With the sponsorship of Franklin Templeton, The Economist Intelligence Unit (EIU) has surveyed 143 investing institutions in North America (part of the global sample of 571) in order to study recent shifts in their portfolio allocation, especially with an eye to the risks that concern them and the length of their time horizon.

In an accompanying press release, Kevin Plumberg, editor of the report, said: “U.S. political and regulatory risks appear to have moved to the foreground for a lot of North American institutional investors, and as a result many have found perhaps temporary refuge in rising stock markets.” This recourse to equities is tactical, not strategic, and these institutions (again in Plumberg’s words), remain “focused on the long-term goals as near-term risks evolve.”

Challenges

When North American investors were asked to select two out of seven possible risks as their “main challenge” in meeting their objectives, they responded thus:

The numbers reach 199% rather than 200%, presumably due to rounding.

An obvious question might be: are risks increasing or decreasing over time, in recent months and years, in North America? But that would be too simple. The report begins with the assertion that the risk environment is “complex, neither very negative nor very positive.”

Focus

The administration of President Trump is “idiosyncratic” and appears to have only a very limited ability to enact legislation. The Federal Reserve wants to increase the federal funds target rate. Equity markets are near all-time highs, which makes many nervous (be worried when most are greedy, be greedy when most are worried, say the sages), the regulatory environment is uncertain and “disruptive technologies are having an impact on many industries.”

Nearly half of the institutions surveyed say they have become more focused on their long-term objectives in recent months (47%). Only 20% say they have increased their focus on the short term.

More than four fifths of the respondents (81%) say that regulatory uncertainty in the U.S. has caused them to reallocate their portfolios to increase holding of a particular asset class. For many of them, equities are this class. That may seem odd, because one intuitively thinks of a flight from equities in times of uncertainty, not a flight toward them! Still, the low-yield environment in fixed income instruments has helped make possible the use of U.S. large-cap equities as a safe haven.

This suggests, says the report, “that some of the current bull market in U.S. stocks is being driven by tactical investments, rather than by fundamentals-driven decisions.”

Nearly half (48%) of the institutions surveyed use alternative investments.

Worries

The issue of the mispricing of risk (the second most prevailing worry on the above chart) is more of an issue for the larger institutions in the survey than for their smaller brethren. The report’s authors speculated that this may be “because the absolute amounts of money that are involved are much greater” for the larger institutions.

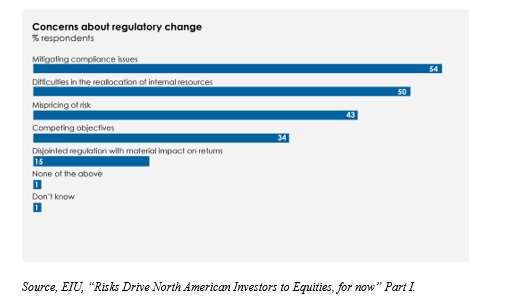

The respondents were also asked to zero in on worries related to regulatory change, and to name the top two priorities here on a list of seven. The results were as follows:

As you can see, compliance issues are the biggest ones here. The possible disjointedness of regulation turns out to be less of a worry than the surveyers seem to have expected it to be, getting into the top two of only 15% of the respondents.

Passivity

Two thirds of the surveyed investors run portfolios that are either entirely or mostly passive. This includes tracking the moves of an index, or a group of indexes, or mimicking the moves of a referenced asset.

Around half of the respondents run portfolios that are evenly balanced between active and passive components. A little less than one fifth (19%) say that they have taken a mostly or entirely active approach.

Vijoy Chattergy, the chief investment officer for the Hawaii Employees’ Retirement System, says that his organization is shifting to a more active approach given present challenges. It “may never return to what has been seen as a normal growth environment,” he said, because it is “much harder to add value in public markets.”