By Andrew Smith, CAIA

By Andrew Smith, CAIA

Master Limited Partnerships, commonly referred to as MLPs are often viewed as a tax advantaged structure for an energy infrastructure company. While this definition is not inaccurate, it is an oversimplification of the MLP industry. Companies structured as partnerships, including MLPs, do not pay income tax at the company level, providing them a tax advantage by eliminating the double taxation of a corporate structure. Many MLPs, unlike most partnerships, are publicly listed companies that trade on major stock exchanges. As is required by all public companies, MLPs must make quarterly and annual reports, and file reports in regards to any material information that affects the business with the Securities Exchange Commission (SEC).

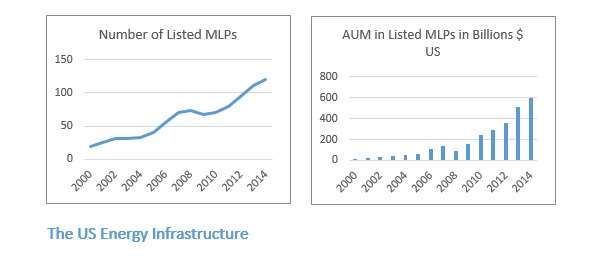

As of October 31, 2014, there were over 115 publicly listed MLPs with a combined market capitalization of approximately $500 billion.

MLPs typically operate under a business model that follows one or more of the following:

Exploration and Production

The exploration and production business model, often called E&P, involves searching for energy commodities such as crude oil, natural gas or coal, and bringing these commodities to the surface.

- Processing

Processing MLPs, much like a processing company that focuses on agricultural commodities, focus on transforming the raw energy commodities into a usable form. This may involve turning oil into gasoline and petrochemicals (such as plastics and other petroleum based non-energy goods), or simply cleaning the raw commodity by removing water and dirt. It could also involve separating the raw energy commodities into different qualities, for example, splitting natural gas into pipeline quality or natural gas liquids.

- Storage

Storage MLPs do exactly what the name implies; they store energy, whether in its raw state, or post-processing. Storage of energy can take many forms ranging from tanks to wells and from above ground to below ground. Storage MLPs provide energy companies economic flexibility, allowing them to control the supply of such commodities in order to maintain equilibrium (or close to equilibrium) with the demand for such commodities.

- Transportation

As the name implies transportation MLPs transport or move the energy commodities from one place to another. Often this is done through pipelines from the wells to the processing facilities, but once processes the refined energy commodities must be moved, once again to a storage facility or to be sold on the market. In North America, the majority of energy transportation is conducted via pipelines; however trucks, ships and railcars are still used to transport both raw energy commodities and refined products.

Comparing MLPs to Traditional Companies

MLPs differ from traditional companies in a variety of ways. One of the most obvious ways that MLPs separate themselves from the broader universe of publicly traded companies is by solely focusing on the natural resources sector. Another common attribute of MLPs that differentiates themselves from the universe of traditional companies is that they pay no corporate income tax, and therefore are able to pay a larger portion of their earnings to their investors. Traditional, corporate structure, companies pay federal and state (if applicable) corporate income taxes.

The ownership structure of an MLP is quite different from that of a traditional corporate structure company. MLPs have two different categories of ownership, as with all limited partnerships. There are general partners or GPs and limited partners or LPs. The GPs ownership interest in MLPs can be held by an investment company or fund, by the management team individually, or by a holding company (as is most common) typically a major energy company. LPs can be in the form of an individual and investment fund or a holding company as well, however legally, LPs may only take, as the name implies, a very limited role in the operations and governance of the company. GPs handle and control the operations and management of the company, and they typically own a much smaller portion of the company than the combined ownership of LPs. Further, unlike other publicly traded, corporate structure or registered investment companies, GPs have no fiduciary duty to the LPs, meaning they do not have to legally act on behalf of the best interests of the LPs. Having said this however, incentives in MLPs and most partnerships are aligned as such that the best interests of the LP and the best interests of the GP are one in the same.

Due to their legal structure MLPs have significant differences with traditional companies when it comes to governance. In contrast with the GP – LP relationship, management teams of traditional companies are controlled 100% by the combined shareholders. While management and founders of the company may own significant shares in a traditional company, all owners have one vote per share they own, and major business decisions are typically made by both management and shareholders by voting on such matters. Further, management of a traditional corporation legally has a fiduciary duty to act on behalf of shareholders, although often the incentives between managements’ interest and shareholders’ interests are not necessarily aligned the way that they are in an MLP ownership structure.

