By Nicolas Rabener of FactorResearch (@FactorResearch)

INTRODUCTION

In finance 101, there is usually little doubt on what constitutes the major asset classes in the investment industry, i.e. there are the traditional ones like equities or fixed income as well as alternatives like real estate or private equity. The instruments of each of these asset classes have unique characteristics. Stocks have unlimited while bonds have limited upside, but both are typically regulated securities. In contrast, private equity and real estate are mostly unregulated and private investments. Seems like clearly differentiated asset types.

However, we can change the perspective and make the case that all of these are the same bet on the economy continuing to hum along. None will do particularly well when the economy is heading into a recession. Equity, whether held publicly or privately, and bonds of corporates, as well as buildings, will decline in value. These assets provide the same exposure to the economic factor and could therefore be considered as diverse components of essentially the same asset class.

How about hedge funds? Some have labeled these as a distinct asset class, others as structures of getting exposure to existing asset classes. The New York Times called them compensation structures for the ones who operate them.

It gets even more challenging with volatility, which is traded and represents a derivative of equities. There is unlikely a definite answer.

However, volatility is interesting as it is broadly negatively correlated to economic growth. When the economy is growing, then economic and financial volatility tends to decline. And vice versa, when the economy is declining, volatility tends to increase.

Given this, volatility strategies might be attractive for diversification, even if it might not be an asset class on its own. In this short research note, we explore volatility strategies offered by hedge funds.

PERFORMANCE OF VOLATILITY HEDGE FUNDS

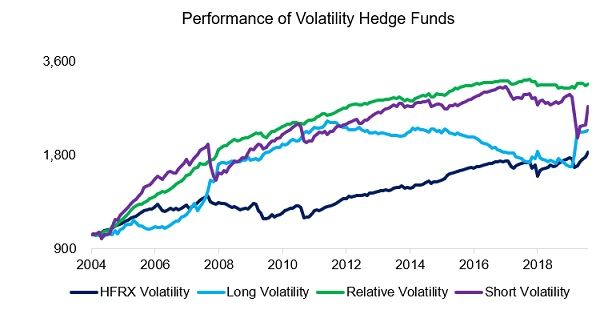

We are using four indices representing volatility hedge funds. The HFRX Volatility index includes funds that are long, neutral, and short volatility, while the other three are from Eurekahedge, which classifies funds into the different sub-strategies.

It is worth highlighting that these indices suffer from reporting biases, which leads to returns being over- and risks understated. Hedge fund managers tend to only start reporting their returns to such databases when the performance is good and stop reporting when the returns are strongly negative. In addition, these indices have few constituents, which increases the risk of being influenced by a single positive outlier. For example, the Short Volatility index currently has only five members.

These characteristics should be kept in mind when reviewing the performance of these four indices. All of these generated positive returns in the period between 2004 and 2020, and even beat the S&P 500 on a risk-adjusted basis. Specifically, the Relative Volatility index had a risk-return ratio of above 2 and a maximum drawdown of 6.5%, which might be regarded as to be too good to be true.

Source: HFRX, Eurekahedge, FactorResearch

DIVERSIFICATION BENEFITS OF VOLATILITY HEDGE FUNDS

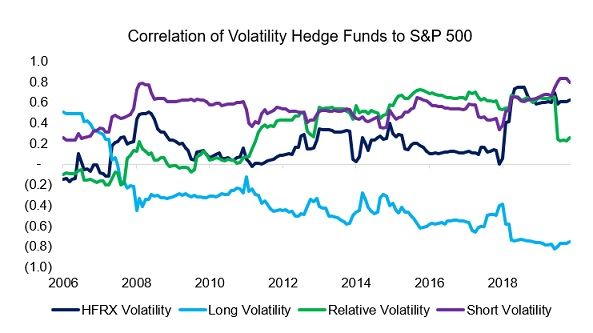

Investors might question which of the different volatility strategies is the most attractive for diversification. If traditional and alternative asset classes are viewed as the same bet on the economy, then they are directionally short volatility. And indeed, as can be seen in the analysis below, the Short Volatility index exhibited the highest correlation to the S&P 500 over time.

The HFRX Volatility index, which represents a mixed bag of volatility strategies, had a low correlation to equities until the end of 2018, when it spiked, which might indicate a style shift or new index constituents. Relative volatility hedge funds were moderately correlated in recent years, except for 2020, when the correlation plummeted during the COVID-19 crisis.

Long volatility hedge funds were most attractive for diversification given the lowest correlations to the S&P 500. However, it is worth highlighting that the correlation has been consistently declining since 2004, which is concerning as uncorrelated strategies are attractive, but not strongly negatively correlated ones. It is far simpler and cheaper to reduce equity exposure or short the index instea.

