, preference to investors who put in an IOI or took a ‘roadshow’ meeting with the issuer (or both), type of investor (more on that below) etc. Usually it is the Syndicate personnel of the bookrunners who decide the final allocation of the bonds but it is not uncommon for CFO, Treasury Head etc. of the issuer to ‘influence’ the allocation.

The investor type at the time of allocation is usually split as follows:

- Banks

- Fund Managers

- Real money funds (mutual funds, benchmarked linked long-only funds etc.)

- Fast money funds (hedge funds)

- Private Banks for their clients

- Life Insurance Companies

- Sovereigns & Central Banks

Another class of investors that is increasingly becoming active is treasury departments of corporations that have excess cash on their balance sheets and look to park it in higher returning bonds as compared to bank deposits.

The allocation is based on some or all of the following factors:

- Type of investor

- Preference to big name investors

- Preference to investors who gave an IOI

- Preference to investors who took a meeting with the issuer during the roadshow

- Preference to investors who gave feedback on roadshow and pricing thoughts

- Preference to investors who participated in the previous bond deal

- Under-allocating to investors who don’t show ‘good market practices’ (like placing unreasonable limit orders, placing an order after the cut-off time for bookbuilding etc.) or were ‘rude’ to the company executives during the roadshow meeting (Please note that there is a difference between asking probing questions and being outright demeaning. The latter is done my many analysts from big fund houses who want to establish a reputation of being ‘tough and detail oriented’ in the market. The same reputation sometimes comes in handy during a discreet reference check for their next job.)

However at least in Emerging Markets, the entire process is still more art than science and is driven to a large extent by relationships both between the investor and the bankers (mainly Syndicate bankers) as well as that between the investor and the issuer.

What is even trickier is estimating the type of investors who have dropped out after the announcement of the Final Price Guidance (FPG). Different types of investors have different sensitivities to price tightening. For example:

- Benchmark linked funds may have to buy the bond despite aggressive price tightening as they have to adhere to country weights in the benchmark.

- If it is a long dated bond, Life Insurance companies may disregard the price tightening and still go ahead in order to match their assets and liabilities.

- If it an investment grade bond with a certain issuance size, ALM desks of banks may still go ahead despite the price tightening as they are faced with many regulatory restrictions on the types of bonds they can buy.

- If the price tightening is too aggressive, most credit hedge funds may withdraw their orders. Some may even short the bond and look to cover after issuance. On the flip side, sometimes even if the price tightening is too aggressive but the demand for the deal is quite strong (known as ‘hot’ deal), many credit hedge funds may keep in their orders and look to sell the bonds at a modest profit the next day (known as ‘flipping’) as they are counting on demand for the bonds by investors who didn’t get any allocation.

- If Private Banks offer their clients leverage against the proposed new bond, they may not withdraw their orders despite an aggressive price tightening. Also a lot of Private Banks offer rebates to their clients ranging from 25c to 50c thereby further incentivizing them to stay in the deal.

The matter is further complicated by the information asymmetry that exists between the bankers/issuer and the investors as the former can see the revised composition of the order book after announcement of the Final Price Guidance (FPG) while the latter has no information except the absolute change in the size of the total order book.

We introduce a metric, called Khosla Pricing Sensitivity RatioTM (PSR) that helps bridge this information asymmetry and provides valuable information to investors, issuers and the bankers on the deal.

COMPUTATION OF THE RATIO

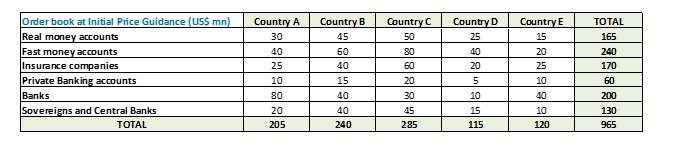

As an example, consider a new RegS/144A US$ 500 mn bond announced by a A rated quasi-sovereign bank with a 10 year maturity. The initial price guidance is T10 + 90 (10-yr US Treasury + 90 bps).

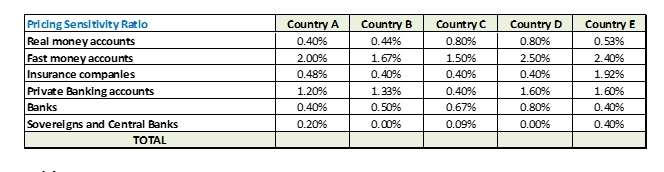

The following is the initial order book. Please note that the investors don’t have access to these numbers and only the bankers on the deal and the issuer see them.

