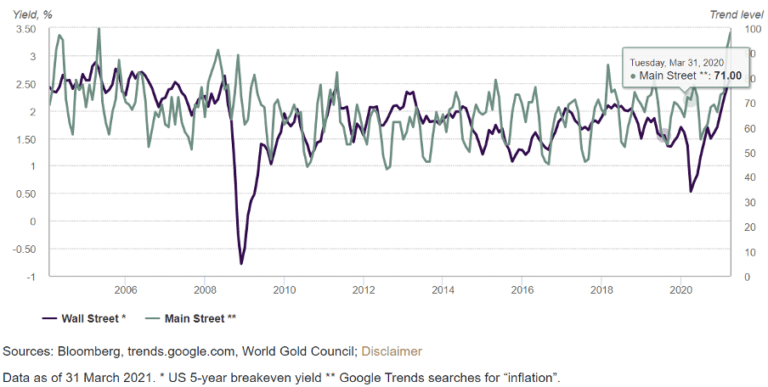

By Jaspar Crawley, CAIA Inflation has emerged as a primary concern for investors. On balance, arguments for ‘uncomfortably high’ US inflation seem to outnumber those against, at least in the near term.1 The appropriate course of action is to implement a risk mitigation strategy. Gold is a proven long-term hedge against inflation but its performance in the short term has been less convincing. Despite this, our analysis revealed that gold can be a valuable component of an inflation-hedging basket. Our research additionally divulges gold as a protector of purchasing power in the long run against more than just the price of goods and services. In tracking money supply, gold can help investors protect against potentially excessive asset price inflation and currency debasement. Why inflation is currently a concern As the global economy recovers from the consequences of the pandemic, a concern for many investors is the somewhat novel prospect of ‘high’ inflation—particularly in the US where investors have been accustomed to low levels for more than three decades. Although both the output gap and unemployment remain higher than pre-pandemic levels, the rapid economic recovery is causing challenges in the supply chain, as demand outstrips existing supply. Commodity prices are reflecting this, as are shipping rates and business inventory data. In addition, the massive increase in global government debt as well as central bank acceptance—if not promotion—of higher inflation suggest the risks are, on balance, skewed to the upside. Both Main Street and Wall Street have taken notice (Chart 1). Chart 1: Market expectations and interest in inflation at multi-year highs US 5-year breakeven yield and Google Trends searches for inflation  Gold and US CPI inflation: a non-linear relationship The hegemony of the US dollar and US interest rates means that broad conversations on inflation invariably focus on the US consumer price index (CPI). For all the talk of gold as an inflation hedge, its relationship to changes in the US CPI is surprisingly poor (Chart 2). Gold returns and CPI changes have a historically weak linear relation Since 1971, only 16% of the variation in gold prices can be explained by changes in CPI inflation.2 While a period from the 1970s to the early 1980s experienced both strong gold returns and extremely high inflation (purple dots, Chart 2), this has not been repeated since, partly because inflation has been much lower and because the relationship between gold and the CPI has been weaker. Chart 2: Gold and the US CPI: weak relationship post- 1970s Correlation between % y-o-y change in gold US$ and US CPI

