By Toby Goodworth, Head of Liquid Markets, at bfinance.

Global deal-making has soared since January, with the value of announced mergers and acquisitions exceeding $2.4 trillion through the end of May. Against this backdrop, event-driven hedge fund managers are taking full advantage of ready opportunities to trade, and the results have been striking.

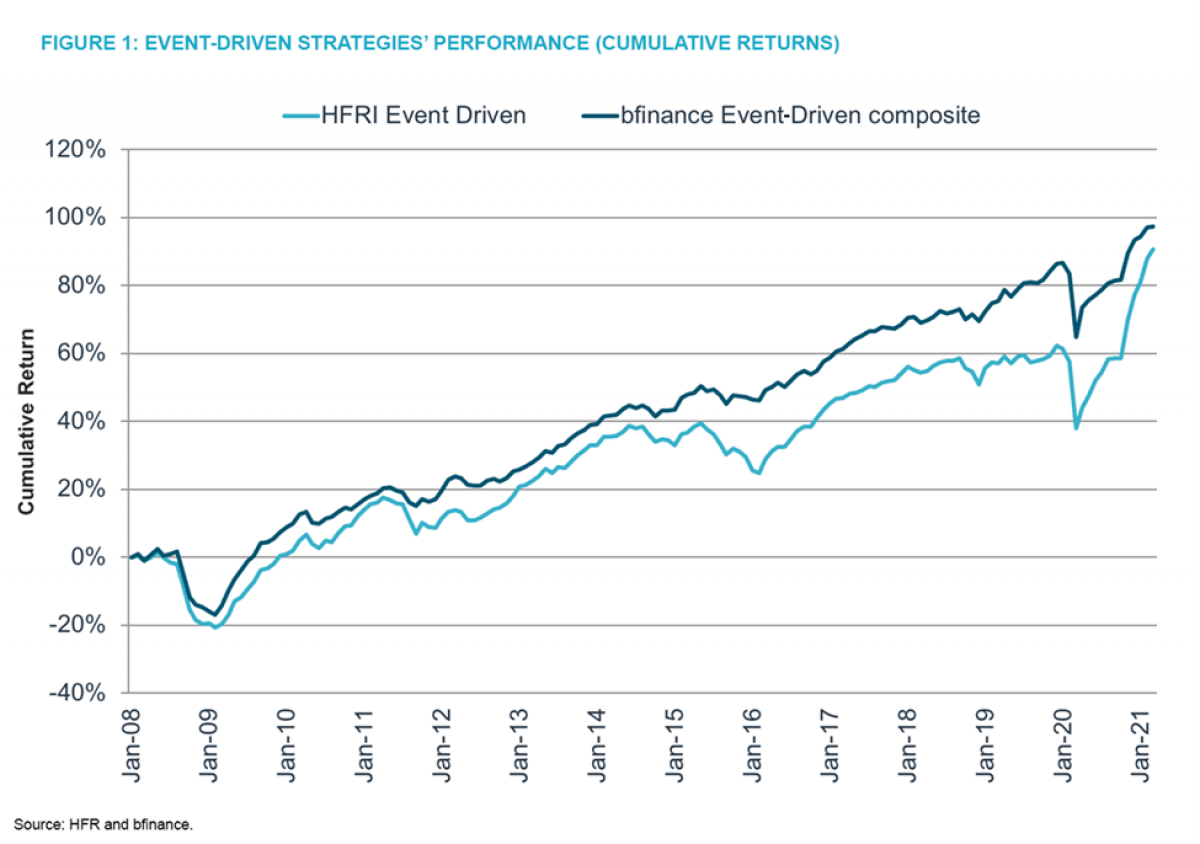

In Q1, event-driven strategies tracked by bfinance posted a composite return of 7.3%—the strongest first quarter performance figure we’ve seen since 1993—and are now into double digits for the first five months of the year. The broad HFRI Event Driven (Total) Index, which is more directional and equity-oriented than the bfinance composite, is up 11.5% over the same period.

