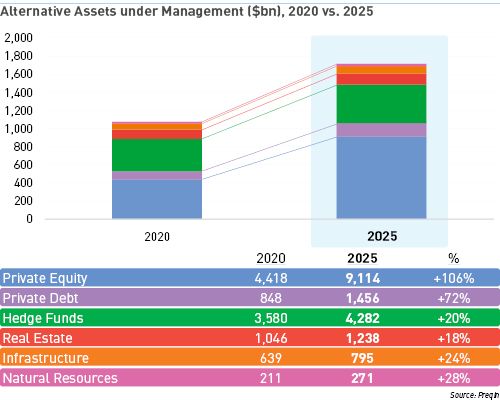

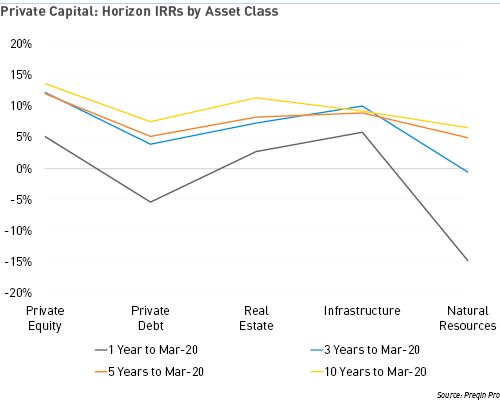

By Grant Murgatroyd, senior writer EMEA at Preqin Preqin predicts that alternative assets under management will rise to $17.2 trillion in 2025. We believe the COVID-19 induced slowdown in 2020 will be temporary and lead to a larger, more efficient, and more sustainable industry. Assets under management (AUM) in alternatives will decline in 2020, ending the year around $10.74 trillion, down from $10.82 trillion at the end of 2019. The economic fallout from COVID-19 will be responsible for the only fall in AUM recorded this century, but Preqin expects this to be a small and short dip on a trajectory of continued growth. Over the next five years the net impact of the pandemic on alternatives will be positive. Preqin launched its Future of Alternatives 2025 digital campaign (www.preqin.com/future) in the first week of November. The heart of the campaign is a predictive model of AUM growth produced by our Data Science and Research Insights teams. The model, which utilizes a range of sub-models to achieve its outputs and which reflects the impact of the pandemic, predicts a 60% increase in global AUM in alternatives between the end of 2020 and the end of 2025, equal to a compound annual growth rate (CAGR) of 9.8% (Fig. 1).  We expect alternative assets to come through the pandemic well, as they have with past crises such as the Global Financial Crisis. The shift to remote working was managed very efficiently, with many in the industry saying that relationships have deepened and improved as the pandemic has evolved. Solutions have also been found for many of the problems that 2020 presented, such as using aerial drones to conduct site inspections of solar panel facilities. It has been harder for people to establish new relationships, whether for investments or fundraisings, but as the pandemic rolls into next year we expect to see this initial reticence lessen. After all, new investments and funds are vital to the continued health of these industries. Investors Demand an Alternative Demand from all types of investors will be the main driver of growth. Some of the increased demand will be the pull of the risk/return offered by different alternative asset classes, which have historically outperformed, while some will be a push from the return prospects in fixed income and public equities, which are not expected to be sufficient to allow institutional investors to meet their liabilities or funding requirements. Long-term performance of all asset classes measured by Preqin has been good, led by a 10-year horizon IRR of 13.6% for all private equity strategies and 11.3% for real estate (Fig. 2).

