The Mekata Investment Group has published a white paper on global macro hedge funds, contending that a position in such a fund is a valuable defensive tool for an institution.

Global Macros are valuable because they perform best during turbulent or volatile markets, which is when defense is most needed, when “traditional assets” are likely to take their hits.

Separately, they have, the paper contends, “decent stand-alone risk-adjusted returns [and] attractive correlations relative to equities.” They also exhibit positive skew, that is, the curve representing their returns is asymmetric, allowing for frequent small losses and few extreme gains. All of that is helpful as an addition to a portfolio that “derives the majority of its risk and return from equity-like strategies.”

The paper is the work of Roberto Obregon CFA and W. Brian Dana CAIA. They distinguish three types of global macro manager, the discretionary, the systematic, and the tail-risk hedger. “Discretionary” means that “individuals, not computers, are responsible for the implementation of all investment ideas.” Systematic managers run quantitative strategies implemented by computer models.

Not long ago, one would also have characterized systematic global macro funds without further ado as “trend following,” since it would have seemed obvious that following trends is what computer models are good at.

But computers are good at a wider range of thing than they used to be, and systematic fund managers can now “implement the entire spectrum of Global Macro strategies (e.g. carry, relative value, etc.).”

Tail risk hedgers are those – whether discretionary or systematic – who hedge against market crashes or disastrous events, perhaps out of the conviction that black swan events are more common than (other) models expect them to be. “Unlike traditional insurance strategies, however,” Obregon and Dana add, “these funds should not be expected to lose money in all other market environments.”

The great limitation on the range of strategies available to a Global Macro fund is portfolio liquidity. This is important to the managers because given the definition of the class they have to have the flexibility to react quickly to changes in global macroeconomic conditions in a top-down way. Given that one limit, though, such managers have a wide opportunity set including “direct ownership of equity and fixed income, and indirect ownership of most asset classes through derivative instruments such as futures, forwards, and options.”

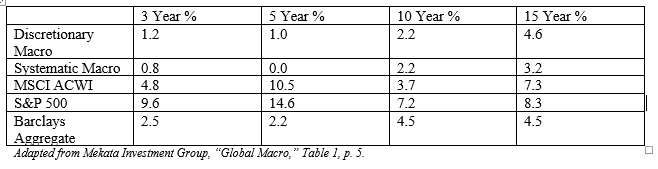

In a table, Obregon and Dana contrast discretionary and systematic Global Macro annualized monthly returns for the period January 2001 to June 2017 with indexes tracking the returns of more traditional assets.

The table shows Global Macro lagging, especially behind the stellar performance of the S&P 500 during the period covered. The paper reminds us that “the performance period studied” in this table “coincided with two strong bull markets for equities, periods that … are not favorable for Global Macro strategies.”

It also shows that the human touch has not yet become obsolete in this digitalized age. Discretionary macro either beats or ties systematic macro in each of the time frames presented. The Sharpe ratio for discretionary global macro is 0.73. For its systematic cousin that ratio is 0.30. Discretionary also has greater positive skewness (0.39 versus 0.34). Each of the three indexes for traditional assets involved in the table above has negative skewness through this period. That is greatest in the case of MSCI ACWI, at -0.73.

In an appendix, the authors discuss trend-following strategies as illustrated by the Societe Generale Prime Services SG Trend Indicator.

They suggest (with the usual qualifications about a hypothetical versus a ‘real world’ strategy) that a trend following strategy that went long on the Japanese yen whenever the 14 day average was above the 6 month average, and went short whenever the reverse was the case, would have done well during the 2016 calendar year. The yen “had a relatively smooth trending behavior, consistently appreciating in value over the first 10 to 11 months of the year,” something that changed right after the U.S. presidential election.

They also say that a trend strategy following the price of Brent Oil during the same year would have been quite unsuccessful, as that asset “experienced multiple inflection points during the year, with eight different signals to change positions.”