By Sara Olsen and David Pritchard of SVT Group and Yuwei Shi of Middlebury Institute of International Studies at Monterey

*Please take a moment to complete the brief survey at the conclusion of this article.

Every investment generates or destroys social and environmental value, aside from financial return. One of the most visible impacts is the number of jobs created by an investment. But there are often many other impacts, some of which may be less visible or indirect—such as jobs created in the supply chain, or a net change in the use of natural resources—which matter to both investors and other stakeholders. These impacts can be looked at in different ways: economists call them externalities; investors view them as Environmental, Social, and Governance (ESG) factors; accountants include them in social accounting; and companies may see them as part of their Corporate Social Responsibility. Whether an investor pays attention to such impacts of their investments is fundamentally not about what they are called, but whether and how impact is accounted for, valued, and managed. Growing numbers of asset owners, especially Millennials, recognize this, and are increasingly deliberate about ensuring that those effects are benign or constructive. And along with the impressive growth of ESG and impact investments over the last decade has come the emergence of a new profession: impact management.

We believe that the impact management profession will grow and decide the staying power and growth of ESG and impact investing. As such this profession will become critically interrelated with investing. Our belief is founded on the two megatrends behind the recent changes in the business and investment world.

The first is the growing pressure to evolve capitalism to a form that pursues value creation for stakeholders, not just shareholders. A market built only on shareholder capitalism will not fully meet human needs and rights in a society, which in turn will make the market, and the businesses and investments built upon it, unsustainable. Lacking systematic ways of accounting for these impacts and their value, the market has the tendency to turn a blind eye to tragedies of the commons that face us today and tomorrow, the most obvious of which is the existential threat of climate change. From rising sea levels to shifting floods and droughts to extreme temperatures, to infestation and loss of biodiversity, the implications for business and society are profound and severe. The COVID-19 pandemic and exposure to the lethal implications of racism in the U.S. have also revealed the immediate and serious interdependence between business and society, and for many, heightened our sense of collective responsibility and urgency for active management of the environmental and social impacts of business. While some of these impacts can be foreseen and planned for, others require agility and an ability to improvise. As the consequences of business as usual manifest with increasing clarity, pressure is building for market capitalism to evolve toward better management of a broader set of externalities along with economic growth.

The second associated force is the increasing necessity for businesses and investors to collect, organize, disclose and manage these “extra-financial” effects of their strategies and activities: to account for and manage impact. The pressure for disclosure is only the tip of the iceberg. What has fundamentally changed is that information on the extra-financial effects of a business transaction or an investment, produced within small, in-person circles of influence, can now travel quickly and broadly. The security and propriety of data is one, but not the only, material issue. Today a story or video captured on a cell phone can go viral globally overnight and change narratives and sentiments about a company. This can deteriorate a firm’s reputation and brand equity, hinder its talent acquisition and retention, destabilize key business relations, or trigger regulatory oversight. Information and misinformation about the effects and performance of business is now instantly and widely available, driven by the relentless advance of information technology and the increasingly distributed modes of information generation and dissemination that come with it. This is forcing companies and investors to place a similar weight on the management of extra-financial information as that of the financial information to ensure that reliable, accurate information about environmental and social performance is also widespread. As such, managing impact is a newfound business responsibility, and key to a healthy marketplace.

“Impact management” implies that investors (or others) make decisions informed by the effects of business on people and on the planet (“impact”). It implies systematic inquiry into the experience of those directly affected, combined with other relevant, quality research evidence where available, in a way that is simultaneously decentralized, networked and aggregated, similar to how financial accounting data is used to assess financial value. Impact management holds the promise of providing both a much-needed organizing principle to assist us all in navigating the oceans of data we swim in, and a bulwark against the tide of misinformation and fear-based reactivity to it that undermine the trust necessary for a stable and functional society.

While impact measurement and reporting standards increasingly serve as a bridge that connects the changing social norms with investment analysis and decisions, a scan of Google yields plenty of articles lamenting the multiplicity of ESG and impact standards and lack of clarity around ESG and impact reporting. These obscure the truth, which is that we are further down the evolutionary path to a mature impact accounting field than it appears to the casual eye. First, the essential categories of information the firm must account for to have a picture of its environmental and social effects are becoming clear. Last year a group of impact analysts (including the authors) summarized the three basic elements of a system to complement financial accounting:

- Environmental, social, and governance (ESG) accounting

ESG typically refers to the measurement of an entity’s efforts to enact best practices with respect to ESG factors through its direct operations (e.g., employee health and safety, gender diversity), its products (e.g., consumer protection), and its distribution and supply chain (e.g., human rights protection). ESG is typically assessed using a predetermined list of indicators of these practices. Such lists now exist as do rankings based upon them. A range of businesses, from tiny startups to large multinationals, now report publicly on these practices.