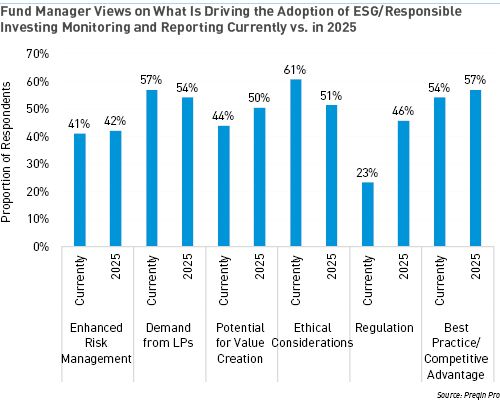

We expect alternative assets to come through the pandemic well, as they have with past crises such as the Global Financial Crisis. The shift to remote working was managed very efficiently, with many in the industry saying that relationships have deepened and improved as the pandemic has evolved. Solutions have also been found for many of the problems that 2020 presented, such as using aerial drones to conduct site inspections of solar panel facilities. It has been harder for people to establish new relationships, whether for investments or fundraisings, but as the pandemic rolls into next year we expect to see this initial reticence lessen. After all, new investments and funds are vital to the continued health of these industries. Investors Demand an Alternative Demand from all types of investors will be the main driver of growth. Some of the increased demand will be the pull of the risk/return offered by different alternative asset classes, which have historically outperformed, while some will be a push from the return prospects in fixed income and public equities, which are not expected to be sufficient to allow institutional investors to meet their liabilities or funding requirements. Long-term performance of all asset classes measured by Preqin has been good, led by a 10-year horizon IRR of 13.6% for all private equity strategies and 11.3% for real estate (Fig. 2).  Our AUM forecasts are supported by the findings of our Future of Alternatives 2025 Survey, conducted in August 2020. We polled more than 100 institutional investors and found that a massive 81% of them intend to increase their allocations to alternatives over the next five years. Just 3% were planning to decrease commitments. Growth Will Not Be Uniform Private equity and private debt will lead the charge, with AUM set to grow by 15.6% and 11.4% per year, respectively, hitting $9.11 trillion and $1.46 trillion in 2025. Hedge funds, real estate, infrastructure, and natural resources are expected to show more moderate growth of 5% per year or less. The bulk of AUM growth in private markets is expected to take place in Asia-Pacific, where we predict AUM will swell from $1.62 trillion in 2020 to $4.97 trillion in 2025. The twin factors of lower penetration rates and faster GDP growth compared with more established markets in the US and Europe will attract significant interest from both investors and fund managers. We expect AUM growth to be strongest in the private equity market. Private equity assets have displayed resilience during times of economic stress and generated returns superior to other asset classes. With the market less mature in fast-growing Asia, a large proportion of overall growth will come from that region. Private debt AUM growth is not far behind that of private equity. The asset class is likely to be buoyed by the global hunt for yield in an era of "lower for longer" interest rates – the phrase may have been overused in recent years, but that does not make it less true. With many government bond yields in negative territory, and some corporate bonds following a similar path, long-term investors that need to match income with liabilities are likely to drive demand for assets with steady income streams. Private debt funds have performed exceptionally well, delivering a horizon IRR of 8.8% in the 10 years to December 2019, according to Preqin Pro. With Maturity Comes Responsibility In our study we will be looking at how global megatrends – including ESG, diversity, digital transformation, big data, and regulation – will play out in alternatives. With ESG, for example, fund managers have a real opportunity to lead. EU legislation has driven the ESG agenda in Europe, such that 63% of the $2.53tn invested in alternatives since 2011 has been invested under sustainable principles. The US (37%) and Asia-Pacific (15%) lag, but we expect them to catch up over the next five years, as the perception of ESG moves from being a costly burden to a lever of risk management and value creation.

Our AUM forecasts are supported by the findings of our Future of Alternatives 2025 Survey, conducted in August 2020. We polled more than 100 institutional investors and found that a massive 81% of them intend to increase their allocations to alternatives over the next five years. Just 3% were planning to decrease commitments. Growth Will Not Be Uniform Private equity and private debt will lead the charge, with AUM set to grow by 15.6% and 11.4% per year, respectively, hitting $9.11 trillion and $1.46 trillion in 2025. Hedge funds, real estate, infrastructure, and natural resources are expected to show more moderate growth of 5% per year or less. The bulk of AUM growth in private markets is expected to take place in Asia-Pacific, where we predict AUM will swell from $1.62 trillion in 2020 to $4.97 trillion in 2025. The twin factors of lower penetration rates and faster GDP growth compared with more established markets in the US and Europe will attract significant interest from both investors and fund managers. We expect AUM growth to be strongest in the private equity market. Private equity assets have displayed resilience during times of economic stress and generated returns superior to other asset classes. With the market less mature in fast-growing Asia, a large proportion of overall growth will come from that region. Private debt AUM growth is not far behind that of private equity. The asset class is likely to be buoyed by the global hunt for yield in an era of "lower for longer" interest rates – the phrase may have been overused in recent years, but that does not make it less true. With many government bond yields in negative territory, and some corporate bonds following a similar path, long-term investors that need to match income with liabilities are likely to drive demand for assets with steady income streams. Private debt funds have performed exceptionally well, delivering a horizon IRR of 8.8% in the 10 years to December 2019, according to Preqin Pro. With Maturity Comes Responsibility In our study we will be looking at how global megatrends – including ESG, diversity, digital transformation, big data, and regulation – will play out in alternatives. With ESG, for example, fund managers have a real opportunity to lead. EU legislation has driven the ESG agenda in Europe, such that 63% of the $2.53tn invested in alternatives since 2011 has been invested under sustainable principles. The US (37%) and Asia-Pacific (15%) lag, but we expect them to catch up over the next five years, as the perception of ESG moves from being a costly burden to a lever of risk management and value creation.  Perhaps surprisingly, more than half (54%) of respondents to the survey predicted ESG will have a positive impact on returns. A further 27% think it will have no impact, compared with 20% foreseeing a negative impact. Among LPs, 58% see a positive impact, 21% no change, and 20% a negative impact. The next five years will not be without challenges, but history has shown that this is an industry that thrives on change. Grant Murgatroyd is senior writer EMEA at Preqin, which provides indispensable data, analytics, and insights for alternative assets professionals around the globe. Visit our Future of Alternatives 2025 hub at www.preqin.com/future

Perhaps surprisingly, more than half (54%) of respondents to the survey predicted ESG will have a positive impact on returns. A further 27% think it will have no impact, compared with 20% foreseeing a negative impact. Among LPs, 58% see a positive impact, 21% no change, and 20% a negative impact. The next five years will not be without challenges, but history has shown that this is an industry that thrives on change. Grant Murgatroyd is senior writer EMEA at Preqin, which provides indispensable data, analytics, and insights for alternative assets professionals around the globe. Visit our Future of Alternatives 2025 hub at www.preqin.com/future

Interested in contributing to Portfolio for the Future? Drop us a line at content@caia.org