By Wu Guowei Jack, CFA, Director, Content APAC, CAIA Association

The Continued Growth of Private Equity

Global assets under management (AUM) in private equity (PE) and venture capital continue to grow despite the economic slowdown from the COVID-19 pandemic and a slight drop in 2020 fundraising. Preqin reported that PE AUM grew to $4.7 trillion as of June 2020 and is still on the growth path to $9 trillion by 2025.

Notably, the proportion of PE AUM in Asia has steadily increased. Since moving into double digits in 2011, it has steadily increased to a record of 28% of global PE AUM in 2020. Indeed, Asia’s share of new capital into PE has been increasing.

Investors are increasing allocations to PE to take advantage of its superior—and relatively consistent—returns; the asset class has performed well in both good and bad times and throughout economic cycles. QIC, a state-government-owned investment company in Australia with an AUM of over US$ 50 billion and a target allocation of 5% in PE, noted in one of its investment insights that private equity outperforms public markets in a late cycle environment, as PE investors seek to create value through active management of their investments, regardless of economic conditions.

Outperformance of co-investments

The rise of co-investments is another notable trend that reflects investors’ expansion into the PE space. Hamilton Lane estimates that for every dollar raised by general partners (GPs), an additional twenty cents are deployed in global co-investment opportunities. Investors are using co-investments as a lever to increase allocation to PE and to potentially generate outperformance.

“Co-investments are a huge part of private equity market.” - Hartley Rogers, chairman of Hamilton Lane, a U.S. based alternative investment management firm.

There have been various studies examining the performance of co-investment. Using theoretical benchmark returns, Cambridge Associates noted that a portfolio with a 70:30 mix of U.S PE and U.S. co-investments would enhance expected 25-year returns to 14.9% p.a., a significant 1.5% p.a. increase compared to a pure U.S. PE portfolio.

In an academic study, Braun et al. (2016) used a large data set which provided 365 observations of buyout co-investments and 615 venture capital co-investments over a period of 32 years from 1978 to 2010. They concluded:

- Buyout co-investments and venture capital co-investments outperform their corresponding funds.

- Co-investments generally have lower costs to investors compared to funds.

- There is no evidence of GPs offering LPs lower quality deals since co-investment deals did not underperform against their corresponding funds. Instead, Braun et al. pointed that GPs may use co-investment to develop stronger relationships with existing or target LPs before their next fundraising. Furthermore, the long-term economic value of a GP is driven by their ability to raise future funds.

Perhaps the best indicator of co-investment performance is gleaned from investors who have a substantial history of doing co-investments. One such investor is Alaska Permanent Fund Corporation (APFC), a state-owned corporation, with over US$ 60 billion in AUM at the end 2019.

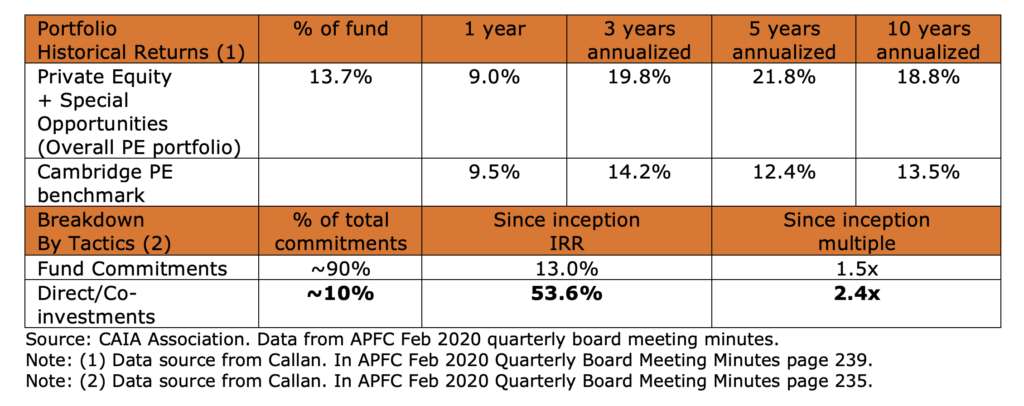

APFC targets a PE allocation of 13% to 19%, and a target ratio of 20:80 between direct/co-investment and fund investments. The exhibit below shows the portfolio performance reported by APFC. APFC’s PE portfolio has outperformed the industry benchmark (Cambridge PE benchmark) across 3-year, 5-year, and 10-year time horizons. The exhibit also shows that APFC’s direct/co-investments have also outperformed their fund investments since inception.

Portfolio Performance of Alaska Permanent Fund Corporation (As of 9/30/2019)

Not as easy as it looks.

The potential outperformance of co-investments is alluring, as is the ability to increase allocations to PE, but the implementation is fraught with difficulties. Even APFC, which has been investing in PE since 2004, noted that they have always negotiated for co-investment rights but did not exercise those rights until they had built an internal team and an efficient co-investment process. Furthermore, APFC actively sources for co-investment opportunities – as many as 400 deals in a year – and less than a handful of co-investment deals pass through their screening funnel to be approved for investment.

We suggest a 4-point checklist for investors thinking of co-investments:

- Build internal expertise and staff. The skillset to select investment deals requires industry and operating knowledge and is different from fund selection expertise. Staff with direct investment experience must be hired with commensurate compensation and performance incentives. This adds another layer of complexity and cost to investment teams.

- Source own co-investments. The investor must have a strong base of existing GP relationships from which they can generate a strong pipeline of co-investment deals. In addition, some investors may have established strong relationships with the GP to the extent that they may have regular co-investment pipeline calls.

- Establish efficient processes. The deal timeline is often compressed. The investor may have as little as two weeks to review available information and complete their own assessment of the opportunity and decide whether to participate. Speed and certainty of response time is critical to build trust with GP and to meet deal timelines.

- Co-investment program risk management. An investor would also need to decide upfront how much to allocate to co-investment exposure. In addition, the investor would need to decide the funding source for co-investment deals as these deals have unpredictable timing, and some deals may require follow-on investments. Lastly, the investor needs to determine their risk appetite for single deal investments by focusing on deal size, geography, and sectors that they are most comfortable with.

Conclusion

The decision to add co-investments as another way to invest into private equity requires serious commitment from the asset owner. Building a co-investment program takes time, resources, and people. With the continued growth of private equity, and the outperformance that co-investments have delivered thus far, it may be well worth the effort for the asset owner.