- Accounting for impact

Beyond measuring and disclosing their ESG performance, companies are beginning to measure and report on their specific positive or negative impacts, particularly ones that affect pressing social or environmental challenges. The scope of impact accounting varies according to the nature, size, and complexity of an undertaking. Impact analysis of projects, products, or services, for example, differs for small companies and large multinationals.

Although it is impossible to come up with a master list of predetermined indicators to cover the particular impacts of every business in context, participants and supporters of the Impact Management Project (IMP) have reached a shared understanding of the five dimensions of impact performance that matter for a complete and comparable picture (and therefore the types of data to collect, organize, and disclose to stakeholders) and on general principles that can guide practitioners in their judgments about what to measure, and how to measure it, in any given context. These dimensions include who, what, how much, contribution, and risk.

- Accounting for the ESG-impact-financial-performance relationship

Frameworks to account for and understand the relationship between ESG and impact, on the one hand, and financial performance, on the other, now exist. Whether an investor focuses on the ESG factors that are material to financial performance in the near term (the way the Sustainability Accounting Standards Board does) or sets out to measure and manage the full range of interaction more broadly and strategically (the way Integrated Reporting does), it is clear that environmental and social factors affect financial performance—and vice versa. Disclosure frameworks try to make this relationship explicit and transparent.

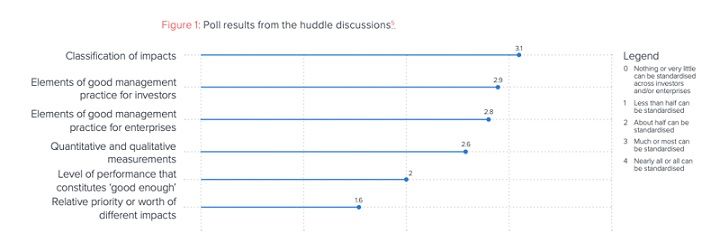

Drilling particularly into the second of these, the question of which parts of this information can be standardized and which cannot have been refined. Beginning in 2016 the Impact Management Project has sought to surface and facilitate consensus among practitioners, investors, enterprises, and standards bodies regarding key conceptual and definitional issues in the impact accounting domain. Among the takeaways, the IMP has gleaned from hundreds of expert practitioners and investors, and more than a dozen standards bodies, as to what elements they currently believe can be standardized with regard to impact management. These are summarized here:

Classification of impacts

General consensus: Much or most can be standardized.

Elements of good management practice for investors

General consensus: Much or most can be standardized

Elements of good management practice for enterprises

General consensus: Much can be standardized

Quantitative and qualitative measurements

General consensus: Much can be standardized

Level of performance that constitutes “good enough”

General consensus: About half can be standardized

Relative priority or worth of different impacts

General consensus: Between a quarter and half can be standardized

There is, however, still far to go to attain a similar maturity as found with financial accounting standards. For comparison, Generally Accepted Accounting Principles (GAAP) were consolidated between the 1929 stock market crash and the Financial Accounting Standards Board’s (FASB) formation in 1973. Between 1973 and today the International Accounting Standards Board created the first international conceptual framework for accounting standards, worked to reduce the number of alternative accounting treatments permitted under International Accounting Standards, and brought 90 countries into full alignment. How long impact accounting will take to be codified to a similar level is anyone’s guess. It may happen faster than financial accounting due to the distributed mode and speed with which information travels today, the opportunity for potentially swifter global collaboration presented by virtual conferencing, and the preexistence of IASB and GAAP as models to learn from. However, the challenge of assessing social and environmental impacts is far more complex than assessing financial performance for four reasons. First, there is not a single measure of social and environmental performance of businesses that is akin to how money is used to assess financial performance. Secondly, the incentive to track broad social and environmental impacts that affect mostly other people is weaker than the self-interest of tracking narrow and direct financial returns. Thirdly, the very fact that social and environmental impacts are broad and often indirect makes tracking them difficult and costly. And finally, social and environmental impacts are always estimated, never truly known, which inhibits the ability and incentive to improve assessment methods over time.

Thus, it is likely that the new accounting for stakeholder value will have aspects unlike and additional to the accounting constructs that have underpinned the capital markets to date. For example, asset owners may relate to content affectively (“black lives matter”) rather than cognitively (“social impact”), and may need or expect to understand impact both in quantitative ($X dollars’ worth of social value created) and qualitative (the increased aspirations of girls who are able to attend school who would not have otherwise) terms.

The big picture is that ESG and impact are quickly becoming not just additional or optional social norms that investors need to manage. They are being hardened into professional standards, regulatory requirements, and even laws. The advance of impact reporting and ESG investing today is indicative of an upcoming paradigm shift in market capitalism. There will be innovations to manage this sea change through new algorithms for risk-adjusted return on investment, for balancing competing stakeholder values, and for pushing investments toward new efficient frontiers. And along the way there will be assets that are stranded by the old paradigm and outdated methods. Finance professionals who want to be leading their organizations tomorrow would do well to become knowledgeable about impact management now.

- To help CAIA Members better grasp the trends on the impact management profession, we invite you to take this short survey and will publish the results soon.