By Nikolay Zvezdin, CAIA, founder of Alter Securities Exchange (as.exchange), Richard Wiggins, CFA, CAIA, Senior Advisor and Editorial Review Board member at CAIA and Michael Edesess, Ph.D, Managing Partner / Special Advisor at M1K LLC.

Since 1998, the global OTC derivatives market has grown rapidly, from a notional value of $80 billion to over $600 trillion in 2020, which is nearly 7 times global GDP. The public is well acquainted with these financial instruments as an effective way to hedge risks and optimize returns by transforming the performance of underlying assets.

Notional OTC Derivatives Amount Outstanding

Source: Bank for International Settlements. (2021, May 12). OTC derivatives statistics at end-December 2020. Retrieved 1:00, September 18, 2021 from https://www.bis.org/publ/otc_hy2105.pdf

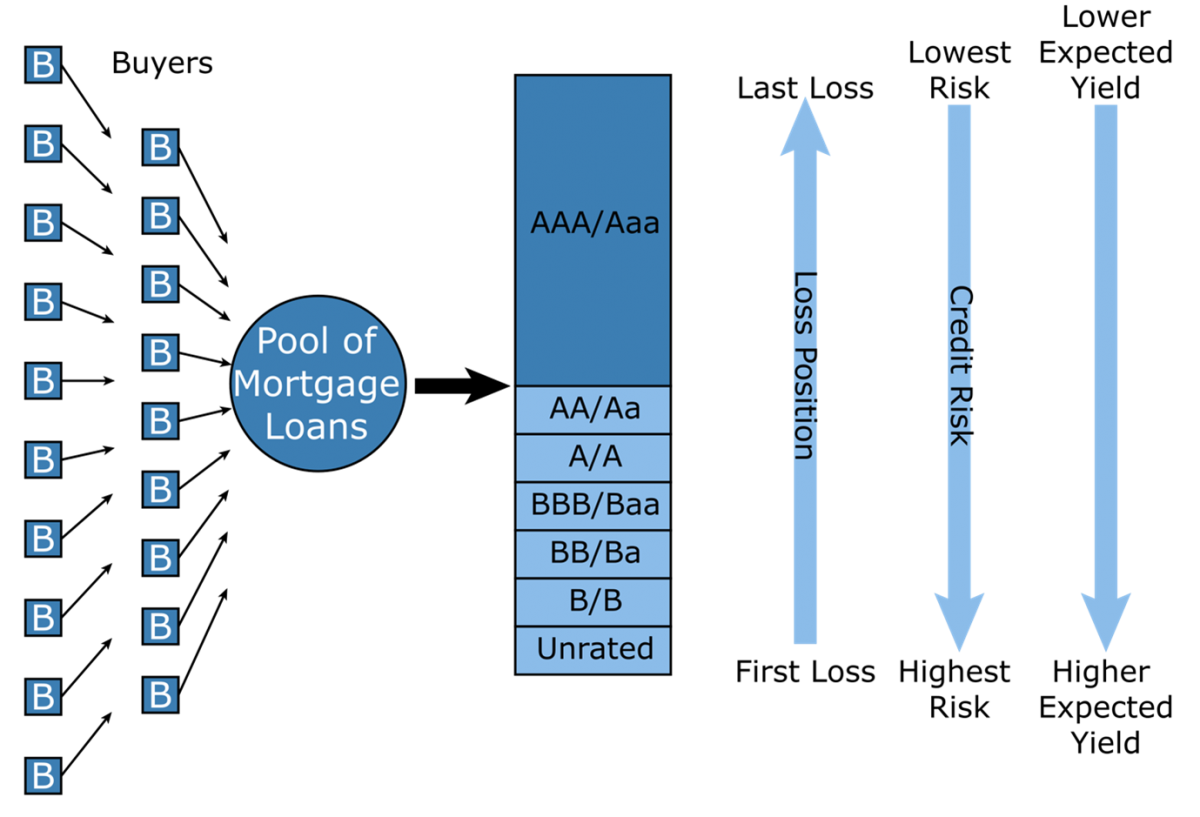

Despite the importance and size of the global derivatives market, there has been little change to the actual structure of products, as most of them either split pooled assets or pooled cash flows. Structured products are made up of several financial assets and are therefore not reliant on one of them individually, but on their combined performance. In general, structured products consist of two components, the first one ensuring the protection of the principal capital and the second one, riskier, allowing the product to maximize its return. Mortgage-backed securities are the best-known example where multiple assets or cash flows are pooled together, tranched and sold as different securities with various investor-desired risk-return characteristics i.e., a pension fund gets safer financial instruments than the original underlying, while investors with a greater return appetite get a riskier product with bigger potential returns.

Cash Flow is Carved Up According to Seniority Rules

Source: Wikimedia Foundation. (2021, July 5). Mortgage-backed security. Wikipedia. Retrieved September 17, 2021, from https://en.wikipedia.org/wiki/Mortgage-backed_security.

Barriers, cliquets, autocallables, volatility-linked CDs, baskets, and rainbow derivatives all combine various products or assets to create a security with diverse payment and obligation structures. However, none of those is currently able to do so with a single asset that serves as underlying. Combining multiple instruments results in market incompleteness and partial efficiency, allowing for asset mispricing, instrument misuse and arbitrage profits for sophisticated investors.