Source: HFRX, Eurekahedge, FactorResearch

GOING SHORT ON SHORT VOLATILITY STRATEGIES

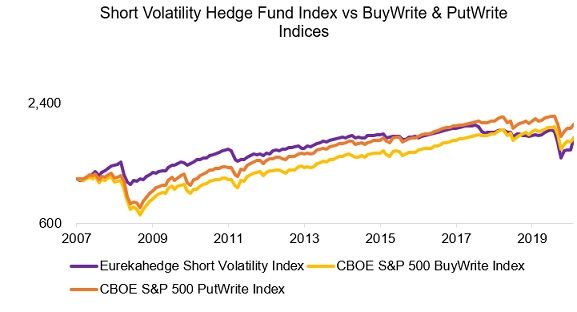

Short volatility strategies are not particularly attractive as they tend to be highly correlated to equities. However, if an investor would still seek exposure, then hedge funds seem a sub-optimal choice for implementation as the same risk-return profile can be acquired via buy-write and put-write indices.

Hedge funds charge high management and performance fees. They also require extensive initial and ongoing due diligence, which makes them expensive vehicles. In contrast, option-based indices have become available as ETFs that offer daily liquidity, high transparency on portfolio construction, and low fees, making these preferable instruments.

Source: Eurekahedge, CBOE, FactorResearch

VOLATILITY STRATEGIES FOR A US EQUITY PORTFOLIO

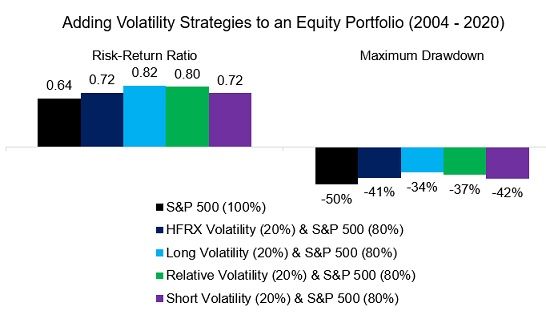

Next, we simulate the impact of adding a 20% allocation to volatility strategies for a US equity portfolio. We observe that the risk-return ratios would have increased and maximum drawdowns would have decreased for all types of volatility strategies.

It is not surprising that long volatility strategies were most accretive, but perhaps surprising that even short volatility hedge funds generated diversification benefits given their high correlation to equities.

Source: HFRX, Eurekahedge, FactorResearch

Although this analysis highlights attractive diversification benefits from allocating to volatility strategies, investors need to be cautious of the index data given reporting biases.

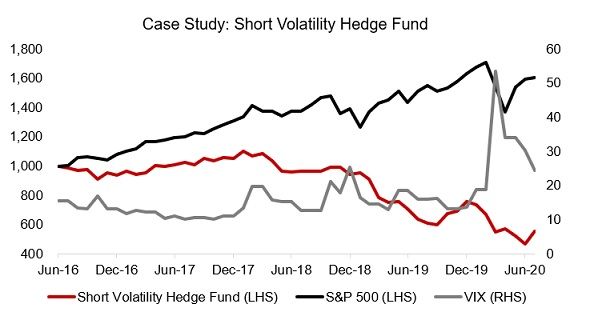

We can visualize the risk of investing in the space by selecting one of the constituents of the short volatility category as a case study. The hedge fund is managed by a UK-based absolute return manager dedicated to the options space with more than 20 years of trading experience. The firm “prides itself above all on its proven risk management discipline”.

The stock market increased between 2018 and 2020 with some minor and major corrections in between. Volatility spiked when stocks crashed, but decreased quickly as central bankers stepped in and provided support via their monetary powers. Intuitively, the short volatility-focused hedge fund should have generated positive returns each time when stocks recovered and volatility mean-reverted to its previous lows. However, the returns were consistently negative and the hedge fund lost more than 50% of its value over a short two-year period.

We can be criticized for cherry-picking a poorly performing hedge fund, which would be fair, but it still highlights the riskiness of these instruments. Hedge funds and volatility strategies are complex and complicated, which means they should be considered with caution.

Source: FactorResearch

FURTHER THOUGHTS

Many strategies claim to offer diversification benefits, but most of these fail to provide them when most needed. For example, merger arbitrage strategies are lowly correlated with equities when stock markets are calm, but often become highly correlated in crisis times when mergers fail to close.

Relative or long volatility strategies are attractive given that these tend to benefit when economic growth deteriorates and volatility increases. However, this also implies that they behave quite differently to stock markets. There will be years of flat or declining returns, which makes them emotionally challenging to hold.

Worse, they are mainly available via expensive and opaque hedge fund vehicles, which perhaps explains the low amount of assets in these strategies. Further research is required to see if these strategies can be replicated systematically with liquid instruments, which would likely increase adoption by investors.

RELATED RESEARCH

Creating Anti-Fragile Portfolios

Global Macro: Masters of the Universe

The Variance Premium: What Premium?