By William (Bill) J. Kelly, President and CEO of the CAIA Association.

I spent last week at the SALT Conference in NYC, and it felt great to be back in a zoom-free zone. It was less of a global crowd this year due to COVID travel restrictions but nonetheless, you always learn a lot when you are elbow-to-elbow with 2,000+ delegates. CAIA Association once again had the honor of hosting an allocator panel which brings the many investment themes circling around the Javits Center down to the reality of a decision-making process. Global CIOs are in the outcome business and their job is a hard one whether you believe we are in the overtime period of this risk-on trade or not.

We are well into the acceptance phase of the secular decline of the defined benefit construct, as the defined contribution plan and/or the IRA have become the new retirement corpus and we are the modern-day CIOs… and our job too is hard. If we have sole responsibility for our investment and longevity risks, why should we not have access to the same uncorrelated risk premia that was available to the nanny-state model of the previous generations? That is essentially the argument for democratization of product under a retirement path that we have (accidently) accepted over 4 decades ago. This genie can no longer get back in the bottle, but if we accept democratization as our pre-ordained destination, transparency must be our guide, as we democratize some facts and realities too:

FACT 1: Liquidity can be a feature but is not necessarily a benefit. The liquid alt juggernaut following the GFC drawdown was product driven and played right into the scarred tendencies of the average retail investor. Our industry took very sophisticated strategies that were largely unconstrained re leverage, liquidity, transparency, position sizing, and regulation, and then jammed them into a highly regulated T+1 wrapper, and expected it all to end up with a differentiated offering #LOL.

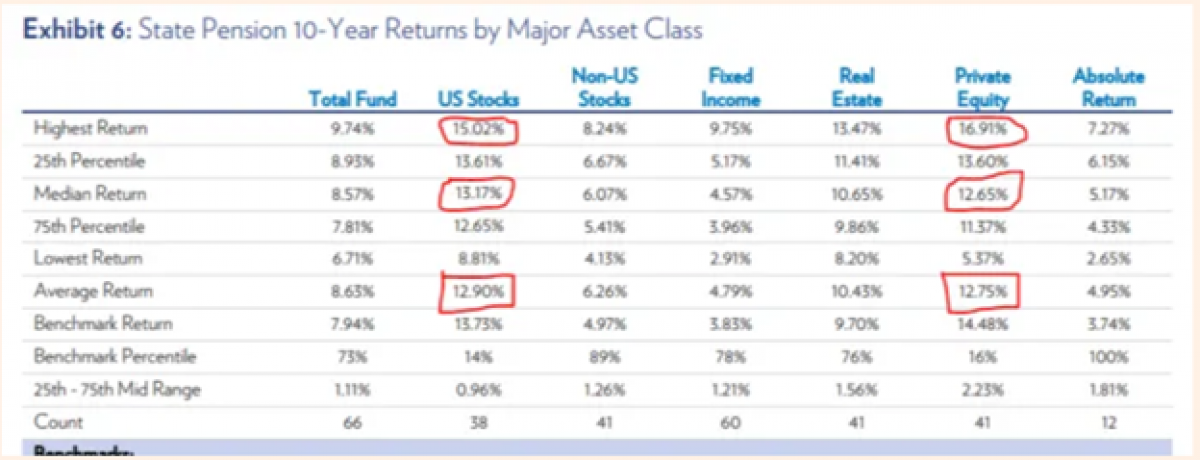

FACT 2: Private Equity is NOT an asset class. There is a lot of talk about the amount of dry powder, rising deal multiples, and the number of active funds that invite increased efficiencies, all of which are the enemy of alpha. Median returns vs the public equity market are undifferentiated (see Cliffwater chart below courtesy of the FT), and manager selection (and their underlying strategies) matters a lot. If the better resourced public pension plans could not muster any meaningful ‘asset class’ premium over the last decade, even at the top quartile, how does the mass-affluent stand a chance?

FACT 3: Return expectations must be grounded in reality. In the annals of institutional investing, the most sophisticated lot is often seen as the university endowment or sovereign wealth fund. Their calls on capital are not driven by specific contractual obligations to individual pensioners, so (as the story goes), they can afford to be even longer-term in their outlook. The Abu Dhabi Investment Authority is certainly a card-carrying member of this club and their 2020 Annual Review is a fascinating read. Their overarching investment theme is ‘resiliency’, and they are rightfully quite proud of their 30-year annualized return of 7.2% (not a typo!). Interestingly they describe the current competition for PE investment opportunities as ‘remaining intense or even accelerating.’… this should be a page one disclosure in the democratization pitchbook.