The book at this point is 1.93 times (965/500) covered.

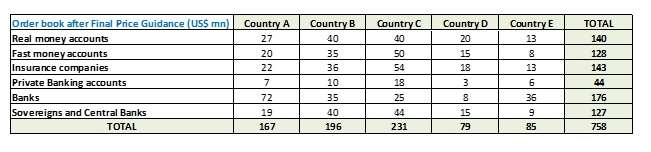

The banks subsequently announce Final Price Guidance of T10 + 65 i.e. 25bps in spread tightening (90-65 = 25). The revised order book after the dropped orders is as follows:

The revised order book is now 1.51 (758/500) times covered. Again this information is not shared with the investors. Only the final size of the order book, US$ 758 mn in this case, is made known.

Khosla Pricing Sensitivity RatioTM

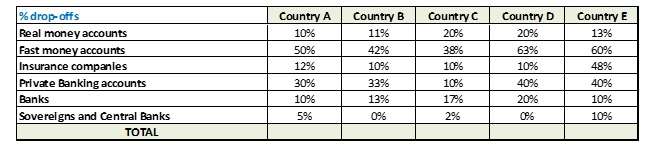

Khosla Pricing Sensitivity RatioTM is defined as the percentage change in order book for every basis point in spread tightening between the initial and final price guidance.

It is computed as follows:

Khosla Pricing Sensitivity RatioTM = Percentage drop-off in order size / Spread tightening from IPG

For this particular example, Pricing Sensitivity RatioTM is computed as:

Insights:

As we can see from the table above, for this particular issue:

- Fast money accounts (hedge funds) across all countries are most sensitive to price tightening.

- The Insurance Companies in Country E are more sensitive to price tightening as compared to other countries probably because their yield/return targets are higher due to the country’s demographics (ageing population etc.).

- The Private Banking clients in Country C are less sensitive to price tightening as compared to other countries probably because the bank offers them a higher LTV (Loan to Value) on this particular bond.

- Sovereigns and Central Banks are not very sensitive to the price tightening.

As an analogy, we can think of Khosla Pricing Sensitivity RatioTM as the equivalent of price elasticity of demand in credit spreads by different types of investors.

VALUE OF THE RATIO TO VARIOUS STAKEHOLDERS

Investors:

The investors shall get visibility into the sensitivities of different types of investors from various geographies, to the price tightening of different types of bonds (investment grade, high-yield, unrated, long-dated, short-dated etc.) and that shall enable to make more informed decisions for comparable bonds that come to the market subsequently.

Issuers:

The ratio shall help issuers gauge the types and geographies of investors who like the company from a fundamental standpoint and consequently probably won’t cause volatility in the bond prices in the secondary markets by taking immediate profits (commonly known as ‘flipping’) by selling the bond a day or two after issuance. That is the stable investor base most issuers look for.

Bankers:

The ratio shall enable bankers to get a sense of the sensitivity of different types of issuers to different types of bonds. For example,

- Life insurance companies may be less sensitive to price tightening in a longer dated paper as compared to a shorter dated one.

- All things being equal, hedge funds may be less sensitive to a rated bond as compared to an unrated one for the same basis points in price tightening.

- ESG funds may be less sensitive to price tightening of Green bonds as compared to hedge funds and real money funds.

The ratio and subsequent insights shall allow bankers to pitch a more realistic pricing range and size while trying to get a mandate from an issuer.

CONCLUSION

Some parts of Developed Markets are even worse than Emerging Markets when it comes to disclosure of allocation stats. There they don’t even reveal the basic data like type and geographies of investors who got allocated the bonds.

Khosla Pricing Sensitivity RatioTM if computed and shared along with deal stats post allocation will make the bookbuilding process more efficient for subsequent bonds and provide valuable insights to investors enabling them to make informed decisions.

ABOUT THE AUTHOR

Tanuj Khosla is an Assistant Portfolio Manager at a Singapore-based Asian long-short credit hedge fund, He has been in the hedge funds for 8+ years and in the financial industry for over a decade. In 2016, Tanuj was named in the Top 20 ‘Most Astute Investors in Asian G3 Bonds for 2016’ by the well-known journal The Asset.

Tanuj started his career with ICICI Bank Ltd. in New Delhi, India. Tanuj holds an MBA with a dual specialization in Finance & Strategy from Nanyang Business School, Nanyang Technological (NTU), Singapore. He holds both the CFA and CAIA charters and is a CAIA Singapore Executive Committee member. He is a part of CFA Education Advisory Board Working Body and was recently appointed as a Curriculum Consultant by the CFA Institute.