The Challenges that Come With Robust Health

A new report from McKinsey says that the asset management industry in North America is “in a robust state of health,” given the “positive momentum of the past five years.”

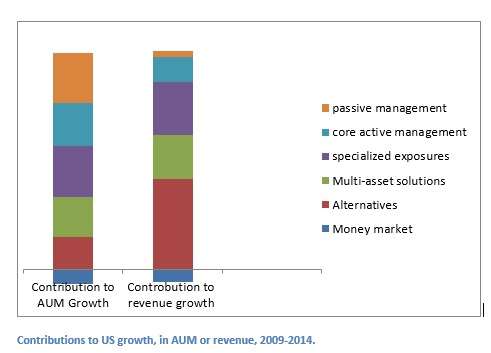

Three asset classes in particular have accounted for this momentum, demanded by both retail and institutional investors. They are: specialized exposures (including emerging markets and high yield bonds); solution-based products (such as multi-asset income funds); and alternatives.

Money markets meanwhile have been losing ground. As the graph below, adapted from the report’s “Exhibit 5,” indicates, their contribution to U.S. average assets under management growth through the period 2009-14 was -7. Since the total AUM growth in the period was $9 trillion, this indicates a loss for money markets funds of $630 billion.

The near-zero interest rate environment surely has a lot to do with the shrinkage in the money market realm and the growth in the other listed asset classes.

New Pools of Capital

The emergence of new pools of capital has been very good to the asset management world in North America. The report lists four new pools – not new in an absolute sense, but pools that have each “come of age” only recently: defined contribution pension systems; insurance general accounts; sovereign wealth funds; and the HNW individual investors of emerging nations, especially Asia. Together, these pools account for 89% of global net flows since 2009.

Contributions to US growth, in AUM or revenue, 2009-2014.

So, all good news, right? But? Yes, there’s always a but.

The report also says that the industry faces challenges going forward, challenges that arise from shifts in client demand, “Product innovation, distribution, technology and regulation.”

McKinsey sees the challenges this way:

- Responding to the passive revolution;

- Serving a fragmenting client base;

- Getting or staying ahead of advances in data and technology;

- Creating and sustaining operating leverage;

- Dealing with the rising tide of regulation.

In connection with the passive-investing revolution, the specific challenge is for management to show clients that it can create value that passive allocation cannot. Managers have material to work with here, because investors have continued to “value what the [high-demand] categories delivered to their portfolios,” and because the very cheapness of the passive strategies leaves investors with additional budget for active alpha pursuit elsewhere in their portfolio. In general, under this head, the McKinsey message to active managers is “don’t panic.” The passive revolution is not as thorough as it sometimes looks.

Focused Decisions and Tech Advances

Under the second heading, management will have to make focused decisions about where to compete in this fragmenting world, both “where” geographically and by strategy. To balance the demand for greater specialization, though, firms will also have to “continue to innovate in distribution and build scalability into their product platforms.” In the process, they’ll come to understand that when factors such as client acquisition costs are taken into account, the “net present value of client segments” is the real bottom line, not gross sales/redemptions.

That leads naturally enough into the discussion of advances in data and technology.

Staying ahead will involve the aggressive adoption of approaches, technologies, and talent, from outside the asset management industry.

Managers ought to be aware of the degree to which unfolding technology frees up bandwidth that might once have been consumed by routine research tasks, such as ploughing through the drab pages of regulatory filings. The industry leaders five years from now will be those who have managed to use the freed bandwidth to do something more creative, something that yields competitive advantage.

On the fourth of the challenges in the above list: the cost base of North America’s asset managers has risen steadily of late – that is, operating leverage has been in short supply. Why? In part due to the performance-related nature of compensation in the industry, in part due to the increasing complexity of operating models, and in part due to a “sales and marketing arms race.” All this leaves the industry’s operating entities highly vulnerable to a downturn, or even just to a pause in the industry growth.

The proposed McKinsey solution comes down to “the greater use of outsourced operational and technology resources that effectively ‘variable-ize’ important spend categories.”

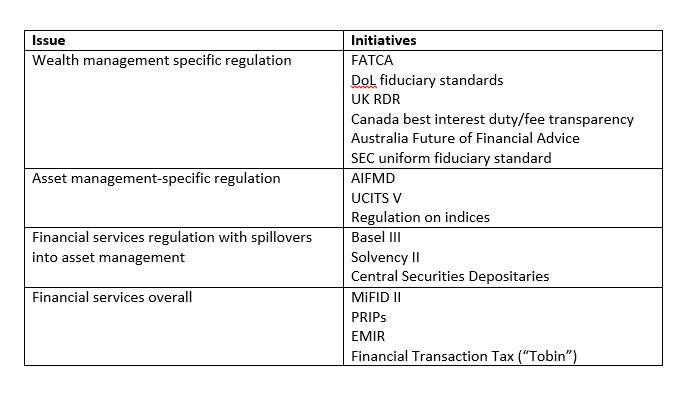

Fifth and finally, there is the “rising tide of regulation.” Below is a table of some leading regulatory issues and the responsive initiatives to each. The table is adapted from the report’s “Exhibit 17.”

The near-term term focus of regulators, McKinsey thinks, will remain the retail side of the market, which entails concern for transparency in pricing, distributor incentives, open architecture in platforms, and a “unified set of fiduciary standards in asset and wealth managers’ relationships with individual investors.”

Look to Arb the Regs

This could have important macro consequences. Bu for example imposing a cash drag on active investment vehicles, rendering more difficult than it is as yet the problem of competing with passive vehicles. Managers should go “beyond a reactive compliance-driven approach to rethinking business models and product lineups in order to take advantage of opportunities created by regulatory discontinuities.”

In short, where there are regulations, there are opportunities for arbitrage. Don’t fight it: join it.