By Stephen Hull, CFA, CAIA, Managing Director of Zerobridge Partners Asset Management

In the years since the Global Financial Crisis, direct lending to middle-market companies and SMEs has evolved into an established institutional asset class. According to the 2021 Preqin Private Debt Global Report, assets under management in direct lending have risen globally by 10x between December 2008 and June 2020, from US$31 billion to US$333 billion.

The structural reasons for this development are well-documented. Post-2008 changes in regulations curtailed some forms of bank lending and an ultra-low interest rate environment has led institutional investors to seek additional sources of stable cash flow and higher yields to help them achieve their return objectives. Experienced asset managers with strong credit platforms stepped into the gap left by the banks to offer client-specified direct lending products.

The era of "cov lite"

The maturation of and competition within the asset class in North America and Europe has in recent years come with some opportunity cost to LPs. Returns and loan quality are being pushed down by a surplus of capital chasing fewer deals and covenants in both markets are getting even more "lite". This has led to plenty of recent commentary around the potential mispricing of risk in private credit markets.

Time for a re-up?

Investor appetite has not waned, however, with Preqin reporting that 48% of investors surveyed expect to increase allocations to private debt long term and 42% expect to maintain current allocations. LPs are seeking fresh capital: distributions peaked in 2013 globally and are now rising again [Preqin, 2021].

APAC as an alternative?

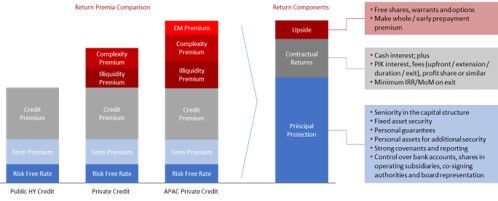

For those seeking to reinvest their distributions into newer vintages while maintaining levels of unlevered returns and covenant strength, we would advocate diversifying some funds into Asia-Pacific middle market lending, which offers meaningful returns over US and Europe equivalents. Investors can expect unlevered, gross IRRs of 15%+ versus 7-10% for the US and Europe.

When we discuss these returns with prospective LPs researching the asset class, we are often met with surprise, even scepticism. What lurks beneath the surface for APAC to be priced this way – are credit risks higher or structures weaker than in other regions?

Comparing structures

APAC deals tend to have tighter documentation and better covenants than comparable transactions in the US or Europe and with lower financial leverage levels. This results in higher quality loans with stronger downside protections. Few deals are PE-sponsored, and as a starting point for documentation, covenants and tenor are all more conservative. Facilities are mainly secured with borrower and third-party collateral and guarantees; covenants are strong with strict cashflow ringfencing and commonly contain EBITDA maintenance, interest coverage, and debt service metrics; and deal tenors are typically two or three years, versus up to the seven years seen in the US and Europe.

Pricing risk: Default and recovery rates

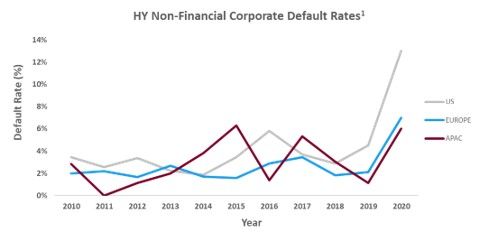

Is this enhanced return profile in APAC driven by disproportionate risks versus other markets? To compare default risk we used Moody's rates on high-yield non-financials as a public market equivalent to compare risk of default across the three major regions and over the last decade. APAC default rates are on average in line with Europe and below the US.

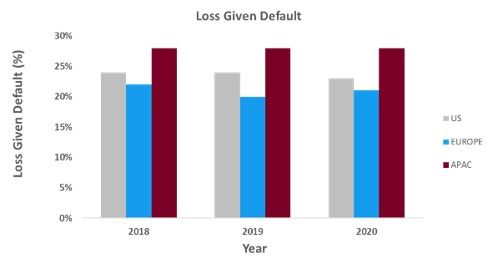

To get a complete picture of potential portfolio impact, default rates should be reviewed in conjunction with loss given default (LGD) and time to resolution data (using GCD large corporate borrowers as a proxy). LGDs over the last three years have moved between 23% and 24% for the US, 20-22% for Europe, and have remained stable throughout APAC at 28%. In addition, time to resolution data is marginally more favourable for APAC (between 1.6-1.9 versus 1.9-2.1 years for US and Europe).

