For years now, the Singapore-based hedge fund advisor GFIA has sent out its monthly report, Research Insights, looking at hedge fund performance over the preceding month on a region-by-region basis.

For years now, the Singapore-based hedge fund advisor GFIA has sent out its monthly report, Research Insights, looking at hedge fund performance over the preceding month on a region-by-region basis.

The reports have always contained a good deal of value, and we at AllAboutAlpha have summarized many of them, as for example here, and here and here.

On October 31st, in our innocent email inbox, we received news that the latest GFIA monthly newsletter will be the last, at least, “in this format.” That appears to mean, “In a pdf mailed out with monthly regularity.” Why? Perhaps because of disillusionment with the horse-race aspect of the sort of tracking this may encourage. After all, as this last review says, “the monthly numbers don’t really mean much – it’s the longer run performance of funds and their managers that matter.”

We are happily informed, though, that GFIA’s principal, Peter Douglas, “will continue to post his thoughts on the industry from time to time,” apparently on a newly created blog.

I’m not sure I agree with the sentiment that monthly results don’t matter. All long-terms are made up of short terms, after all, just as forests are made up of trees, and the body of an onion is made up of its skins, each seemingly superficial: The seemings of life, taken together, amount to the whole of life.

So let us launch ourselves into one final summary of these monthly pdfs.

Asia ex Japan

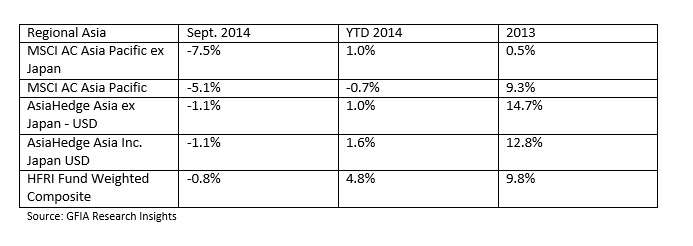

GFIA tells us of a sharp correction in September, hitting Asian markets (especially ex Japan) very hard, though not hitting the hedge funds quite so hard.

Equity markets fell more than 7% each in Korea, Hong Kong, Taiwan, and Vietnam. Southeast Asian markets performed better than did their northern cousins, but SE Asia too was hit by the U.S. Fed’s intention to taper its quantitative easing and thus to raise interest rates. [On September 17th, the Fed announced “a further measured reduction in the pace of its asset purchases.”] Most of the SE Asian currencies depreciated by more than 2% against the USD.

As you can see from the table above, the hedge fund indexes outperformed the equity markets, although they also inhabited negative territory in September.

Long/short SEA Crest Fund did better than that, getting into the black with 0.5% return, during a September in which it was lowering both its gross and net exposure. GFIA observes that this is counter to a trend; in general “managers are increasing their gross and net exposure to ASEAN while maintaining a more neutral position on China/Hong Kong.”

Cheyne Malacca Asia Equity Fund is part of this trend: quite aggressively so, with its gross exposure at 127%, a historic high.

Japan

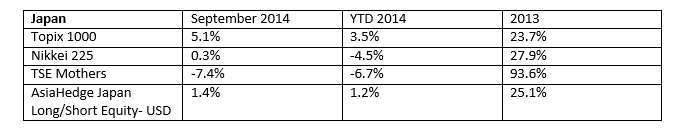

Meanwhile, in Japan, the weakening of the yen created an updraft in equities, but the small cap stocks underperformed, as you can see from the TSE Mothers’ September number in the table below.

GFIA credits GCI Japan Hybrid (0.2% in January) with a track record of “small but consistent returns” in recent months with a track record YTD of 4%. It’s a multistrategy fund that has benefitted from its convertibles and options positions, overcoming the losses on its financial sector hybrid securities.

UMJ Kotoshiro returned 0.6% in September. This comes despite its “high proportion of long small cap positions which saw pressure as investors piled up on large index names.”

In general, GFIA says, hedged Japanese positions should be seen as “the bedrock of any Asian alternative investment position” given the fine risk management skills displayed by the managers in that space.

Elsewhere

India has been enjoying a boom since its elections. But that ride has apparently come to an end, the benefits expected from the new government are now presumably fully reflected in asset prices, and attention turns to the international arena and India’s place there. The indexes showed weakness in September. As usual, some funds did well nonetheless, including Alchemy India Long-Term Fund (2.5%), which benefitted from improving consumer demand.

Emerging market currencies headed down in September against the U.S. dollar: the Brazilian Real down by 9%, the Russian Ruble down by 6%. And notwithstanding the relative calm in the Ukraine in September, confidence in Russian assets did not return.

Dubai’s Bourse was down for the month, and the action there was “all about IPOs” rather than broad price moves.