However, it is possible to create a new type of financial instrument that would tranche the value of a single asset or a single cash flow, resulting in the creation of multiple instruments of various risk profiles from a single asset. This instrument – the Tranched Value Security (TVS)* - was first described in a research paper published on the Social Science Research Network (SSRN). It facilitates further improvement of risk-transfer practice, and evolution of the financial system. TVS contracts securitize a single asset value rather than cash flows (as in MBS) or asset pool (as in ABS). Carving a single asset into an array of risk profiles satisfies different types of investors – from sovereign wealth and pension funds who invest only in the safest instruments (or tranches), to speculative hedge funds aiming for high risk, high return investment opportunities.

Value is Carved Up According to Seniority Rules

Source: Zvezdin, Nikolay, Tranched Value Securities (February 19, 2019). Available at SSRN: https://ssrn.com/abstract=3337692 or http://dx.doi.org/10.2139/ssrn.3337692

The simplest Tranched Value Security contract is broken into a Variable Value Share and a Fixed Value Share which has the first claim priority on value (rather than cash flow). The value of both shares is derived from the price of the underlying security, but parties will earn differing rates of return from the same asset when they own tranches of differing seniorities. The highest value tranche is similar to a planned amortization class (PAC) tranche which is designed to protect investors from sharp declines in portfolio value. The lowest value tranche can be viewed as a support value tranches (SVT), which exhibits the highest risk and highest expected return.

Like sequential-pay collateralized mortgage obligations (CMOs) which are structured so that each tranche retires in sequence, the payment rules for principal payment distribution are known but the exact amounts to be paid are not. If the value of the underlying decreases significantly, exceeding the detachment point of the junior value tranche, the junior value tranche might experience nil value, while the senior value tranche may still be positive. All senior value tranches must be paid if requested (similar to exercising a call option contract), followed by the less senior tranches if any value is left.