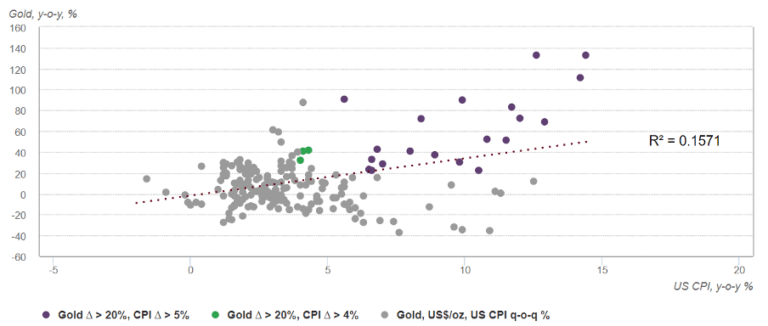

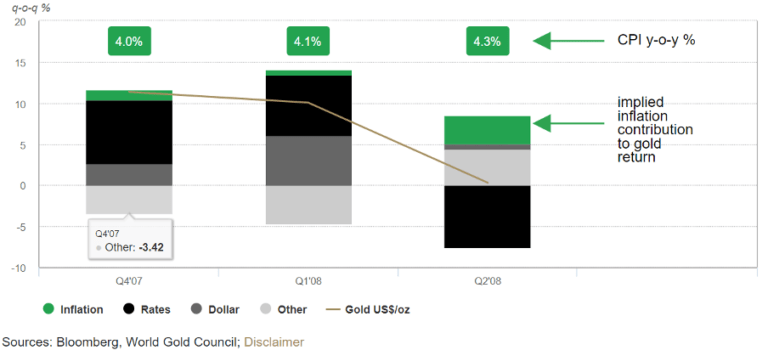

Gold and US CPI inflation: a non-linear relationship The hegemony of the US dollar and US interest rates means that broad conversations on inflation invariably focus on the US consumer price index (CPI). For all the talk of gold as an inflation hedge, its relationship to changes in the US CPI is surprisingly poor (Chart 2). Gold returns and CPI changes have a historically weak linear relation Since 1971, only 16% of the variation in gold prices can be explained by changes in CPI inflation.2 While a period from the 1970s to the early 1980s experienced both strong gold returns and extremely high inflation (purple dots, Chart 2), this has not been repeated since, partly because inflation has been much lower and because the relationship between gold and the CPI has been weaker. Chart 2: Gold and the US CPI: weak relationship post- 1970s Correlation between % y-o-y change in gold US$ and US CPI  Data from Q1 1971 to Q4 2020. Coloured dots refer to periods of ‘high’ CPI y-o-y and high gold returns. The purple dots refer to occurrences between Q2 '73 and Q3 '80, the green dots to occurrences between Q4 ’07 and Q2 ’08. In fact, since the early 1980s the only sustained period of ‘uncomfortably’ high CPI inflation (+4%) amid good gold returns ran from Q4 ’07 to Q2 ’08 during the depth of the Global Financial Crisis (GFC) (green dots, Chart 2). Although gold returns were good, inflation or inflation expectations appeared not to be prominent drivers – as suggested by our short-term gold returns model (Chart 3).3 Chart 3: Recent ‘uncomfortably high’ inflation readings did not appear to drive gold returns Gold short-term returns model attribution*

Data from Q1 1971 to Q4 2020. Coloured dots refer to periods of ‘high’ CPI y-o-y and high gold returns. The purple dots refer to occurrences between Q2 '73 and Q3 '80, the green dots to occurrences between Q4 ’07 and Q2 ’08. In fact, since the early 1980s the only sustained period of ‘uncomfortably’ high CPI inflation (+4%) amid good gold returns ran from Q4 ’07 to Q2 ’08 during the depth of the Global Financial Crisis (GFC) (green dots, Chart 2). Although gold returns were good, inflation or inflation expectations appeared not to be prominent drivers – as suggested by our short-term gold returns model (Chart 3).3 Chart 3: Recent ‘uncomfortably high’ inflation readings did not appear to drive gold returns Gold short-term returns model attribution*  *Our short-term multi-factor gold returns regression model comprises 15 explanatory variables. We can attribute a variable’s impact on each period’s return and we can sum any combination of variables to compute a grouped impact. In this instance we have grouped these variable attributions into four new categories in the chart. Inflation is the sum of US 10-year breakeven yield, current and lagged as well as Brent crude oil. Inflation risk is likely to be of concern to investors throughout 2021. While no one knows with any certainty the ‘type’ of inflation we might see, there are plenty of questions that will need answering:

*Our short-term multi-factor gold returns regression model comprises 15 explanatory variables. We can attribute a variable’s impact on each period’s return and we can sum any combination of variables to compute a grouped impact. In this instance we have grouped these variable attributions into four new categories in the chart. Inflation is the sum of US 10-year breakeven yield, current and lagged as well as Brent crude oil. Inflation risk is likely to be of concern to investors throughout 2021. While no one knows with any certainty the ‘type’ of inflation we might see, there are plenty of questions that will need answering:

- Can we define a relationship between gold and inflation?

- Which assets are the best for protecting new portfolios against both increasing and stable inflation?

- Are there other inflation proxies that have a ‘better fit’ to gold’s returns?

In our ‘Beyond CPI: Gold as a strategic inflation hedge,’ we explore the answers to these questions while reviewing and comparing six potential inflation hedge assets including real estate, energy, and TIPS, ranking them based on sensitivity to the inflation type, consistency of relationship, cost of holding the asset and portfolio impact. Endnotes 1 There is no official definition of ‘high’ inflation. With the Federal Reserve (Fed) accepting 2.4% for 2021, a higher rate or a longer period than this might justifiably be termed uncomfortable as it questions the Fed’s ability or willingness to curtail inflation – and potentially the risk of expectations becoming un-anchored. 2 This figure is 5% if we measure % q-o-q changes. 3 One explanation for this is that gold’s sensitivity to inflation is non-linear and/or time-varying. Our simple model assumes a static relationship.