By Mike Parsons, Senior Analyst, at Masterworks.io.

Art has a long history as a transactable asset, with marketplaces and auction houses like Sotheby’s having existed for more than 275 years. Throughout that time, blue-chip works have demonstrated they can increase in cultural significance through universally appreciated aesthetic qualities. Art has proven to be valuable financially as well, with works at the high-end of the market being worth 10s of millions of dollars. Until recently, however, art’s ability to appreciate was understood principally through anecdotes of the ultra-wealthy. The lack of quantitative research around the financial profile of art as an asset has prevented the broader investment community from participating in the asset class. However, with improvements in technology and growing interest from investors in allocating to alternative investments, the financial profile of art is becoming better understood and increasingly available via securitization of the asset class.

Art Market

Size and Investability of the Art Market

With ~$60 billion in annual transaction volume(1) and a total estimated global value of $1.7 trillion(2), art represents a massive asset class. Art is comparable in size to other major private markets, all of which have participation from hundreds or thousands of institutions.

Within the collectibles market specifically, which includes jewelry, watches, sports memorabilia, collectible cars, and wine, art accounts for roughly 75% of annual transaction value(6). Art’s dominant share of the collectibles market is largely attributable to the international scope of the art market, greater demand levels for the asset, and a higher average price point per object. The cultural significance underlying the uniqueness of each individual work of art creates a scarcity not generally present in other collectibles, where editions and multiples are common, even at the high end of the market.

Securitization Opportunity

Despite the size and longevity of the art market, participation has been almost entirely limited to ultra-wealthy individuals buying and selling physical artwork. Securitization of the asset class is becoming increasingly prominent and will make art more accessible to the broader investor community. Securitization of the asset class occurs at the individual artwork level and can be done via the SEC. As a public offering, equity shares can be issued at the underwritten value of the painting and made investable at a substantially lower price point. Though this approach seems novel, art is following a similar trajectory to other investments like real estate and gold, which began as non-securitized asset classes and are now investable via a number of different products.

History of Other Alternative Assets

Two of the largest alternative assets today, real estate and gold, had to overcome similar obstacles of access and market inefficiencies that art currently faces.

Real Estate: As a product of the rise of capitalism and rapid population growth in the 19th century, real estate investing has been around for 200+ years, but it was not until the creation of REITs in 1960 that the real estate market became securitized(7). From there, institutions would rapidly grow investor access through private and public markets via private equity funds, joint ventures, publicly traded REITs, mutual funds, and ETFs. Investor participation in the asset class grew ~120% from 2001 as a result of these new investment products(7). Today, real estate funds have an estimated AUM of ~$9.6 trillion(8).

Gold: Throughout history, gold was used as a medium of exchange, until 1973, when the U.S. ceased using the gold standard (the last country to do so). Not linked to a currency, gold became available to legally own and trade, allowing it to begin functioning as an investable asset. However, the purchase and storage of physical gold was costly, so investor allocation remained low. With the advent of securitized gold products like ETFs in the early 2000s, global investment demand grew rapidly, averaging 14% per year over the next 20 years(9).

Similar to real estate and gold, art lacks investor participation, not because it is an unattractive asset, but because it suffers from the problem of high price points, non-transparent marketplaces, and high ownership costs—all of which can be addressed through securitization of the asset class.

Given the size of the art market, it is well positioned to follow in the path of other major alternative asset classes like real estate and gold, which saw increased investor portfolio allocation upon securitization.

Price Performance

Generally, appreciation in the blue-chip art market is driven by three key global factors: growth in the purchasing power of the ultra-high-net-worth community, the diminishing supply of available artwork (as it is acquired by museums and permanent collections), and the international marketability of the asset. These macro drivers are global and somewhat unique to art, which has resulted in the asset class being generally uncorrelated to traditional investment markets like stocks and bonds.

Methodology and Market Level Performance

As a heterogenous, characteristic-driven asset, traded in a non-continuous pricing market, art tends to be priced on a relative-value basis using comparable sales, similar to real estate. As a result, the price index methodologies developed for home price appreciation (HPI) have the most applicability to the art market, making a dollar-weighted repeat sales pair index, developed by Case-Shiller, the most compelling way to study price appreciation.

