Clifford S. Asness and two associates have made the case in a recent paper not only that a strategy of betting against beta (BAB) can yield positive returns, but that its success in doing so is not the consequence of a preference that the strategy creates for certain industries over others. This contravenes the interpretation that certain earlier authors, including for example Ronald Shah of Dimensional Fund Advisers, have given to the success of BAB.

Clifford S. Asness and two associates have made the case in a recent paper not only that a strategy of betting against beta (BAB) can yield positive returns, but that its success in doing so is not the consequence of a preference that the strategy creates for certain industries over others. This contravenes the interpretation that certain earlier authors, including for example Ronald Shah of Dimensional Fund Advisers, have given to the success of BAB.

Stated very briefly: the BAB strategy works because low-volatility equities have higher returns than they ‘should’ have, so buying them – especially while one shorts high-vol stocks – produces above normal risk-adjusted profit.

The Reductionist View

There is empirical evidence in support of BAB, and its existence has been a matter of public knowledge at least since 2007. That year David Blitz and Pim van Vliet documented low vol outperformance of 12% -- matching the lowest vol decile against the highest in equities between 1986 and 2006.

Asness and his associates – Andrea Frazzini and Lasse H. Pedersen – begin their discussion quoting Shah’s view, expressed in a 2011 paper, that an investor gets lower vol by making decisions that are industry specific. The decisions have “substantial industry tilts that, when removed, substantially reduce volatility-adjusted returns.”

Asness et al. test that hypothesis and find it false. They find along the way that the best low-risk strategy is one of a group that is designed to eliminate industry tilt.

What they call the ”regular” BAB, the one most prominently featured in BAB literature, is a portfolio constructed by sorting stocks on beta, buying some and shorting others, without regard to industry. Thus, in principle and at first glance, Shah could have a point here. The regular BAB could be driven by industry bets.

It is also possible, though, to create a BAB with deliberate reference to industries, making it a pure industry bet, deliberately going long on low-vol industries and shorting high-vol industries. If this is the key, then the pure industry-play portfolio should outperform the regular BAB portfolio.

It is also possible, thirdly, to create an industry-neutral BAB portfolio, by going long the low volatility stocks and shorting the high volatility stocks within a single industry, or within each of the included industries in a balanced way.

Looking at the Numbers

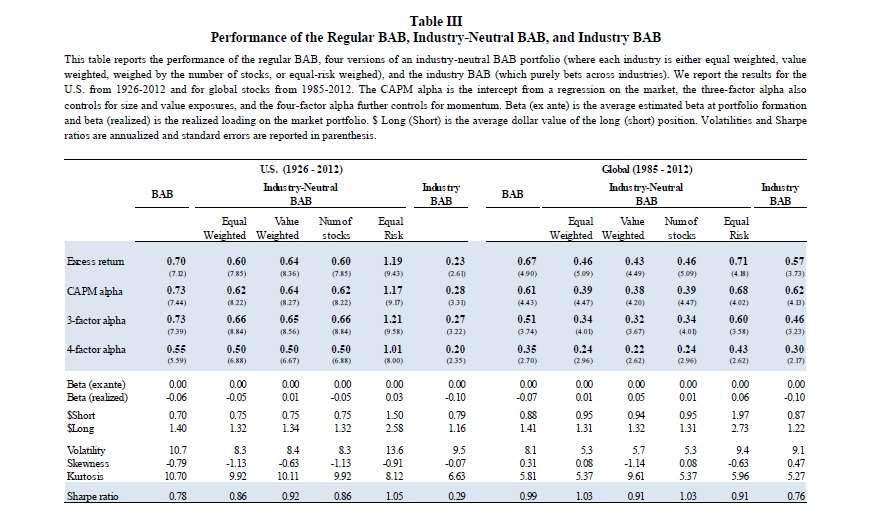

The authors make the further observation that the effort to ensure an industry-neutral BAB can be construed in four different ways, and they slice their data accordingly. The table above provides the heart of their answer to the questions they’ve posed.

Look first at the left-hand half of the table. The data indicate that over the covered period in the U.S., beginning in 1926, regular BAB (the first column) earned CAPM alpha of 0.73. The four variations of industry-neutral BAB earned CAPM alpha in a range from 0.62 to 1.17, with one of them doing better than regular BAB. Industry BAB, the pure play according to Shah’s view of BAB, earned a quite modest CAPM alpha of 0.28.

On the right hand side of that table, the geographical database is expanded, although the chronological database is narrowed. This looks at global results, but the period begins in 1985. The results track closely those on the left, although the pure play did better on the global scene than in the U.S.

Specifically, CAPM alpha for regular BAB global is 0.61. For three of the four systems of creating an industry-neutral BAB it is less than that. But for the fourth neutralizing method, an ”equal risk” weighting of industries, neutralized BAB beats regular BAB. Finally, the pure play industry BAB in effect ties the regular BAB in performance.

Why Does BAB Work?

Looking at these facts and the others displayed above, the authors’ conclusion sounds reasonable. The numbers “utterly disprove the common sentiment that BAB – and low-risk investing in general – is really just an industry bet. It’s neither driven by industry bets nor is it more effective for industry bets.”

This leaves the question: why does it work? Why do low-vol/low-risk investments get higher risk-adjusted returns? This is not a central concern of the paper, the same authors have addressed leverage aversion elsewhere, but here again they do suggest that their results support a “leverage aversion” theory.

Dining on the returns offered by safer assets on a large scale requires significant leverage, and aversion to borrowing that much money dissuades some from taking advantage of this. That in turn means that crowding does not drive those returns down in the way that standard theory suggests it ‘should.’