According to his twitter account, Yanis Varoufakis has been “quietly writing obscure academic texts for years, until thrust onto the public scene by Europe’s inane handling of an inevitable crisis.” He is on the scene because the coalition government emerging from the Greek elections has named him that country’s new finance minister.

According to his twitter account, Yanis Varoufakis has been “quietly writing obscure academic texts for years, until thrust onto the public scene by Europe’s inane handling of an inevitable crisis.” He is on the scene because the coalition government emerging from the Greek elections has named him that country’s new finance minister.

The announcement of this name for this office seems to have taken some observers by surprise. The Telegraph’s correspondent, Peter Spence, marvels that this is “not the socialist firebrand one might expect.”

Back to Athens Through Austin

Varoufakis has been teaching of late at the University of Texas at Austin, the Lyndon B. Johnson School of Public Affairs. His appearance on the public scene in Greece, by “thrust” or otherwise, is really a re-appearance. A decade ago he was an advisor to George Papandreou, who was then leader of the opposition in parliament.

Obviously a lot of water has flowed under a number of bridges, personal and political, since that time. Varoufakis had no connection with the Papandreou government of 2009-11.

What is clear about him is this: Varoufakis believes in the single currency. It is unlikely that he will preside over the finance ministry of a government bringing back the drachma. Indeed, he was one of three co-authors of a 2013 paper, “A Modest Proposal for Resolving the Eurozone Crisis, Version 4.0.” This paper advocated more centralization in the Eurozone, not less.

The title of that paper might suggest Jonathan Swift’s infamous parody of the inhumanity of English policy in Ireland, but this particular “modest proposal” really does seem unassuming. For example: One of the items on the agenda of Varoufakis et al. there involves direct bank capitalization. That is, he and two colleagues (Stuart Holland of Coimbra University in Portugal and James K. Galbraith, one of Varoufakis’ UTexas colleagues) propose that Europe’s banks in need of recapitalization from the European Stability Mechanism appeal to the ESM directly, over the heads of their respective national governments.

At present, the national governments (of Cyprus, Greece, or Spain) borrow from the ESM on their bank’s behalf. It seems sensible for Varoufakis et al to want to change that, to want to remove the national government as indispensable middleman for such a bail-out, because as they point out the “deadly embrace of insolvent banks by insolvent [national] governments” is clearly part of the problem, and isn’t going to be any part of the solution.

The take-away, though, is that Varoufakis’ views, coupled with his immediate appointment by the new PM, indicate that the new government doesn’t want out of the Eurozone, or out of the euro.

Another Take-away

The problem with the new government may prove to be not that it will consist of a bunch of fire-breathing radicals, but that it will consist of people whose sometimes-radical rhetoric hides their refusal to look into the root of the problem: that is, of people who aren’t radical enough for the task at hand.

For the problem isn’t one that will be resolved by half measures. The problem is that the Eurozone looks like a more-or-less random collection of states, and a very odd collection to wear the garb of a single currency.

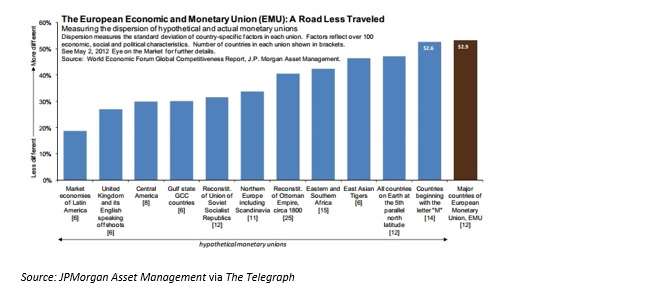

The chart above illustrates this point in an amusing way. Back in 2012 an analyst at JPMorgan calculated the “dispersion of hypothetical and actual monetary unions.” The market economies of Latin America, at the left edge of that chart, might be a plausible candidate for a monetary union; their economies are the least dispersed of any of the sets that the analyst, Michael Cembalest, tested. Or if all the nations that were once part of the unlamented USSR should adopt one currency – that would be, though a more disperse group than the Latin American analog, still far less so than the Eurozone. Less divergent, too (in terms of a collection of “economic, social, and political characteristics”) are the nations that would be involved in a reconstitution of the Ottoman Empire, or the East Asian Tigers.

Indeed, the closest analog to the EMU, according to Cembalest’s analysis, would be a collection of all the countries on earth that begin with the letter “M.”

To return to the new finance minister: just before the voting that put the new government into office Varoufakis told the Economist that he objected to many features of the ECB’s quantitative easing plan. He sympathized with Mario Draghi’s difficulties: The ECB, Varoufakis says, “faces political and legal constraints that prevent it from pursuing a sovereign-bond-purchase program that would work well in practice.” But for that very reason it ought to create money by buying some other asset, bypassing those constraints and thus making itself more effective “in tackling deflation and the chronic underinvestment that has caused it.”

Some of the (friendly) critics of the Federal Reserve in the U.S. have made much the same point, seeking to press it, too, into buying other sorts of assets. As James Rickards told us almost two years ago, these aren’t so much radical proposals as they are wild-card proposals. Varoufakis is the Greek answer to Lawrence Summers.