Through index construction and analysis, investors can gain insight into historical performance at the market, segment, and artist levels. Figure 1 highlights how three different segments of the art market have performed over the last 25 years. Noticeably, contemporary art (broadly defined as works created after 1945) demonstrates attractive historical price appreciation, with prices outperforming the S&P 500 over this period, increasing 14.0%.

Contemporary Art

The outperformance of contemporary art prices relative to the other segments of the market can be attributed to the higher demand for works created after 1945. The idea that price performance follows recency in generational increments is supported by contemporary art’s market share of annual transaction volume. As of 2020, contemporary art had an estimated market share over 55% of annual public transaction volume, both in terms of dollar amount and number of works sold(1).

The demand for contemporary art drives up the value of works from that time period / style, which in turn increases the amount offered and transacted, relative to other segments of the market.

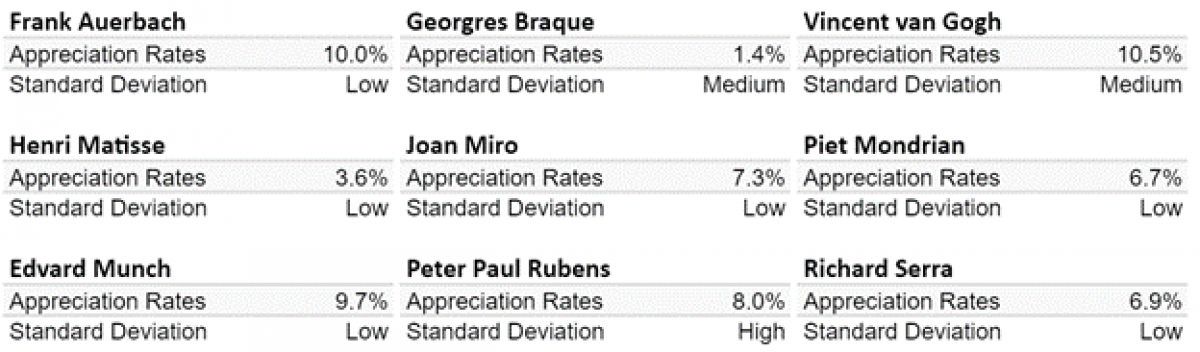

Appreciation by Artist

Through analysis of repeat sales pairs, financial metrics like appreciation, standard deviation, and loss rates can be determined at the artist level. As seen below, the financial profile of a specific artist's performance can vary significantly across artists, as well as the broader art market indices. If an investor is targeting a portfolio with a specific risk / return profile, understanding appreciation rates at the artist level is the key driver of making intelligent investment decisions. However, like with any asset, if the investor is simply targeting beta exposure to the art market, or art market segments, diversification across artists / works is more important than specific artist selection.

Diversification Benefits of Art

Art exhibits low correlation and strong capital preservation qualities. As mentioned above, the low correlation between contemporary art and other asset classes is a result of the underlying driving forces of art market appreciation, which are growth in the purchasing power of the ultra-high-net-worth community, the diminishing supply of available artwork, and the international marketability of the asset.

For example, annual performance by select years highlights the lack of correlation between art and traditional asset classes. As discussed above, the driving forces of art market value are somewhat unique to the asset class, allowing art prices to perform well in years like 2008 and 2018, when most traditional asset classes lost money.

Art as a strategic diversifier presents valuable portfolio diversification qualities. Its strong potential price appreciation rates and lack of correlation make it an asset that can be deployed across a variety of different portfolios to improve risk-adjusted returns.

State of the Art Market

2020 further illustrated how the value of art is disconnected from general global trends and also indicated that the asset class is positioned to further appreciate in the future. COVID’s impact on the art world highlights the reality that the top 1%, on a global basis, has been less impacted than the rest of the population. While auctions were cancelled and moved online, the contemporary art market appreciated by 15.1%. This increase corresponded to the increase in the number and wealth of billionaires, which reached all-time highs in 2020, according to the 2021 Art Market Report published by UBS and Art Basel. The ultra wealthy also indicated that their interest in collecting had increased during the pandemic, so while there were fewer opportunities to buy paintings as a result of COVID, the value of art continued to improve.

