A recent publication on merger arbitrage strategies makes the case that global M&A activity will “remain muted” despite some bright spots.

A recent publication on merger arbitrage strategies makes the case that global M&A activity will “remain muted” despite some bright spots.

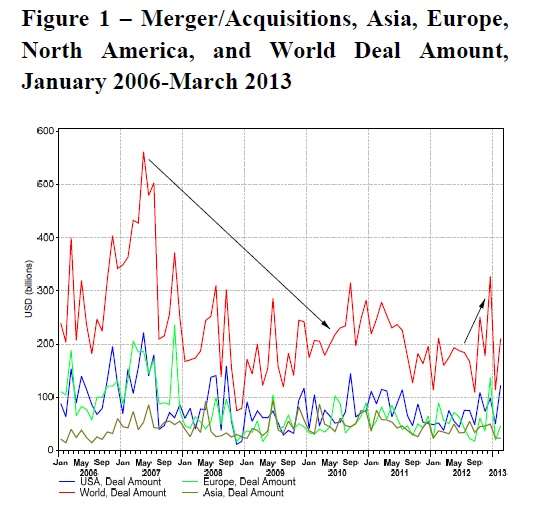

PrevInvest, which describes itself as offering “leading intelligence and independent insight,” cited Dealogic in saying that M&A activity fell in 2012, 3% from 2011 for all deals. But there was some pick-up in the first quarter 2013, with a surge of megadeals in the U.S. in particular. Notably, competing bidders have turned Michael Dell’s attempt to go private with his corporate alter ego into an auction.

On February 5, Dell announced that founder Michael Dell, along with Silver Lake Partners and with funding assistance from Microsoft (a $2 billion loan) planned a leveraged buyout of the public company. That proposal included a “go shop” period that was set to end March 23. Before the ending of the period, Blackstone Group LP made a preliminary offer, as did Carl Icahn. Blackstone has since bowed out, though Icahn remains very much in.

In the Asia-Pacific region, meanwhile, the first quarter has been very slow, with M&A volume at just $136.6 billion. That makes it the slowest first quarter in this space in nearly eight years.

Japanese Outbound Capital

Japanese companies in particular are scaling back their interest in acquiring, according to the report. This new sense of scale may have been catalyzed by the weak yen.

But the second half of last year saw two blockbuster deals by Japanese concerns looking for exposure in Vietnam. In the third quarter of 2012, Mizuho Financial Group bought a 15% stake in Vietnam Bank for Foreign Trade. In the fourth quarter, Mitsubishi UFJ Financial Group bought a 20% stake in Vietnam Joint Stock Commercial Bank for Industry & Trade (VietinBank).

Japan’s own deflationary spiral is motivating an “outbound” movement of capital. in such acquisitions, by limiting at-home opportunities.

In the graph above, the blue line represents the U.S merger activity (brown Asia, green Europe, red global.) As you can see there, the subprime crisis of mid-2007 coincided with a plunge in the M&A numbers in the U.S., Europe, and the world. There were wild swings in the following months, until things settled down at a very low level at the end of 2008. The global market exhibited a slow recovery over the next couple of years, but experienced renewed decline in 2011 and well into 2012.

As the PrevInvest report by Aureliano Gentilini and Ferenc Sanderson tells us, “In spite of the fact that the macroeconomic environment in Europe remains difficult, total deal amount in January and February increased 0.3% year on year,” with the U.K., Ireland, and France constituting the most attractive European target environments.

Interest Rates and Bonds

Central bankers are likely to ensure that interest rates remain at low levels throughout 2013, so debt-financed mergers and acquisitions will remain possible, as will arbitraging the opportunities thus created. A related point: the globe’s “corporate bond issuance is expected to remain high for some time.” Bond issuance for 2012 was $2.158 trillion.

Bond issuance was healthy in Japan last year. It rose 16% in 2012 from 2011. Marubeni Corp. and Itochu Corp. issued bonds last year to finance their M&A activities.

Meanwhile, twelve ministries in the People’s Republic of China, including the Ministry of Industry and Information Technology, have together released guidelines for accelerating M&A activity in key industries. This is part of a “wider plan to consolidate China’s fragmented major industries, including [electronics], steel, shipping, automobiles, cement and aluminum.”

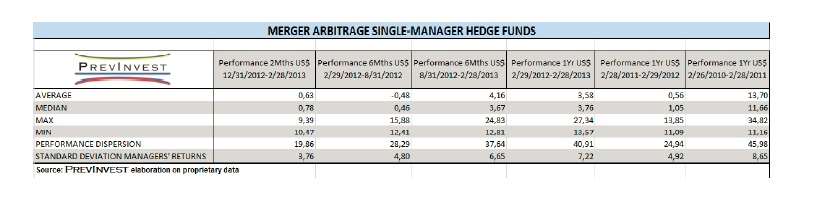

Source: PrevInvest

PrevInvest’s database for the risk arb strategy shows a 0.63% average return for the first two months of the year. Over the twelve-month period that ended February 28, 2013 the average return was 3.58%

All in all, though, PrevInvest takes “a cautious stance of the outlook for risk arbitrage … strategies for the current year.”