The MLP Business Model

Most MLPs (excluding exploration & production MLPs) operate under a fee based business model. A fee-based business model means regardless of the market price of the energy commodities being processed, transported or stored; MLPs receive a flat fee per ton of coal, barrel of oil or cubic foot of natural gas. This is often described as a “toll-roads” model, due to the similarity to toll roads and their fee based model for using the roads, regardless of the type of car or cost of the car for that matter that is using the road. Further, for the sake of stability of their business model, and the ability to predict costs, MLPs often have extremely long term contracts with the clients, on average ranging from 5 to 50 years, with the latter being quite common.

As a result of their fee based, or toll-road, business model predicting and/or calculating the revenue for an MLP is elementary. For predicting MLP revenue, analysts and investors would simply multiply the fee for using the MLP infrastructure ($ per barrel of oil for example) by the expected volume of the energy commodities. For actual revenue, the same equation is applied, however instead of using expected volume analysts, investors or management would use actual volume.

For E&P MLPs, the model is quite different. E&P MLPs typically purchase and manage mature oil and gas wells that are still producing, or can very quickly start producing energy commodities. For E&P MLPs profits are generated based on the amount of energy commodities they produce and the market price of said commodities. E&P MLPs commonly use futures and options to hedge their exposure to price fluctuations in the energy commodities they are producing, allowing them to lock in certain prices for a specific period of time.

Investor Benefits of MLPs

Investors in MLPs benefit from ownership when one or both of the two following occurs:

- The MLP distributes cash (often referred to as dividends with traditional companies) in the form of distributions. Typically this is measured by dividing the nominal amount of the total annual distribution per share by the price of the share to determine what is known as the yield.

- If the market prices of the MLP units increase to a price that is more than what the investor bought it for, the investor can sell and take a profit, commonly this is referred to as price appreciation.

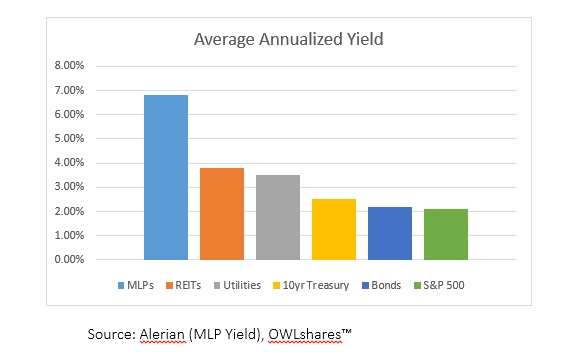

Historical average yields for MLPs over the past decade or so has been 6.8%. This means that if an investor held $100 of their portfolio in MLPs each year the investor would have received, on average, $6.80 in distributions.

In comparison, Real Estate Investment Trusts and Utility stocks, two asset classes well-known for their income producing potential and their high-yield, have averaged approximately 4% yields per year over the same time period. Bonds and the S&P 500 have averaged only 2% yields, approximately.

MLPs, unlike registered investment companies such as REITs and BDCs do not guarantee the distribution of a percentage of their cash flow or income each quarter. MLPs typically have within their partnership agreements a set or variable level of distributions that they attempt or intend to achieve, on average however, MLPs distribute between 80% and 100% of their cash flows.

MLP History

The history of publicly listed MLPs dates back to the early 1980s. During the 1980s, beginning with Apache Corporation, corporations, mostly energy and gas, but some notable non energy companies as well, began to aggressively restructure as MLPs. By the mid-1980s there were MLPs that were involved in everything from cable TV to amusement parks. As a result, congress began to see revenues from corporate taxes decrease significantly. In order to prevent corporate tax revenues from diminishing further Congress passed the Tax Reform act of 1986, subsequently President Raegan signed it into law. Not only did this law remove many of the tax shelters that existed at the time, it clearly defined the modern MLP structure.

Another act, the Revenue Act of 1987 limited businesses that could be structured and treated as MLPs as businesses that earn at least 90% of its gross income from “qualifying sources”, strictly delineating those qualifying sources as transportation, processing, storage, and production of natural resources and minerals. In order to not anger any of the firms that took the time and underwent the expenses related to restructuring as an MLP were allowed to be “grandfathered” in and remain an MLP, however over the past 3 decades these companies have, for the most part, been converted to other structures or are no longer publicly traded.