The longer-term outlook of the market is positive as well. The shift to online transactions from the pandemic has increased interest from young buyers in the art market. Sotheby’s estimated that buyers under 40 accounted for 25% of bidders in online-only auctions (compared to 15% in live auctions). Given the infrastructure for online sales now exists, auction houses will likely keep this feature to continue to attract younger buyers.

Conclusion

As art becomes an increasingly securitized asset class, growth in interest from the investor community will continue to mount. By understanding how art can be used as a strategic asset within a portfolio, investors will be able to improve both absolute and risk-adjusted returns, as well as further protect against downside losses. Understanding art as an asset can better position investors, advisors, and asset managers to make intelligent investing decisions as the accessibility of investment products continues to improve.

Footnotes

- Art Basel and UBS: The Art Market 2021.

- Deloitte, ArtTactic: Deloitte Art and Finance Report 2019. Estimated based on surveys of wealth allocation to art and estimates of total wealth held by individuals. Estimated value of artwork held by individuals.

- Preqin Website, McKinsey & Company: Private Markets Come of Age: McKinsey Global Private Markets Review 2019. Private market assets under management investing in debt.

- Preqin Website, McKinsey & Company: Private Markets Come of Age: McKinsey Global Private Markets Review 2019. Private market assets under management investing in real estate, natural resources, and infrastructure.

- Preqin Website, McKinsey & Company: Private Markets Come of Age: McKinsey Global Private Markets Review 2019. Private market assets under management investing in private equity.

- Forbes Website, Deloitte and Credit Suisse: Collectibles: An integral part of wealth. Collectibles reflects

- Nareit Website. Reflects increase in American households invested in REIT stocks.

- MSCI: Real Estate Market Size.

- GOLDHUB: The relevance of gold as a strategic asset.

- Repeat-Sale Pair (as defined by the applicable auction house) using Standard & Poor’s CoreLogic Case-Shiller Home Price Indices Methodology. Index shown through 2020. Index data updated as of December 31st, 2020.

- The Standard & Poor’s CoreLogic Case-Shiller Home Price Indices Methodology results in a value-weighted index. Auction results realized in a currency other than U.S. dollars have been converted using exchange rates provided by FRED (St. Louis Federal Reserve) at the time of the most recent sale. This adjustment is made to account for long-term exchange rate trends that would otherwise distort artworks’ performance.

- S&P 500 Total Return Index as of December 31, 2020.

- Internal Masterworks.io Analysis. Low risk profile is standard deviation <10%, Medium is between 10% and 20% and High is >20%. Reflects only returns on repeat-sale pair paintings.

- Internal Masterworks.io Analysis. Yahoo Finance. MSCI Database. FRED (St. Louis Federal Reserve).

About the Author

Mike Parsons is a Senior Analyst at Masterworks.io. Masterworks.io began with the goal of providing broad investor access to the blue-chip segment of the art market. To date, the business has securitized more than 60 paintings valued between $1 - 20 million and anticipates buying around $300 million in art in 2021. Looking forward, Masterworks plans to continue to educate the various investor communities around the financial characteristics of art as an asset. By combining art market research with the securitization of the asset class, we want to serve as a resource and market leader in the growth of art investing. Should you have any questions regarding the above article or would like to learn more about art as an asset class, please contact Mike Parsons at mparsons@masterworks.io.

The information contained herein neither constitutes an offer for nor a solicitation of interest in any specific securities offering. For any proposed offering pursuant to an offering statement that has not yet been qualified by the SEC, no money or other consideration is being solicited, and if sent in response, will not be accepted. No offer to buy the securities can be accepted and no part of the purchase price can be received until the offering statement for such offering has been qualified by the SEC any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of acceptance given after the date of qualification. An indication of interest involves no obligation or commitment of any kind. Offering circulars for Masterworks offerings are available here.