By Aaron Filbeck, CAIA, CFA, CIPM

Associate Director, Content Development at CAIA Association

If you’ve ever watched an old Bob Ross video, you’ve probably felt a combination of relaxation and, in many cases, exasperation… “how does he do that so effortlessly?!” While there are rarely “happy accidents” in investing, I think our profession can learn a lot from the way Bob Ross approaches creating a beautiful piece of art. At the beginning of each session, both the audience and Bob start with a blank canvas and an idea in mind. By the end, he has created something beautiful, while we probably have paint on our clothes and are frustrated because we can’t get our painting to look like his.

Even in art, there’s an underlying science. Bob has years of practice but uses that experience to be creative and make spur-of-the-moment decisions. He understands how colors should be mixed, how much pressure to apply to his canvas, and which brush to use. More importantly, he is agile while still making ‘data-driven’ decisions throughout the process. Making a mistake might discourage even the most well-trained artist, but not Bob! That blob of paint is a beautiful little tree!

I want to make a similar argument about investment management. Investment management has always been a mix of art and science. We have well-trained investment professionals who can codify fundamental or alternative data, and other well-trained professionals who can communicate, make decisions, and be creative. As our industry evolves, let’s not forget the artists.

Canvassing for Talent

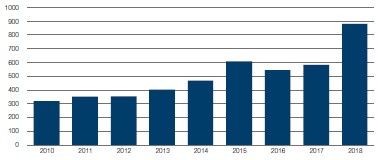

Figure 1: Average Daily Big Data Job Postings (US)

Source: Eagle Alpha, Burning Glass Technologies

The number of alternative datasets available to investors has exploded over the past five years, hedge funds have seemingly led the way, while private equity isn’t far behind. The rapid pace of evolution in datasets, combined with some level of efficacy to generate alpha signals, has caused many investment management organizations to re-align their hiring needs, with an emphasis on data-talent. For recent graduates, which are often tech savvy, the appeal of being an investment banker or investment analyst has dwindled and the appeal of being a data scientist has taken its place.

Let’s Create Some Random Forests Happy Trees

For those paying attention, many have developed career insecurity and anxiety. “Things are moving so fast; how will I keep up? Everyone keeps telling me to learn to code! Should I quit my job and go back to school?” I’ll answer these questions like a good economist: it depends. Just as not everyone can be a Bob Ross, not everyone is meant to be a “scientist” in this profession. If everyone became a scientist, where would all the art come from?

While it makes for a provocative story, I believe the death of intuition has been greatly exaggerated.

“Skilling up” isn’t as simple as taking a bunch of online coding lessons and calling it a day. We still need artists in the room, those who are agile, creative, and problem solvers. While there is certainly a need for full-time coders and quants, we need professionals who can speak the coding language and bring economic intuition into the equation. Otherwise, all we’re doing is overfitting.

Morgan Housel made a great art vs. science analogy in a recent blog post when he discussed the concept of “expiring” vs. “permanent” skills – “Expiring skills tend to get more attention. They’re more likely to be the cool new thing, and a key driver of an industry’s short-term performance. They’re what employers value and employees flaunt. Permanent skills are different. They’ve been around a long time, which makes them look stale and basic. Permanent skills can be hard to define and quantify, which gives the impression of fortune-cookie wisdom vs. a hard skill.”

It is easy to talk about the expiring skills: they’re tangible and easy to quantify. Regardless of where change is occurring, I think we do current and future professionals a disservice by putting more emphasis on the tangible instead of the pervasive. Why foster anxiety around these “expiring skills,” when not everyone is wired to take advantage of them and other (career-) opportunities are still available? I think our industry needs to find better ways to promote and value permanent skills. Even if they’re hard to quantify, many skills will stand the test of time. How many people do you know that are experts at one thing, but totally lack the ability to communicate, relate to their colleagues, or can put it all together? We need more “artists!”

Working Together

Investment professionals, along with many other industries, have historically worked in silos – and we now know, that this the way of the past. Technology companies have broken down the proverbial barriers, and the world of finance is experiencing the beginnings of a similar change. Generalists with permanent skills, will thrive in this collaborative environment, how exciting.

In terms of job or career disruption, I believe we will simply see job augmentation and enhancement. Jobs will be enhanced by data, and employees will be empowered to see a holistic view of the organization.

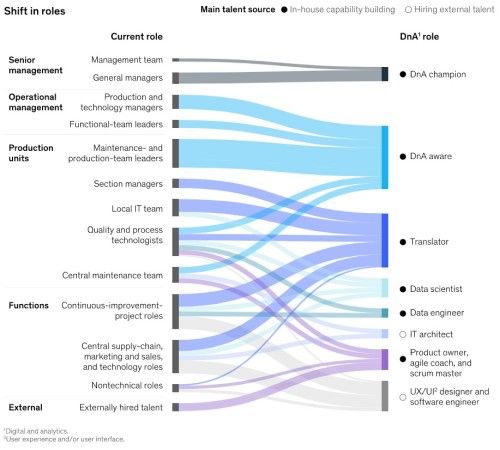

Figure 2: Shift in Roles

Source: McKinsey & Co.

While my vision for generalists with permanent skills in a transforming industry may seem “pie in the sky”, I recognize the multiple shifts many employees will experience over time. As Institutional Investor pointed out from a Greenwich Associates report last year, asset management professionals must balance creativity with the ability to leverage new technologies.

McKinsey offers a tangible schematic how data and analytics (DnA) will infiltrate organizations, from the top to the bottom of the organization chart. While each employee has their functional role in the organization, data analysis will require collaboration across disciplines. In asset management, this might mean a Risk Manager and a Portfolio Manager both become Translators but look at the data in different ways. Even the subject matter experts will become more aware of the big picture.

The Joy of Data Science

Let’s view the evolution of our industry as an opportunity to clean our paintbrush to create something new. We still need artists in the room, but even artists need to upgrade their palette sometimes to understand what the scientists are doing. We’re in an exciting time of innovation in our industry, but it can get overwhelming sometimes to see the rapid pace of change. Even if you can’t become a world-class quant, you still have a place in this profession. We need people who are collaborative, big picture thinkers who think across the entire organization and who understand and speak the Language of the Nerds. Diversification goes beyond a portfolio; it applies to highly functioning teams as well.

Aaron Filbeck, CAIA, CFA, CIPM

Associate Director, Content Development at CAIA Association

Follow Aaron on LinkedIn and Twitter