Fundraising for agriculture/farmland-focused funds has been remarkably strong recently, according to research by Preqin, the multi-national data and consulting firm.

Farmland has been aptly described as the “oldest alternative investment” and dates as far back as 9,000 years ago.

The focus on Preqin’s special report on agriculture is somewhat more recent than that, though. It discusses trends in the field since AD 2006.

Some quick facts

More than 100 unlisted ag funds of one variety or another have closed over the last 10 years, raising aggregate capital of approximately $22 billion.

In 2013, 18 of those funds closed, securing $1.6 billion.

In 2014, the number of closings was 17, but the amount of money raised was $4 billion, a peak.

In 2015, ‘only’ ten funds closed, but those closings secured $3.9 billion.

At present there are 48 vehicles in the pipeline.

More than a third (35%) of the capital raised since 2011 has been for funds with a primary focus on North America. Sixteen of the 48 in-pipeline funds focus on North America.

Missing the Target

Managers have been aiming quite high in terms of their fundraising targets, so they sometimes fall short. The average fund that closed in 2012 secured only 77% of its target. On the other hand, some funds have closed significantly above target. For example, TIAA Asset Management raised $3 billion for TIAA-CREF Global Agriculture II last year, thus exceeding by 20% the target of $2.5 billion.

TIAA-CREF Global Agriculture II will invest in high-quality land in a number of regions around the globe, including the U.S., Australia, Brazil, Chile, and New Zealand.

When unlisted ag fundraising is graphed as a proportion of all natural resources fundraising, the result is very volatile. The farmland percentage was only 0.8% in the first year covered by Preqin’s data, 2006. It has been as high as 7.4% (twice, in 2007 and again in 2012). In 2014, the percentage was 5.4%. In 2016, up to July 20, it was 1.8%.

Natural resources’ fundraising as a whole is dominated by energy-focused funds, which constituted 78% of the overall natural resources assets under management as of December 2015.

A League Table

The preparers of reports like this are spoils’ sports unless they include a league table. Preqin includes more than one, but we’ll present only one of them here.

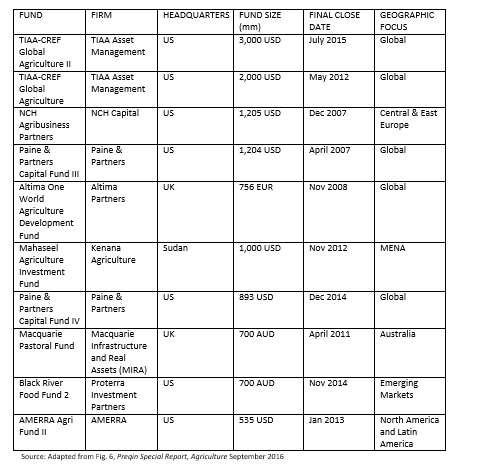

The ten largest funds that have closed since 2006 are as follows:

It is clear from the above table that the managers of nine of the 10 largest funds are headquartered in either the U.S. or the U.K. The Sudan-based exception is Kenana Agriculture, the manager of the Mahaseel Agriculture Investment Fund.

The Investors

So: who are the investors in such funds? Preqin says that the largest proportion of institutional investors in ag are public pension funds (20%), followed by endowments at 14%, foundations (12%) and private sector pensions (also 12%).

Only 6% of investors have a separate portfolio allocation for farmland. For the remainder, such farmland investments as are made come out of the allocations for private equity, or real assets, or natural resources.