By Amit Soni, Portfolio Manager, Strategic Asset Allocation, New York Life Investments

Lofty valuations in traditional assets have encouraged investors to explore alternatives. Unfortunately, the lack of a holistic investment framework to incorporate alternatives poses a challenge. Traditional risk-return based approaches, alone, over-allocate to alternatives--a result of underestimation of risks resulting from a) significant manager performance dispersion and b) smoothness in the pooled return indices utilized for alternatives. Much research corrects for smoothness of returns; however, the risk from performance dispersion remains unaddressed. In the new white paper on Portfolio Construction with Alternatives, the Strategic Asset Allocation & Solutions (SAS) team from New York Life Investments discusses a methodology to quantify performance dispersion risk and incorporate it in the portfolio construction process.

Portfolio Construction with Alternatives

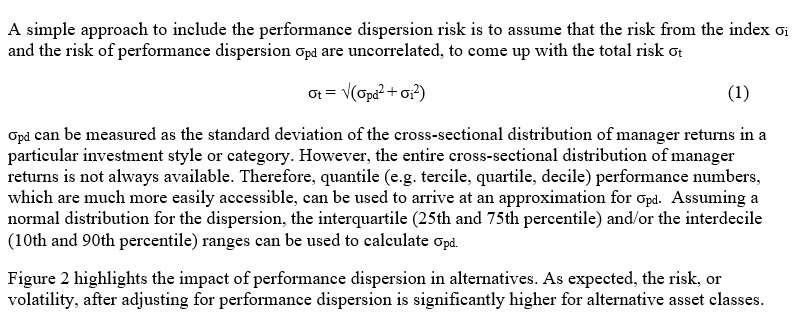

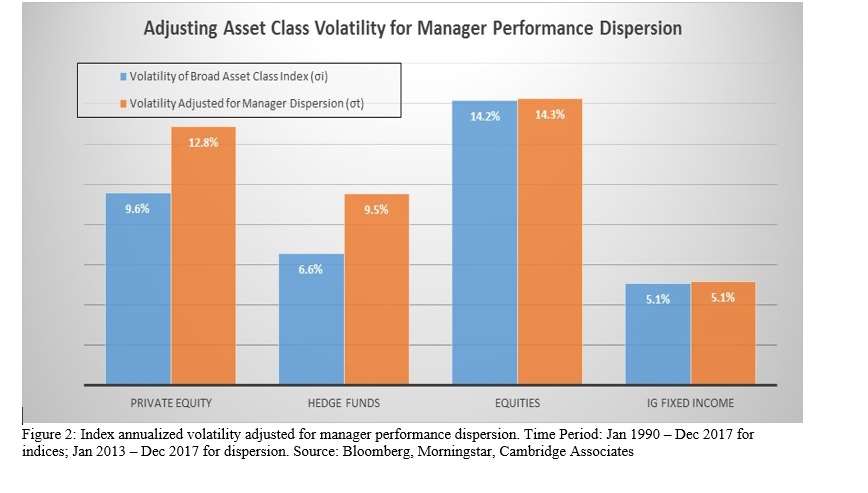

Alternatives, both liquid and illiquid, have piqued investors’ interest recently. A traditional mean-variance or risk-based approach has not been very useful since the results, in many cases, recommend allocations which are much higher than what the investors are rightly comfortable with. This is partially a result of using alternative indices based on pooled returns from multiple hedge funds, which boast an artificially low level of volatility. These indices disguise the significant dispersion of returns for managers within the index. They are also subject to a smoothing effect that comes with illiquidity.

A lot of research has already been done to correct for the smoothness of returns in illiquid asset classes. The smoothness in returns resulting from a lack of daily pricing manifests as high autocorrelation and, based on the specific problem, investors can pick the right approach to adjust the asset class returns. However, we have not yet seen a solution to measure the risk from manager performance dispersion and incorporate it in portfolio construction. This has implications, not only for alternatives, but also for active management in general, where the actual performance of the investment can materially deviate from that of the broad market index.