MLPs, in the mid-1990s, had experienced a downturn in business and many of the original MLPs structured in the 80s were not able to maintain their cash distributions. As a result many of them stopped trading. In the same time frame, many of the real estate companies that had restructured as an MLP during the 80s converted to a REIT structure.

The MLP industry began to evolve in the early 2000s, with many MLPs buying, operating and maintain tanker ships, used for sea transportation, as well as storage tanks and tanker trucks used to transport and store propane. Also in the early 2000s, coal companies began converting their structure to MLPs. In the middle part of the first decade of the new millennium, due to all-time highs and upward trends in oil and gas prices, exploration and production MLPs began to resurge.

Over the past 5 years, the use of hydraulic fracturing, commonly referred to as fracking, has led to a US energy renaissance, and in order to serve the companies that utilize fracking to unleash the enormous oil and gas reserves in the US, frac sand (a key component to fracking), natural resource marketing, and refining MLPs have come into existence. Since 2000, at least one new MLP has listed on major US stock exchanges every year except for in 2009, when there were no new MLP listings. In total, over the past 14 years 124 new MLPs have been listed and now trade publicly, that is an average of approximately 9 new MLPs per year since the turn of the millennium.

The US Energy Infrastructure

Prior to World War II, the majority of energy transportation was conducted via tanker ships, most commonly transporting oil from the Middle East to refineries along the gulf coast, and then once refined, back to the east coast ports to be delivered to the major US cities, the largest regional consumers of energy. When the US military involved itself in WWII, Hitler’s German Submarine fleets began attacking and sinking these tanker ships. The government, in cooperation with major energy companies, built a system of pipelines that were able to transport energy commodities over long distances.

These pipelines consisted of both large “trunklines”, often as large as 42 inches in diameter, that transport energy to smaller pipelines, which connected to towns and cities as delivery lines.

The larger pipelines take in oil and gas products from many different sources, and when delivered to an end customer, the amount is the same, however the exact source of that product may be difficult to define as the energy product from multiple sources are combined in the pipelines. Smaller delivery pipelines however deliver the exact order from a specific source to the end customer.

The US Energy Boom

Technological advances have constantly changed human interaction and economic activity, often for the better but typically with some minor drawdowns. The internet made global communication much more efficient, smartphones and mobile internet access has increased the efficiency of many professionals, going back in time, industrialization of everything from agriculture to construction shifted the dynamic of both rural and urban life.

As the technological advances dramatically changed the lives of those living in developed nations, energy production technology in the US has significantly increased the country’s capacity for producing energy commodities. The new technologies we speak of are hydraulic fracturing (fracking) and horizontal drilling.

For the past century, dating back to the last 1800s, vertical drilling was the only way to build an oil or gas well and harvest the earth’s natural energy resources. Vertical drilling, as the name implies, consists of using an industrial drill to go straight into the ground and dig down to the pool of resources. Vertical drilling limited the amount of resources that energy production operations could harvest.

Horizontal drilling, as the name implies, allows the drill bit to make a 90 degree turn, usually once the depth of the well has been reached, and continue to drill horizontally. Instead of drilling many vertical wells, now energy companies can drill one vertical well, and then cut horizontally to other pools of natural resources in the area.

Fracking is a process that occurs after the well has been drilled. When the hole is dug, so to speak, the well is then lined with a protective casing, preparing it for the fracking process. Fracking uses a mixture of specific chemicals, sand and water which is then pumped, at an extremely high pressure, into the well to break up rock. The fracking process is very controversial, but is also very effective for unleashing energy resources that were not previously able to be harvested. These natural resources were previously unable to be harvested because they were trapped between layers of what is known as shale rock. While the applications of these technologies, widespread, are something that has only recently begun to occur, horizontal drilling has been around since the first half of the 20th century. Fracking has existed since the 1940s, and was first applied commercially in 1949. Natural gas companies were the first to apply these technologies across the industry in the early 2000s, however after seeing the potential profitability of the application of these technologies oil producers began utilizing horizontal drilling and fracking in the second half of the first decade of the 2000s.