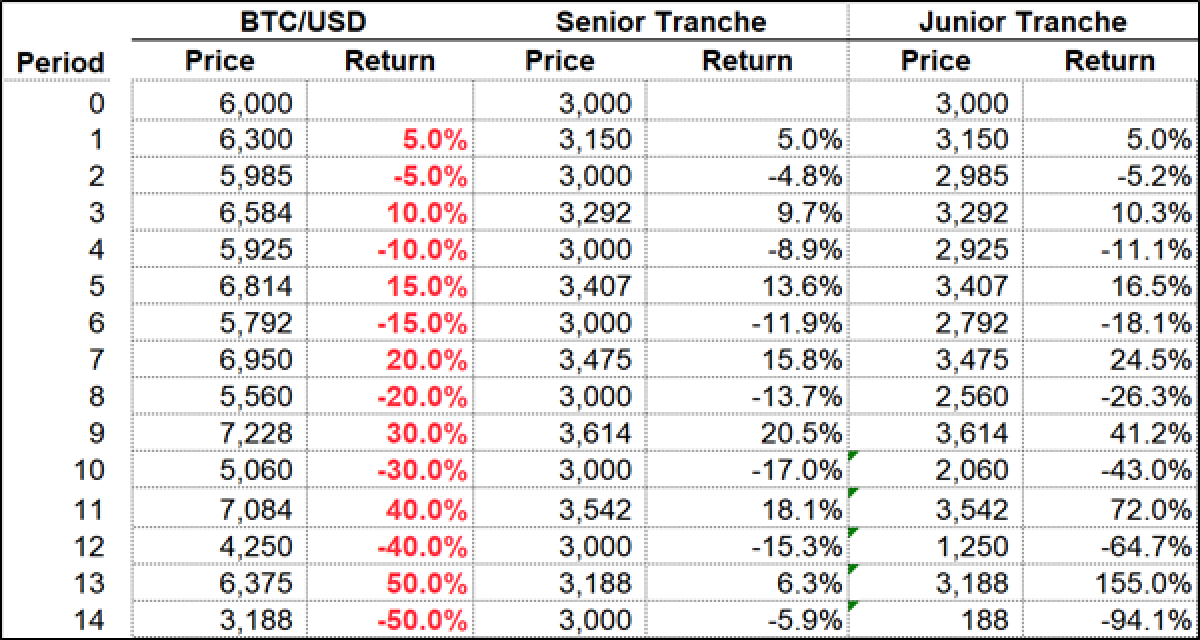

The variable value tranches can be viewed as support value tranche (SVT), which exhibit the highest volatility of returns. A simple example presented below shows how tranching a single underlying security can create multiple derivative securities suitable for a range of risk-averse and risk-tolerant investors.