Given this data, we conclude that APAC private credit is of similar risk when compared to the US or Europe. More recent Moody’s data on US corporates [Keisman, D., Chursin, J. and Padgett, C., 2021] suggests recoveries from the 2020 pandemic-induced default cycle are below average, so we retain a watching brief on our conclusions.

Explaining the return premium

In our opinion, APAC's higher returns from a deal perspective really come down to two differentiating and connected factors: the scarcity of funding and the complexity of the deals. In addition, investors should get an incremental return to compensate for the additional illiquidity of the deals in the region.

The APAC region offers global investors higher risk-adjusted returns while increasing portfolio diversification.

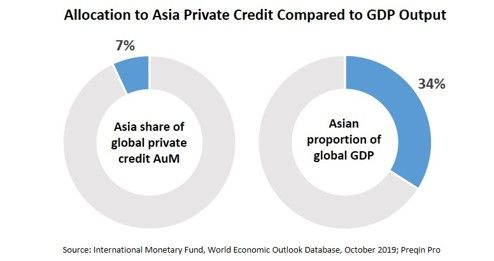

Despite the economic growth of the region, APAC SMEs faced a US$4.1 trillion funding gap pre-COVID [Ellwood-Russell, J. and Sung, M., 2020] and many international banks are retrenching from lending in this space. Private credit has an important gap to fill, but deals must be highly structured and bespoke and there is a scarcity of talent available to do them. Only around 7% of global private debt AUM has been raised in APAC [Preqin, 2021] and there are still only a handful of asset management firms active in this space.

Complexity and scarcity

APAC is a diverse and fragmented regional market with high barriers to entry, including language, culture, regulation, tax, and longer origination and execution periods. Investors in the region operate in over 10 different jurisdictions, ranging from lender-friendly developed markets to middle-income, high-growth "emerging APAC" countries. Emerging Market APAC creditor rights continue to evolve closer to Developed Market APAC, but if deals are not structured correctly, there is risk to the overall portfolio.

This is a stark contrast to the US with a single legal and business framework and highly sophisticated financial services infrastructure. European private credit falls somewhere in between, as there are differences between countries, especially those in northern versus southern Europe but it is still a more sophisticated marketplace.

Active management matters

APAC private credit is playing a different game to the US and Europe. Capital is not chasing deals, but rather the other way around and active management genuinely matters. Deal origination, selection, and structuring, along with experience in multiple jurisdictions and workouts, are all critical to ensuring successful outcomes.

An earlier version of this article was published on the Zerobridge Partners website in April 2021.

About the Author

Stephen Hull, CFA, CAIA, is a Managing Director of Zerobridge Partners Asset Management (“ZPAM”), which is supervised and regulated by the Securities and Futures Commission in Hong Kong. ZPAM takes advantage of the less developed banking and capital markets in the APAC region, and capitalises on strong proprietary deal flow to deliver low volatility, uncorrelated alternative credit strategies with a focus on capital preservation via funds and separate accounts.

References

Ellwood-Russell, J. and Sung, M., 2020. Private Credit in Asia. Hong Kong: Alternative Credit Council (ACC).

Global Credit Data. 2021. GCD Recovery Rate Dashboard Corporates April 2021. [online] Available at: <https://www.globalcreditdata.org/library/lgd-report-large-corporates-202> [Accessed 21 May 2021].

Keisman, D., Chursin, J. and Padgett, C., 2021. Hard Data for Hard Times: pandemic edition. Corporate Defaults and Recoveries - US. New York: Moody's Investor Service.

Lau, CFA, C., 2021. High-yield non-financial companies – Asia-Pacific: Asia's economic recovery will alleviate default risk in 2021 but uncertainty remains. [online] Hong Kong: Moody's Investors Service Hong Kong Ltd. Available at: <https://www.moodys.com/research/Moodys-Expect-lower-default-rate-in-APAC-in-2021-on--PBC_1264005> [Accessed 21 May 2021].

Nesbitt, S., 2017. The Investment Opportunity in U.S. Middle Market Direct Lending. The Journal of Alternative Investments, [online] 20(1), pp.92-99. Available at: <https://jai.pm-research.com/content/20/1/92/tab-article-info> [Accessed 21 May 2021].

Preqin Ltd, 2021. 2021 Preqin Global Private Debt Report. [online] London: Preqin Ltd. Available at: <https://www.preqin.com/insights/research> [Accessed 21 May 2021].