Performance Dispersion Risk

For traditional asset classes like equities or bonds, one can use an appropriate passive index such as the S&P 500 for equities or the BofAML US Corporate Bond Index for investment-grade fixed income as a proxy for all strategies operating in that market. The risk characteristics of the index will be generally similar to those of any given manager’s strategy, and actual resulting performance can likewise be expected to be similar, whether the investor ends up selecting a passive strategy or an active manager. However, in alternative investment categories, the investors usually do not have a well-defined benchmark. Instead, they often rely on alternative indices offered by firms like Hedge Fund Research (HFR) or Cambridge Associates, which pool returns from a universe of alternative managers to build a time series of returns. These are useful in modeling the asset class exposure, but since the underlying components are not easily investable, the alternative managers cannot run their portfolios relative to these benchmarks. As a result, the dispersion among managers is much higher among alternative managers than within traditional investment categories.

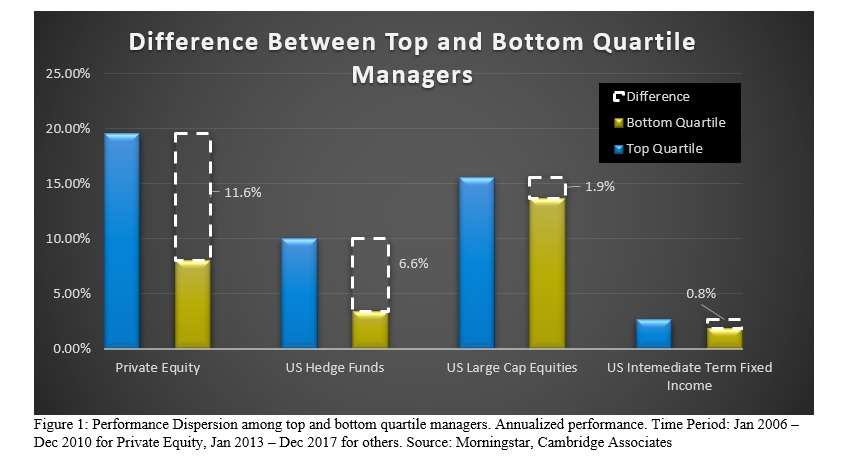

As we can see in Figure 1, the performance dispersion among traditional asset classes i.e. US large cap equities and intermediate term fixed income, is much smaller compared to the dispersion among alternative asset classes like private equity or US domiciled hedge funds. This means the harm that comes with selecting an underperforming manager is much greater in the alternatives space. This risk is not captured by the volatility of the index but should be taken into consideration.

The impact of smoothness in returns and performance dispersion must be considered while building portfolios that involve both traditional and alternative asset classes for an accurate assessment of the risk involved. Unadjusted alternative indices are much more likely to underestimate the true risk of an investment. The proposed allocation to alternatives from traditional mean-variance or risk-based portfolio optimization methodologies are much more reasonable and intuitive after making the adjustments for illiquidity and performance dispersion.

Managing Performance Dispersion Risk

While it is important to accurately measure the performance dispersion risk, it may also be important for some investors to mitigate this risk. Some strategy types, through certain implementations, allow us to reduce this risk within our portfolios:

- Passive alternative strategies

- Replication strategies

Though not always possible, some alternative strategies can be run in a passive format. Merger arbitrage is a good example of this. Similar to a passive equity strategy, a passive strategy in merger arbitrage can take exposure to the entire set of merger and acquisition deals outstanding in the investable universe. Passive strategies through ETFs or other vehicles already exist in this space.

Another way to reduce the performance dispersion risk is to use replication strategies that try to mimic a broader index of pooled returns. This is accomplished by using quantitative tools to decompose the index into more traditional investable risk factors or securities, and then investing in those risk factors or securities.