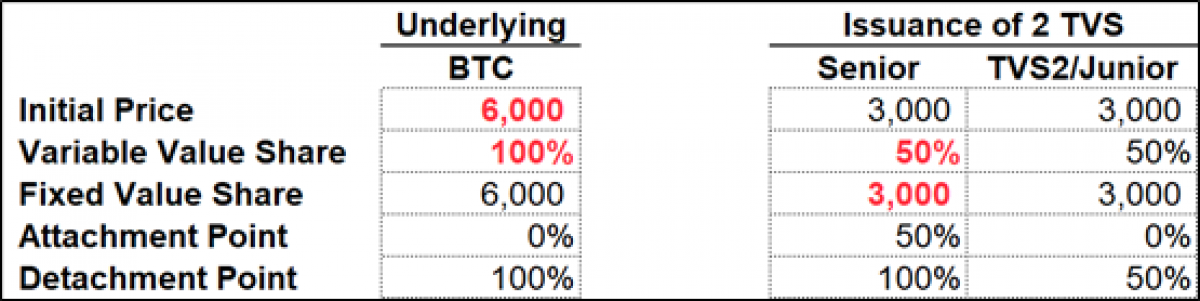

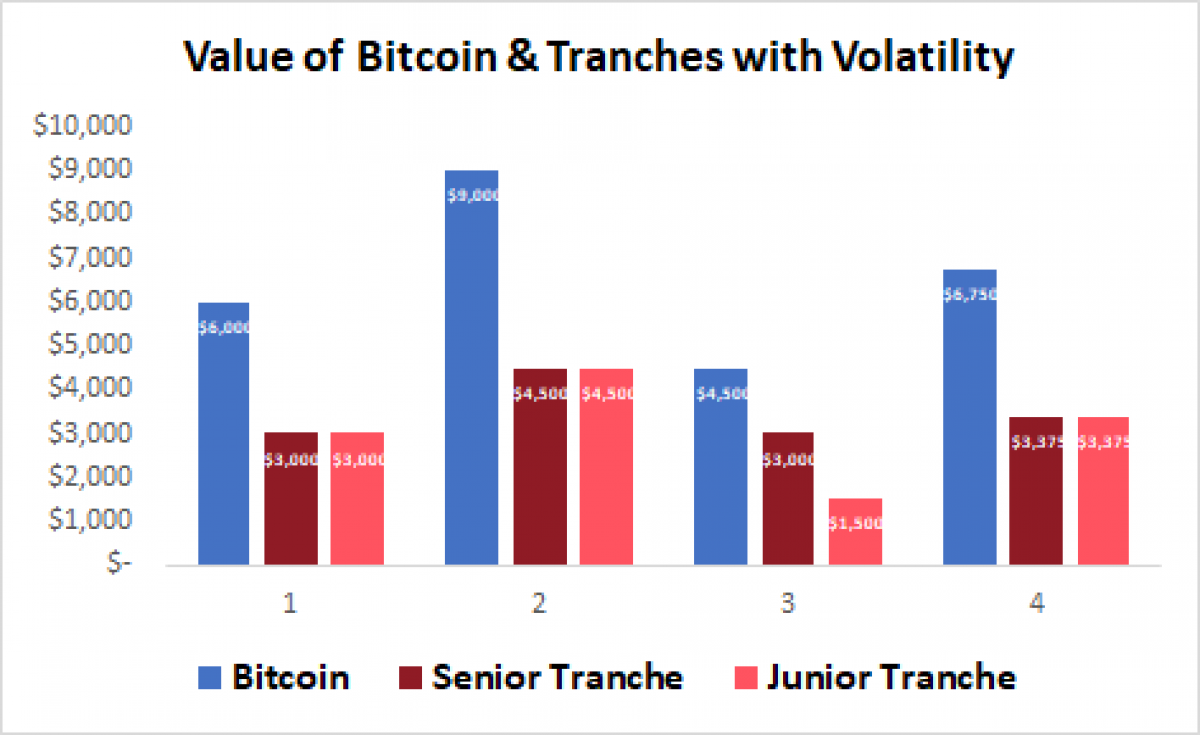

Imagine that you have one Bitcoin, assume the price is $6,000 (yes, we all wish it still cost that) and you issue 2 TVSs backed by it – senior, and junior. Each TVS has a variable value share (VVS) of 50% of Bitcoin market price, and a fixed value share (FVS) of $3,000. When the price goes up, the tranches appreciate equally, but when the price of Bitcoin declines, the junior tranche loses first. This sounds unappealing but if the price starts increasing afterwards, the junior TVS is compensated by a magnified return.

Although the senior and junior tranches appear to share the same value in an appreciating market, TVS’s market prices aren’t going to be equal to their guaranteed values. In fact, the market will price them so that the senior tranche is a lower risk / lower return vehicle, while the junior tranche is a higher one. In a declining market, the TVS contract guarantees the senior tranche a price equal to the greater of:

- half the price of Bitcoin (the variable value share), or

- $3,000 (once determined by the contract this fixed value stays the same). If 50% of a single Bitcoin is worth less than $3,000 then the junior tranche will have to make up for it. The junior tranche is worth whatever is left after the senior tranche A has received its guarantee.

If, however, a single Bitcoin drops below $3,000 then the junior tranche will receive nothing and the senior tranche will receive less than so-called Fixed Value Share. The Fixed Value is not an insurance guarantee, if the underlying Bitcoin goes to zero and stays there then both tranches could be worth nothing.