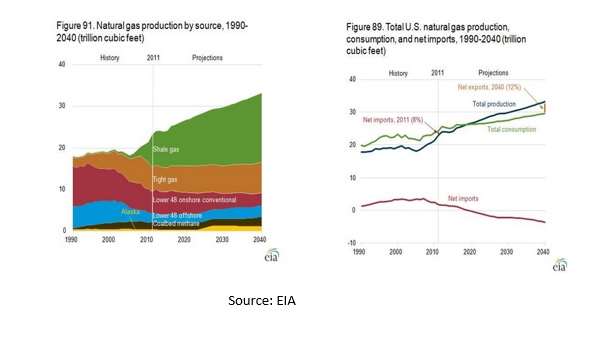

As a result of the application of these technologies, oil and gas production has increased significantly, and is expected to continue to do so. Expectations are predicting an increase in natural gas and oil production of up to 55% from 2014 to 2040, with the majority of this increase resulting from shale gas production. The expected increase in shale gas production alone is over 100% during the same period.

One of the major results of the application of this technology is that the US is now the global leader in natural gas production, and is also projected to become the largest oil producer in the world by the end of 2014. Further, it is expected that the US, due to this boom in energy production, will become energy independent between 2020 to 2030, with some projections showing we will become net energy independent by 2016 and some as far out as 2040. The goal is to produce more oil and gas domestically than is consumed, allowing the US to become a major net exporter of energy commodities globally.

Global Growth in Demand for Energy

Countries around the world that were previously thought of as 3rd World nations are industrializing and rapidly advancing both socially and economically. The result is an increase in the demand for energy. These countries, using recycled technologies, primarily generate energy from coal plants. The result has been an increase in the exporting of coal and an increase in demand for coal. Historically, and currently coal has been and still is the largest source of energy production in the US, however natural gas power plants are becoming more popular due to their economic and environmental viability. Under the current political environment the use of coal is viewed as environmentally damaging, and the Environmental Protection Agency (EPA) has been appointed the responsibility of crafting and enforcing widespread regulations and standards aimed at reducing carbon pollution, this has increased the cost of operating coal power plants and the likelihood of the retirement of such plants.

Further, the demand for natural gas among petrochemical corporations has significantly increased, with many global and multinational companies moving their petrochemical operations to the US in an effort to capitalize on cheap natural gas domestically. The increase in the supply of natural gas has led to the development of what are known as gas-to-liquid (GTL) plants. GTL plants convert natural gas into liquid forms of fuel such as gasoline or diesel. Currently there are no GTL plants operating in the US, however the development of such plants are being planned due to the abundant supply of natural gas domestically, typically these liquid fuels are refined from crude oil, however the potential to turn natural gas into liquid fuels may soon be a reality.

Due to globalization and global industrialization, the demand for energy has skyrocketed the past two decades. As a result of both the increase in demand for energy globally as well as the abundant supply of cheap natural gas in the US, companies in the US are now exporting natural gas for the first time ever, and the exports of liquefied petroleum gas (LPGs) are at all-time record highs.

How MLPs Benefit from Supply & Demand for Energy

While some MLPs are involved in exploration and production, the majority of MLPs are not the firms taking on the massive risks involved in drilling and utilizing the new technologies leading to the energy boom in the US. Instead, MLPs provide the services that these E&P firms require to move their products from field to refinery, to store their products prior to sale, and to refine their products into the final good that will be sold to consumers. MLPs that provide the transportation, processing and storage for the abundant supply of oil and natural gas coming to market benefit significantly from the expansion of US energy production, without the high risks involved with drilling new wells.

As a result of the US energy boom and the abundance of supply of oil and natural gas massive new energy infrastructure will need to be built throughout North America, and primarily in the US. The Interstate Natural Gas Association of America (INGAA) released a study in 2014 that projected and quantified the amount of new infrastructure that would be needed by 2035. The INGAA study claims that over $640 billion, or approximately $30billion or more per year. As discussed in the “Introduction to MLPs” topic, the current market size, measured by market cap, of MLPs is approximately $500billion. According to the INGAA, that market will need to increase by approximately 128% over the next 20 years.

According to Alerian, the largest MLP focused index company, the MLP space is expected to grow 10%-12% annually long term. This assumption is based on no meaningful price appreciation, but rather is based on an assumption of a 6% annual yield and distribution growth of 4%-6% per year. The growth numbers they project are based on incremental construction of new assets to support the US energy boom.

The Risks of MLPs

Understanding the risks of any investment is one of the main factors to long-term success as an investor.

