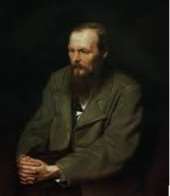

Sometimes I can’t help but think of a passage from The Brothers Karamazov:

Sometimes I can’t help but think of a passage from The Brothers Karamazov:

“It was known too that the young person had, especially of late, been given to what is called ‘speculation,’ and that she had shown marked abilities in that direction…. [S]he had for some time past, in partnership with old Karamazov, actually invested in the purchase of bad debts for a trifle, a tenth of their nominal value, and afterwards had made out of them ten times their value.”

The evident condemnation of Grushenka’s entrepreneurship by her unhappy neighbors was part of the great historic tragedy that led in time to the liquidation of the “kulaks.”

The ongoing MiFID II process is unlikely to have quite so tragic a consequence but it does display the old speculation-is-evil premise, a premise one might have hoped had long been abandoned.

This all brings us to Eurelectric, an association representing the interests of the electrical power industry throughout Europe, and which sent a letter to the European Commission recently that expressed its unhappiness with proposed rules for the implementation of MiFID II.

The letter is symptomatic of the continuing concern on the part of industrial firms that use energy derivatives that they are going to be collateral damage in an effort to control the financial/speculative employment of such derivatives.

A Process Nears Completion

MiFID II/MiFIR authorizes the European Securities and Markets Authority (ESMA) to create regulatory technical standards (RTS) and implementing technical standards (ITS).

ESMA expects to submit the final RTS to the EC in June of this year, and the Final ITS in December.

Eurelectric is plainly unhappy about the direction in which things are going. “With the current proposals,” it says, “we believe that ESMA is exceeding its given mandate and that it is defining rules that do not respect the text and spirit of the adopted legislation.”

The Directive itself, as Eurelectric’s letter observes, acknowledged “the difference between financial and physical trading and includes on this basis specific provisions for the energy sector. “ But the implementing rules … not so much.

The proposed implementation does allow an exemption from MiFID coverage for commodity trading activity that is “ancillary” to a company’s operations, which sounds re-assuring from Eurelectric’s point of view. But there is a tricky two-part test for ancillary: the capital employed in the commodity derivatives trading must remain below 5% of total capital and the group’s market share in individual commodity markets (i.e. the coal or power market) must remain below 0.5%. Companies can find themselves subject to the MiFID regime if they pass either of those low thresholds.

Bullet Points

In bullet point format, Eurelectric’s objections are:

- That the greater costs of trading will lead to the withdrawal of market participants from the market, illiquidity, and a loss of market competition;

- That the loss of liquidity will make risk management more difficult in the energy sector;

- Market prices for industrial and other end users will increase, endangering “the competitiveness of European industry compared to other geographical zones”;

- The loss of opportunities to hedge will increase price volatility which will impede the development of renewables;

- There will be other unintended consequences as industrial customers “see purely commercial contracts for delivery of commodities defined as commodity derivatives.”

Part of the underlying problem here, I think is the whole notion that it is possible and desirable to separate speculation from hedging. Speculation, according to the instincts of the run-of-the-mill central planner, is bad. Hedging is good. So, surely, the two have to be different. Hedging is “Main Street,” operational, physical, all that good stuff. Speculation on the other hand is either wildly disastrous or wildly and undeservedly successful, and a bad thing for “the public” in either case.

Someone who is working from that kind of premise will end up chasing speculation from the macro to the micro, lowering any thresholds to its definition, and running right into the legitimate hedging activities they started off praising. That has been the story of MiFID II, the story that the Eurelectric comment traces in the manner of someone who has been forced to suck on a lemon against either will or inclination.

The Angelic Side Keeps Narrowing

Along with the above thresholds, there is also the question of whether contracts that must be physically settled have a special status on the angelic side of this distinction. It turns out they do, but that the angelic side keeps narrowing!

ESMA is willing to exempt from MiFID contracts for wholesale gas or electricity that are traded on an organized trading facility (OTF) and it “must be physically settled.” This is known as the REMIT carve-out.

In its final technical advice, submitted to the EU in December 2014, ESMA narrowed the side of the angels. In pre-Copernican terms, it introduced an epicycle. “Must be physically settled contracts” should contain “provisions which ensure that parties to the contract have proportionate arrangements in place to be able to make or take delivery of the underlying commodity.”

This epicycle was introduced at the last minute, Eurelectric complains, and thus hadn’t been part of the foregoing consultation process. It does seem likely to give the European energy markets a push toward the five unhappy bullet points above.