Source: as.exchange Research

Attachment Point (AP) and Detachment Point (DP) can be calculated to give a better idea of potential risks of a particular value tranche. The AP provides an indication by how much Bitcoin must drop before the senior security starts to be worth less than the ‘Fixed Value’. Thus, an AP of 50%, means that if BTC declines by anything less than 50%, the junior tranche will lose but not the senior one. The DP, on the other hand, is an indication by how much the underlying needs to decline in order to completely wipe out the value of the tranche. A tranche with the DP of 100% implies that BTC needs to be priced at $0.00 to lose all value, while the junior tranche with a DP of 50% indicates that a decline of 50% will wipe out all its value.

Source: as.exchange Research

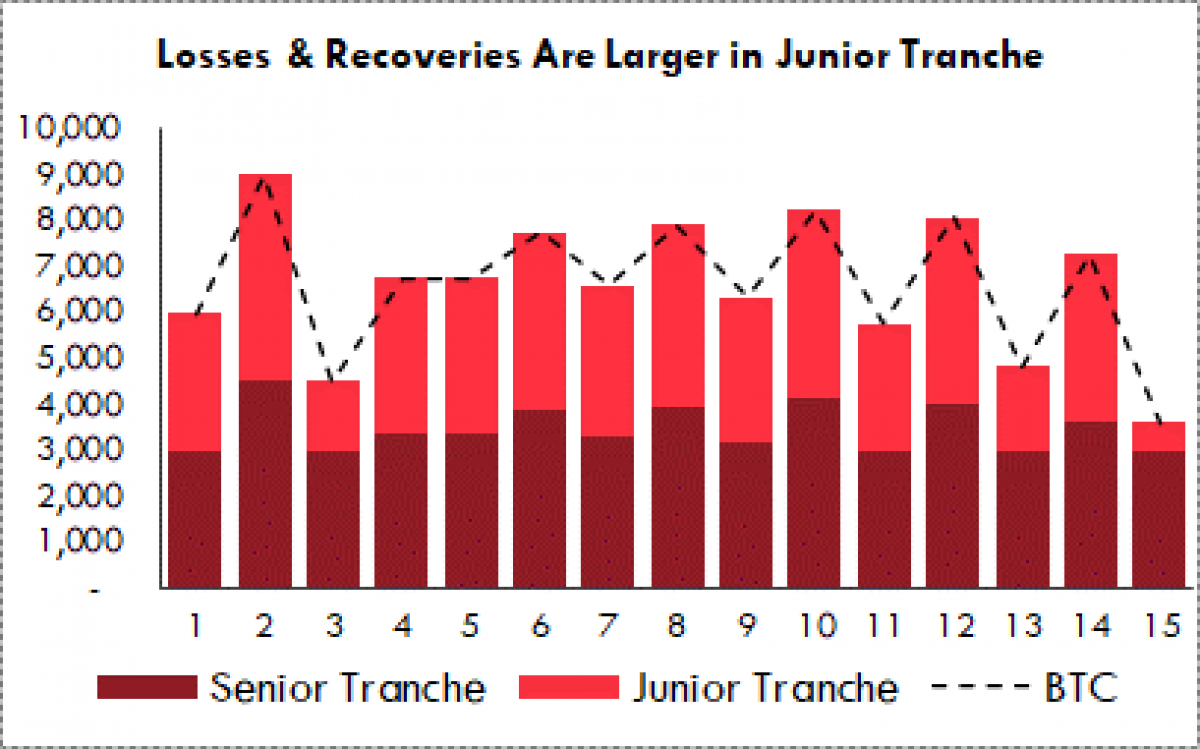

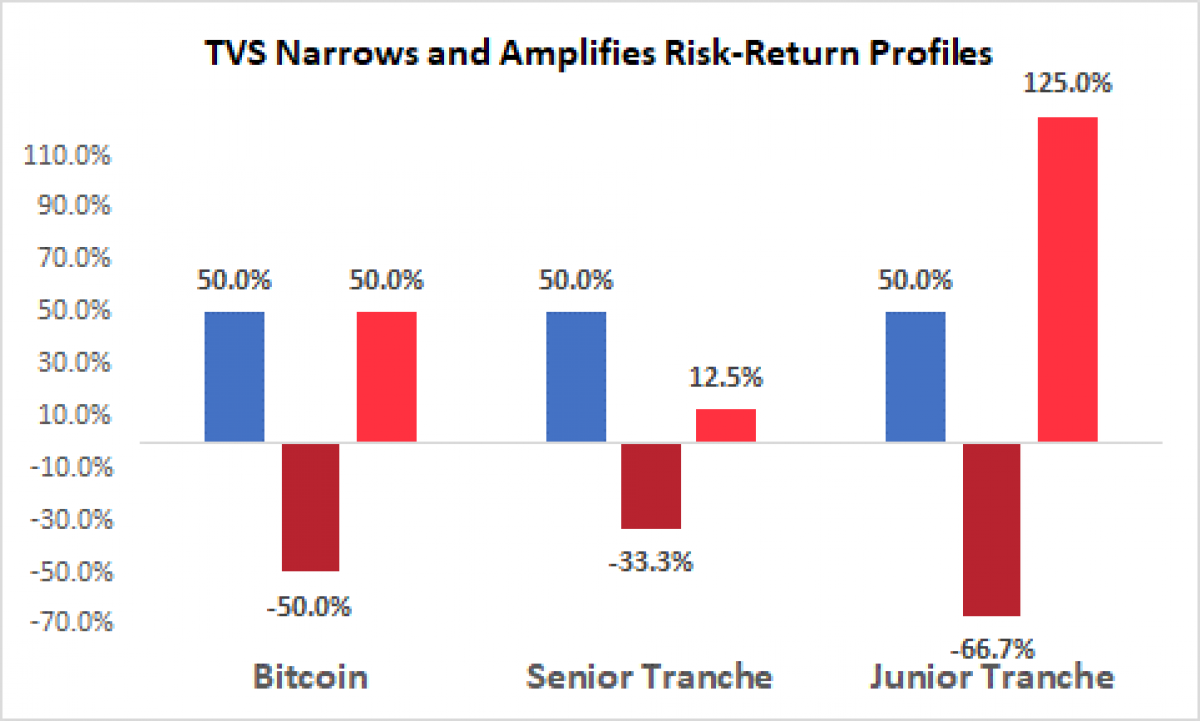

As can be seen, the returns on the junior tranche are more exaggerated but the combined value of the senior and junior tranche is equal to the underlying Bitcoin.

Source: as.exchange Research

To get a better feel for the mechanics, BTC price swings of larger magnitudes of +50%, -50%, and +50% are depicted here.

Source: as.exchange Research

With an ending Bitcoin value of $6,750, both the tranches split the appreciation 50-50 and are worth $3,375 but for risk averse investors the senior tranche is preferable while investors who purchase the junior tranche on the dip have an opportunity for even greater gains. The senior tranche is less volatile than the underlying while the junior tranche has superior expected returns.

Source: as.exchange Research

Bitcoin is the most known and widely accepted digital asset in the world with a price that can either increase or decrease by double-digit numbers every day and such tranching can mitigate the swings. Moreover, Bitcoin can be tranched into additional tranches that further mitigate risk to the senior tranche.

The current model omits a price premium that must be paid for receiving a superior claim right on value tranche of a particular security, which on its own is of value to investors. The market price of the senior tranche should be higher because its future downside is better but will vary depending on how much the market puts a premium on low-risk vs lottery ticket securities. While someone might earn 10%, the junior tranche makes it possible to earn 100%, or even more without leverage, and without risk of being liquidated. There has been a continuous increase in the demand for financial instruments with asymmetric return patterns, and the Tranched Value Security (TVS) is one such instrument. The volatility of digital assets scares common people, and puts pressure on professional traders forcing them to search for efficient ways to manage risks and enhance performance.