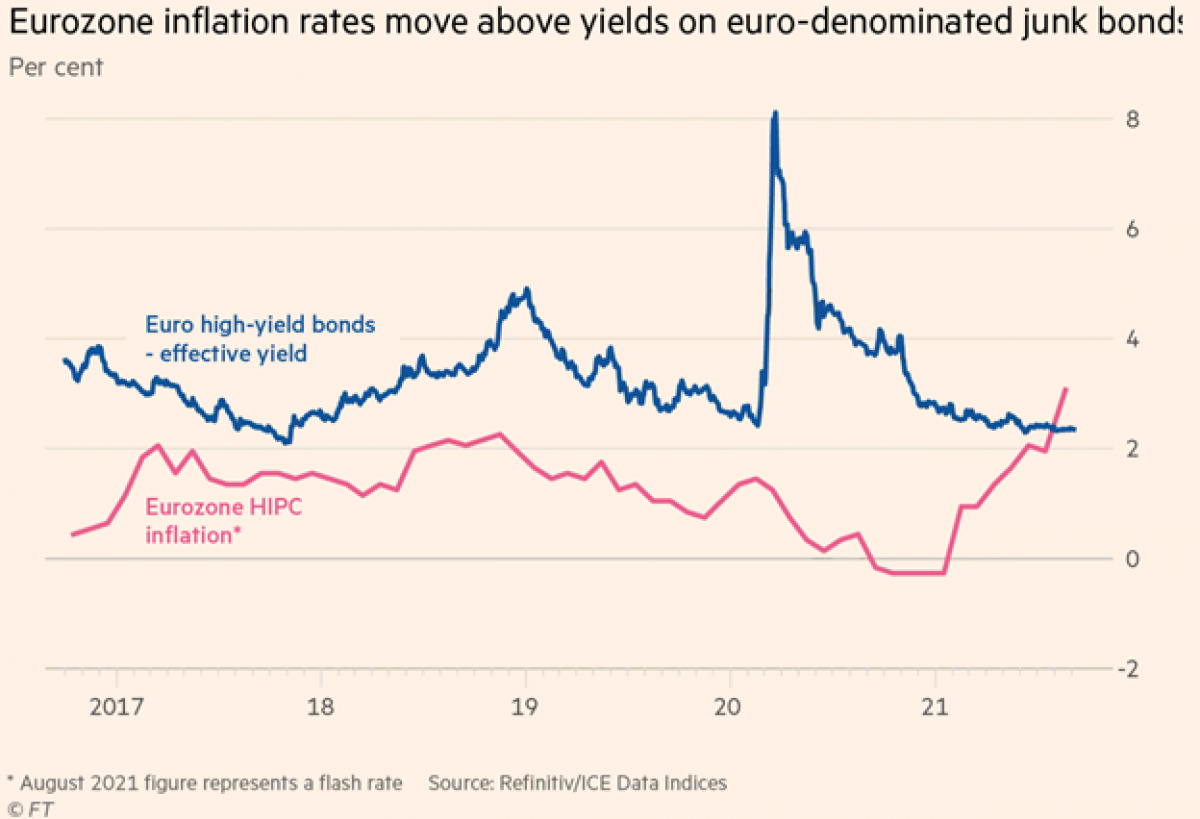

FACT 4: Risk is being massively mispriced in many parts of the current market. The flood of liquidity has pushed so many sectors toward the more extreme ends of valuation. How/when/if this ends is subject to one’s (informed) views and individual risk tolerance, but this reality needs to be constantly informed by the obvious signposts, and a recent FT article was flashing more red than yellow as the real high-yield return in Europe went negative this month.

FACT 5: Protection is easier to legislate than education. The wizards in Washington are sending conflicting messages. Last year the DOL issued new guidance on the use of private market investments in TDFs, and the SEC modestly expanded the definition of an accredited investor… and the product machinery cheered. Last week, we learned that the proposed tax bill by the House Democrats might just prove to be a skunk at the democratization picnic as this early draft eliminates any private offering from IRA plans, regardless of one’s accredited investor status. Seemingly a very contradictory set of views as the long-term responsibilities of the individual investor continue to be subject to the shorter-term turnover in administrations that do not have the tenacity or courage to deal with a much larger problem.

FACT 6: Diversification is no longer a free lunch. Let’s stop pretending that a product label automatically means diversification. There is a client on the other side of every trade, and we must always understand the liability side of her balance sheet, her risk tolerance, and a realistic pathway to achieve those end-goals. Sometimes the latter will be dreamy or unrealistic, and then our job becomes one of tempering those goals, rather than feeding those tendencies with product and promise that have no resemblance to reality.

CAIA Association’s mission was founded on the #clientfirst principle, and we proudly and protectively carry that torch down a path that will dictate greater product access led by a democratization of a new triumvirate of #ETFs: Education, Transparency and Facts.

Seek education, diversity of both your portfolio and people, and know your risk tolerance. Investing is for the long term.

About the Author:

William (Bill) J. Kelly, CEO of the CAIA Association, is an asset management industry veteran with extensive managerial and boardroom experience gained through successive CFO, COO, CEO and Independent Board director roles.

He has led both start-ups and full scale global organizations. Bill is the former CEO of Robeco Investment Management, a subsidiary of the Netherlands-based global asset management organization with over $200 billion of assets under management, where he oversaw all aspects of United States business, including portfolio management, distribution and product development. He also was responsible for the strategic growth, introduction, and positioning of new managed products in the US and Europe, including alternative investments. Bill was a founder and former CEO of Boston Partners Asset Management, a self-funded partnership enterprise, which became one of the industry’s largest and most successful start-up money management organizations. Previous to that, he served as CFO of The Boston Company Asset Management and earlier in his career held various positions at Bear Stearns and was an auditor at PricewaterhouseCoopers.