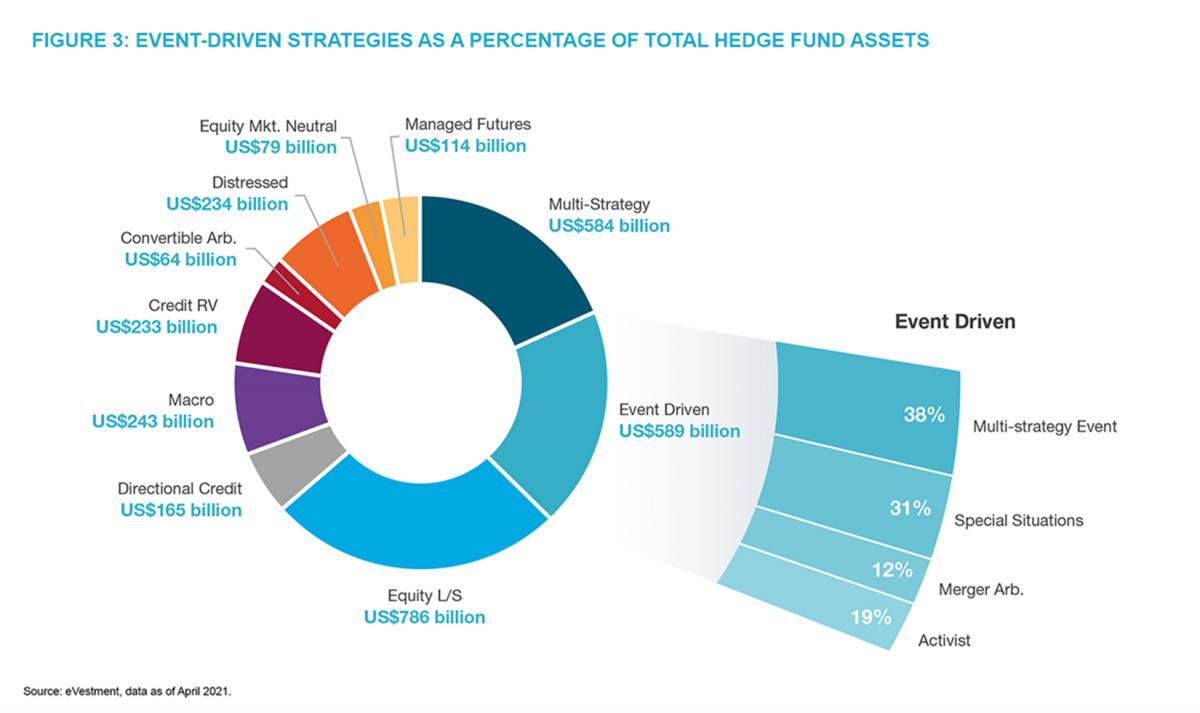

Asset flows have also been strong as investors have flocked to event-driven strategies, which represent the largest family of styles by assets under management. Currently, event-driven assets command $590 billion, or 19% of the $3 trillion-plus total assets invested across the hedge fund industry, according to market research firm eVestment—and the event-driven sector was one of the few to see assets under management expand in both 2019 and 2020. This year, event-driven strategies as a whole have already attracted as much money in Q1 2021 as they did in the 2020 calendar year.

With performance running hot and capital inflows rising, investors may rightly wonder whether it’s already too late to reap any benefit from making new allocations to the event-driven space. We think not—in a well-diversified portfolio, event-driven strategies can have a powerful, protective effect by dampening portfolio volatility and providing an alternative source of alpha. As multiple positive tailwinds continue to drive stock markets higher, many investors are actively searching for the means to reduce their portfolios’ exposure to pure equity risk; in our view, event-driven strategies can offer usefully different return patterns that allow investors to minimize that risk while still maintaining equity-centric allocations.

Leveraging corporate catalysts for diversified returns

Unlike long-short equity strategies, which are designed to offset the volatility of holding equities over time, event-driven strategies are constructed to generate returns from temporary mispricings or arbitrage opportunities that arise from specific corporate situations. These events are, by their nature, short- to medium-term dislocations that arise from either hard catalysts, such as mergers, acquisitions, restructurings, bankruptcies and spinoffs; or soft catalysts, such as anticipated events or changes to a company’s capital structure.

Since the beginning of 2021, the frequency of corporate catalysts—whether hard or soft—has accelerated, powered by strong economic recovery and growth in developed markets, record equity market and convertible bond issuance, and the explosion of special-purpose acquisition companies (SPACs): blank cheque investment vehicles designed to take private companies public, which have helped fuel an enormous surge in initial public offerings (IPOs) this year. Although SPACs have lost a little of their lustre in the past month or two, the markets are still rich with trading opportunities for event-driven managers—and we don’t expect to see any sudden deterioration in the number of corporate catalysts arising in the current recovery period.