In the future, Tranched Value Securities will be available on equities like Apple and Facebook and the implications are extraordinary. An investor holding senior TVS, and junior TVS, backed by the same equity have little co-movement. The return distributions for most TVSs exhibit positive skewness and positive kurtosis. Some TVS structures allow for the creation of duplicates of existing derivatives, but at lower cost, with greater leverage, or with more stable return profiles. Price revelation could be improved, and the combined value of value tranches might be greater than the value of the underlying on its own.

For a non-asset owner, buying TVS means going long a portion of underlying expected risk and return, while for an asset owner selling a portion of TVS (depositing the asset and securitizing or selling some TVS) it means going short a portion of underlying expected risk and return, while keeping long position in the TVS that s/he kept. The current implementation of TVS doesn’t allow shorting TVS contracts, however, TVS in principle can be shorted as well. TVS could provide a great deal of information about the various levels of risk within the same underlying/issuer.

TVS allows more efficient trading strategies and facilitates more effective risk management strategies. It’s the next step forward in improving market efficiency, market completeness, risk transfer and sensitivity to new information.

The Tranched Value Security (patent pending*) is an innovative financial security and is only available at as.exchange. In theory, it allows you to split anything (Bitcoin, stock, or any other asset) into multiple “independent” securities and is currently available on Bitcoin and Ethereum. Currently as.exchange offers Tranched Value Securities with Bitcoin (BTC) and Ethereum as the underlying, however, they will be launching other types of digital assets, and capital market assets (both equity and fixed income) for securitization soon.

* Alter Securities (the parent company operating as.exchange) has filed a patent application with the World Intellectual Property Organization (WIPO) for the Tranched Value Securities (the “TVS”) instrument.

(9) as.exchange Tranched Value Securities (TVS) Explainer - YouTube

Example:

Appendix:

About the Author

Nikolay Zvezdin, CAIA, is founder of Alter Securities. Nikolay is a seasoned cross-border investment manager with activist investments, private equity, and venture capital experiences in FIG, TMT, Healthcare, and T&L across the EMEA and APAC regions.

Alter Securities is an R&D driven developer of novel financial instruments that operates Alter Securities Exchange (as.exchange) where proprietary, novel, and common financial products are traded. The first products offered on as.exchange include Tranched Value Securities (TVS) backed by digital asses, with further assets to be added in the near future. Moreover, Alter Securities facilitates large OTC deals in structured instruments and innovative derivatives for institutional clients.

Alter Securities is developing novel financial instruments and innovative technology to improve market efficiency through expanding investment opportunities, and enhancing investors’ risk-return profiles. We equip traders and investors with the financial instruments that allow them to benefit from what was inaccessible before, create new investment strategies, and tailor-tune returns with a wide range of novel securities and technologies.

Richard Wiggins, CFA, CAIA is a well-known asset allocator and institutional advisor on portfolio construction, risk, and alternative assets. His work has been featured in the Wall Street Journal, Barron's, Institutional Investor, and various practitioner journals. LinkedIn.

Michael Edesess, Ph.D is an accomplished mathematician and economist with a Ph.D. in pure mathematics in stochastic processes and expertise in the finance, energy, and sustainable development fields. He is an adjunct associate professor in the Division of Environment and Sustainability at The Hong Kong University of Science and Technology, managing partner / special advisor at M1K LLC, and a research associate of the EDHEC-Risk Institute. He is author or coauthor of two books and numerous articles published in Advisor Perspectives, MarketWatch, The Wall Street Journal, Financial Times, South China Morning Post, Bloomberg, Nikkei Asian Review, Technology Review, and other publications, and was previously a co-founder and chief economist of a financial company that was sold to BNY-Mellon. He has chaired the boards of three major nonprofit organizations in the fields of energy, environment, and international development.