Interest Rate Risk – MLPs are high-yield investments, due to this historically MLPs have been perceived by the market, and subsequently trade similar to other yield investments such as bonds, utilities or REITs. This subjects yield assets to being analyzed in comparison to government bonds (commonly 10 year treasury bonds). Analysts and investors use a measurement called the yield spread to make this comparison. The yield spread is the difference in the yield of an asset class, such as MLPs and the yield on government bonds. US Government bonds are considered risk free, as such, the yield spread typically defines the additional risk that investors are willing to accept in return for a higher yield. Yield moves inverse to price, therefore if interest rates on government bonds increase, and investors demand the same yield spread to MLPs, the price of MLPs will decline. There is some historical evidence that indicates MLP prices do not respond positively to announcements of a rise in interest rates. Over the long term however, as interest rate increases are typically correlated to an increase or expected increase in inflation, revenues of MLPs tend to increase in line with inflation, and therefore as do dividend distributions made by MLPs, which can potentially mitigate the effect on price depreciation of MLPs due to a rise in interest rates.

Commodity Pricing Risks – The price of commodities typically does not correlate directly to the price of most MLPs, however for E&P MLPs and refining MLPs the price of energy commodities does directly affect revenue and earnings. For other MLP business models, commodity price volatility or changes in supply and/or demand that leads to commodity price volatility can have indirect effects on revenue, earnings and pricing of MLP securities. For example, if energy commodity prices increase significantly consumers are likely to decrease their energy consumption, this will in turn lead to a lower demand for transportation and storage of energy commodities, and thus effect the revenue of MLPs, and vice versa. The psychology of market participants may, due to the business models of MLPs, determine there is a connection between the success of MLPs and energy commodity prices without considering the effects of higher supply and lower energy commodity prices in regards to the business model of MLPs.

Environmental Risk – Much of the energy infrastructure currently in place in the US is aging. Pipelines, in particular those built in major transportation corridors were designed and built most prevalently in the 1950s and 1960s. Further, in the past decade or so there have been a couple of highly controversial oil spills that were covered excessively by the mainstream media. The combination of high profile spills and an aging pipeline system has raised some concern in regards to environmental implications and thus has raised concern among investors in regards to potential regulatory changes that may add financial burdens to MLPs. Having said that, pipeline transportation is by far the safest way to transport energy commodities. According to a presentation given by Cheryl Trench at the April 2012 API Pipeline Conference, titled “Improving Liquid Pipeline Safety: Signposts from the Record”, pipeline transport is 34x safer than transportation by road. Further, due to advancements in technology that allow from more accurate and frequent monitoring in pipelines, the number of spills per 1,000 miles (the standard measurement for pipeline spills) have decreased by 60% over the past decade, and the number of barrels released during the pipeline transportation process has decreased by approximately 42% over the same time period.

Legislative Risks – The environmental risks listed above can often carry over into the category of legislative or regulatory risk. Government actions are often dictate by public opinion. Currently public opinion in regards to many important aspects of the MLP business models are mixed, particularly in regards to the subject of Hydraulic Fracturing (Fracking). The potential environmental risks are constantly being weighed against the potential economic benefits. Fracking is the subject of much debate, such debate has already lead to certain changes in the regulatory environment. For example, in the state of California and in New York State, fracking is banned, as it is in parts of Europe. If fracking bans occur in other states in the US or potentially federally, it could potentially damage the MLP business. The Environmental Protection Agency and the Department of Energy & Interior are currently conducting a joint study on the safety of fracking and how it potentially effects drinking water. This is the result of mixed claims that fracking may or may not contaminate ground water resources. Other claims that lead to the debate of the safety of fracking is whether or not fracking has an effect on tectonic plates and whether or not it can potentially cause more frequent earthquakes.

Potential regulatory risks, unfortunately, are not the only legislative risks surrounding MLPs. Due to the tax advantaged structure of MLPs they have become wildly popular, particularly among investors seeking stable tax advantaged income. Historically speaking however, changes in the tax structure and particularly that of MLPs has been changed before. If there is public sentiment that urges the government to eliminate what are perceived as tax loopholes, it is possible that the MLP tax structure may be legislatively eliminated. While the precedent for such sweeping changes do exist, due to ongoing conflicts in the Middle-East, the historical dependence on Middle Eastern oil supplies, a perceived economic advantage of becoming energy independent in regards to both these conflicts as well as global economic competitiveness, and the need for significant energy infrastructure investment if such independence is to become reality, the likelihood of tax regime changes in regards to MLPs is in our opinion low. Though the likelihood of this type of change in tax policies is low, it must be considered.

Andrew N. Smith, CAIA is a Co-Founder and Chief Product Strategist for OWLshares and serves as the chairperson of the Steering Committee for the Los Angeles Chapter of the CAIA Association.