For investors, the key challenge in selecting an event-driven manager arises from an abundance of choice: The sector comprises more than 380 managers implementing a wide range of investment strategies. For ease of analysis, we break down the sector down the event-driven space into four distinct sub-categories:

Merger arbitrage: managers trade on hard catalysts and announced deals, seeking to profit from the deal spread independent of equity market direction.

Special situations: managers invest opportunistically across a broader range of soft catalysts seeking to profit from a wide range of anticipated corporate events.

Activist investing: managers aim to generate returns by active engagement with a company’s board of directors to affect corporate change.

Distressed: managers seek discounted investment opportunities in stressed or default debt with the aim of profiting over the long-term from corporate restructuring.

Although event-driven strategies are inherently directional in aggregate, the more market-independent styles—such as merger arbitrage and multi-strategy—provide refuge for investors seeking to dial down beta in their portfolios and mitigate pure equity risk, as shown in Figure 2. Activist strategies and special situations, by contrast, are far more sensitive to market directionality.

Although event-driven strategies were affected by the onset of the Covid crisis in Q1 2020—as all risk assets sold off in line with equities—they were fairly swift to recover, resulting in a transient correlation spike. The dislocation reveals that even market-independent strategies can have brief periods of elevated correlation, but the key takeaway from bfinance’s data is that these periods, when they do occur, are not long-lasting; the diversification benefit of event-driven strategies remains quite consistent over time.

Although returns have been strongly positive across the spectrum of event-driven subcategories tracked by market specialist firm HFR Inc., some have significantly outperformed their peers since the start of this year. Special situations, for example, have risen by 14.1% through May, followed by activist strategies (13.4%), distressed strategies (12.5%) and multi-sector strategies (9.7%). Although merger arbitrage was the comparative laggard in absolute terms, delivering a positive return of 8.4% through May, its inherently more conservative risk profile meant that it emerged at the top end of all risk-adjusted returns across this sector. By comparison, the HFRI Asset Weighted Composite was up just 6.0% through the end of May.

Contrary to what some investors may believe, event-driven strategies are comparatively liquid strategies. Merger arbitrage strategies tend to provide monthly or weekly liquidity (some even offer daily liquidity); special situations typically provide quarterly liquidity—only distressed strategies, due to their longer time horizons, restrict redemptions to semi-annual or annual frequencies.

‘Usefully different’ returns help mitigate pure equity risk

Whatever their particular trading catalyst, the strength of these strategies lies in their diversifying power over time. Some investors currently use them for uncorrelated return generation—setting aggressive return targets and generous, equity-like risk budgets for their allocations to more directional sub-strategies—while others take a strong view on pure equity risk and favour more market-independent styles with very low equity beta of 0.1% or 0.2%.

Even if the pace of new deals tapers off in the second half of 2021, we don’t anticipate any immediate slackening of opportunity in the current market. Many of the recently announced mergers will take months to play out; in the meantime, event-driven managers are continuing to take advantage of the trading opportunities brought about by continuing deal flow, record levels of new issuance in equity and convertible bond markets, and broad acceptance of SPAC-financed IPOs. For investors, the potential to reap usefully different—and diversifying—returns has perhaps never been better.

An earlier version of this article was originally published at www.bfinance.com.

About the Author

Dr. Toby Goodworth is Head of Liquid Markets at bfinance and a member of the firm's Senior Management Team. Before joining bfinance in 2012, he was Head of Risk Management at Key Asset Management, one of Europe's oldest fund of hedge funds, where he designed and ran the firm's bespoke risk models. Prior to that, he was a risk analyst focusing on quantitative global equity strategies. Toby holds a Ph.D in Physics from University College London and a First Class honours degree in Physics, also from UCL.

About bfinance

bfinance is an award-winning specialist investment consultancy with a range of services including manager research, fee/cost benchmarking, risk analytics, performance monitoring, asset allocation and investment policy design, ESG advisory and more. Headquartered in London with offices in nine countries across four continents, the firm is known for exceptional client servicing and high-quality research execution (based on independent customer research). Clients include pension funds (DB and DC), sovereign funds, endowments, foundations, insurers, family offices, financial institutions, wealth managers and other investor entities.